It was summer 2017 when Bob Goldberg ascended the stage at the Sheraton Grand Chicago. With Bruce Springsteen’s “Born to Run” playing in the background, Goldberg was introduced as the new “boss” of real estate’s most powerful trade association.

The lifelong Springsteen fan — he’s seen the Boss in concert nearly 200 times — clutched a red electric guitar and seemed to signal the beginning of a new era at the 110-year-old National Association of Realtors as he pledged to “knock down the ivory tower façade of NAR.”

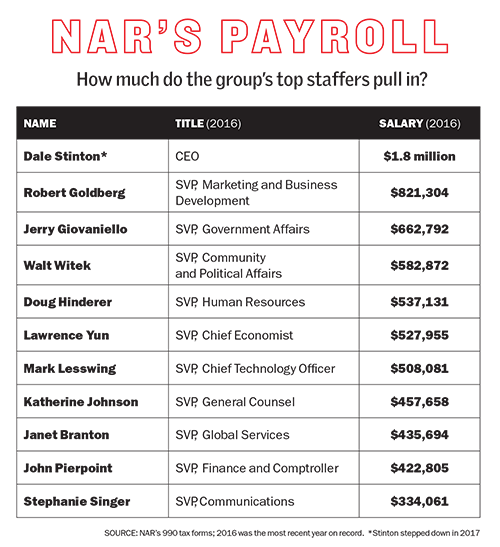

But doing so hasn’t been easy for the 23-year NAR veteran, who headed marketing and business development before succeeding longtime CEO Dale Stinton.

With 1.3 million members spread across 1,300 local associations, NAR is a lobbying powerhouse. But it’s facing something of an existential challenge: how to embrace the technology that is rapidly changing the brokerage business without rendering agents obsolete.

Its efforts to do so — through a wholly owned venture fund as well as a multimillion-dollar listings portal — have generated sharp criticism from its own members.

Rob Hahn, founder of real estate consulting firm 7DS Associates, said most of NAR’s members join not because they value its services, but because it gives them access to local multiple listing services.

“The vast majority of people that are ostensibly members are just buying MLS access,” he said. “That creates a lot of animosity among brokers.”

And for all the talk of shattering ivory towers, NAR recently secured city approval to sink $45 million into its Chicago headquarters at 430 North Michigan Avenue — where plans call for adding 18,000 square feet of office space and a 25-seat glass-encased boardroom. The group plans to finance most of the project through its existing budget, but will also use $6 million from a dues increase this past May.

Amid questions over what members are getting for their money, the association is still paying the price for one of its biggest blunders.

That misstep dates back to the 1990s, when NAR licensed the listings portal Realtor.com — which it controlled — to California-based Move Inc. for $9 million a year. In theory, Realtor.com could have gone head to head with Zillow if it had focused on consumers, insiders said. Instead, critics said, NAR handcuffed Realtor’s growth by limiting the kinds of searches and data available. Today, Zillow has more than 175 million average monthly users, compared to Realtor’s 63 million.

“The story is that NAR stifled Move, and that’s why Zillow won,” said the CEO of a data startup, who spoke only on the condition of anonymity for fear of alienating NAR members. “With 1 million-plus Realtors and a great platform, Realtor.com should have beat Zillow.”

While there are those who believe the fight for digital listings is over, Goldberg isn’t one of them. In 2014, News Corporation famously bought Move for $950 million, and it has since boldly gone after Zillow’s market share. And NAR’s licensing agreement remains in place.

At his guitar-strumming introduction last year, Goldberg promised technology that could change the industry for the better.

“If we resist change, it is futile,” he said at the time. “The status quo is not an option.”

NAR’s tech play

NAR was a different kind of disrupter when it was founded in 1908 in Chicago by 120 “real estate men of America.” The group formed to exert their “combined influence” on the industry — which in 1916 included trademarking the name Realtor.

