Sales of Manhattan development sites fell to their weakest level in six years against the backdrop of slow condominium purchases and no resolution to the renewal of the state’s 421a program.

Sales of Manhattan development sites fell to their weakest level in six years against the backdrop of slow condominium purchases and no resolution to the renewal of the state’s 421a program.

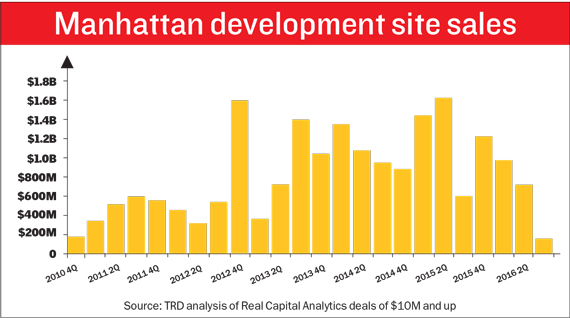

The $195 million worth of land sold in the third quarter of 2016 was the lowest dollar volume for construction parcels in the borough since the fourth quarter of 2010, when several deals totaling $190 million sold, an analysis of Real Capital Analytics data by The Real Deal revealed.

While the main causes of the market slowdown have been discussed at length since the middle of last year, the activity has only become more anemic in the second half of 2016. Several brokers noted in October that sellers are beginning to adapt to the new norm.

“It usually takes a year to 18 months to get adjusted to the new reality,” Robert Knakal, of Cushman & Wakefield, told TRD. “Sellers are starting to capitulate to the new values.”

But others said the market could turn around if 421a undergoes a revival, and are advising their clients to wait for now and recapitalize their properties, if need be.

But others said the market could turn around if 421a undergoes a revival, and are advising their clients to wait for now and recapitalize their properties, if need be.

James Kuhn, of Newmark Grubb Knight Frank, said he had several clients who own land but who can’t develop right now.

“We have three or four guys stuck in deals,” Kuhn said. “They don’t want to get out — they have a lot of money in the deals. We are telling them not to sell, but advising them to recap and bring in a strong partner.”

TRD analyzed more than 300 transactions, identified in RCA’s database as development sites, of $10 million and up over the past six years.

Overall, Manhattan deal volume is 75 percent below the average quarterly volume of $773 million between late 2010 and now, and is down nearly 50 percent for the first three quarters of the year — from $3.7 billion in 2015 to $1.9 billion in 2016 — the analysis found.

Even as transactions have slowed, some of the city’s most active builders have continued to buy over the past year. Extell Development purchased four separate parcels for a combined $268 million, including 1010 Park Avenue for $25 million in June and 350 East 86th Street for $93 million in July. Those acquisitions come on the heels of Extell and its partners selling just under $782 million in development sites to firms such as Collegiate Asset Management and the General Investment & Development Companies in 2015.

And volume in the fourth quarter is not looking up. RCA reported just one closed deal, for $60 million, in the fourth quarter as of late last month.

“We only have two months left, and it is a deceleration,” Kuhn said.