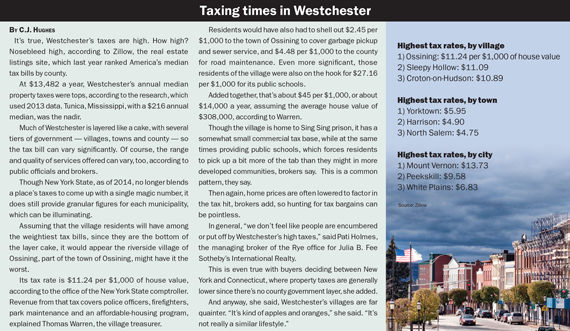

In an age of disruption across the board, Westchester brokerage firms have hardly been immune to the greater trend, with shake-ups roiling the county’s real estate scene.

In an age of disruption across the board, Westchester brokerage firms have hardly been immune to the greater trend, with shake-ups roiling the county’s real estate scene.

In a few short years, newcomers have chipped away at the dominance that old-line real estate brokerages enjoyed for decades, according to an analysis by The Real Deal, which ranked brokerages by sales volume over the past year.

Firms like Douglas Elliman Real Estate, which opened its first office in the county in 2011, and William Raveis Real Estate, which arrived in 2009, are now among the top five brokerages in the county, according to the ranking, which treated franchised firms as separate companies and included transactions by both listing and selling brokers.

While it would be a stretch to consider those particular firms upstarts, they did make a play for market share in suburbs thick with entrenched firms and seemingly set in their ways, where some agencies have been selling houses since the 19th century.

But the establishment seems to be fighting back.

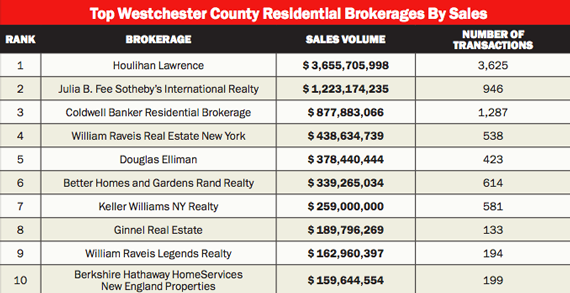

Reinvesting in storefront offices and shelling out for new software has allowed longtime family-run firms to hang tough against the competition. Two such firms landing in the top 10 on TRD’s list were Houlihan Lawrence, with sales volume of about $3.7 billion, and Better Homes and Gardens Rand Realty, with a transaction volume of $339 million, although it should be said that Rand — like others on the list — benefits from its status as a franchise overseen by Realogy, the global real estate company.

It’s not hard to figure out why so many firms are jockeying for the same turf. Home sales totals are hitting record heights in the county, which stretches from the Hudson River to the Long Island Sound and offers rural villages, rebounding cities and tidy suburban blocks.

And while prices may still have room to climb, this is the year that Westchester could achieve escape velocity, brokers say, as New York City becomes increasingly unaffordable.

“I don’t care what they say about millennials being OK with renting apartments forever,” said William Raveis Jr., chairman and CEO of his family’s company. “They will eventually want to buy, and they will eventually want to live in houses.”

It’s a family affair

Focusing locally and filling management positions with siblings — what some say is a tried and true strategy for growing businesses — appears to still produce results.

For instance, Westchester-based, family-run Houlihan Lawrence, which was founded in Bronxville in 1888, nabbed the No. 1 slot in TRD’s ranking by raking in a hefty $3,655,705,998 over 3,625 transactions. With that haul, the firm stood head and shoulders above its rivals, with about triple the sales total of Julia B. Fee Sotheby’s International Realty, the second-place finisher.

“The competitive landscape around here has new players, and some of the relative positions have shifted,” said Chris Meyers, the firm’s managing principal, who helms the company along with brother Stephen, the CEO, and sister, Nancy Seaman, the chairwoman. In 1990, Nancy and her husband, the late Peter Seaman, purchased the firm from the Lawrence family, which had controlled it since its inception.

