Penn Plaza takes its moniker, of course, from Pennsylvania Station — the nation’s busiest transit hub. But Vornado Realty Trust, the mega-REIT that owns some 8 million square feet of office space in the area, has another name for it: the Big Kahuna.

Penn Plaza takes its moniker, of course, from Pennsylvania Station — the nation’s busiest transit hub. But Vornado Realty Trust, the mega-REIT that owns some 8 million square feet of office space in the area, has another name for it: the Big Kahuna.

With hot office markets like Hudson Yards (rising to the west), Chelsea (moving north) and Midtown South (coming in from the east), the Penn Plaza area is the company’s top priority.

“They’ve got a war room dedicated to the area,” one source, who visited the company’s headquarters at 888 Seventh Avenue, told The Real Deal.

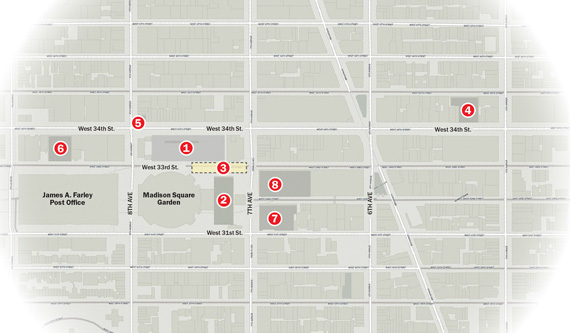

The company is investing hundreds of millions of dollars into properties in the vicinity of the Penn Plaza district to give the buildings and public spaces “a little TLC,” as company CEO Steven Roth has put it. (The company’s properties span from Fifth to Ninth avenues between 31st and 34th streets).

The portfolio is one of the largest concentrations of office space owned by one landlord in the city. All told, it’s about on par with the Related Companies’ Hudson Yards, the World Trade Center site and Tishman Speyer’s Rockefeller Center.

Rents in the Penn Plaza office submarket currently average about $55 per square foot. But Vornado executives have said on earnings calls that upgrading the buildings and the surrounding streetscapes should allow them to jack up rents to rates approaching $90 a square foot, roughly the same as Hudson Yards.

If the REIT can push rents up, say, $20 or $30 per square foot, it stands to gain hundreds of millions of dollars annually in the neighborhood, executives believe.

Alex Goldfarb, a REIT analyst who covers Vornado for investment banking firm Sandler O’Neill, said because Vornado bought several of its buildings a while ago at such a low cost basis, it can comfortably shell out a significant amount of cash to upgrade its properties.

“They’re at a basis where they can really spend,” he said.

Steven Roth

And, he noted the rent increases will be directly tied to how much the company pours into those upgrades.

“The scope of what they’re going to undertake is going to be determined by what kind of rents they think they can get out of tenants there,” he said. “If they’re going for a fluff and buff then you only need 10 bucks more [per square foot in improvements]. If you’re going to do something major, like rip off the skin and put on glass, that could cost 40 or 50 bucks.”

To bolster its efforts, the REIT recently hired Marc Ricks, a former economic development policy advisor for the Bloomberg Administration, as senior vice president of development.

And in April, the company hired Ed Hogan from Brookfield Office Properties, where he was head of the retail division. Hogan — now a key member of the Penn Plaza renovation team — is credited with breathing new life into the former World Financial Center, which his former employer repositioned as Brookfield Place.

“We are knee-deep in planning multiple projects to transform and enhance our vast Penn Plaza holdings,” Roth said on an earnings call last month. “The goal here is to achieve market rents as much as 50 percent higher than today’s rents.”

The following is a rundown on the pieces of Vornado’s Big Kahuna puzzle.

#1 & #2

One and Two Penn Plaza

One Penn Plaza

The most ambitious component of Vornado’s Penn Plaza revamp is its plan to combine the two largest buildings in the area into a 4.2-million-square-foot, tech-style mega complex.

The 2.5 million-square-foot, 57-story One Penn Plaza and the 1.6-million-square-foot Two Penn Plaza sit on the west side of Seventh Avenue, directly across from each other on 33rd Street.

The buildings are currently both linked underground to Penn Station, which Vornado is in the running to redevelop.

“They sit right on top of the busiest train station in North America. There are not many other buildings that share that honor,” Roth said.

“When you think about it, those two buildings are giant,” he added. “They are really sort of like kissing cousins.”

Roth did not reveal much in the way of details on how exactly Vornado would combine the two buildings, but he did disclose plans to re-skin Two Penn and replace the punched windows with new ones that will run nearly floor to ceiling.

