It was hard to miss the near mass hysteria that overtook social media in October when the beloved upstate supermarket chain Wegmans opened its first New York City location at the Brooklyn Navy Yard.

And the enthusiasm surrounding the grand opening was a much-needed reprieve for the city’s retail sector. It came sandwiched between the bankruptcy filing of fast-fashion pioneer Forever 21 and the announcement that retail institution Barneys is closing its doors.

But Wegmans was not alone. The same week it opened, Nordstrom opened a massive department store at Columbus Circle and the American Dream Mall debuted across the Hudson River in New Jersey.

“To me that’s a pretty significant moment in our world,” said Newmark Knight Frank’s Jeffrey Roseman, a top retail broker. “The three of them are thumbing their noses at all the talk that people don’t want to shop anymore.”

That’s not to say the retail market has seen all of its problems evaporate overnight. Stores are continuing to close, rents are declining and unfavorable regulation may be on the horizon. But in recent months, there have been signs that buck the trends, with some stores opening and leasing volume starting to pick up.

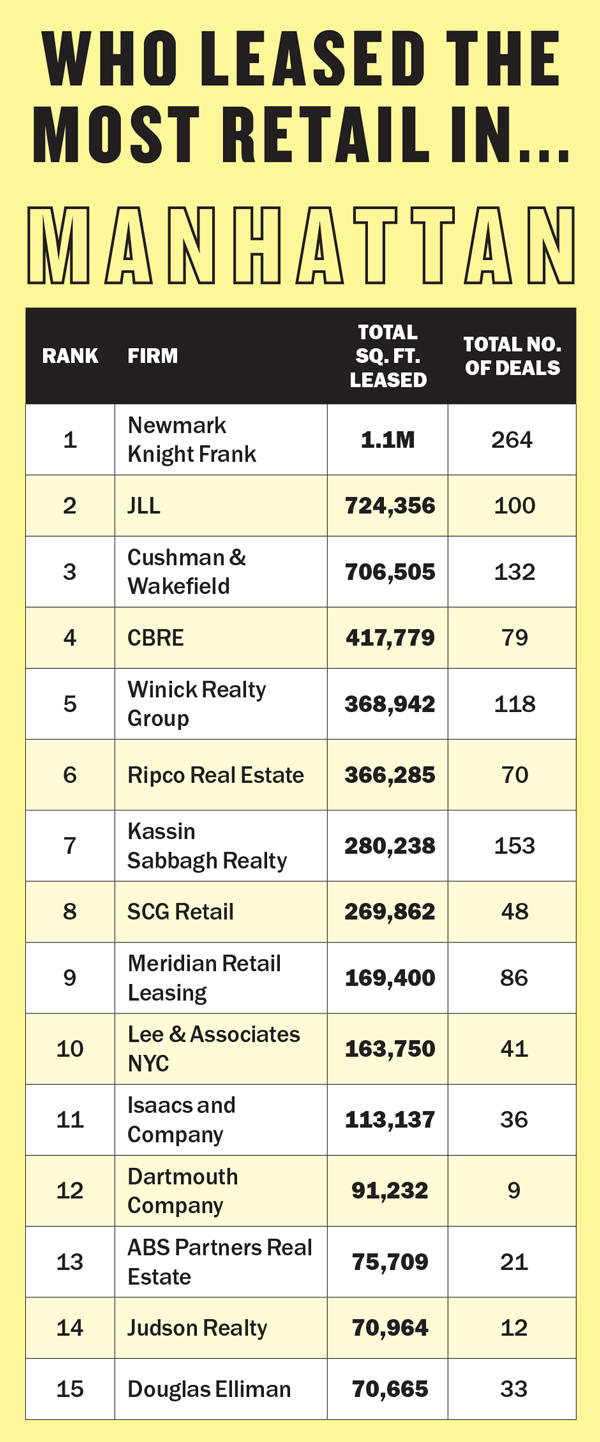

This month, amid these conflicting messages, The Real Deal ranked the city’s largest retail brokerages in both Manhattan and Brooklyn by the amount of square feet they leased and the number of deals they brokered between Oct. 1, 2018, and Sept. 30, 2019.

In Manhattan, the annual ranking found that Newmark is now the undisputed leader — indicating that its 2018 purchase of the powerhouse boutique retail brokerage RKF is paying off.

