Nestled at the intersection of Soho, Greenwich Village and Tribeca, Hudson Square is seeing a wave of condominium projects that could define it as a cheaper option for luxury housing in the area.

Nestled at the intersection of Soho, Greenwich Village and Tribeca, Hudson Square is seeing a wave of condominium projects that could define it as a cheaper option for luxury housing in the area.

In the wake of a 2013 rezoning, the waterfront neighborhood, also known as West Soho, has been primed for residential development. Over the last four years, the median sales price there has climbed 29 percent, data compiled by appraisal firm Miller Samuel shows. And as the post-industrial enclave has become a hub for creative agencies and media companies, more big businesses — including the Walt Disney Company — are setting up shop, which will drive up the need for housing.

With pricier properties to the north, south and east, though, big-time developers are banking on the allure of buyers getting more space for their buck in Hudson Square. For the time being, prices there start below $2,500 per square foot, while condos in surrounding neighborhoods can easily go for more than $5,000 a foot.

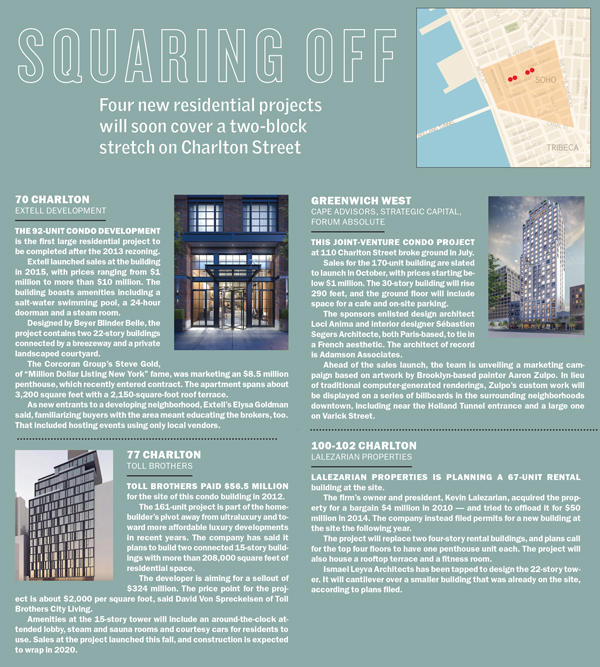

Gary Barnett’s Extell Development is leading the first round of large residential projects with its 92-unit condo development at 70 Charlton Street, which launched sales in 2015, while three other residential towers on the same street are in the works.

Hudson Square “had all the makings of a great area,” Elysa Goldman, Extell’s vice president of development, told The Real Deal. “All the bones were there, it just hadn’t been utilized.”

The first condo developers in a neighborhood tend to establish a standard base price, and that can be a risk, she said. Extell set its price point for 70 Charlton at about $2,000 a square foot, while prices in Tribeca and Soho climbed as high as $6,600 and $8,100 per foot in August, according to StreetEasy.

Extell and other developers, including Toll Brothers and Cape Advisors, have played up the relative affordability as a selling point. But the cycle of rapid development is a sign it’s unlikely to last, and the projects, while priced lower, are by no means cheap. A four-bedroom unit at 70 Charlton, for example, is listed for $4.7 million.

And the other planned projects in Hudson Square may kick off their sales at higher price points as developers and corporations continue to flock to the neighborhood. More attractive pricing makes sense in the early stages of development, said Warburg Realty agent Karen Kostiw, who has brokered home sales in the area.

But as more projects get underway, the area will begin to receive the same attention as Tribeca, Soho and West Village, Kostiw said, noting that buyers who get in early “will be the clear winners, as pricing will inevitably fall in line with its more well-known neighbors.”

“Hiding in plain sight”

Hudson Square — historically known as the Printing District due to its large concentration of printing companies — has rapidly shed its industrial roots. And a handful of food and entertainment spots, including City Winery, have opened alongside more established ones like Film Forum. The neighborhood, which only spans about a one-tenth of a square mile, is also bounded by the Canal and Houston Street subway stations for the 1 and 2 trains and the Holland Tunnel.

Trinity Real Estate, the real estate arm of New York’s Trinity Church, has been one of the area’s largest property owners and controls about 40 percent of the land there.

56 Leonard Street

“In many ways, Hudson Square has kind of been hiding in plain sight,” said Phillip Gesue, chief development officer at Strategic Capital, which is part of the joint venture behind Greenwich West — a 170-unit condo project at 110 Charlton Street.

