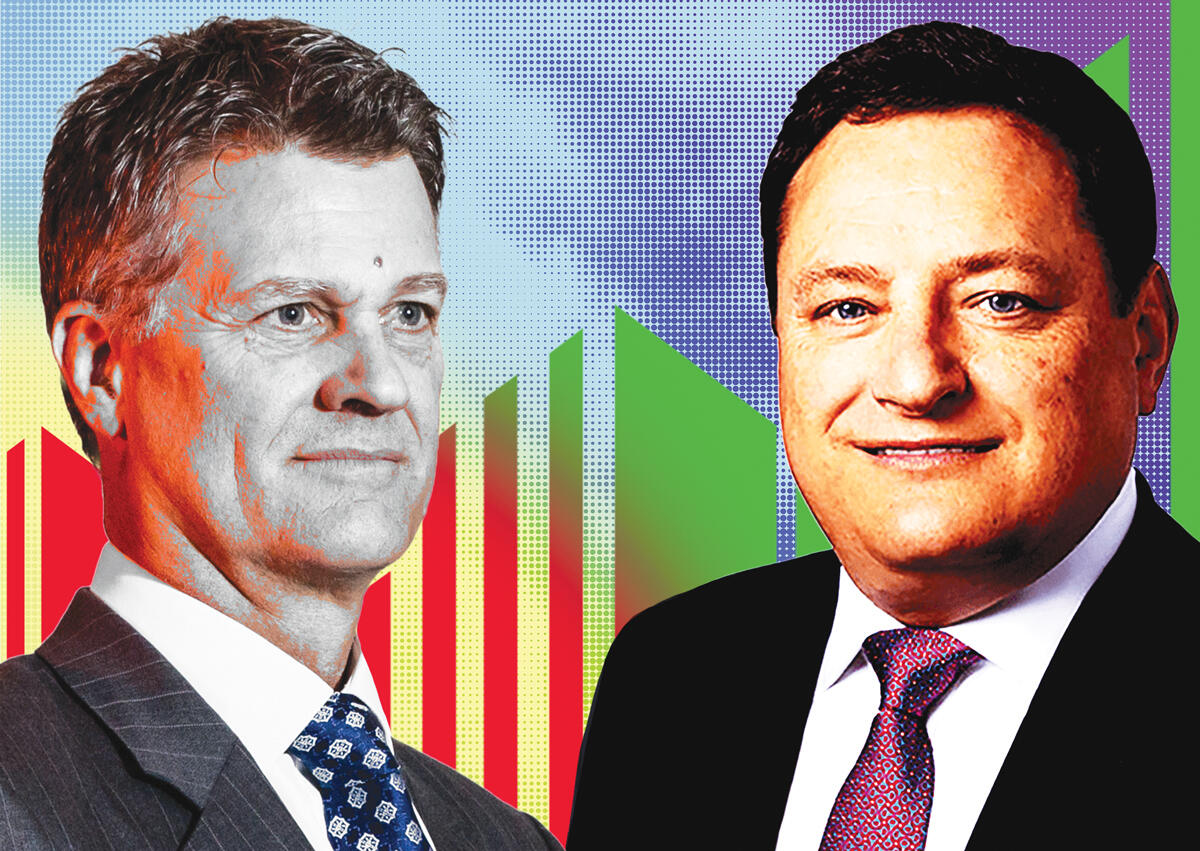

Executive chairman and CEO Brett White, CEO-elect John Forrester (Photo illustration by Steven Dilakian)

For his first media interview as CEO of the global commercial real estate firm DTZ in 2011, John Forrester’s chosen venue was the Gherkin — the famed bullet-shaped skyscraper in London’s financial district that was his badge of pride. His seven years spent working on “every aspect of the development, design, leasing” of the building, including its £630 million sale in 2007, “was never anything less than a joyful experience,” Forrester told the British real estate outlet Property Week.