In Manhattan, the annual ranking found that Newmark is now the undisputed leader — indicating that its 2018 purchase of the powerhouse boutique retail brokerage RKF is paying off.

Last year, RKF and Newmark ranked first and third, respectively, with a combined 1.27 million square feet leased in Manhattan. This year, the joint firm leased less than that at 1.1 million square feet, but still outperformed all of its Manhattan rivals.

JLL came in a distant second with 724,356 square feet in Manhattan deals. Rounding out the top five were Cushman & Wakefield with 706,505 square feet leased in Manhattan, CBRE with 417,779 square feet leased and Winick Realty Group with 368,942 square feet.

Retail leasing activity — which began stabilizing last year after a shaky stretch — turned a corner around mid-2019 in Manhattan. In the third quarter, leasing volume logged a 12.3 percent year-over-year jump, according to data from Cushman.

Sources said that activity was spurred on by drops in average asking rents. Those rents continued to fall from their 2015 peak, tumbling 5.7 percent in 2019’s third quarter year-over-year to $756 per square foot, according to CBRE.

Still, retail bankruptcies continued to drag on the market.

On a third-quarter earnings call, Vornado Realty Trust President Michael Franco called Forever 21’s bankruptcy a “negative surprise” for the company. The retailer has space at three Vornado buildings: 435 Seventh Avenue, 1540 Broadway and 4 Union Square South.

Franco said Vornado had reached an agreement with Forever 21 to shorten its leases in the first two locations “for a little less than half of their current rent.” The Union Square lease, meanwhile, expired last month and some of the space has already been re-leased to Whole Foods.

The move, Vornado execs said, put a damper on its financial outlook for 2020.

Barneys, meanwhile, is closing all of its 22 stores nationwide, though its Madison Avenue flagship — owned by Ashkenazy Acquisition — will reportedly remain open for a year. In Brooklyn, its 10,000-plus-square-foot Atlantic Avenue store will close, according to news reports.

But despite these pain points, this past year saw two huge shopping meccas open in Manhattan: the Columbus Circle Nordstrom and Neiman Marcus at Hudson Yards.

“I think the Nordstrom deal is a huge game changer that took a tremendous amount of guts on their part,” said David Firestein of SCG Retail, which ranked No. 8 with 269,862 square feet. Among the firm’s largest deals this past year was — the 60,000-square-foot lease Whole Foods inked at 63 Madison Avenue, which was negotiated by SCG’s Chase Welles and Jacqueline Klinger .

Firestein noted that Nordstrom is helping to draw in shoppers with seven bars and restaurants spread across different levels of the store. That includes some watering holes that are offering happy hour specials to draw in large crowds toward the end of the day.

“Right now [Nordstrom] flies in the face of what everybody else is doing, and they’re doing it in a really creative way,” he said.

Meanwhile, the 1 million-square-foot mall at Hudson Yards open was the arguably the biggest shot in the arm for New York City’s retail in years.

Richard Hodos of CBRE — who brokered the 35,000-square-foot lease for Warner Bros. Entertainment’s Harry Potter-themed exhibit at 935 Broadway in the Flatiron District — said the landscape is changing fast as retailers scale back footprints or close stores while rents fall and vacancies climb.

Retailers, landlords and brokers, he said, are having a difficult time keeping up with the changes: “In my 32 years of doing this, I’ve never quite seen a market like this. It’s not as bad as some would have you believe, but it’s been a year of tumult and change.”

‘How much is too much?’

Hudson Yards opened in March with a spectacle that included a marching band parading through its shopping corridors and Liza Minnelli singing “New York, New York” to a crowd at Neiman Marcus.

Now, nine months on, New York retail brokers said the project appears to be defying the odds in a still-shaky retail sector.

(SOURCE: TRD ANALYSIS OF MANHATTAN AND BROOKLYN RETAIL LEASING DEALS THAT WERE COMPLETED OR MADE PUBLIC BETWEEN OCT. 1, 2018, AND SEPT. 30, 2019. DATA WAS PULLED FROM PUBLIC SOURCES AND FROM DEALS SUBMITTED BY FIRMS. POP-UP LEASES OF ONE YEAR OR LESS WERE EXCLUDED. DEALS AND TOTALS WERE SHARED WITH FIRMS FOR CONFIRMATION. NOT ALL FIRMS PARTICIPATED, AND SOME FIRMS ONLY PROVIDED A PARTIAL LIST OF THEIR DEALS.)

