Headlines about the wave of foreclosures that swept the country a few years ago have begun to fade from memory. Yet in New Jersey, foreclosures that originated in the housing bubble are still painfully working their way through the system.

Headlines about the wave of foreclosures that swept the country a few years ago have begun to fade from memory. Yet in New Jersey, foreclosures that originated in the housing bubble are still painfully working their way through the system.

The state saw a spike in foreclosure starts in 2012, according to RealtyTrac. And in 2014 and 2015, New Jersey recorded the highest foreclosure rate of any state in the U.S. New Jersey still has 73,000 homes in foreclosure, and nearly 13,000 homes on the market that are classified as “REO,” or owned by a lender — typically a bank or government agency — after an unsuccessful foreclosure auction.

Two-thirds of New Jersey’s foreclosure activity is tied to loans originated during the housing bubble from 2004 to 2008, when many mortgage lenders loosened their standards. “The pipeline is moving slower here than in other states,” said Daren Blomquist, a senior vice president at RealtyTrac.

New Jersey takes 1,234 days on average to complete the foreclosure process, the longest of any state. The state mandates that each foreclosure go through the judicial system.

The snail’s pace of this process is bad for all homeowners. Foreclosed properties that linger on the market can drag down home values in the surrounding areas. “They are eyesores in the neighborhood,” Blomquist said. He said there can also be a ripple effect for the local economy, as the black mark of a foreclosure drags down the credit scores of former homeowners, “which has a chilling effect on the economy.”

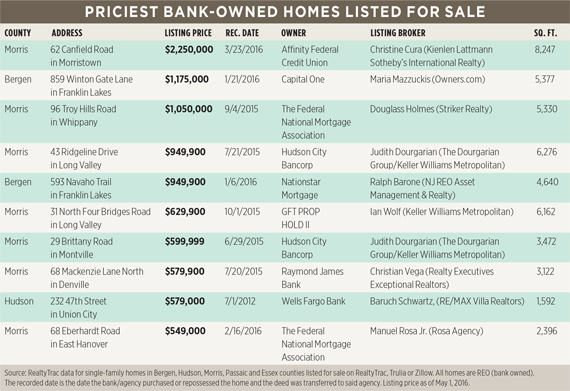

62 Canfield Road in Morristown is the most expensive bank-owned home listed in northern New Jersey.

With New Jersey’s foreclosure process moving at the speed of molasses, by the time officials arrive with the foreclosure papers in hand, many homeowners know what to expect. “A lot of properties are already abandoned before we get there,” said Pam Hoerter, a fiscal officer at the Atlantic County Sheriff’s Department.

The one bright spot on the horizon — new foreclosure starts have slowed.

Rising home prices may be helping some struggling homeowners avoid foreclosure — and the stain that would leave on their credit scores, which persists for seven years. A robust market can allow these homeowners to sell properties before the foreclosure process begins.

Home prices have rebounded sharply in the five counties across the river from Manhattan — Bergen, Passaic, Morris, Essex and Hudson — where new residential development has been growing at a brisk pace. Homeowners facing foreclosure in some other parts of the state aren’t as lucky, though. For example, the residential market is lagging near Atlantic City, where casino closures have thrown some homeowners out of work.

Bargain hunters

Some brokers see a silver lining. Homes that are owned by lenders are listed for 41 percent less per square foot than the median asking price in New Jersey, compared withan average national discount for REO homes of 34 percent.

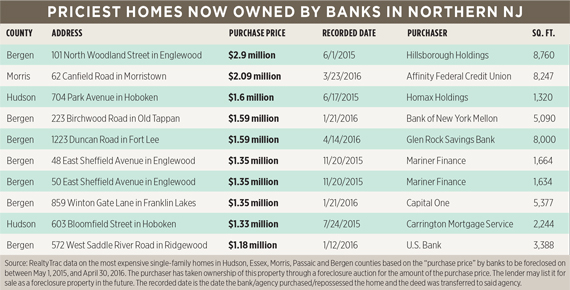

Yet New Jersey has many high-priced foreclosed homes for sale. For example, in The Real Deal’s rankings of REO properties in Bergen, Passaic, Morris, Essex and Hudson, 10 were sold to their previous owners for more than $1 million.

The most expensive foreclosed home on the market now is a $2.25 million, 8,250-square-foot Victorian home located on more than three acres of land at 62 Canfield Road in Morristown. The 10-bedroom, 6.5-bathroom manse has original oak paneling and double French doors.

The most expensive foreclosed home on the market now is a $2.25 million, 8,250-square-foot Victorian home located on more than three acres of land at 62 Canfield Road in Morristown. The 10-bedroom, 6.5-bathroom manse has original oak paneling and double French doors.

The next-priciest home on our foreclosures list is a $1.18 million, 5-bedroom Tudor-style home tucked away on a 1.8-acre wooded property at 859 Winton Gate Lane, in Bergen County’s Franklin Lakes.

Coming in third on TRD’s priciest foreclosures list is a $1.05 million, 5-bedroom new construction home at 96 Troy Hills Road in Whippany, in Morris County.

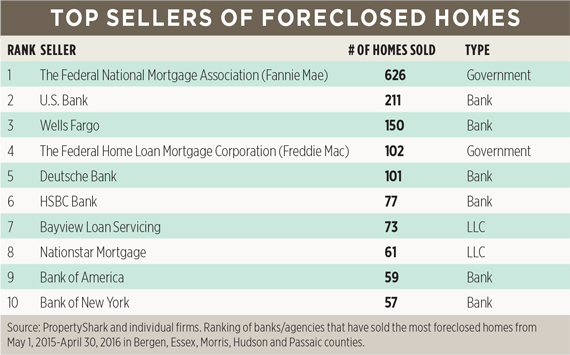

The Federal National Mortgage Association, better known as Fannie Mae, tops TRD’s list of foreclosed home sellers. The Federal Home Loan Mortgage Corporation, or Freddie Mac, isn’t far behind, coming in fourth. The top bank sellers of foreclosed properties in New Jersey include U.S. Bank, Wells Fargo, Deutsche Bank and HSBC.