Long Island, traditionally associated with single-family homes, is still seeing demand for denser living skyrocket as buyers, particularly empty-nesters looking for less upkeep and easier living, flock to new condo developments across Nassau and Suffolk counties. And the builders who outlast the often years-long permitting processes can reap millions in rewards, as evidenced by The Real Deal’s analysis of the priciest new Long Island condominium developments ranked by sellout.

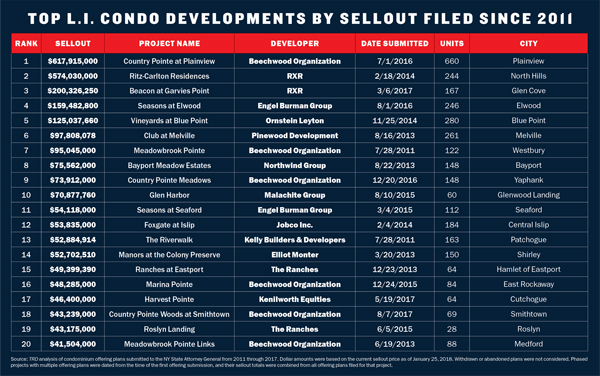

Beechwood’s Country Pointe at Plainview topped the list at nearly $618 million, mostly due to the large number of units in the development. It was followed close behind by the Ritz-Carlton Residences, North Hills, built by RXR Realty, at $574 million. In third was another RXR project, the Beacon at Garvies Point in Glen Cove, at $200 million.

“You’re seeing all these people, from baby boomers to whatever age group. Condo living, multifamily living, is the future,” said Joe Graziose, executive vice president of residential development and construction for RXR.

“For me, my mom and dad said, ‘You gotta buy a house. Don’t ever live in a rental or a condo.’ Those days don’t exist anymore,” he added.

TRD’s analysis looked at condo offering plans submitted to the New York State Attorney General from 2011 through 2017, with dollar amounts based on the sellout prices as of January 25, 2018. Projects with multiple phases and plans were dated from the time of the first offering submission, then combined with all offering plans filed for that project.

It’s important to note that condos on Long Island can differ from what is typical in other regions. In big cities, like New York and Miami, a condo development usually means a tall tower. In Long Island, developments are generally more low-rise and condos can include townhouses and even detached, single-family homes. It all comes down to whether each unit is paying into a homeowners association and sharing the costs for amenities and maintenance. If so, they’re governed by condo law. For the purposes of this analysis of denser condo communities, TRD included only apartment-style units and townhouses, not detached single-family homes.

The easy life

Several experts confirmed what’s been trending in recent years: the typical Long Island condo buyers are either empty-nesters looking to downsize or young people being priced out of New York City. And they both want one thing: to avoid the headaches of managing a big house.

Despite coming in second by sellout, the Ritz-Carlton Residences, with 244 units, had the 10 priciest condo sales of 2017, with the most expensive unit going for $4.9 million.

Eighty percent of current sales in the project were to empty-nesters who came from within a 10-mile radius of the site, according to Graziose. He said the other 20 percent were mostly families with school-aged children, from the city or other areas of Long Island.

Eighty percent of current sales in the project were to empty-nesters who came from within a 10-mile radius of the site, according to Graziose. He said the other 20 percent were mostly families with school-aged children, from the city or other areas of Long Island.

The owners are buying into a lifestyle, said Gail Holman, associate real estate broker with Daniel Gale Sotheby’s International Realty, which is handling sales and marketing for the project.

“They’re people who can afford a $2 million house, but they don’t want the upkeep,” she said, noting the high-end construction of the units. Residents there don’t have to worry about the gardening or opening or closing the pools. They can use the 25,000-square-foot clubhouse, and each building houses its own clubroom and gym. There’s also a Cadillac Escalade reserved for chauffeuring residents to and from the Manhasset train station, or to the nearby upscale Americana shopping center, she said.

Phase I of the North Hills project, located between the Long Island Expressway and the Northern State Parkway, is nearly sold out, with fewer than five units remaining. Prices for the two- to four-bedroom units started at $1.5 million and peaked at $4.9 million.