The city’s rezoning in March 2013 was the catalyst that made it ripe for more residential, retail, office and hotel development, he added.

In a report before the final approval, the City Planning Commission noted that Hudson Square faced several headwinds: Zoning regulations limited mixed-use development, and new real estate projects were “often out of character with the large-scale warehouse style and industrially oriented architecture of these blocks.”

Ellen Baer, president and CEO of Hudson Square Business Improvement District, said the organization has spoken with developers in the area about keeping a cohesive aesthetic.

“Many of the early developers have been sensitive to the existing architecture,” she said. “We’ve talked about contributing to a consistent neighborhood identity, which very much comes from those loft-like buildings.”

Down the road, the rezoning could lead to the creation of more than 3,000 new apartments in Hudson Square, per the Planning Commission’s study. Nearly 500 planned residential units are now in the pipeline.

And the sales strategy based on lower asking prices is particularly helpful in the current market: In 2018’s second quarter, the median sales price of Manhattan luxury homes slid 4 percent while inventory swelled 10 percent, according to Elliman. Given the supply glut, buyers have been in no rush — which has led to deeper price cuts and properties lingering on the market.

“It’s soft at the top and tighter as you move down in price,” said Jonathan Miller of Miller Samuel. “There’s a wider audience for that product.”

The cheaper prices at 70 Charlton, for one, have helped garner interest from a diverse pool of New Yorkers, said Rachel Glazer, an agent at Brown Harris Stevens who has marketed units at the project. Extell declined to give specific numbers other than to say the building is “well-occupied.” StreetEasy shows 17 units at the property on the market, with another three in contract.

Demand in Hudson Square is also high due to the fact that for-sale housing options have remained slim as more businesses have moved to the neighborhood, according to developers and brokers.

WeWork, Viacom and the communications firm Edelman all have offices in Hudson Square.

And the Disney-ABC Television Group picked up a massive development site at 4 Hudson Square for $650 million in July and will eventually move its New York headquarters there. The media giant acquired the rights to develop the Trinity-owned site, which offers 1.2 million buildable square feet, for 99 years. A spokesperson for the company said it’s leasing back its West 66th Street campus for up to five years while the new site is developed. Because the planning is in early stages, the spokesperson was unable to provide any occupancy estimates.

On the retail front, Trader Joe’s recently opened a location there, and Cadillac House, which runs a cafe and spaces for events and galleries, opened its public space on Hudson Street in 2016. Two luxury boutique hotels are also in the area — the Dominick on Spring Street and Hotel Hugo on Greenwich Street.

Hudson Square, meanwhile, is getting a $27 million facelift from a team of design firms looking to add more open spaces and make the streets more pedestrian-friendly while improving traffic flow.

The domino effects

The larger development boom along Manhattan’s West Side has given Hudson Square a leg up, developers and brokers say. One clear advantage is that the neighborhood’s transformation isn’t happening from scratch, and the current wave of projects adds to the many offices, stores and restaurants already there.

“Hudson Square is really just a westward extension of Soho, which is one of the most desirable neighborhoods,” said David Von Spreckelsen, president of Toll Brothers City Living, which is developing a 161-unit condo project at 77 Charlton. “It is already part of a larger neighborhood that has all of the amenities one would want.”

One buyer at 70 Charlton, who had moved from Westchester and previously lived on the Upper East Side, said she was specifically looking for a new building with a swimming pool and liked the neighborhood’s mixed-use atmosphere. The price point was relatively affordable for that part of downtown, Beth Fisher said, and she was spurred on by the increase in commercial activity.

“It’s an evolution, rather than a ground-up, wholesale shift in the area,” Fisher noted.

But as more condo buildings in the neighborhood launch sales, the dynamic of Hudson Square will inevitably change — with more developers looking to capitalize on “attainable luxury,” Miller noted. That rising competition and steep construction costs will pose challenges for the developers looking to keep prices reasonably affordable for Manhattanites, he added.

Already, offers at 70 Charlton have been close to the listing price, according to Glazer of BHS.

“I’m not getting $1.2 million offers on a $1.5 million ask,” she said, adding that prospective buyers at the 22-story building have included those looking for apartments as investment properties. Glazer said she even considered snagging one herself.

“I’ve had people choose this over other downtown areas,” she said. “It’s not just one kind of person that’s walking in the door.”