Chris Meyers

“Our agents are really deeply woven into the fabric of the community,” Meyers added. “We try to emphasize the home team advantage we have in this area, if you will.”

The firm, with 998 agents in 19 offices across the county, has also stuck to its guns about how best to sell houses.Unlike the 100-percent-commission, every-agent-for-themselves model increasingly popularized by firms like Keller Williams (No. 7 in TRD’s ranking), Houlihan’s business plan is more traditional.

The firm splits its commissions with its brokers. But the brokers save money because Houlihan covers marketing and other costs. That gives the firm control over its advertising and creates a similar look across all mailings, magazine ads and billboards. “We try to create a consistency of experience across the brand,” Meyers said.

(Click to enlarge) Source: Top residential brokerages in Westchester County based on total sales volume of single-family homes recorded in the HGMLS from November 1, 2015 – October 31, 2016. Franchised firms were treated as separate companies. Transactions by both listing and selling brokers were included.

Though a handful of Houlihan offices closed during the recession, the firm did cut the ribbon in 2013 on a new office in Yonkers, Westchester’s largest city. A longtime manufacturing hub for carpets and elevators, Yonkers is gradually gentrifying its downtown with luxury high-rises. Meanwhile, the firm completed a $2 million renovation of its original home, a low-slung but high-visibility slate-roofed structure in Bronxville’s downtown that originally served as the gatehouse of a large farm.

For all its celebration of the past, Houlihan does not seem to be resting on its laurels. In 2013, surprising some, it expanded into nearby Greenwich, Connecticut. Today, it has five offices in the Constitution State, where it does about $1.5 billion in sales, Meyers said. And a sixth office, in Westport or Fairfield, is scheduled for the near future.

“It’s been a subtle shift,” Meyers said. But, he added, “we still believe in owning the Westchester market.”

The company has also franchised itself: Two of the firm’s Connecticut offices, in Darien and New Canaan, carry the Houlihan banner but are independently owned affiliates.

Local roots, international ties

Across Westchester, another household house-selling name is Julia B. Fee, a broker who opened an office in Scarsdale in the 1950s. Eventually maturing into a four-location firm, it was acquired by William Pitt Sotheby’s International Realty, from next-door Connecticut, in 2009.

Today, the cross-state company, which is owned by Paul Breunich and Building and Land Technology, a developer, is the largest Sotheby’s franchise in the country. Through most of 2016, Sotheby’s — part of the Realogy franchise empire — also had three much smaller affiliates in Westchester, located in Pelham, Bedford and Tarrytown. But in November, William Raveis Legends Realty Group purchased the Tarrytown location.

For its part, the Julia B. Fee division, which has five offices and 220 agents, garnered $1.2 billion in sales between November 2015 and October 2016, helping it to clinch the No. 2 spot, according to TRD data. Its newest office opened in Irvington, by the Metro-North train station, in 2015.

While its deep local roots are helpful, the ability to score referrals from other agents in an international company is also critical, especially in a place where many of the buyers are transplants from overseas, said Pati Holmes, the managing broker of Julia B. Fee’s 97-agent Rye office, its largest in the county.

Joe Rand

Some of those buyers, from England, Russia and South America, are bypassing New York City entirely, Holmes said. And they are putting pressure on prices: A 1909 six-bedroom home in Rye on three acres sold to a South American family in September for $8.85 million.

“The school system is what draws people in,” Holmes said, adding that those buyers will even tour various public grade schools, college-style, before choosing a place to live. The high quality of those schools makes many buyers look past the fact the property taxes tend to be steeper in Westchester than they are in Connecticut, according to Holmes.

Similarly, Coldwell Banker Residential Brokerage, whose Westchester offices are owned by NRT, a subsidiary of Realogy, also allows agents to tap into a wide audience far beyond the Hudson Valley, which might explain its strong third-place finish, with $878 million in sales.

