When Kushner Companies paid $1.8 billion for 666 Fifth Avenue, a dated office tower that Brookfield’s Ric Clark once described as a “dinosaur,” it was supposed to cement Jared Kushner’s rise.

The Kushner family, much like the Trumps, had been on the periphery of New York’s real estate elite, eclipsed by big names like Stephen Ross and Gary Barnett.

The firm that Jared’s father, Charles Kushner, founded in the mid-1980s had stronger ties to New Jersey, where it often pooled money from investors for apartment building acquisitions, before officially moving to New York. And Charles, having been released from federal prison in 2006, hoped the trophy deal would redeem him in the eyes of the real estate world.

But during his ascent in New York, and later Washington, D.C., Jared has faced nonstop questions about 666 Fifth Avenue — a fiasco for Kushner from the start — and whether Brookfield Property Partners’ $1.28 billion investment in the tower was part of a quid pro quo for a U.S. foreign policy decision.

Ever since Jared was named a senior adviser to his father-in-law, President Donald Trump, political opponents have accused the Kushner family and associates of using the White House to further their business interests.

Four years in the Washington spotlight have included numerous inquiries into the firm’s business practices. The latest could be the most significant: a probe launched by congressional Democrats this month to determine whether Brookfield’s bailout of the beleaguered skyscraper in 2018 was linked to the lifting of a Saudi blockade of Qatar.

“Regarding 666, the fake narrative about Brookfield’s involvement being influenced by Qatar is too dumb to warrant a response or a comment,” Christopher Smith, Kushner’s general counsel, said in a statement.

The conclusion of Jared’s stint as White House senior adviser marks a transition that could mean less scrutiny for his family’s firm. Whether or not Jared returns to his father’s side after Jan. 20, 2021, the company is forging ahead on rental property investments in New York, New Jersey, South Florida, Memphis and smaller markets outside major metropolitan areas.

Laurent Morali, who took over from Jared as Kushner Companies’ president in the summer of 2016, told The Real Deal in an interview last month that the time to invest in an asset class is “when no one else wants to touch it” — which is true now of rent-stabilized buildings in New York City.

But as Kushner Companies shifts its focus back to buying and building apartments, the turmoil of the past four years may hamper the firm’s bid to refocus on the unglamorous but potentially lucrative world of multifamily investing.

“It just depends on how active Jared wants to stay in the political system,” said Marc Tropp, a senior managing director of the brokerage firm Eastern Union Funding. “If he wants to be a player in politics, he’s going to bring more scrutiny on the company.”

Bread and butter

While Kushner Companies has made headlines with 666 Fifth, most of its holdings are low-profile.

The company has found the most consistent success in buying older, garden-style apartments and urban rental properties where it can rehab units and raise rents — a tried-and-true real estate strategy.

But even that has brought controversy with city and state officials and tenant groups often accusing the company of foul play.

Kushner Companies’ multifamily assets are largely outside of the five boroughs with the majority still in New Jersey, though the firm declined to provide details of the full scope of its portfolio.

According to its website, the company owns 17,000 apartments in New York, New Jersey, Maryland, Virginia and Tennessee. The Kushner family controls another 2,100 units in the East Village, Greenwich Village, Soho, the West Village, Brooklyn Heights and Williamsburg, as well as Northern Liberties, in Philadelphia.

Kushner Companies’ relatively small footprint in the city could change, however. “Right now, it’s a great time to look at entering the New York City market, if you’re not [already] in the market,” Morali said. “I’d love to expand our presence there, no question.”

Morali explained that buyers and sellers are still struggling to price rent-stabilized multifamily assets in New York following a rent law overhaul last year. But opportunities might arise to score assets at a significant discount.

In the meantime, the firm is also looking to acquire more apartments in suburban areas seeing a pandemic-induced surge of interest from investors and renters.

Acquisitions outside of dense urban areas could draw less scrutiny from politicians and tenant watchdog groups. Aaron Carr’s Housing Rights Initiative, for instance, has been investigating Kushner Companies’ activities in New York City for years, producing a string of lawsuits alleging the company has illegally evicted tenants and inflated rents at its buildings.

But flying under the radar anywhere figures to be a challenge for Kushner Companies, especially with Jared’s father-in-law plotting to run for president again in 2024 if he cannot overturn the election results.

Even outside of New York City — a liberal stronghold where Democrats know certain investigations will appeal to voters — Kushner Companies has drawn scrutiny.

In October 2019, Maryland Attorney General Brian Frosh sued Westminster Management, the property management entity owned by Kushner Companies, for “unfair or deceptive” rental practices. (Jared Kushner received $1.65 million in income from Westminster in 2019, White House ethics filings show.)

The lawsuit came after a bombshell investigation by ProPublica into conditions at the apartments.

In an interview, Frosh told the Baltimore Sun that the landlord was “cheating tenants before, during and after their tenancy” and that there were hundreds of thousands of Consumer Protection Act violations. At the time, Morali called the charges “bogus.”

“Regarding the Maryland lawsuit, the case has been tried in court, and the final judgment rendered, which we look forward to, will speak for itself,” Kushner’s general counsel wrote in a statement.