With broad shoulders and the large hands of a rugby player, Forrester, affectionately known as “Big John,” discussed his goals as CEO while exuding optimism and fierce loyalty to the firm in the midst of a restructuring.

Forrester’s tenure in the top job, however, lasted just four months. DTZ was acquired in December 2011 by Australian construction firm UGL, and Forrester’s role in the larger firm shifted to that of a regional executive.

A decade later, Forrester, now 59, will again find himself taking the reins of a storied commercial real estate firm with global ambitions when he assumes the CEO role at Cushman & Wakefield.

His second ascent, which follows a series of acquisitions that ultimately made DTZ the third-biggest global real estate services company upon its mega-merger with Cushman in 2015, is remarkable on the often bumpy road of M&A.

Forrester will fill a chief executive role vacated by Cushman’s executive chairman, Brett White — a 28-year veteran and former CEO of Cushman rival CBRE who led a private equity consortium to acquire DTZ from UGL for $1.1 billion in 2014, then merged it with Cushman a year later in a $2 billion deal.

“He’s a much-admired and respected leader both inside our firm and across our industry,” White told analysts about his successor. “His high level of integrity, exceptional work ethic, deep client knowledge and many, many corporate relationships make him the obvious choice as our next CEO.”

Forrester has flown mostly under the radar since DTZ’s acquisition. With White remaining as chair and the private equity backers maintaining a strong presence on Cushman’s board, it’s unclear how much autonomy he will even have.

“He’s a very diplomatic, very smart man,” said one of Forrester’s former colleagues at DTZ. “And I think in order for John to survive and to prosper, he has kept a very low profile.”

Read more

White will work alongside Forrester to oversee the firm’s strategic moves, including his strength, mergers and acquisitions, the firm said in August.

“Brett [White] is a leader that has had a track record of doing large transformational deals. He helped really put the company together, integrated and then brought it into the public markets,” said JPMorgan analyst Anthony Paolone. “And he’ll continue to do that.”

Paolone said that after an M&A-fueled expansion, an initial public offering and a restructuring that immediately preceded the pandemic last year, “what you hope for [in Cushman’s new CEO] is someone that’s going to come in and take that baton, and really drive the day-to-day operations into the future.”

“Stunted” growth

Forrester is taking over a firm that has struggled to find its groove since going public three years ago.

In 2019, its first full year as a public company, Cushman reversed three consecutive years of losses by reporting net income of $200,000. Then Covid wrecked the leasing and investment sales sectors, resulting in a net loss of $220 million last year.

“It’s like they got Covid in their adolescence, and it stunted their growth somewhat at a critical time in the development of their life as a public company,” said Tod Lickerman, the former CEO of DTZ who led Cushman’s American operations after the merger before exiting in 2017.

Cushman finally turned a profit again in the second quarter of this year, and its net income increased in the third quarter. But the brokerage’s stock, initially offered at $17 per share in August 2018 and peaking above $20 in January 2020, has been slow to bounce back since. After cratering to below $9.50 a month into the pandemic, it was hovering around $19 by late November. Shares of chief rivals CBRE and JLL, meanwhile, have steadily recovered and, as of mid-November, exceeded their pre-pandemic prices by 65 percent and 55 percent, respectively.

JPMorgan’s Paolone said the biggest drag on Cushman’s stock price has been not the firm’s performance, but downward pressure from its largest shareholders — the private equity consortium including TPG Capital, PAG Asia Capital and the Ontario Teachers’ Pension Plan — selling.

Between April 2019 and April 2020, TPG sold 4.3 million shares, or 8 percent of its holding. The PAG-affiliated funds also dumped about 9 million shares, or 17 percent of their holding, between April 2019 and April of this year. Together, TPG, PAG and the Ontario Teachers’ Pension Plan still held more than 47 percent of Cushman as of April.

Paolone also said that some investors might have felt Cushman’s outlook after the second quarter was too conservative, causing them to shift to competitors.