Floor plans initially showed 126 units of about 1,600 to 1,700 square feet, but 16 buyers purchased two units to combine them for more space. That led RXR to tweak Phase II designs to include larger units, up to 3,800 square feet. Of the 120 on offer for the second phase, 42 contracts are already out, said Graziose. Delivery is currently scheduled for the first quarter of 2019.

At RXR’s Beacon at Garvies Point project — with 167 units priced from $575,000 to $2.5 million — 40 condos have already sold. Move-ins are planned for fall 2019.

The Country Pointe at Plainview project, which topped the list, sold out of all 227 units from Phases I and II. Another 523 units in four more phases are on the way, for a total of 750 in the project, said Steven Dubb, principal of The Beechwood Organization. (TRD numbers show plans for 660 have been filed so far.) Move-ins for the first two buildings are expected to begin by April. Sales for the remaining units in phases three through six are anticipated to begin by early spring, said Dubb.

The development, which is for buyers age 55 and older, is about 60 percent condos, 20 percent townhouses and 20 percent villas. Prices range from the mid-$600,000s to $1.35 million for 1,300 to 2,800 square feet, said Dubb. The 143-acre project is off Exit 48 on the Long Island Expressway.

Amenities include a 25,000-square-foot clubhouse, two outdoor swimming pools, a fitness center, tennis and bocce-ball courts and an on-site concierge and event coordinator. Fifty-seven acres are being dedicated to the town of Oyster Bay and will include a two-mile walking path connecting to Trail View State Park.

“The clubhouse will replace the country club for many of our buyers. And that’s a significant selling point,” said Dubb. Beechwood sells its own units and does not use an outside brokerage.

The development also features about 115,000 square feet of retail space, with a ShopRite, Starbucks, Pilates studio, hair salon and hardware store, along with an Iavarone Brothers Italian restaurant scheduled to open.

“The retail sets us apart from other condo communities,” added Dubb.

Beechwood made the top condo projects list multiple times, with Meadowbrook Pointe ($95 million), Country Pointe Plainview ($74 million), Marina Pointe ($48 million), Country Pointe Woods at Smithtown ($43 million) and Meadowbrook Pointe Links ($42 million).

Marketing strategies

RXR’s Graziose said they did a lot more marketing for the Ritz-Carlton project than for previous developments. “We do a lot better when we bring existing buyers and prospects into the same room,” he said. “One thing I’m extremely proud of is [that] seven buyers from Phase I bought in Phase II to move across the street. We must be doing a good job.”

Just east of the Ritz-Carlton is Roslyn Landing, a smaller condo project with just 28 units with rates starting at $1.4 million. Its selling point is that it’s located right in the center of Roslyn Village, allowing residents to walk to shops, restaurants and historic sites, “and it’s close to the beaches,” said Tara Poli, manager of new development marketing for Daniel Gale, which is handling listings for the project in tandem with an in-house sales office.

The target audience for the project is local people who are downsizing, who wanted new construction and who are looking for an alternative to New York City, Poli said. The sales team for the project is “super local — most live in or close to Roslyn,” said Poli. “They have their pulse on how to get to [prospective buyers].”

Only a “handful” of the units from Phase I are still available, said Gwen Levy, the sales manager for the Roslyn Landing office. Most are about 3,000 square feet in size. Each has a two-car garage, a private elevator and a private entrance. More details on Phase II, which will bring another 50 units to the market, will be available in spring, she said.

In Suffolk County, the Vineyards at Blue Point (sellout value of $125 million) has seen success based on the reputation of previous developments built by Ornstein Leyton. “The best advertising you can’t buy is word of mouth,” said Jennifer Ornstein, sales associate for the developer OLC.

The project has four phases. The first two, with 150 units combined, are complete and sold out. Phase three, with 54 homes, is under construction and is also sold out. It’s set for spring 2018 delivery. About 40 units remain of the 70 additional homes coming in phase four in 2019, said Ornstein. The development is age restricted to those 55 and older.

The price point is below that of new luxury developments found in Nassau County, with units starting just under $500,000. “But our location is key, because you can come from a lot of different areas and get back to your roots or to your children easily,” said Ornstein.