In December, Kushner Companies listed 10 multifamily properties in the Baltimore area for $800 million, a move that Morali said was unrelated to the Maryland charges but rather was prompted by the assets having reached their investment horizon.

Political punching bag

Three months before his re-election in 2018, New York Gov. Andrew Cuomo launched an investigation of alleged tenant harassment by Kushner Companies at the 338-unit Austin Nichols House in Williamsburg, Brooklyn.

That came a day after tenants at the building filed a $10 million lawsuit alleging the company drove rent-stabilized residents out of their homes with construction harassment — a common complaint of rent-stabilized tenants at the time. (Landlords’ incentive to create vacancies has since been significantly reduced by the new rent law.)

Announcing the investigation, state officials touted Cuomo’s “zero tolerance” for tenant harassment. At the time, a Kushner Companies spokesperson called the investigation baseless, saying the company was being targeted for political reasons.

666 Fifth Avenue

Asked this month about the investigation, Jonathan Sterne, a spokesperson for Cuomo, said he had no knowledge of it. He did not respond to subsequent inquiries on its status.

Kushner Companies has faced a stream of similar investigations and lawsuits in recent years — and its political opponents haven’t let up since Trump lost to Joe Biden.

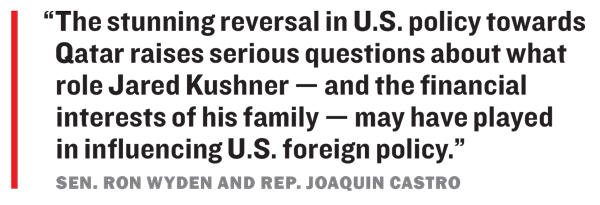

On Dec. 9, Sen. Ron Wyden of Oregon and Rep. Joaquin Castro launched a probe into the 666 Fifth Avenue transaction, a deal which shocked the real estate world.

Kushner Companies purchased the office tower for $1.8 billion — a record high for a single office building in the U.S. — in 2007, taking out debt for all but $50 million. A decade later, the 1950s-era property was 30 percent empty and not producing enough income to cover the debt service.

Months before a $1.4 billion debt payment was due, Brookfield saved the Kushners from a financial catastrophe by buying the ground lease for $1.28 billion and prepaying nearly a century in rent.

A month before the deal closed, the Trump administration supported lifting diplomatic and economic restrictions on Qatar. The Persian Gulf country’s sovereign wealth fund was the second-largest shareholder in the Brookfield entity that financed the 666 Fifth Avenue deal.

“This sequence of events, especially the stunning reversal in U.S. policy towards Qatar, raises serious questions about what role Jared Kushner — and the financial interests of his family — may have played in influencing U.S. foreign policy regarding the blockade,” the lawmakers wrote.

Return of the Jared?

While Kushner Companies copes with controversies, inquiries and investigations, sources close to the firm expect it to seek a lower profile as it returns to its roots as a multifamily landlord.

But the success of that effort will depend on how much political blowback continues to plague Jared.

Several industry sources said they expect him to return to a larger role at the firm, from which he never completely divested. Jared and his father enjoy working together and think much alike, according to sources who know them.

The company’s reversion to multifamily is well timed. Outside of New York City, the asset class has become increasingly sought after during a turbulent period for its consistency and dependability. Renters, by and large, have continued to pay each month, even if by credit card, or by skimping on other expenses. That’s good news for landlords like Kushner, and investors have taken note.

Morali underscored the interest that investors from around the world have in multifamily assets, which many consider to be a port in the storm.

“The large global asset allocators that need to deploy money in real estate — they’re looking to deploy it into the safe haven that is multifamily,” he said, adding that low interest rates bolster returns for multifamily, creating a “double-whammy” effect.

In the upcoming years, “you’re going to see multifamily keeping its attractiveness compared to the other asset classes,” he predicted.

The company has also enjoyed attractive financing from Freddie Mac, the government-sponsored entity that securitizes mortgages, scoring an $800 million loan package with unusually good terms for its Maryland acquisition.

Likewise, major banks may not be deterred by Kushner Companies’ controversies. Although lenders are typically averse to reputational risk, some banks will continue to finance acquisitions as long as the deals pencil out. Kushner Companies knows that well, having had success getting loans after its patriarch went to prison.

But Trump’s controversial presidency has made the Kushner name a lightning rod and headaches a certainty. Asher Abehsera, who previously partnered with Kushner Companies, has faced community opposition to an investment although Kushner Companies is not involved, Business Insider reported this month.

It could be, though, that negative press starts to lose its effect post-Trump and becomes relatively inconsequential for the Kushners and those who do business with them. David Eyzenberg, president of New York City investment bank Eyzenberg and Company, said that any “initial chilling effect” stemming from the investigations will likely ease eventually.

One prominent multifamily player was inclined to agree.

“Kushner has really laid themselves on the table, for good and for bad,” said the landlord, who spoke on condition of anonymity. “They’ve had so many bad headlines, one more can’t hurt.”