Era of consolidation

White and Forrester both started their careers in real estate in the mid-1980s, White as a broker at CBRE and Forrester as a surveyor who soon became a leasing agent at DTZ. Both were elevated into executive roles in the late 1990s, with White rising to CEO of CBRE in 2003.

White oversaw a series of acquisitions that built CBRE into the $30 billion firm it is today, including $500 million for Insignia/ESG in 2003, $2 billion for Trammell Crow in 2006 and $940 million for ING’s real estate investment arm in 2011.

Across the Atlantic, DTZ’s troubles started when it took on a large debt to acquire rival Donaldsons in 2007, as the world was heading into a financial crisis. After an abandoned sale to BNP Paribas in 2011, Forrester was appointed CEO to lead the company through a tumultuous time. Instead of BNP, it was UGL, whose businesses included engineering and property services, that scooped up DTZ for just over $100 million.

White, who stepped down as CBRE’s CEO at the end of 2012, jumped back in the market as a private investor, leading the private equity consortium to acquire DTZ for $1.1 billion in 2014.

In early 2015, the consortium acquired Cassidy Turley, adding its 4,000 employees to DTZ. Then, in September 2015, DTZ acquired Cushman & Wakefield for $2 billion, and White became executive chair and CEO of the combined, 43,000-employee firm, which kept the Cushman name but moved its headquarters to DTZ’s base in Chicago.

“Each of the predecessor companies was what I call too big to be small but too small to be big,” recalled Lickerman. “They were no longer either narrowly focused on service lines or geography. They had started to broaden out to multiple service lines and multiple geographies, but they were far short to be really global.”

The goal was to merge those firms to create a truly global real estate services company, Lickerman said.

“They did a really good job forging these companies together,” he said. “Sure, it was hard, but they got through it.”

Mergers & inhibitions

Mergers often come with challenges, and layoffs tend to follow.

A month after its merger with DTZ, in October 2015, Cushman let go about 250 employees, many of whom were support staff for brokers.

Brokers themselves jumped ship, including many who joined upon the firm’s December 2014 acquisition of Massey Knakal Realty Services, a $100 million deal that helped quadruple Cushman’s investment sales volume.

But in 2016, Cushman’s new leadership hired New York City’s top investment sales team, led by Doug Harmon and Adam Spies, from Eastdil Secured, and tension started to build, insiders said. In 2018, Massey Knakal veteran James Nelson, then one of Cushman’s top investment sales brokers, jumped to Avison Young to lead its tri-state investment sales team. That same year, Paul Massey quit to start his own firm, B6 Real Estate Advisors, and Bob Knakal moved to JLL to lead its investment sales team. Nelson, Massey and Knakal declined to comment.

The departures came as Cushman was also fending off what was internally known as the “Newmark Siege.” John Busi, the global head of the firm’s valuation and advisory practice, decamped to Newmark in 2016 after more than three decades at Cushman. A year later, he attempted to poach about 100 of his former Cushman colleagues, and Cushman paid nearly $14 million in retention bonuses to keep them, according to a lawsuit filed against Cushman by Nicole Urquhart-Bradley, who oversaw its valuation group after Busi left.

In the lawsuit, Urquhart-Bradley said she was at the forefront of the company’s retention effort against the siege, but was fired after Shawn Mobley, Cushman’s then-CEO of the Americas, suspected that she was considering an offer from another firm. Urquhart-Bradley, who is Black, is suing for discrimination based on race and gender. Cushman has denied the allegation. Urquhart-Bradley declined to comment. Busi and Mobley did not respond to requests for comment.

In Chicago, an eight-broker office leasing team jumped ship in January for Stream Realty Partners. The team had joined Cushman in April 2015 when it acquired local office leasing powerhouse J.F. McKinney & Associates.

Jack McKinney Jr., whose father founded the leasing brokerage in 1990, was among those who moved to Stream. Cushman “went through quite a bit of changes really rapidly” during his five years there, he said.

