It’s high tide. Long Island’s luxury residential brokerage business is seeing a new wave of competition as more new entrants grab market share by way of new technology and hefty commission splits.

From the grassy edges of Queens to the pebbly shores of Montauk, upstart firms are flexing their muscles in ways that are increasingly drawing attention — even if not all of that attention is positive.

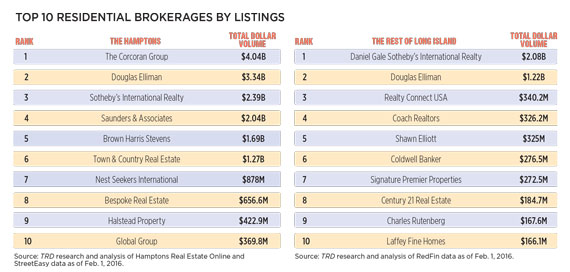

Some of those younger brokerages, ranging from several years to just a few months old, are beginning to boast agent and listing totals that rival heavyweights including Douglas Elliman, Sotheby’s International Realty and the Corcoran Group, according to a recent analysis by The Real Deal.

Of course, Long Island, which is checkered with suburbs and resort getaways, can’t really be painted with the same broad brush. For one, brokerages in the tight-knit Hamptons seem to be losing more ground to the new kids on the block than their counterparts on other parts of the Island, according to

the analysis.

Andrew Saunders of Saunders & Assoc.

But the sense of rising competition across Nassau and Suffolk counties remains clear. “This is a time of significant disruption,” said Andrew Saunders of Hamptons-based Saunders & Associates. His firm, which launched in mid-2008, is still considered a new face by many longstanding players, even if younger firms like Compass are now challenging it.

“In times of disruption, in any business, you are going to get compromised if you rely on your reputation alone,” Saunders said.

The Hamptons

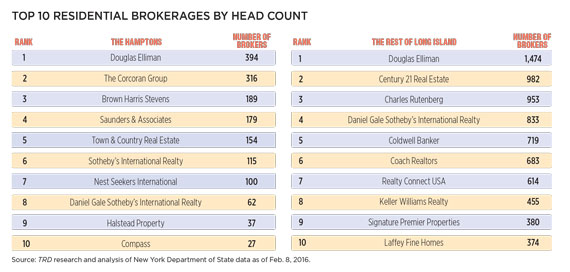

From 2015 to 2016, Saunders & Associates added 13 agents, marking an eight percent bump, according to TRD’s rankings. While that may have paled next to Saunders’ growth from 2014 to 2015, when the firm hired 38 agents, the yearly increases come as more established firms are slimming down.

The Corcoran Group has 19 fewer agents in the Hamptons this year, after losing seven the year before. Likewise, Douglas Elliman has two fewer agents in 2016, though that reduction comes a year after it gained 26, the numbers show.

Evaluating brokerages by headcount can be of limited use in measuring those firms’ health, according to some folks in the industry. Yet for ranking purposes, the metric loosely coincides with other data points, such as listing dollar totals, and sheds some light on the workings of the industry as a result.

That said, several newbies have made inroads by broker totals. Last October, Compass, which has 27 agents in the Hamptons, opened its first office there on Main Street in Bridgehampton in a former Corcoran berth. Outposts in East Hampton and Sag Harbor quickly followed.

This spring, Compass plans on cutting the ribbon on a fourth office, in Southampton — also in onetime Corcoran digs — and will hire more agents to staff it, said Ed Reale, a senior managing director at the firm, which launched as Urban Compass in 2013.

As for Reale’s hiring strategy, he said that he and his associates remain selective. “We want to be careful about the culture of the office and the dynamics,” he said. “It just depends on how many people fit the bill.”

Reale added that the idea is to go after “the top 10 percent” of Hamptons agents, including talent from Corcoran, Elliman and Sotheby’s, which tacked on just two agents from 2015 to 2016.

Compass, which boasts software that allows its agents to create elaborate “pitch packages” for sellers, is also looking to grow its ranks through acquisition. In January, the firm snapped up Sag Harbor’s 21-year-old Strough brokerage, a deal that gave it a new office and three additional agents, Reale said.