And Coldwell does not seem to be afraid to dabble in all corners of the market. To reach its total, it handled 1,287 transactions last year, or about one-third more deals than second-place finisher Julia B. Fee, which had 946 transactions.

Overall, Coldwell’s website gets 50 million visitors a year while another 60 million visitors arrive from partner sites, said Joseph Valvano, the president of the brokerage’s Westchester and Connecticut divisions.

More important, Valvano says, is Coldwell’s tech-savviness, using apps like HomeBase, allowing buyers and sellers to jointly access remotely held documents and to update them with signatures as deals go forward. Software like that will soon lead to paperless offices, Valvano said.

With 13 offices and 591 agents in Westchester, the firm, which opened its first office in Rye in 1957, seems to have charted a mostly safe course: No offices have opened in recent years, but none closed during the last recession, either. Valvano added that the firm was considering adding new offices in Westchester but declined to offer specifics. “Our brand is the most widely recognized real estate brand in the world,” he said.

Newcomers dig in

But while established firms have hung on, insurgents have made gains, like William Raveis Real Estate New York and Douglas Elliman, which nabbed fourth- and fifth-place finishes, with $439 million and $378 million in sales last year, respectively.

Raveis, which opened its first office in Rye in 2009 with the acquisition of Realty 3 Real Estate, and Elliman, which in early 2011 snapped up Prudential Holmes & Kennedy, were already dominant firms when they came to Westchester. But despite keeping a grip on other parts of the metro region for years, they had avoided Westchester. Not anymore.

“We just grind away at markets,” said Raveis, the CEO of his firm, which has 199 agents in the nine offices it owns in Westchester, though it has other affiliates including William Raveis Legends Realty, which also made the top 10 list.

“We don’t want to be a Houlihan Lite or a Rand Lite. They are good firms, they are good people and they made an impact,” Raveis added. “But the market chooses.”

Where Raveis has succeeded, he said, is in reinventing the storefront office. Gone are rows of cubicles; in their place is bench seating that resembles a “Starbucks within the branch, with couches and chairs and lattes,” he said, adding that Scarsdale was just redesigned as such for $1 million.

As agents take bigger cuts of commissions, the portion flowing to firms shrinks, from 50 percent a decade ago to 30 percent today. So firms have been forced to sell other products, like insurance, Raveis said, even if only about a third of his clients currently avail themselves of it.

Buyers are not in short supply. In the third quarter of 2016, there were 3,193 closings across the county, up from 3,044 closings in the same period a year earlier and the most closings in more than three decades, according to a market report from Douglas Elliman. Likewise, the absorption rate fell to 4.2 months, from 5.6 months in the third quarter of 2015, so inventory is sitting on the shelves for less time.

A tale of two markets

Roberto Vannucchi

Still, in somewhat of a paradox, the average sales price has barely budged. It was $679,000 in the third quarter, according to Elliman, down from $697,000 the previous year.

The soft prices, so far, can be explained by a tale of two markets, said Rob Vannucchi, the Elliman executive vice president responsible for Westchester.

While the suburbs in the southern part of the county, close to New York City, remain robust — namely, Scarsdale, Pelham and Dobbs Ferry — those towns north of the I-287 dividing line are less popular, he said. “The south, in a nutshell, is propping up the north,” Vannucchi said. For its part, Julia B. Fee has just five agents working in northern Westchester and no offices there.

Considering its size elsewhere, Elliman might seem to have a small footprint in Westchester, with 302 agents in five offices, the newest of which, in Scarsdale, opened in 2014. But Vannucchi says what matters are the thousands of lead-generating agents working in New York City, where Elliman is still tops, employee-wise. Many buyers interested in Westchester, he said, start by asking an Elliman agent in the city about where to start hunting.

“At the end of the day, we are the only brokerage firm that has the most meaningful and substantial connection back to New York City,” Vannucchi said.

