In 2015, Manhattan was a little less hospitable to hotel owners than it was in 2014.

In 2015, Manhattan was a little less hospitable to hotel owners than it was in 2014.

Indeed, at the end of last month, Manhattan’s $8 billion hotel market was on track to see its first decline since at least 2010, according to figures from hospitality analytics firm STR that The Real Deal reviewed.

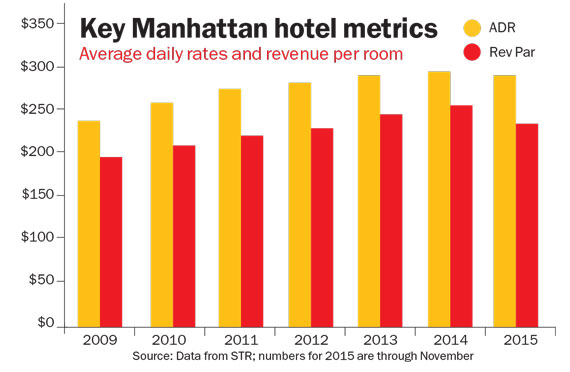

Two of the industry’s key metrics — the average daily room rate (ADR) and the revenue per available room (RevPar) — were down year-over-year through November. That marked the first time since shortly after the recession that either of those figures trended negative.

The dip came against a backdrop of robust hotel development and investment in Manhattan, with more than 3,400 rooms hitting the market in 2015. Plus, there’s more construction in the works, with leading players such as Extell Development and the Witkoff Group building high-end hotels in portions of other big projects. Witkoff and its partners, for example, are building a 452-room Marriott Edition at its mega mixed-used project at 701 Seventh Avenue in Times Square.

Meanwhile, 2015 also saw a record hotel purchase — Anbang Insurance Group’s $1.95 billion Waldorf Astoria Hotel buy.

While the hotel declines are minor, any negative news in the sector is worrisome for developers and owners.

Vijay Dandapani

“It’s really bad on so many levels,” said Vijay Dandapani, the president of the Manhattan-based Apple Core Hotels, noting that profits are getting squeezed because revenue is shrinking and costs, such as taxes and employee wages, are surging.

Dandapani, whose firm owns five economy-rate Manhattan hotels, said one potential upside is that the softening market might slow down future hotel development.

So what do the numbers actually show?

Manhattan’s ADR — the amount guests paid for overnight stays — fell 1.2 percent from 2014 to $284. That’s a significant turning point because since the recession that metric had been going up between 2 percent and 8 percent annually — despite the additional hotel supply coming onto the market.

In addition, RevPar dropped in 2015 by 1.9 percent to $245 compared with the same period in 2014. While RevPar in 2015 was still higher than it was between 2009 and 2012, it’s now below where it was for the last three years.

Steven Kamali, principal with the consulting firm Hospitality House, attributed the drop to several factors, including increased supply and competition. And he predicted further softening in 2016.

“You will see ADR constrained and RevPar down,” he said. “It’s not only a function of oversupply, it’s a function of Airbnb.”

However, he said, the dip does not signal a market collapse of any sort. “I don’t think anyone out there is saying, ‘I am in big trouble,’” Kamali said.

In fact, total revenue for hotel owners was up a sliver and was likely to break the record set in 2014 of $8.06 billion, industry professionals said.

“It looks as if Manhattan is on pace to eclipse 2014’s numbers by a slight margin,” said STR’s Jeff Higley.

Still, industry observers say when the final figures are tallied for 2015, which will happen this month, ADR and RevPar could be down even further.

And, Apple Core’s Dandapani said that December, which is normally a strong month for New York hotels given the holidays, was off and that guests were increasingly shopping around for the best deals. Other operators he spoke to last month were witnessing the same trend. “Rates are lower and cancellations are rampant,” Dandapani said.