“I think Related did a tremendous job in a very difficult retail environment,” said CBRE’s Hodos.

But he added that the mall was siphoning business away from Midtown on stretches such as Fifth and Madison avenues and the 34th Street shopping corridor.

Whether that can be directly attributed to competition from Hudson Yards may be up for debate, but some of Midtown’s prime shopping areas are struggling to lease available space. Madison Avenue, for example, saw the number of ground-floor availabilities rise to 38 spaces from 34 over the past year, according to CBRE.

But Hodos also noted that new malls are still coming online, such as the Empire Outlets on Staten Island (and the American Dream).

“There’s some question as to how much is too much,” said Hodos. “We have way too much retail space in the country.”

As of the beginning of October, U.S. retailers had announced plans this year to shutter almost 8,600 stores, far more than last year. And store closures are on pace to hit nearly 12,000 by the end of the year, according to data firm Coresight Research, a retail consultant.

While there are plenty of store closures throughout the five boroughs, New York City is generally a different beast than the rest of the country.

Related Companies said the retail at Hudson Yards, which spans 720,000 square feet of leasable space, was 85 percent spoken for when it opened and is projected to be 95 percent leased by the end of the year. If that pans out according to plan, it would be slightly ahead of schedule: The company was predicting that it would be 90 percent leased up by the end of 2019.

Nonetheless, retail brokers said it will take some time to see how the mall truly performs. Related estimates 20 million to 24 million people will visit on an annual basis. But broker say traffic may fall off as the novelty dies down.

And the project will soon face competition as the retail portion of Brookfield Property Partners’ Manhattan West starts opening across the street. Whole Foods, Peloton and a restaurant from Danny Meyer’s Union Square Hospitality Group are set to open there in 2020.

Winick’s Lee Block said Hudson Yards is having a ripple effect up and down the Far West Side, turning it into one of the more active markets.

Block is leasing up new retail space at Lalezarian Properties’ 35-story rental tower at 507 West 28th Street, where he’s inked deals with a school and an optical store.

“Even outside of Hudson Yards proper — down 10th Avenue and on the side streets — we’ve seen a major uptick in our activity for retailers looking to be in that district,” he said.

In Brooklyn, meanwhile, the retail landscape is also in flux.

In Brooklyn, meanwhile, the retail landscape is also in flux.

In that borough, the boutique brokerage RIPCO took the top spot on TRD’s ranking. It was followed by Tri State Commercial Realty, Cushman, EXR and Newmark.

Those brokerages are also dealing with rents that are correcting.

Average asking rents decreased over the summer in 12 out of 17 of the borough’s main shopping corridors, according to the Real Estate Board of New York’s most recent Brooklyn retail report.

By and large, rents are on the decline in the borough’s more mature neighborhoods as property owners look to remain competitive, REBNY noted.

Yet Brooklyn remains in demand. Life Time fitness inked a 77,000-square-foot lease at CIM Group and LIVWRK’s under-construction condo-and-rental complex Front & York, which is slated to open in 2021 in Dumbo. The outpost is Life Time’s first in Brooklyn.

And the popular clothing retailer Everlane opened its first outer-borough store in September. The company, which started out as an e-commerce brand, opened its first New York brick-and-mortar store in Nolita in 2017 and is now expanding to Williamsburg.

“It was always like Soho was a really important market to tenants growing, and now Williamsburg is extremely important,” said Greg Tannor of Lee & Associates.

Jockeying for position

RKF brokers are in the midst of finalizing their move into Newmark’s offices near Grand Central Terminal, one of the final steps left in integrating the two firms.

And while the acquisition turned Newmark into the most dominant retail brokerage in the city, it hasn’t been without drama.

Nordstrom opened a massive store at Columbus Circle in October.

Some of RKF’s longtime brokers left before the deal closed. Among them, Beth Rosen decamped to RIPCO, and restaurant specialist Spencer Levy went to CBRE. And Newmark fired RKF founder Robert Futterman this summer because of alleged erratic behavior and drug use.

Futterman said he had been using medical marijuana and argued that he was falsely accused and unfairly treated. He’s been scarcely heard of since he was arrested for a DWI crash in the Hamptons in July.

Newmark CEO Barry Gosin, meanwhile, told TRD last month that Futterman’s departure had no negative impact on the company’s bottom line, noting that RKF revenue is up more than 21 percent from a year ago.

