Trending

Firm footing: Long Island’s established brokerages fend off upstarts

Traditional players are expanding to stay on top, but high commissions tempt agents to new firms

From Floral Park to Farmingville, tradition still seems to matter on Long Island. Especially when it comes to real estate.

In other markets, like the Hamptons, upstart firms that offer fatter commissions and a freelance lifestyle have cut deeply into the dominance long-enjoyed by established brokerages.

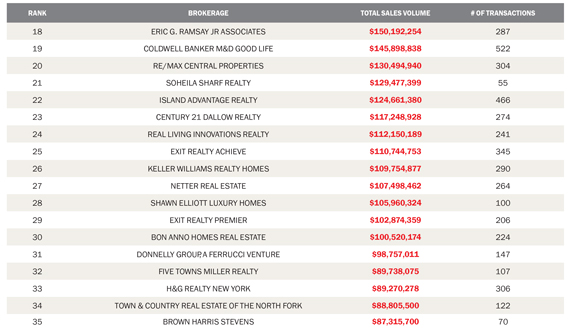

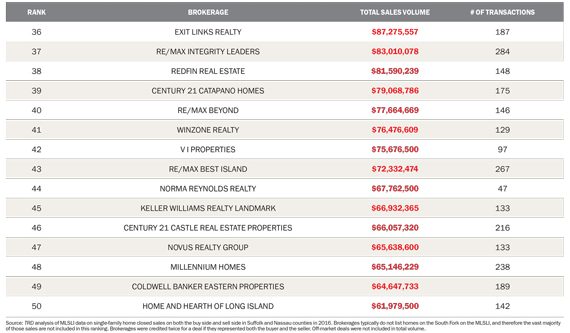

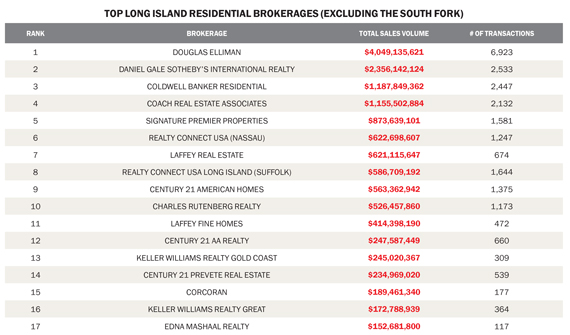

But across the suburban markets east of New York City, these insurgents have so far failed to knock off brokerages with more conventional business models, according to an analysis by The Real Deal, which ranked firms in Nassau and Suffolk counties — excluding the Hamptons — by the value of their closed single-family home sales last year.

The TRD ranking revealed that stalwart Douglas Elliman is far and away the region’s powerhouse. At $4 billion, it had nearly twice the total of closed deals as the second place finisher, Daniel Gale Sotheby’s International Realty, which clocked nearly $2.4 billion. The analysis credits firms for twice the value of the deal if their agents repped both the buyers and sellers.

When it comes to newer firms, Signature Premier Properties, which launched in 2007, finished in fifth place, thanks in part to an aggressive expansion last year with the opening of seven new offices, more than doubling its total.

The firm still takes a hefty chunk of every commission, unlike eight-year-old Realty Connect USA, which lets its agents keep 90 percent of their commissions. Despite its relative youth, Realty Connect USA earned a spot among the top 10 brokerages. “We are the future of real estate,” said Fern Karhu, a Realty Connect founding principal and owner of its Nassau branch.

While some veteran agents looking to come away with more revenue from existing clients may head to a firm like Realty Connect USA, brokers say the traditional model still reigns at most of Long Island’s top-producing firms.

Indeed, seven of the top 10 brokerages in TRD’s ranking split their commissions in the standard manner. “We’re kind of immune to these disrupters,” said Ann Conroy, the president of the Long Island division of Elliman, which at the end of last year had 23 offices and 1,602 agents.

Warding off “disrupters,” she said, is possible through key hires. “We continue to attract and retain sophisticated agents who believe in the value of the brand,” she wrote in an email. She added that, “in my opinion, they don’t attract the top producers,” like Elliman’s Maria Babaev, who sold the firm’s priciest 2016 Long Island listing, a 17-room French Tudor on 10 acres in Upper Brookville for $8.5 million.

While big ticket transactions clearly boosted Elliman’s haul, they were largely few and far between. The luxury market — defined as the top 10 percent of all sales — remains soft, according to the firm’s market research on Long Island, excluding the Hamptons and the North Fork. The median sale price for these high-end homes in the fourth quarter of 2016 was $974,000, down from $999,000 in the year-ago quarter.

However, the median price of all single-family houses in the fourth quarter was $400,000, up from $388,000 in the year-ago quarter, according to the Elliman data.