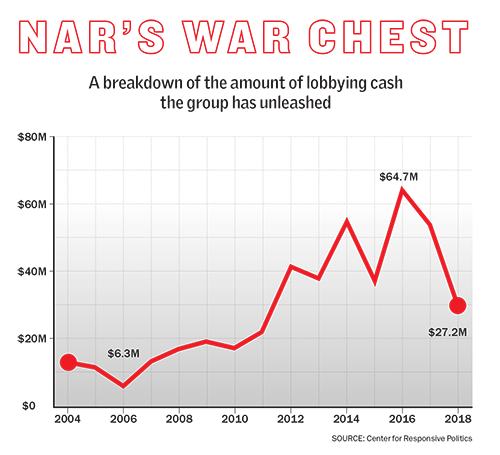

Since 2004, the organization — which also occupies a wedge-shaped, glass building a stone’s throw from the U.S. Capitol in Washington, D.C. — has spent $440 million lobbying on issues like tax reform, flood insurance and reforming Fannie Mae and Freddie Mac to protect 30-year fixed rate mortgages.

This year has been no different on the lobbying front. During 2018’s first half, NAR spent $27.3 million on federal lobbying, second only to the U.S. Chamber of Commerce, which shelled out $43.7 million.

“Not to be glib, but there are homeowners in every congressional district and the Realtors frequently work to inform and mobilize them, which gives the Realtors a powerful base across the country,” said Michael Beckel, policy analyst at the Washington, D.C.-based Issue One, a nonprofit that aims to reduce the influence of money in politics. “It’s safe to say NAR is one of the big dogs.”

But starting in 2008, NAR also began investing heavily in tech startups through its wholly owned subsidiary Second Century Ventures.

Such funds are extremely rare for trade organizations, according to analysts, largely because the investments could easily lead to conflicts of interest. This past May, for instance, the American Heart Association’s announcement of a $30 million VC fund sparked criticism from prominent cardiologists for that very reason.

Second Century Ventures’ initial $20 million war chest came from the membership association in the form of a line of credit. Since then, SCV has taken its returns and reinvested the money in other startups, said David Garland, a general partner at SCV since 2016. “This was never dues” money, he said.

With a median investment of $3.3 million, SCV has made 38 investments to date, showing a preference for seed- and early-stage companies, according to a dossier from research firm PitchBook. “Anything we believe can keep the Realtor at the center of the transaction and also yield a very sizable return,” Garland said.

But Second Century has kept a relatively low profile among other real estate-focused funds like MetaProp, Fifth Wall, Camber Creek and Moderne Ventures.

Competitors say that’s because it’s exclusively focused on residential real estate and tends to favor investments that can generate solid returns with less flash.

“Because they are not invested in any of the products that could be a threat to the residential community — listing aggregation platforms or anything that’s a disintermediator — they also haven’t had many big wins,” said Clelia Peters, a co-founder of MetaProp and president of Warburg Realty in New York.

In addition, sources said, at times the fund has moved slowly or been stymied by bureaucratic holdups.

“There were investments I couldn’t make along the way,” said Constance Freedman, who was SCV’s general partner until she left to found Moderne Ventures in 2015. “At the end of the day, they are a trade association, so I understand the criticism.”

Startups that have sought out SCV as an investor, however, count the affiliation with NAR as an asset.

Andrew Flachner, CEO of the data platform RealScout, said for him it was simply about the numbers: “NAR has access to 1.3 million Realtors.”

At NAR’s annual conference in Boston early last month, its executives hinted that SCV could launch another fund. But this one could use money raised directly from members. Addressing several thousand in the audience, NAR Treasurer Tom Riley said SCV — like NAR itself — was getting a major “revamp.”

“Every single subsidiary, every single rock, every single structure of the organization for the past year and a half, we dug deep,” he said. SCV’s revamp is “going to be amazing,” he promised.

Questionable investments

But the blurry line between NAR and its portfolio companies has attracted criticism.