But critics say Compass is too aggressive in its growth. Both Brown Harris Stevens and Corcoran have sued the firm over poaching agents. Also, in December, Saunders filed a suit against Compass for allegedly hacking into Saunders’ computers and swiping thousands of listings. Compass denies the charges.

James Phelps Retz of Daniel Gale Sotheby’s

Other Hamptons newbies include Bespoke, owned by two brothers, Zach and Cody Vichinsky, both ex-Corcoran agents. Launched in 2014, and focused on $10-million-and-up listings, Bespoke, with just a dozen agents, offers $657 million in listings, for an eighth-place finish on TRD’s list of the top 10 Hamptons brokerages by dollar volume.

If old-guard firms are scaling back, these “disrupters” have only something to do with it, said Paul Brennan, Elliman’s regional manager for the Hamptons. What also has to be considered is that market conditions aren’t quite what they used to be, he added.

In the fourth quarter of 2015, the housing market in the Hamptons was robust. The average house price, $2.38 million, was up from both the third quarter and year-ago quarter, according to a recent Douglas Elliman report. Even the average price in the luxury segment — the top 10 percent of all sales — seemed strong. It stood at $12.3 million, the report stated, up from $10.9 million in the fourth quarter of 2014.

Still, Brennan said the first quarter of this year has been comparatively sluggish.

“Deals have been very sporadic,” he said. “Buyers have been much more circumspect about writing checks.”

The Non-Hamptons

Away from the beachside glitz, in the non-Hamptons parts of Suffolk and Nassau, upstart brokerages are also standing out.

Fern Karhu of Realty Connect USA

Realty Connect USA, which launched in the thick of the recession in December 2009, has now swelled to 614 agents, which is good enough for a seventh-place finish on TRD’s list of the top 10 non-Hamptons brokerages by listings dollar volume.

The Woodbury-based firm has been able to attract so many agents in part because it awards them a notable 90 percent share of all commissions, versus the 60 percent historic norm, said Fern Karhu, a Realty Connect founding principal and former employee

of Elliman.

Also unusual: Most of the firm’s 11 offices on Long Island (and a 12th in Queens) are basic 1,500-square-foot “conference centers” that lack receptionists and traditional desks but are open to all employees round the clock. “Agents can work out of any location they chose,” Karhu said.

While the set-up undoubtedly keeps the firm’s overhead low, the arrangement also provides brokers with a flexibility that other firms can’t match, said Karhu, who has recruited talent from major players including Daniel Gale and Elliman.

Despite any erosion of its ranks, however, Elliman remains a dominant player in Nassau and Suffolk. Its 1,474 agents are tops on Long Island, according to TRD’s analysis, followed in distant second place by Century 21 Real Estate’s 982 agents. Signature Premier Properties, a 9-year-old company that first opened in Huntington, came in ninth place, with 380 agents, while Laffey Fine Homes came in 10th with 374 agents.

Likewise, if Elliman or Daniel Gale, which has sold homes on Long Island since 1922, feel threatened by Realty Connect and other insurgents, it’s tough to notice. Daniel Gale, which has 833 agents across 28 Long Island offices, is marketing $2.1 billion in properties, the largest haul on the Island. Elliman, with $1.22 billion in listings, was second, according to TRD’s ranking.

James Phelps Retz, a senior vice president with Daniel Gale, pointed out that last year was the brokerage’s best in terms of sales volume, with $2.5 billion in closed transactions. (Daniel Gale is an independent company that pays fees to be a franchise of Sotheby’s International Realty.)

In step with a recent ramp-up in hiring, last month the brokerage opened a new office in Nassau’s Rockville Centre, which will employ 30 agents, many of whom will be new, Retz said.

“Being bigger doesn’t necessarily mean being the best,” he added. “But there is a burning desire here to be the best.”

New business lines have buoyed the company, suggesting ways in which established firms may evolve. Over the past three years, Daniel Gale has expanded into new development marketing, Retz said, “for reasons of necessity.” Past and present clients have included RXR Realty, Cord Meyer Development and O’Sullivan Builders and Developers.

Also, to cater to the North Shore’s influx of Chinese buyers, Daniel Gale has encouraged its agents to be conversant in other tongues. About 20 percent are fluent in a second language, according to Retz.

“This is a culture of people who care about their own success,” he said. “But they care about the people they work with, too.”