Don’t discount the brokerages on this year’s ranking of mid-sized residential real estate firms just because they’re in the middle of the pack.

Like horses circling a racetrack, they jockeyed for position — and listings — in a highly fluid market where luxury properties have lingered but “everyday” homes were in hot demand.

As in years past, this year’s lineup saw firms come and go, as some brokerages pulled ahead of the competition and others fell behind.

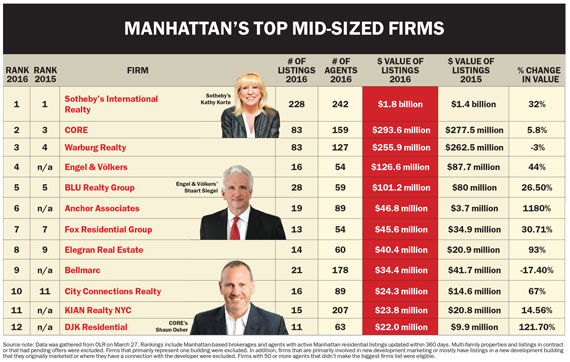

The ranking, TRD’s fourth annual survey of Manhattan’s mid-sized firms, includes companies with 50-plus agents that didn’t make the biggest firms list. However, unlike the biggest firms list, in which size matters most, this ranking is done by dollar volume of active listings. TRD collected those listings as part of a one-day snapshot of properties in On-Line Residential on March 27.

Leading the pack by a massive margin was Sotheby’s International Realty, which racked up nearly $1.8 billion worth of Manhattan listings, up from $1.4 billion last year.

The firm’s priciest exclusive is a duplex asking $70 million at the Pierre Hotel formerly owned by late financier Lionel Pincus. The co-op, on the 30th and 31st floors, is believed to belong to Pincus’ longtime companion, HRH Princess Firyal of Jordan.

CORE, meanwhile, took the No. 2 spot with a far-less-but-still-impressive $293.6 million in listings, up from $277.5 million last year. Its priciest listing is a 6,226-square-foot Tribeca loft at 140 Franklin Street that’s asking $24.9 million.

Warburg Realty rounded out the top three, with nearly $256 million in listings, a slight drop from its $262 million last year. Its priciest exclusive was a co-op at the Dakota, at 1 West 72nd Street, asking $14.5 million. The firm was joined by the international brokerage Engel & Völkers, based in Germany, and the Midtown-based BLU Realty Group in the top five.

As a group, the top 12 mid-sized firms held more than $2.8 billion worth of active listings, up from last year’s $2.6 billion.

The majority of the firms on this year’s mid-sized ranking saw listings volume rise thanks to the addition of more inventory in the overall market. Sotheby’s, for example, added more than $430 million in exclusives and bested its next-closest competitor by $1.5 billion.

Sotheby’s President and CEO Kathy Korte said the firm’s New York agents are working with a new crop of international buyers, in particular those in India and Singapore. “We’re in a position to pivot our marketing and leverage the Sotheby’s footprint in 63 countries very nimbly,” she said.

Musical chairs

As in years past, this year’s mid-sized firm ranking was tantamount to a game of musical chairs.

Engel & Völkers — which launched in Manhattan in 2014 — graduated from TRD’s boutique firm ranking because its agent count soared to 54 from 25 last year. It also drummed up $126.6 million in listings — up from $87.7 million. Some of those increases were the result of absorbing boutique brokerage Mercedes/Berk in late 2015, but the firm has also been aggressively recruiting.

“The impact of Mercedes/Berk is just being felt now, and it’s exceeding all forecasts,” said CEO Stuart Siegel, noting that Mercedes/Berk had a track record at key buildings such as 15 Central Park West.

Siegel, a veteran of Sotheby’s, said that his brokerage gives agents, as well as buyers and sellers, a leg up because of its global platform and size.

Siegel, a veteran of Sotheby’s, said that his brokerage gives agents, as well as buyers and sellers, a leg up because of its global platform and size.

