The six-story building at 600 Broadway had long served as an informal welcome sign to Soho with Hollister’s logo splashed across its broad side facing Houston Street.

The six-story building at 600 Broadway had long served as an informal welcome sign to Soho with Hollister’s logo splashed across its broad side facing Houston Street.

But in recent years, a new building went up next door and blocked the property’s northern facade. The loss of its branding status became all the more tangible in late May when Abercrombie & Fitch said it will close the Hollister store this year after a decade in the space.

Behind the scenes, things haven’t fared much better.

Just weeks before the announcement, a $120 million loan that landlord Aurora Capital Associates secured for the property in 2016 went into special servicing, after the borrower failed to fund a $3.5 million reserve account, according to Kroll Bond Rating Agency.

The reassignment of the 10-year loan, issued by Bank of New York Mellon and Iron Hound Management’s IH Capital, helped push Trepp’s special servicing rate on CMBS deals to just over 3.5 percent nationally. That increase, though not as drastic as some other recent shifts in real estate, marked the rate’s highest jump in two years.

Thor Equities, another heavyweight in the city’s high-end retail scene, is facing similar challenges in the commercial mortgage-backed securities world — once seen as a cakewalk for high-rolling property players due to the debt being sold off like company stocks.

This spring, a pair of securitized loans backed by two retail properties Thor has stakes in at 545 Madison Avenue and 115 Mercer Street, totaling $67 million, went into special servicing. And the servicer for a $17 million loan on a third property the company owns at 1006 Madison filed to foreclose on the building in May.

Representatives for Aurora and Thor declined to comment.

Struggling retail loans around the country were the leading cause for the servicing rate hike in April, per Trepp. And while the percentage of delinquent debt hit a new post-recession low in May, there are signs of trouble ahead for the CMBS market as it enters a new phase.

Struggling retail loans around the country were the leading cause for the servicing rate hike in April, per Trepp. And while the percentage of delinquent debt hit a new post-recession low in May, there are signs of trouble ahead for the CMBS market as it enters a new phase.

Apart from luxury retail, some say other sectors like Manhattan office have become overheated while the hotel business remains highly susceptible to another downturn. That’s become all the more pronounced as the 10-year economic recovery sparks new anxieties over how much time is left.

All in all, new CMBS deals are on the decline, and the industry’s still recovering from a rough patch when late 2018’s stock market selloff put issuance on hold, according to several people in the business. Wall Street’s market-wide malaise just before the new year sent aftershocks across U.S. debt markets, and as new securitized debt deals to ground to a halt, credit spreads — the difference between CMBS interest rates and the U.S. Treasury rate — expanded to their widest point in years.

“I think we’re in sort of what I would describe as a Goldilocks environment,” Joseph Dyckman, co-head of Citi’s commercial real estate finance team, told The Real Deal in reference to new issuance activity. While there are fewer new loans being originated compared to recent years, spreads have tightened since late 2018, helping to spur new deals, he added.

“I think the fact that rates have compressed over the last four months has really stimulated a lot of activity, both on the refinancing and acquisitions front,” Dyckman said.

But others are less confident about the 25-year-old CMBS business going forward. Raj Aidasani, a senior director at the industry trade group CRE Finance Council, noted that a number of competitors, from mortgage REITs to private debt funds, have increasingly stepped in to offer borrowers an array of alternatives.

“What you’re seeing right now is that CMBS maybe isn’t the outlet it once was for borrowers in terms of getting to that leverage point or getting riskier loans done,” Aidasani said.

Between two cycles

Total CMBS issuance fell nearly 10 percent year over year to about $78 billion in 2018, while new originations for all commercial real estate loans rose 8 percent to $574 billion in the same period, according to the Mortgage Bankers Association.

The recent lull in CMBS activity coincides with a transitional period for the market, following years of anticipation over the “wall of maturities” — legacy 10-year deals that closed right before and at the start of the last financial crisis. Those securitized commercial loans have now all matured and many industry players are gearing up for the first big wave of “CMBS 2.0” deals to come due in 2020.

Though some see that as the best test for how the market holds up going forward, several estimates put new originations in 2019 below last year’s total with some saying it could be down more than 25 percent year over year. Meanwhile, more than $170 billion in CMBS debt is expected to mature between 2020 and 2023, down from the $222 billion-plus that matured in 2015 to 2017, according to Morningstar.

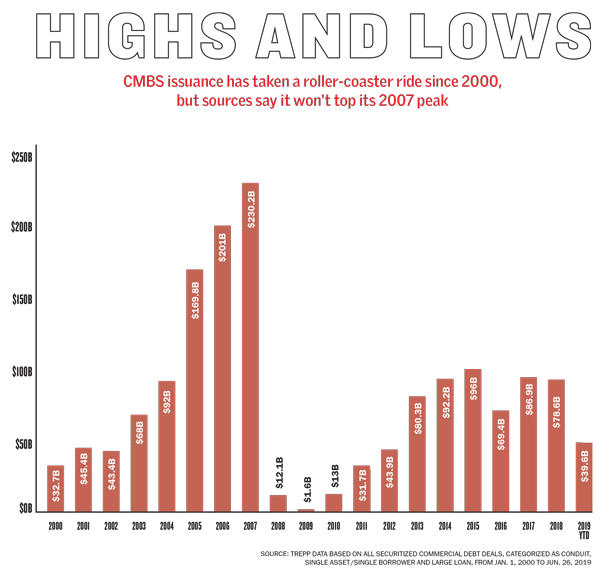

Many see the downward shift as a sign of stagnant investor confidence in the once white-hot sector that ballooned to just over $230 billion in 2007.