For example, along with the California Association of Realtors, NAR jointly owns a company called zipLogix — which provides digital transaction services. CAR separately has proprietary transaction forms that it gives its members as a benefit, which it allows zipLogix to license. Some have taken issue with that practice. Zillow, for example, sued, calling it anti-competitive.

Meanwhile, Second Century’s investment in DocuSign, another tech firm, erupted into public criticism this year after NAR proposed a dues hike for 2019. (Despite resistance from members, the board approved the increase.)

“It appears that prior NAR leadership invested $20 million of member money into Second Century Ventures, which stands to generate an estimated windfall of $100 million with the pending DocuSign IPO,” said Kenya Burrell-VanWormer, head of the Houston Association of Realtors, in an April statement. “But it appears that windfall may not benefit the members. Does this make any sense to anyone?”

In a scathing op-ed published by Inman, Jim Harrison, president and CEO of MLS Listings in the San Francisco Bay Area, accused NAR’s top ranks of pocketing the DocuSign earnings.

“Efforts by industry leaders, media and real estate entities to unearth information on how these funds will be accounted for or used, have been met without transparency or accountability,” he wrote in May. “They have been shrouded in secrecy.”

NAR’s board fired back, calling Harrison’s characterization replete with “falsehoods, misrepresentations and misinformation.”

At NAR’s midyear conference in Washington, D.C., Goldberg detailed where that money went. He said Second Century invested $5 million in DocuSign in 2009 and made $43.8 million after selling 28 percent of its shares post-IPO. Of that money, it returned $20 million to NAR. Goldberg did not say what happened to the remaining $23.8 million, but the trade group has said in the past that it reinvests its profits. Goldberg and Stinton declined requests for comment for this story, as did other NAR representatives.

Despite dissent within NAR’s ranks, some 20,000 members attended the association’s Boston conference — where leader said a planned dues hike in 2020 was off the table. The hike, they said, was unnecessary because of savings from budget cuts, a staff reorganization and a surge in membership.

“If you add it all up, it’s a substantial savings, which totally turned the tide on our financial operations,” said NAR’s Riley.

Outgoing NAR President Elizabeth Mendenhall — who received a standing ovation at the event when she officially handed off the job to successor John Smaby — said the organization remains as vital as ever.

“With the changes in the industry, a lot of members are questioning where they go with their own businesses,” she said. “That’s the role that NAR continues to play — to ensure Realtors are essential to the transaction. Knowing that NAR is behind you is very powerful.”

To symbolize the leadership transition, she handed Smaby a crystal gavel, cautioning that it cannot be used to silence the crowd: “If you hit too hard, it’s going to chip.”

‘The horse has left the barn’

One of NAR’s most ambitious projects in recent memory — not to mention one of its most controversial — has been the creation of UpstreamRE, a single point of entry for residential listings nationwide. Plastered across its homepage are the words: “Streamline and take control of your data and your future.”

But today, a sense of powerlessness remains.

Introduced in 2015, the portal was billed as a way to make data more efficient and accurate by having each MLS enter listings directly. It also gives brokers and MLSs greater control over listings at a time when many see digital platforms like Zillow as a serious threat.

“There’s a common analogy that the horse has left the barn,” said Alex Lange, president and CEO of Upstream, describing the feeling among brokers that they’re no longer in control of their listings. “I say, what responsible ranch hand lets the horse go?”

Early on, NAR earmarked $6 million for Upstream. It was expected to go “full throttle” by 2016. But a year later it was still puttering along and got another $9 million boost from NAR.

Not surprisingly, members voiced frustration as they watched their dues being spent with little to show for it, several said.

“This is members’ money,” Cindy Hamann, then-chair of the Houston Association of Realtors, told Inman in 2017.

John Mosey, president of NorthstarMLS in Minnesota and Wisconsin, said NAR made statements about Upstream “to the effect that they’re on track and achieved great progress.” But Mosey — whose MLS was selected as a pilot market for Upstream three years ago — said the opposite was true.