When Cushman was readying itself for the IPO in August 2018, for example, it pulled back resources that brokers enjoyed — such as expense reimbursements for marketing materials and travels — to make its operation leaner, McKinney said. Even so, employees who came from different companies through M&A deals stuck together and developed an esprit de corps, he said.

“Despite some of the bumpiness that occurred in the wake of the IPO, they had done a really good job of instituting a company culture that seemed to be pretty unifying,” McKinney said, adding that in 2019 and going into 2020, his office leasing team was as busy as it had ever been. “We were rocking and rolling. Things were really looking up. And then of course, Covid happened.”

The business momentum was stymied by the pandemic, and the lack of deals made members of his office leasing team introspective, ultimately resulting in their move to the smaller firm, McKinney recalled.

“We felt bad about leaving. They were good to us,” McKinney said. “Cushman was coming together, culturally, but it was a slow process.”

Turning the page

Some observers suggested that one reason for Cushman’s slow recovery may be continued post-merger and post-IPO turmoil.

An obvious symptom of that is Cushman’s higher leverage ratio compared to its peers. More than $3 billion of debt is still on the books, and Moody’s analysts said Cushman’s key indicators on leverage “trail business service peers by a wide margin, which primarily reflect [Cushman’s] appetite for growth through leveraged acquisitions.”

Cushman’s recent deals include last year’s acquisition of Pinnacle Property Management Services, one of the largest multifamily property management firms. To expand in the multifamily sector, the firm is also set to buy a 40 percent stake in Greystone’s rental apartment lending and loan servicing business for $500 million. In October, it teamed up with WeWork on a $150 million deal, aiming to attract and retain corporate services clients with flex offices.

Cushman’s debt might have become a roadblock for further M&A opportunities. When the company reportedly approached Newmark about a potential merger last year, Newmark rejected the deal partly because it believed Cushman had too much debt, Bloomberg reported. When JLL was also said to be in talks with Cushman about a potential acquisition last year, JLL CEO Christian Ulbrich brushed off the rumor, saying that he hadn’t seen anything that would be “worth spending our shareholder’s money on.”

Others dismissed the concerns over Cushman’s debt load, saying that the firm has plenty of liquidity to meet its debt obligations. The company reported net cash of $1.2 billion in the third quarter, resulting in net debt of $2.1 billion.

“If you look at the cash flow coverage ratio, they’re fine,” one former employee said. “They’re not going to have any trouble servicing the debt.”

Cushman CFO Neil Johnson said the firm’s net leverage ratio — net debt divided by adjusted EBITDA — was down to 2.8 in the third quarter, from 4.3 at the end of 2020.

As the commercial real estate market reawakens from the pandemic, Cushman is in a position to pursue more organic growth, people familiar with the firm’s operation said.

But a former colleague of Forrester cautioned that as long as the private equity consortium remains as Cushman’s top shareholder, White, whose contract lasts at least until December 2023, may continue to call the shots.

“The real question is when he is going to exit and really hand over the reins so they can start their next chapter,” the person said about White. “Because they are stuck in the private equity chapter” that focuses on expansion through M&A and aggressive cost-cutting.

Cushman did not make Forrester or White available for this article, but one insider told The Real Deal that he expects nothing will change when Forrester becomes CEO in January, because Forrester, as global president, has been running day-to-day operations under White for many years. White is giving Forrester the official title to reward his long-time stewardship, the person said.

A glimpse at the future operation was offered during the third-quarter earnings call when White invited Forrester to speak to analysts for the first time.

Forrester, who will have offices in both London and Chicago as CEO, highlighted Cushman’s recent investments into Greystone and WeWork as examples of the firm’s “disciplined capital deployment” to grow its market penetration.

“I’m thrilled to be on the call today as our leadership transition approaches at the beginning of 2022,” Forrester, who was in London, told the analysts. “I’m pleased to report that the execution of our strategic realignment and multi-year transformation to become a leaner, more efficient and agile organization is well on track.”