Big names. Big projects. Big price tags.

Despite being New York City’s smallest borough, Manhattan development has clearly grown to outsized proportions during the current construction craze.

Overall, developers here have more than 64 million square feet of residential development in the works, comprised of over 440 projects and an astounding 47,285 units, according to The Real Deal’s analysis of building permits and offering plans filed between Jan. 1, 2011 and July 31, 2015. If there was any doubt that Manhattan is where the big dogs play, the volume of construction here bested the next-busiest borough, Brooklyn, by more than 20 million square feet.

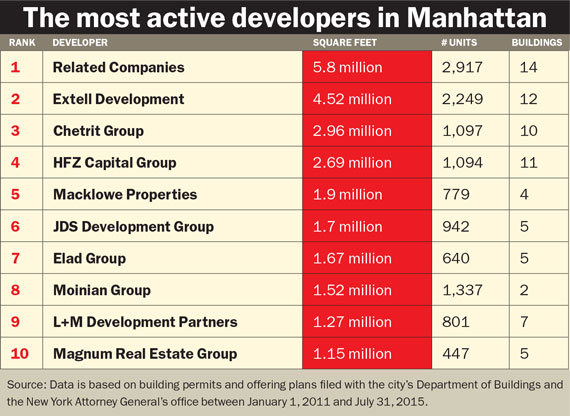

Related Companies, already one of the city’s biggest landlords, led the pack with over 5.8 million square feet filed — nearly 2 million more than the next-busiest developer. Not surprisingly, Related’s pipeline reflects its massive Hudson Yards project — reportedly the largest development in the country — which will total 17.4 million square feet when completed, including 5,000 residential units, five office towers and retail space.

But Related isn’t the only big game in town, and TRD’s list was dominated by longtime machers in New York real estate circles as well as bold up-and-comers who are envisioning some of the tallest residential towers the city’s ever seen.

Gary Barnett’s prolific Extell Development snagged the No. 2 spot, with more than 4.52 million square feet, including 12 buildings and 2,249 units combined.

The Chetrit Group followed, with roughly 2.96 million square feet across 10 buildings, that will be home to 1,097 units.

Rounding out the top five were other familiar names in real estate circles: HFZ Capital at No. 4 with 2.69 million square feet and 1,094 total units, and Macklowe Properties at No. 5 with 1.9 million square feet and 779 units.

The Moinian Group’s 61-story rental tower Sky at 605 West 42nd Street is nearing completion.

Scaling up

The top 10 developers on TRD’s list have each filed plans for north of 1 million square feet since 2011— a serious feat, given high land prices and the scarcity of development sites.

“The scale is so much bigger than it once was, in terms of master plans at Hudson Yards and Riverside Center, as well as large-scale properties,” said Kelly Kennedy Mack, president of the Corcoran Sunshine Marketing Group.

Related CEO Jeff Blau said 2015 has been a “very active year” for the company, which will launch Hudson Yards’ first residences, a rental and condo building, in 2016.

“At our neighboring rental, Abington House we are achieving some of the highest rents in our portfolio,” he said in a statement, referring to the 390-unit tower at 500 West 30th Street.

Mack said the city’s savviest developers spent years assembling sites, and many relied on reputation and pre-existing relationships with financial partners to close deals after the 2008 financial crisis. “In this hyper-competitive landscape they were able to move quickly and lock up deals,” Mack said.

Of course, high land costs in Manhattan are pushing even some of the borough’s most active developers into other parts of the city. Chetrit, for example, is not only on this ranking, but is also one of Brooklyn’s most active developers with 1.6 million square feet and 1,421 units under development there.

David Bistricer, CEO of Clipper Equity, Chetrit’s partner on five projects in Manhattan, including the conversion of the former Sony building at 550 Madison Avenue into luxury condos, said banks are being very selective about backing deals.

“There’s a lot of money out there, but the banks have been very concerned about who they’re dealing with. It’s not just numbers anymore, it’s about the people and the project,” he said.

Chetrit and Clipper gravitate toward larger projects, where there’s more profit thanks to “economies of scale,” Bistricer said.

Others have done the same. Manhattan’s largest single residential project since 2011 is the Moinian Group’s 71-story rental at 605 West 42nd Street known as Sky, which is nearing completion. Prices at the 1.4-million-square-foot, 1,175-unit tower range from $3,000 for studios to $6,175 for two-bedrooms. Moinian ranked No. 8 on TRD’s list with 1.52 million square feet and 1,337 total units at Sky and a 163-unit condo at 572 11th Avenue.

In terms of massive individual projects, Extell’s Central Park Tower at 217 West 57th Street, formerly known as Nordstrom Tower, isn’t far behind at 1.2 million square feet and 178 ultra-luxury units. As of press time, it was also slated to be the tallest residential tower in the city at 1,494 feet, excluding its spire, followed by JDS Development and Property Markets Group’s 111 West 57th Street at 1,431 feet.

Joseph Moinian, the CEO of the Moinian Group, attributed his firm’s ability to capitalize on the current market to low interest rates and increased foreign investment, as well as the firm’s long-term outlook. The developer is in the predevelopment phase on a 1.8 million-square-foot mixed-use development at 3 Hudson Boulevard at 555 West 34th Street, which may contain condos at the top. (That tower was not included in TRD’s tally because plans have not yet been filed with the city.)