Blue Point is located 10 minutes from Ronkonkoma and Patchogue, and 15 minutes from MacArthur Airport in Islip.

Strength in the numbers

The overall Long Island condo market, excluding the Hamptons, saw the shortest average marketing time in more than a decade, and the fastest market pace in more than eight years, according to the fourth quarter 2017 Douglas Elliman Long Island report. Days on the market dropped dramatically, from 95 to 81 year-over-year, while the absorption rate also declined 20.4 percent, from 4.9 to 3.9 months. Price indicators were mixed, however, as the average sales price dropped 9.8 percent to $345,449. But the median sales price held steady, increasing 0.8 percent to $277,500.

As for data on the luxury market for both single-family homes and condos, listing inventory declined year-over-year for the seventh consecutive quarter. As with the overall condo market, days on the market and the absorption rate both declined, 5.5 percent and 11.9 percent, respectively, to 10.3 and 10.4 months.

The median luxury sales price, representing the top 10 percent of all sales (in this case, those priced at $800,000 and above), rose 4.7 percent in the fourth quarter, to $1.02 million, over the past year, according to the report.

“Over the past several years, we have seen greater acceptance of high-end condo [pricing],” said Jonathan Miller, president and CEO of Miller Samuel, which produces the Elliman report. “Renters and buyers from the city, priced out and used to multifamily living, have created a new source of demand for luxury condos.”

Will the building boom continue?

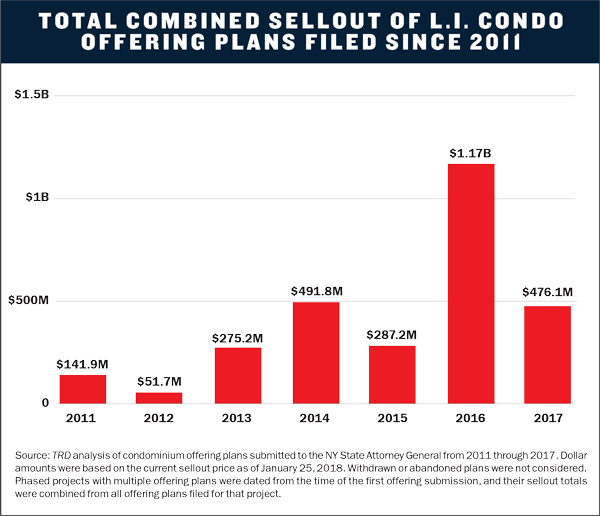

The chart above shows that the value of condo plans offered spiked fourfold in 2016 to $1.17 billion, then fell off in 2017 to $476 million. This mostly has to do with the timing of when projects come to market.

One explanation for the high number of plans filed in 2016 relates back to the recession a decade ago. After the downturn, developers “came out of the trenches in 2010” and started to figure out where they were going to go with each development, said RXR’s Graziose. This continued for a few years, then they moved forward, with the permitting process and other requirements needed before filing, “then boom, they hit in 2016.”

Most sources agreed that the demand for high-end condo living in Long Island will continue to grow, and Long Island will see similar projects in the future. In fact, Graziose said RXR plans to file for another $500 to $700 million dollars’ worth of units in 2019. The challenge is finding the right locations.

“There’s a limited amount of real estate and a lot of buyers want brand-new construction,” said Roslyn Landing’s Levy. “It’s a conundrum. I’m sure builders left and right are looking for parcels of land for luxury condo developments. I wouldn’t be surprised if older developments will get torn down and replaced with new builds.”

Even if developers find the right site, it can take years for a project to come to fruition. RXR took over from another developer for the Ritz-Carlton Residences, but for its new Glen Cove project, it’s already been 10 years in the making.

“It’s such a dilemma in getting these things permitted, a lot of developers give up,” said Graziose. “They take years and years of process and pain to get developed, and [some locals] want to leave things status quo. It’s the minority voice that gets heard, and the majority doesn’t say anything.”

This will naturally drive up prices on the current stock of new-build condos on the market. The buyers coming in here understand that land is scarce, said Levy. “And I think they feel a sense of urgency and want to get in while they still can.”