1006 Madison Avenue

But the broader outlook for CMBS largely hinges on whether the U.S. economy slips into another recession after a decade of growth, sources say.

Kevin Fagan, a research director at Moody’s Investors Service, cited more than 270 defaults on CMBS loans originated after 2009 — mostly on properties exposed to particular concentrated risks such as high-street retail, suburban offices and hotels in tertiary markets.

Fagan said Moody’s expects an “echo wave” of defaults in 2020 on properties within three to five years into their loan terms, a time frame when borrowers are most likely to default.

“If we see a recession happen at the same time, those kinds of properties that have high exposures are more likely to have more stress,” Fagan said, noting that borrowers are “certainly at higher risk of default in a stressed environment.”

On the inside, one big change with “CMBS 2.0” is that special servicers — which often charge expensive fees for CMBS workouts — may have less to gain from helping restructure troubled loans.

David Herman, a real estate attorney at Weil, Gotshal & Manges in New York, said that after the Great Recession, borrowers became more focused on the lofty fees special servicers were collecting on workouts.

Lenders, meanwhile, responded to concerns from CMBS bondholders who felt special servicers held too much power. As a result, borrowers and lenders began negotiating deals that took some chips away from many of the servicers and reduced their fees, Herman added.

“CMBS 2.0 was designed to be much more restrictive than CMBS 1.0,” he said. “On the whole, the special servicers have less flexibility with [what they can offer] borrowers.”

At the same time, “master servicers and special servicers have made a lot of effort to improve borrowers’ experience[s], so they come back and want to take out another CMBS loan, said Keith Banhazl, a managing director at Moody’s.

The bank equation

Big banks have also had less of an upper hand in the CMBS market in recent years.

That’s been the case since late 2016, when the federal government enforced risk-retention rules under Dodd Frank requiring banks to keep 5 percent of all securitized loans on their books for at least five years.

The measure was designed to prevent some of the reckless practices that led to the financial crisis. But many say that has caused banks to scale back their overall CMBS lending — driving more sponsors to alternative lenders that charge higher rates and pushing up borrowing costs.

Doug Mazer, head of Wells Fargo’s real estate capital markets group, told TRD that banks have generally adapted to the new regulations. “Some banks might have been a little bit slow to originate CMBS loans as a result of risk retention,” he said. “But CMBS lenders have really gotten through the initial angst.”

Mazer also noted it’s difficult to isolate the effect that risk-retention has had on secured commercial bank loans relative to all the other factors that impact bank lending volumes. He pointed out that bank CMBS leverage has gone down since the retention rules went into effect, to about 60 percent, which may have resulted in some higher-leveraged loans going to nonbank lenders.

In order to compete with “shadow banks” not bound by the same rules, though, institutional lenders have had to offer new incentives to drum up business. The result has been a surge in interest-only loans within the past few years, sources say.

600 Broadway

“You have to be competitive with your product [and] have something to market to borrowers,” said Steve Jellinek, vice president of research at the global financial services firm Morningstar, who added that interest-only seems to be the incentive “that works best.”

Real estate attorney and investor Ed Mermelstein said that’s part of the natural progression of real estate cycles: Once things get too frothy, lenders pump the brakes and tighten their standards, but as the market starts to recover over time, he noted, they often loosen up.

“Once the memory of those difficult times starts to fade, you see some of the risk coming back into the market,” Mermelstein said.

Reinventing the deal?

Some say the CMBS market is contracting and may never reach its pre-recession heights again.

The $230.2 billion in securitized commercial loans issued at the height of the last cycle remain a far cry from total origination volumes post-crisis — which have hovered under $100 billion a year.

“We’re not likely to get back to the good old days,” Moody’s Fagan said. “There’s just a lot of other types of lenders out there.”

But the loans that are coming due this year were among the first CMBS deals to close after the financial crisis and are generally seen as better underwritten. Morningstar projects that roughly 80 to 85 percent of those loans will be paid off, compared to just over 70 percent of the CMBS loans that matured in 2017.

Many in the business say underwriting standards are much stricter now than they were in the previous cycle — when Tishman Speyer and BlackRock defaulted on their $3 billion CMBS deal on Stuyvesant Town–Peter Cooper Village, which closed right before the crash. That transaction became the poster child for speculative underwriting.

To name one other infamous deal: Jared Kushner’s record $1.8 billion purchase of 666 Fifth Avenue in 2008, backed by a nearly $1.22 billion CMBS loan and $535 million in mezzanine debt. As reported by this publication and many others, Kushner Companies’ equity in that acquisition came to just $50 million.

With borrowers and lenders factoring in risk more carefully before signing on the dotted line, massive securitized loans of that scale are virtually unheard of in 2019.

Matt Petrula, a senior group manager in M&T Bank’s commercial real estate division, said he thinks one of the biggest shifts with the next wave of CMBS will be owners scaling down their debt when they go to refinance.

“I think there were certainly loans — particularly on high street retail — that will require some resizing,” he said.