Colliers International’s Bob Tunis, who has represented top tech tenants like Google and Facebook, said the Penn Plaza buildings have the potential to attract the types of tenants Vornado is after.

“If you start with the supposition that you’ve got location, and add to that a physical plant that can accommodate tremendous infrastructure improvements, you’ve really got the makings of an extraordinarily attractive center for lots of folks, including those in the tech realm,” he said.

The buildings are already home to tenants such as engineering giant Parsons Brinckerhoff, McGraw-Hill Education and the Dolan family’s Madison Square Garden Company.

Two Penn Plaza

Connecting the buildings will allow Vornado to shuffle tenants between the two properties as their space needs change. It will also allow for a large amenities package that wouldn’t be economical in smaller buildings.

“The population of those buildings that will be coursing through this space is also enormous and we can put food offerings, and even delivery of food, into the complexes,” Roth said. “So there [are] lots of different ideas that we have.” Vornado has already started improving the amenities in and around the buildings. Below ground, the company upgraded some of the food options on the Long Island Rail Road concourse of Penn Station, kicking out fast food joints like KFC and Pizza Hut in favor of Duane Reade and Pret a Manger.

And in January, an 8,000-square-foot, celebrity-chef food court dubbed “The Pennsy” opened at the base of Two Penn in a portion of the space left vacant when retail tenant Borders shuttered five years ago.

#3

Plaza 33

Last year, Vornado hired the global architecture firm Snøhetta — the company behind the public plazas in Times Square and the 9/11 Memorial and Museum — to design a master plan for the district.

The centerpiece of the plan, at least so far, is “Plaza 33,” an outdoor space at the base of One and Two Penn Plaza.

Over the summer, the city temporarily shut down the corner of 33rd Street at Seventh Avenue in front of the towers. Vornado transformed the stretch into a public area with wooden benches that formed a public amphitheater for passersby to sit, play life-sized games of chess or watch the U.S. Open on an outdoor movie screen.

Plaza 33

The company also brought some life to the far end of 33rd Street between Eighth and Ninth avenues. The landlord teamed up with the celebrity caterer Giuliani Social to sponsor a curated food truck park cheekily called “Shipping & Receiving” near the loading docks behind its 330 West 34th Street building across from the Farley Post Office.

“The idea here is to create a large public pedestrian plaza where the street had been, which will provide amenities to the public, improve circulation and access to Penn Station and connect our One Penn and Two Penn properties,” Roth said on a call with investors in August.

“This is an important first step in neighborhood change and creating a sense of place,” he added.

The closure was a test run, and Vornado said it hopes to make it permanent by the end of this summer. The city also temporarily closed a lane of traffic on 32nd Street just south of the Pennsylvania Hotel and ending at the Penn Station superblock, to install benches and make the area more pedestrian-friendly.

#4

7 West 34th Street

Originally designed in 1901 as home to Ohrbach’s Department Store, the 477,000-square-foot building spent a good portion of its life as a showroom for fashion and design companies.

Vornado bought the property back in 2000, reportedly paying around $130 million. Two years ago, it became the first renovation project in the REIT’s Penn Plaza portfolio.

7 West 34th Street

The 12-story building, which sits across the street from the Empire State Building, was only pulling in office rents averaging $29 per square foot before Vornado took back portions of the building from tenants and enlisted the architecture firm MdeAS — best known for its redesign of the GM Building’s public plaza — to transform the lobby.

Then in 2014, the REIT inked a 17-year lease with Amazon to occupy all of the office space in the building at an average rent of about $63 per square foot. The mega e-tailer has plans to open up a 7,000-square-foot store on the ground floor.

The revamped entrance has stone corridors that lead to a futuristic-looking “oculus space” lined in white glass.

The full overhaul also included upgraded elevators, new restrooms and a large outdoor terrace. Vornado is reportedly considering a partial or full sale of the building now.

#5

Eighth Avenue retail corner

In addition to office space, Vornado also owns a lot of retail property in the area, including the 1.1-million-square-foot Manhattan Mall at the southern end of Herald Square.

In June, the company added to its retail portfolio, closing on a $355 million acquisition of the three-story, 78,000-square-foot Old Navy property at 144-150 West 34th Street.

Eighth Avenue retail corner

But not all of the REIT’s retail holdings in the neighborhood are suitable for flagship stores.

The company owns a handful of small retail sites (occupied by pizza joints and trinket shops) near 34th Street and Eighth Avenue.