“The high end is hurting,” said Deirdre O’Connell, the general sales manager for Daniel Gale, a 95-year-old firm with 18 offices in Nassau and Suffolk, which had 848 agents as of Dec. 31. She specifically pointed to properties over $3 million in the areas closest to New York.

The Cold Spring Harbor-based firm, which has been focused mostly on the affluent North Shore, this year opened an office near the South Shore, in Rockville Centre. O’Connell said more offices are planned for that area in an effort to tap into what Daniel Gale sees as a sweet spot: entry-level houses. “We don’t want to be everywhere,” O’Connell said. “But we want to be in communities that recognize the strength of our brand.”

The flurry of activity — 5,984 single-family homes sold in the fourth quarter, the most since 2007, according to Elliman — is carrying the market, brokers say.

“Our biggest challenge is a lack of inventory,” said Michael Litzner, an owner of Century 21 American Homes, which has 10 Long Island offices. “We don’t have a lot of construction, it’s very hard to build here, the NIMBY forces are strong and there is not a tremendous amount of land left.”

Eschewing trophy properties, Litzner’s firm specializes in Nassau homes with prices that start at $350,000, and despite the lack of inventory, put together enough for $563 million in business in 2016 across 1,375 transactions, putting it ninth on TRD’s list.

On Long Island, which is peppered with tiny brokerages (of the 50 firms surveyed, a handful did only about 50 deals last year), snapping up rivals is another way to expand. And 2016 was a frenzy of merger activity.

For instance, Century 21 American Homes merged twice in 2016, once with Century 21 Best in Elmhust, adding 83 agents, and once with Realty Executives 1st of Lynbrook, adding 28 agents, Litzner said.

Similarly, last winter, Coach Real Estate Associates (No. 4) bought Abbott Realty in Floral Park and established that business as its 19th Long Island office, said L.P. Finn, Coach’s chief operating officer.

“Ninety percent of our growth has come through acquisitions,” said Finn, whose firm, founded in the 1950s, is an affiliate of Christie’s.

In the same vein, in June Signature Premier purchased the Donnelly Group, a six-year-old firm that brought three offices into the fold, including two new offices in Garden City and one in Floral Park. Offices in East Northport — the company’s new headquarters — as well as Babylon, Woodbury and Merrick were also added in 2016. An office in Locust Valley opened in February, resulting in a total of 14 Signature Premier offices.

Agents were added at a brisk clip, too. At the end of 2016, the firm totaled about 555 residential agents, and about 30 have since been added, said Peter Morris, who co-owns the firm with Kathleen Viard.

“Most agents want a desk to go to, managers to help them grow their business and an office-type environment,” Morris said. But he said the alternatives “are interesting models, and I do think they’re here to stay.”

Last year also saw Coldwell Banker Residential Brokerage (No. 3) buy Pagano Properties, a Huntington Station business.

Still, Laura Rittenberg, the president of Coldwell’s Long Island division, says her leads come through other channels, too, since unlike its rivals, Coldwell has agents in 42 other countries . “When most people say they’re global, they mean they have a website translated into different languages,” she said.

However, off-island connections don’t always guarantee local business. The Corcoran Group, a top New York City firm, finished 15th on TRD’s list with about $190 million in 177 single-family home deals on Long Island, excluding the Hamptons. When it comes to the South Fork, however, Corcoran rules the roost, taking the top spot in TRD’s May 2016 ranking of top Hamptons brokerages.

But while established firms may have kept the competition on the other side of the hedgerow for now, advances have been made.

Chief among them is Realty Connect USA, whose two Long Island brokerages in Woodbury and Hauppauge landed in TRD’s top 10.

The Nassau company boasts six offices in the county and about 357 agents, with new ones being added daily from rival companies, according to co-founder Karhu. In January, the firm hired three Elliman agents, among others, she said.

Being able to pocket 90 percent of a commission is a major draw of the firm, which Karhu founded in 2009 after 26 years with Elliman. Most firms give agents 50 or 60 percent of any commissions.

“Our pay structure is very 21st century, but our operations and management is very similar to a traditional office,” Karhu said.

For the first two years of the company’s existence, the Nassau and Suffolk sides were united; in 2011, the business split into different ownership structures.

Charles Rutenberg Realty, which has five offices on Long Island and awards 100 percent commissions, has also made great strides since its 2006 founding. It wound up in 10th place on TRD’s list.

Despite different business models, most firms agree that business is booming, which has meant more people coming out of the woodwork to become brokers. With interest rates relatively low and the popularity of towns served by commuter trains on an upswing, many agents feel that the good times will continue as 2017 unfolds.

“I have to say, there is something about Long Island,” said Rittenberg of Coldwell Banker, who has worked in several suburban markets of New York. “People are very passionate about being here.”