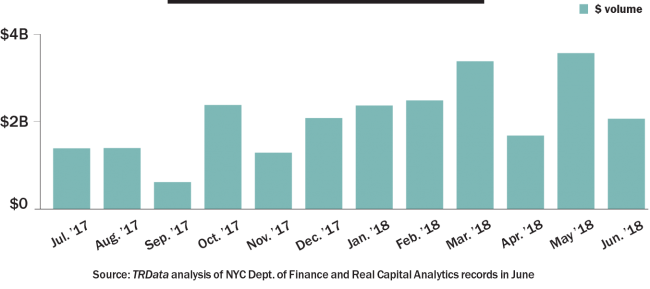

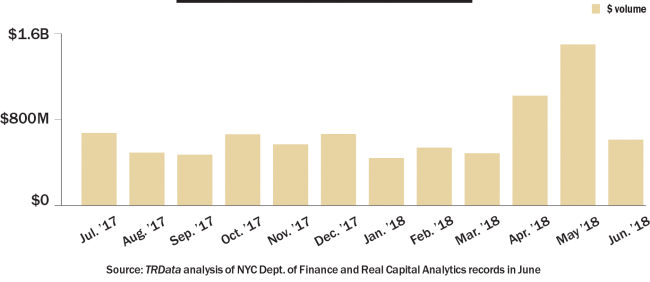

Investment sales in Manhattan and Brooklyn

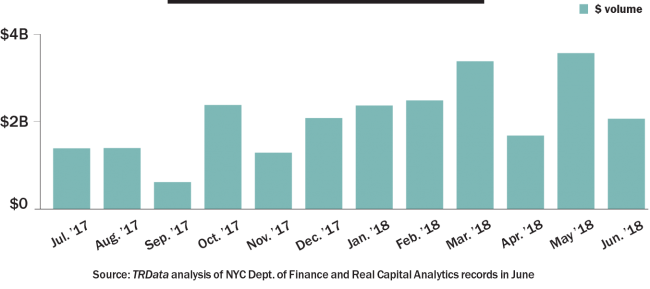

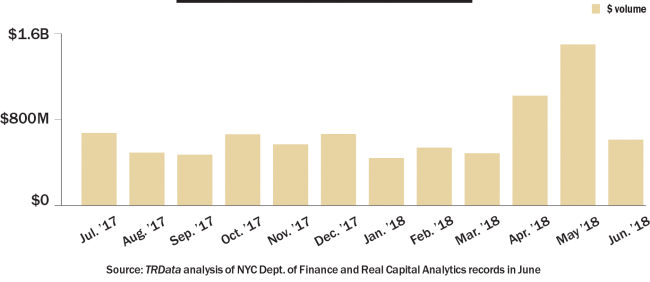

Manhattan investment sales retreated in June, with just over $2 billion recorded. The figure was a steep decline from May’s $3.6 billion, but was right on the average of the past year. The top sale was Invesco buying the office condo at 1745 Broadway from SL Green Realty and Ivanhoe Cambridge for a reported $633 million (although in transfer documents the price was $596 million). In Brooklyn, buyers recorded $623 million in property sales, a 59 percent decline from the prior month and 10 percent below the 12-month average. The top deal in the borough in June was Brookfield Property Partners purchase of a controlling stake in two development projects in Greenpoint Landing for $148 million.

Manhattan investment sales

Top Manhattan investment sales recorded

Top Manhattan investment sales recorded

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGS BROKRAGE |

|---|

| 1745 Broadway n(office condo) | $633 million (recorded as $596 million) | Unnamed Invesco client / nSL Green Realty, Ivanhoe Cambridge | Eastdil nSecured |

| 80 Broad Street n(office) | $223 million | Invesco / nRXR Realty, Colony Capital | Cushman & Wakefield |

| 250 Water Street n(development site) | $183 million | Howard Hughes Corporation /nMilstein Properties | N/A |

| 101 West 57th Street (hotel) | $174 million | Hilton Grand Vacations /n UBS Asset Management | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June.

Brooklyn investment sales

Top Brooklyn investment sales recorded

Top Brooklyn investment sales recorded

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGS BROKRAGE |

|---|

| Greenpoint Landing sites on Commercial Street nand Eagle Streetn(development sites) | $148 million | Brookfield Property Partners / nPark Tower Group | N/A |

| 520 Prospect Place n(residential) | $64 million | Cassena Care / nCenter for Nursing & Rehabilitation | N/A |

| Caesaru2019s Bay Bazaar nat 8949 Bay Parkway n(retail) | $40 million | Gazit-Globe / Surrey Equities | N/A |

| 4525 8th Avenue n(development site) | $28 million | NYC School Construction Authority /n4509 Eighth LLC | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June.