“To my knowledge, no one in our market is using it,” he said.

NAR isn’t alone in its attempt to catch up to its digital rivals.

For years, major New York City brokers resisted calls for a local MLS — inadvertently paving the way for StreetEasy to gain massive market share. It was only last year, when the Zillow-owned portal rolled out a series of fees, that the industry scrambled to syndicate listings through the Real Estate Board of New York.

But Upstream has also drawn scrutiny for how its rollout has been handled. The job of building it fell to Realtors Property Resource, a property database and NAR subsidiary.

Upstream’s Lange, who took over in 2016, acknowledged that while the work is complex, Realtors Property had taken “entirely too long to build this.” But, he said, because Realtors Property was “building it for me for free, I kind of have to go with it.”

Under Goldberg’s leadership, NAR has responded to the Upstream delay. In February, it directed Realtors Property to pull the plug on a project that would provide back-end technology for small and midsized MLSs. And in August, NAR slashed 10 percent of Realtors Property staff.

But it’s still not clear that Upstream has member buy-in — or that it ever did.

In a survey last year by the Council of Multiple Listing Services, more than half of MLSs said they weren’t sure if they would participate in Upstream, and 13 percent had “no interest” in participating.

Last year, former NAR Chief Executive Stinton blamed the MLSs. He said they hadn’t fully participated because they were unhappy that Upstream would control the listings.

“It’s pretty disappointing,” Stinton said. “Politics, and that’s my polite word.”

Even outside the MLS world, there remains an underlying skepticism about whether Upstream is a good idea.

Last summer, eXp Realty’s chief product and technology officer, Scott Petronis, expressed concern about having a “single point of failure” if Upstream consolidates control in one place.

And then there’s Zillow, which has a vested interest in ensuring that Upstream doesn’t succeed, given that its own lifeblood is the listings data that Upstream wants to control.

The listings giant —which has been Upstream’s fiercest critic — told federal regulators in July it was “greatly concerned” that Upstream could potentially cause “erosion of equitable access to listings data.”

The critique was part of a seven-page letter submitted to the Federal Trade Commission and U.S. Department of Justice in response to a June workshop on competition in real estate.

Zillow wrote that “members of Upstream’s board have repeatedly commented in public settings and in written communications that one goal of Upstream is to allow brokers to restrict data distribution to online portals.”

Yet regulators didn’t mention Upstream during the workshop itself.

Hahn, of 7DS Associates, finds that omission curious. “To have a national repository of some sort that was going to control access to listing data — that sounds like a big fat target for the DOJ and FTC,” he said.

Upstream’s governance prevents the company from making a profit, as does NAR’s. Once Upstream goes live in a market, it charges the MLS or brokers who enter data a fee. It can use those fees to cover operational costs. It’s also supposed to repay NAR’s initial funding; the first payment of $7.6 million is due in January.

Lange said that as of May, Upstream had commitments to cover a revenue target of $250,000 a month. But not all of those who have committed to participate are live.

“It’s not a 1, 2, 3, turn on,” Lange said. “Right now, it feels like a big Tetris puzzle. But it’s doable, and it’s happening.”

In the meantime, NAR and Upstream are facing competition from some of the very MLSs they are looking to serve.

In September, five MLSs — in Arizona, Wisconsin, Silicon Valley, Oregon and Utah — launched MLS Aligned, a platform that manages and distributes shared data.

“With 650 MLSs, we have a big industry,” said Chris Carrillo, president and CEO of MetroMLS in Wisconsin, referring to the number of MLS portals nationwide. “There’s plenty of room under this big tent to support different initiatives.”

But as projects like MLS Aligned and others launch, they may make Upstream somewhat irrelevant, Hahn said. Still, given how much money NAR has already invested, abandoning it also doesn’t make sense.

“It’s hard not to lose face if you just back away now,” he said. “Yet there isn’t a face-saving option that’s available.”