“The proof is in the pudding,” he said, adding that Newmark established a joint committee made up of leaders from both firms to help direct the retail business. “I’ve got no shortage of leadership to lead brokers.”

Despite those internal disputes, with RKF now part of a larger (and more corporate) brand, some see an opening in the competitive landscape.

“An independent competitor was removed from the competitive set,” said Gene Spiegelman of RIPCO.

Spiegelman — who left Cushman last June to become a partner at RIPCO — said his company has more than 100 brokers spread across the tri-state area.

And Spiegelman, who this year did a 67,000-square-foot lease for discount clothing store Century 21 at the Roosevelt Field Mall on Long Island, said RIPCO now sees itself as the top independent retail shop. “That’s the business opportunity I personally step into,” he said.

Other than the Newmark-RKF shakeup, the top of the Manhattan pack remained relatively unchanged — with the exception of Meridian Retail Leasing, which cracked the top 10 for the first time, brokering 169,400 square feet of Manhattan retail details and clocking in at No. 9.

The firm had no retail leasing division until last June, when it hired James Famularo and his team, who were looking to set up shop after Eastern Consolidated shuttered.

Famularo said he now has 18 brokers on his team — up from the six he had at the team’s high point at Eastern — and that the group had just closed its 100th lease since joining Meridian.

Neiman Marcus opened at Hudson Yards earlier this year.

“Keep in mind, that was while we were putting in our infrastructure,” he said. “Now we’re killing it.”

And while it wasn’t a massive year for broker poaching, there were some notable moves.

In August, Lee & Associates hired Jedd Nero, who spent five years heading up Avison Young’s retail group.

On a more somber note, Faith Hope Consolo, the outsized personality who ran Douglas Elliman’s retail division, died suddenly of a heart attack last December.

“It was pretty shocking, to say the least,” said Corey Shuster, one of the team members who took the reins.

The 73-year-old Consolo — the self-described “Queen of Retail” — had been one of the city’s most prolific retail brokers and served as the chair of Elliman’s retail group.

Elliman has kept her team in place and is now expanding its ranks.

Shuster said the group has added two more people for a total of five brokers, and it plans to grow to 12 next year.

Elliman ranked No. 15 this year with 70,655 square feet.

“Since January, we’ve put the pieces back together,” Shuster said. “Obviously, the retail market been a challenge, but it’s been a successful year.”

Revisiting regulation

Store closures and empty storefronts have drawn attention from local lawmakers, who have proposed legislation the industry is adamantly opposed to.

In September, City Comptroller Scott Stringer — who is planning a 2021 run for mayor — released a study showing that empty retail space doubled from 5.6 million square feet in 2007 to 11.8 million square feet in 2017.

Meanwhile, in July, the City Council passed a bill to create a registry of retail information including vacancies, rental rates, lease lengths, store sizes and upcoming expirations.

But the proposal that concerns brokers the most is the council’s Small Business Jobs Survival Act, referred to in the industry as commercial rent control.

The industry was furious when the bill was first introduced in March 2018. The initial proposal would have given commercial tenants — even companies that lease hundreds of thousands of square feet of office space — the right to renew a lease for 10 years and demand arbitration for rent hikes they considered too high.

The legislation stalled, but last month Brooklyn Council Member Stephen Levin announced plans to introduce a new version focused on “community-facing” businesses that occupy smaller spaces.

Winick’s Block said the new regulations would be a “major strain on the entire industry.”

Overall, the numbers do not indicate a retail crisis is brewing.

Collectively, Manhattan’s top 15 firms leased 5 million square feet last year — up from 4.2 million on TRD’s 2018 ranking. In Brooklyn, meanwhile, the top 15 brokered 1.6 million square feet in deals, up 12 percent over last year

Still, almost all brokers agree that it’s a strong tenant’s market. Landlords are still willing to lower rents and give greater concessions in order to lock down deals, a trend since the market peaked a few years ago.

Lee & Associates’ Tannor said he’s seeing more opportunities for tenants that might have found it difficult to break into the market in the past.

He cited a 3,100-square-foot deal he brokered for Small Door Veterinary at Rudin Management’s Greenwich Lane. In a tighter market, he said, Rudin may have been more aggressive with its lease terms and may not have bothered taking a chance on a startup.

“My tenants love this type of market,” Tannor said. “[There are] vacancies throughout Manhattan and the opportunity to take positions that [tenants] can afford now that maybe a few years ago were not affordable.”