Though large-scale multifamily projects aren’t as numerous as in the city, Elliman also dabbles in new-development marketing, like Greystone on Hudson, a ritzy 24-house enclave where prices start at $4 million.

But while deep-rooted agents in Manhattan may be optimal for leads, buyers also flow in through other channels, said Jim Gricar, the general sales manager for Houlihan Lawrence, who decamped from Halstead Property in 2015. For starters, Houlihan is a member of a professional referral network that includes Halstead and other firms, which helps. Yet “the consumer is less interested in going with the same company than they are with using someone who can answer all those question marks before them,” Gricar said. “We find that our local knowledge and expertise mitigates that easy handoff.”

Close behind Elliman is Better Homes and Gardens Rand Realty, whose $339 million across 614 transactions was good for sixth place in the TRD ranking.

With seven offices and about 300 agents in Westchester, Rand can also tap a broader network. Not only does it cut a swath across the lower Hudson Valley, unlike some of its peers — it has six offices in Rockland County, for instance — it’s also an independently owned Realogy franchise.

Like Houlihan, Rand is a family affair: Joseph Rand, a managing partner, works alongside his mother, Marsha Rand, the firm’s founder and chairwoman. Joseph’s siblings are also involved: Matthew is the chief executive officer, while Daniel is a managing member.

“What we do differently is have a more aggressive agent focus,” Joseph Rand said, specifically pointing to an emphasis on training.

Though it isn’t reflected in TRD’s ranking, Rand is also focused on rentals, which make up about 10 percent of its gross revenue in Westchester.

A lag drag on prices

Why aren’t prices rising? Because of a market lag, Rand said. While buyers used to leave Manhattan for Westchester, in the past decade they went to Brooklyn, “where they could get a little more space but retain their urban sensibility,” Rand said in an email. “Now, though, much of Brooklyn is almost as expensive as Manhattan, so I think we’ll start seeing that migration pattern pick up, which will also drive Westchester pricing up.”

Newbie Keller Williams, which controls three Westchester franchises, opened its first, Keller Williams NY Realty, in White Plains in 2005. That 187-agent office, or “market center” in Keller Williams parlance, is its most profitable in Westchester today, with about $259 million in 581 deals last year — good for a seventh-place finish in the TRD ranking. Melissa Riley, CEO of the White Plains office, declined to comment.

In an area dotted with affluent communities, not all clients want their real estate wheelings and dealings made public, which results in secret “pocket listings” that aren’t easily tracked through records. Ginnel Real Estate, a 66-year-old single-office firm in Bedford Hills, for example, says it did about $57 million in private deals in Westchester last year.

For example: Ginnel brokered the transaction last winter when Adam Neumann, a co-founder of WeWork, bought a 60-acre farm in Pound Ridge for $15 million, according to Dan Ginnel, the firm’s president and owner.

Publicly, though, his firm’s sales total was about $190 million, which means that almost a third of its deals weren’t counted. It landed in eighth place.

Also highly localized is William Raveis Legends Realty Group, which focuses on a slice of the county’s “river towns.” The firm, which is the result of a 2011 merger, wound up in ninth place, with about $163 million in deals, but seems poised to climb. In November, it purchased Hudson Homes Sotheby’s International Realty, a four-office, 15-agent firm headquartered in Tarrytown, which will broaden its reach. Marcene Hedayati, Legends’ managing partner, did not return a call for comment.

In a close 10th place, with nearly $160 million in deals, is the four-office Berkshire Hathaway HomeServices New England Properties. It, too, is something of a disrupter. Arriving in the Northeast in 2012 by buying Prudential Connecticut Realty, it pushed across the border into Westchester in 2015 when it snapped up two small but established firms, the two-office Prudential Centennial Realty, in Scarsdale and Larchmont, and Tri-Crest Realty, in Eastchester. And a new Rye office opened in 2016, with others, according to news reports, in the works.