“We have owned this valuable land on 11th Avenue for more than 20 years, with the expectation that it would eventually be a key to major development activity along the new Far West Side,” Moinian told TRD in an email. “That day has come.”

Neighborhood dive

Neighborhoods throughout Manhattan are seeing an influx of new condos.

Chelsea and Midtown West are each expected to see roughly 2,500 new condos hit the market in the next three years, according to Corcoran Sunshine data, while the Financial District, with roughly 2,000 units, is “coming back with a vengeance,” said Mack. Midtown East and the East Village are projected to get 1,400 units each, followed by the Upper East Side (1,200 units) and Upper West Side (1,000 units).

Mack said the East Village and Lower East Side are at a turning point as large-scale projects migrate Downtown. The average number of new condo launches is expected to increase 400 percent in 2015 through 2017, compared with 2002 through 2014.

For example, Extell is developing 815 units at 250 South Street, also known as One Manhattan Square, and Silverstein Properties’ 30 Park Place has 157 condos atop a 185-room Four Seasons Hotel. Macklowe, meanwhile, is planning a rental-condo conversion at 1 Wall Street. (The number of units is unknown.)

“All you need to say is ‘Harry Macklowe’ and ‘1 Wall Street’ to understand how the area is changing, or ‘Larry Silverstein at 30 Park Place,’” said Nancy Packes, founder of the eponymous new development marketing firm, who noted that the development of luxury condos below Canal Street reflects the all-out quest for development sites in Manhattan.

“It’s not the Downtown it was 15 years ago,” said Marty Burger, CEO of Silverstein.

He noted that condos at 30 Park Place are selling in the mid-$3,000-per-foot range. “It’s still a great discount to the Central Park buildings that are trying to get $7,000-plus per foot.”

Meanwhile, one of Downtown’s most prolific developers is Ben Shaoul, who began by flipping smaller buildings on the Lower East Side. Shaoul’s Magnum Real Estate Group clocked in at No. 10 on TRD’s list with 1.15 million square feet and 447 units in the past four years.

With partner CIM Group, Magnum is behind the condo conversion at the old Verizon Building at 100 Barclay Street. Renamed the Ralph Walker Tribeca, the project has 161 units at prices ranging from $3.2 million to $11.5 million.

Luxe condos (still) king

With soaring land prices, condos are still king in Manhattan.

More than 5,300 new condos are set to launch this year, with another 6,200 on the horizon in 2016, according to Corcoran Sunshine.

“Manhattan is going to remain king in the condo market and I don’t expect that to change anytime in the near future,” said Mack.

Land in Manhattan traded for an average of $759 per foot during the second quarter, according to data from Cushman & Wakefield. Year to date, the average price is $665 per foot — up from $587 per foot last year and $446 per foot in 2013.

“Everyone is paying a premium, so the question remains, ‘Will the math work?’” said Jonathan Miller, president of real estate appraisal firm Miller Samuel. “Developers are at the mercy of their going-in costs.”

HFZ Capital’s 88 and 90 Lexington Avenue, which have 118 units combined

For that reason, an increasing number of developers are chasing condo conversion deals. For example, Magnum purchased the top 21 floors of the Verizon building for $247 million in 2013 and later bought the retail portion for $40 million.

“If a developer were to build that [building] today, they couldn’t afford it because space is at a premium with the cost of land,” said Susan de França, president of Douglas Elliman Development Marketing, which is marketing the project.

The quickly escalating market and high cost of development also means new condo product is, of course, almost always luxury — or ultra-luxury.

For example, Chetrit and Clipper’s Gramercy Square, a four-building, 223-unit conversion of the former Cabrini Medical Center, has a 75-foot pool and a wellness center. “Developers are creating a lifestyle destination,” said de França, whose firm is also marketing the condos there. “People pay up for these amenities.”

Gramercy Square’s prices range from $1.2 million for a 640-square-foot studio to $22 million for a 7,120-square-foot penthouse.

To put those prices into context, the average new development condo fetched $4.2 million during the second quarter, up from $3.5 million a year earlier, according to Miller Samuel. In the luxury market, new condos had a median price of $13.9 million during the second quarter.

“One of the biggest challenges in the new development space has been filling in the void in the lower end of the luxury market,” Miller said. “How many $10 million buyers are out there?”

Developers — who have a lot riding on that question — have vastly different answers. Bistricer said the market is “very deep” thanks to demand from buyers who want to purchase condos for their personal use, not just for investment purposes. Similarly, Barnett, whose $100.5 million penthouse at One57 is the city’s priciest condo sale on record, described “tremendous global demand” for luxury real estate at a panel discussion this spring.

HFZ’s Ziel Feldman said the market is as “strong as it’s ever been,” with no sign of overbuilding. Nonetheless, he added: “We definitely have looked to fill what was a growing dearth of ‘affordable’ and ‘approachable’ housing.” At HFZ’s pair of condo conversions at 88 and 90 Lexington Avenue, which have 118 units combined, the average sales price is $2,000 per square foot — a discount compared to condos a block to the west which fetch $2,300 to $2,500 per foot, Feldman said.

Despite China’s economic turmoil and last month’s stock market slide, new development marketers insisted demand for high-end condos is still there.

“With gyrations in the international economy and markets, some may perceive the super high-end as having oversupply,” said Stephen Kliegerman, president of Terra Development Marketing. “I think the opposite. People will flock to those residences for equity preservation and to diversify their portfolio versus keeping their money in their own country.”