In September, it picked up a 1,690-square-foot “taxpayer” at 265 West 34th for $28.5 million. The property came with 16,900 buildable square feet, which, combined with two other adjacent sites the REIT owns, gave the company some 69,000 square feet of development rights at the corner of Eighth Avenue.

Vornado bought the corner property in 1997 from the estate of Murray Riese, who made a fortune operating fast food franchises like Dunkin’ Donuts and Houlihan’s.

Riese’s T.G.I. Fridays occupied the building until a few years ago when his son, now head of the company, bought a small building further east on the block and renovated that for his restaurant.

Vornado’s now got a three-story-tall construction fence up around the site, and it is keeping tight-lipped about its plans.

The only clue comes from Vornado’s website, which pictures a rendering of a new-and-improved facade with signage bearing the name “Vindali.”

The website notes that there will be slightly more than 4,800 square feet available across five levels with nearly 90 feet of frontage wrapping around the corner.

#6

330 West 34th Street

The 682,000-square-foot building near Ninth Avenue is humming with new office tenants. But Vornado, which has owned the building since 1998, has yet to reveal the storefronts, which are currently hidden behind construction fences emblazoned with the phrases “Onward and Westward” and “The Future is West.”

330 West 34th Street

Vornado saw an opportunity back in 2011, when the city’s Human Resources Administration announced plans to relocate to Brooklyn and in the process leave about 271,000 vacant square feet in the REIT’s property.

In 2014, Vornado hired HOK Architects to renovate the lobby, storefronts and entrance.

The company then boosted rents, which were hovering around $30 a square foot, to an average of $60 per square foot with a trio of big leases.

In early 2014, it signed woman’s clothing retailer New York & Co. to 185,000 square feet. Then in the summer, it inked an 85,000-square-foot deal with the advertising app Yodle, which was preparing for a $75 million initial public offering and expected to nearly double its workforce to 550 employees.

Also during the summer of 2014, Vornado drew Donny Deutsch’s advertising agency away from the Google building at 111 Eighth Avenue to a roughly 74,000-square-foot space.

More recently, Vornado convinced retailer Foot Locker to relocate its corporate headquarters from Empire State Realty Trust’s 112 West 34th Street two blocks east.

#7

11 Penn Plaza

11 Penn Plaza

Sitting across the street from Penn Station, 11 Penn Plaza is just a quick step away for commuters who enter the former Equitable Life Building through its dramatic vaulted lobby.

Vornado purchased the building in 1997, when it paid developer Bernard Mendik $437 million to buy a portfolio that included both 11 Penn Plaza and 2 Penn Plaza. Mendik, who died in 2001, had renovated the building’s lobby and restored its facade in 1982.

About a year ago, AMC Networks renewed and expanded its lease to take 330,000 square feet in the building. Asking rents at the time were reported to be in the $60s per square foot range.

“AMC looked around the market and ultimately decided to remain committed to 11 Penn. The key to making this deal with AMC was finding growth space for them in a fully occupied building,” said David Greenbaum, president of Vornado’s New York division, on a company earnings call last year.

The trick to getting the deal done, Greenbaum explained, was unlocking three floors in the building to free up more than 60,000 square feet.

Earlier that year, the landlord renewed Dolan’s MSG company for about 60,000 square feet. And in 2013, Vornado renewed Macy’s for 646,000 square feet of office space, locking up the tenant through 2035.

#8

Hotel Pennsylvania

Vornado is still up in the air with its plans for the 1,700-room hotel across the street from Penn Station on Seventh Avenue.

Hotel Pennsylvania

Prior to the financial crisis, the developer had a handshake deal with Merrill Lynch to tear down the building and construct the financial firm a 68-story, 2.8-million-square-foot headquarters on the site that would top out taller than the Empire State Building.

During the financial crisis, however, Merrill Lynch was purchased by Bank of America, and plans for a new headquarters were shelved.

Vornado still has approvals in place for that project and has been approached in recent years by other interested tenants. But back in 2014, Roth said the numbers didn’t work out.

The on-again, off-again plans have also included renovating the property or connecting it to the company’s 1.1-million-square-foot office-and-retail property Manhattan Mall, which counts JC Penny and advertising giant FCB Global as tenants and sits on the other side of the block facing Sixth Avenue. The building is currently clad in construction netting. But in August, Roth again told investors he couldn’t yet commit to a teardown or renovation.

“We are also unable to make a commitment now as to whether it’s going to go for a hotel use or an office use or whatever,” he said on an earnings call.

“We have all kinds of different conversations going on,” he added. “I can only tell you one thing with incredible sincerity: It will be well worth the wait.”