Yet he feels no need to be the biggest. “We have no aspirations to be in the nuclear arms race of who has the most agents and largest footprint,” he said.

Instead, the firm is aiming for a smaller number of highly productive agents.

Also new to this year’s mid-sized list — and making its debut on TRD’s overall residential firms ranking — is Anchor Associates, which was founded in 2001 and this year clocked in at No. 6 with $46.8 million in listings. The firm did not respond to multiple requests for comment.

Anchor was followed by Fox Residential Group ($45.6 million), Elegran Real Estate ($40.4 million), Bellmarc ($34.4 million), City Connections ($24.3 million), KIAN ($23.8 million) and finally DJK Residential ($22 million).

Bellmarc — which fell off this year’s ranking of the biggest 12 firms — has been plagued by financial woes. The firm lost nearly 120 agents, shrinking its headcount to 178. In January, meanwhile, it shuttered four offices, consolidating its footprint into a single office in the Flatiron District. At that time, founder Neil Binder told TRD that he had created a patented real estate search engine called Homepik.com, which would be used to generate business.

Despite all the turmoil, Bellmarc saw its listing volume drop by only 17 percent, to $34.4 million last year.

Who gained, who lost?

Though there might be more listings to go around thanks to the uptick in inventory, Engel & Völkers’ Siegel said there is still “fierce” competition to land them with a realistic price tag.

“The discipline is not winning listings based on how much you tell the seller you can get, but winning based on what you’re going to do to market [a unit] if it’s priced well,” he said.

Among mid-sized firms, Sotheby’s posted the biggest gains in pure dollars with its $430 million dollar volume increase — a 32 percent jump from 2015. In addition, it saw its agent count rise by nearly 27 percent to 242 as it opened a new Upper West Side office. Korte said Sotheby’s agents are increasingly “closing out” sales at new development condos that have just a handful of units left, such as JDS Property Group and Property Market Group’s Stella Tower at 425 West 50th Street and Macklowe Properties’ 737 Park Avenue.

BLU — which was founded in 2011 by Alon Chadad, a former broker at Douglas Elliman and Nest Seekers, and four other top agents — also grew listings by roughly 26.5 percent to $101.2 million from $80 million in 2015. Fox, meanwhile, saw exclusives rise nearly 31 percent, while Engel & Völkers’ gain amounted to a 44 percent jump.

Other firms on the mid-sized ranking posted more modest gains, and, in some cases, slight losses.

Warburg, which has 127 agents, saw its total listings slide slightly to $255.9 million from $262.5 million. But Clelia Peters, who just took over for her father, Frederick, as president of the company (see related story on page 166), took issue with TRD’s methodology and said the firm’s business is trending up, thanks to its work on both the buy and sell sides of the market. The ranking, she argued, does not capture those buy-side deals, and the one-day snapshot of listings — which includes properties that are lingering on the market — doesn’t accurately reflect which firms are performing best.

“As with any living organism, there are good days or bad days to be photographed,” said Peters.

CORE, which recruited 40 agents last year for a total agent headcount of 159, controlled $293.6 million worth of exclusives, up 12 percent from 2015.

Firm CEO Shaun Osher said: “At the end of the day, there’s not much good product on the market.”

Nonetheless, Osher said 2016’s first quarter was the strongest in CORE’s 10-year history, driven by strong resale activity, particularly in the now-active $2-million-to-$5-million range. The firm’s robust new development pipeline also continues to grow. CORE is currently working on

16 new development projects. Osher said that some — though not all — of his firm’s new development work can be attributed to its relationship with the Related Companies, which acquired a stake in CORE in late 2014.

Osher also said the firm is planning to open a fourth Manhattan office and a Brooklyn outpost. In the past 18 months, CORE hired Robert McCain from Stribling, Heather McDonough and Henry Hershkowitz from Elliman and Jason Walker, who also came from Elliman via Compass.

According to Osher, who co-founded his firm with the Cayre family, recruiting agents is still blood sport among residential firms. “It’s aggressive to the point where I received a call from a company to be recruited as an agent,” he said. “True story. I laughed.”