Duke Realty welcomed the first warehouse it ever developed in New Jersey last October, in Linden. A second opened there in April.

The construction projects follow the Indianapolis-based real estate trust’s 2013 purchase of two warehouses in Cranbury, New Jersey leased to Crate & Barrel. And the company is on the prowl for more opportunities in the area.

“It’s just a great place to be,” said Jeff Palmquist, senior vice president of Duke’s Northeast region. “It is such a viable market being so close to New York City.”

Duke’s and numerous other firms’ desire to set up in Northern New Jersey has set off a building boom in the industrial market. In 2014, 17 new projects totaling nearly 8 million square feet were completed, the most active year of industrial development in the area in the past two decades, according to a report by CBRE. An additional 15 projects are scheduled to be completed by the end of this year. Prime locations include the ports in Newark, the terminal in Elizabeth and the towns off exits 7A to 13A on the New Jersey Turnpike.

The improving economy has certainly spurred interest in the area, but perhaps even more important is the continued growth of e-commerce. Such sales now account for 6.2 percent of total retail sales in the U.S., up from 4.1 percent five years ago. Northern New Jersey allows for immediate access to the Greater New York area, which is home to 23.4 million people, and is a day’s drive from 130 million consumers — one-third of North America’s population. Retailers and manufacturers such as Home Depot and Pepsi have warehouses and distribution centers in the area.

“Urban professionals in the city want same-day or next-day delivery so companies need to be nearby,” said Mindy Lissner, an executive vice president at CBRE.

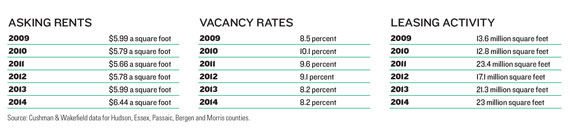

Renewed leasing activity and higher rents for industrial sites are helping to fuel North Jersey’s building surge. Leasing activity skyrocketed 80 percent for the five years ending in 2014 to 23 million square feet, according to a Cushman & Wakefield report. Asking rents increased 11 percent to $6.44 a square foot during the same time period. Meanwhile, the overall vacancy rate is edging back to pre-recession levels. It stood at 8.2 percent last year, down from 10.1 percent at the height of the economic downturn.

“In my 25 years on the job, I haven’t seen it so busy,” said Jules Nissim, an executive vice president at Cushman & Wakefield.

Still, Nissim points out that roughly 75 percent of the buildings under development have not been fully pre-leased. During the last boom, 50 percent of the projects had tenants before they opened.

“It is an interesting dynamic,” said Nissim. “We will see if it can all be absorbed.”

Some companies say it is a challenge to find other locations with New Jersey’s advantages.

“New Jersey has so many transportation access points,” said Jonathan Frisch, vice president of sales and marketing at AP&G, which makes the Catchmaster line of pest-control products.

Duke built a second warehouse in Linden that opened in April.

Three months ago, it started moving from Sunset Park, Brooklyn to a 170,000-squarefoot building in Bayonne that it bought last year. Frisch said the company couldn’t find column-free, high-ceilinged space that was large enough to accommodate its needs in New York City. Upstate New York and Long Island didn’t offer robust transportation

options. The company also considered moving to North Carolina but some members of the family that own the business weren’t keen on such a radical relocation. Plus, Frisch said it was important to the company to keep its roughly 100 employees.

New Jersey has also been offering major tax incentives to lure businesses to the state. Published reports noted that AP&G received $11 million in tax subsidies from New Jersey to move across the river. Frisch wouldn’t comment on the subsidies but said they weren’t the most significant factor in the decision. Location was the firm’s chief concern.

“We need to strike a balance between the family’s desire to stay in the neighborhood and what makes economic sense,” said Frisch.

Palmquist also said that while Duke appreciated the tax breaks it received, they weren’t that significant in the firm’s decision to move into New Jersey.

He said the 50-year-old company had decided to expand into the Northeast so Northern New Jersey was a logical

place to go.

The 144,000-square-foot building in Linden that Duke completed in April is already fully leased to three clients. And 60 percent of the 495,000-square-foot building the company debuted last October has been rented to a liquor distributor.

“We are very pleased with our assets,”

said Palmquist.