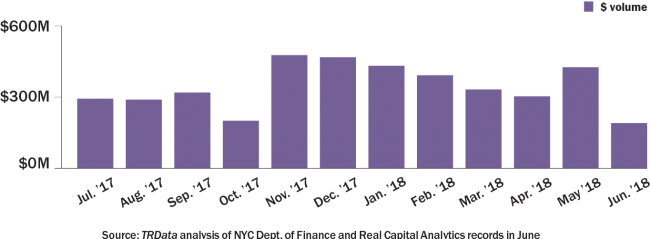

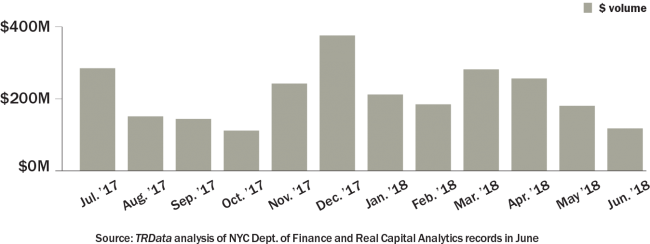

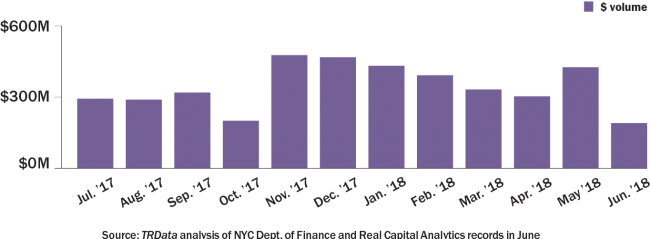

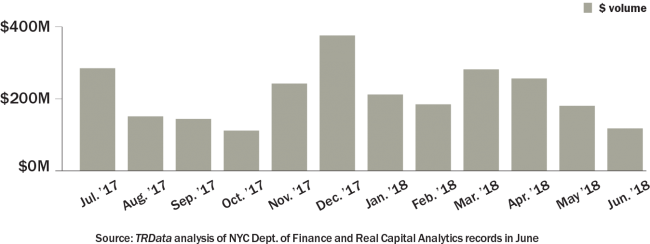

Investment sales in Queens and the BronxIn Queens, investment sales volume reached its lowest level within the past 12 months, with just $191 million in sales recorded. That figure was 44 percent lower than the 12-month average. The top sale was by the Sisters of the Order of St. Dominick, which parted with a school and residential building for $20 million. The Bronx also saw a slow month, with buyers recording $117 million in transactions. That’s less than the $180 million in May and 44 percent below the 12-month average. The largest sale in June was Chestnut Holdings’ purchase of a retail property at 12-18 East 167th Street for $11.7 million.

Queens investment sales

Top Queens investment sales recorded

Top Queens investment sales recorded

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGS BROKRAGE |

|---|

| 89-14 161st Street and 89-25 162nd Street (school and residential) | $20 million | JJSS Jamaica LLC / nSisters of the Order of St. Dominick | N/A |

| 84-01 Roosevelt nAvenue (retail) | $19.1 million | Henderson Holding Group / nJackson Realty Company | N/A |

| 142-27 Barclay Avenue (apartment) | $13.3 million | Vanderbilt Realty / C-Hattan Inc. | Marcus & Millichap |

| 14-39 31st Avenue nand others n(development site) | $13.25 million | Shangri-La LLC / Sithonia LLC | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June.

Bronx investment sales

Top Bronx investment sales recorded

Top Bronx investment sales recorded

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGS BROKRAGE |

|---|

| 12-18 East 167th Street n(retail) | $11.7 million | Chestnut Holdings / nB&K Realty Management | N/A |

| 3190 Riverdale Avenuen(apartment) | $8.1 million | LAL Property Management / nM Badaly LLC | N/A |

| 150 Van Cortlandt nAvenue East n(development site) | $7.6 million | Housing Partnership nDevelopment Corp. / Stagg Group | N/A |

| 2537 Valentine Avenue | $6.8 million | Avdi Realty / Moybros Realty | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in June.