As the local economy continues to shake off the aftereffects of the previous recession, New Jersey developers have begun pouring money into big-ticket projects slated to put millions of new square feet on the market. National retailers are inking leases in new malls. Even foreign investors, long a force in the Big Apple, have begun venturing across the Hudson. The one dim spot in the landscape remains the office leasing market.

Of course, it can be tricky depicting the five counties that make up northern New Jersey — Bergen, Passaic, Morris, Essex and Hudson — with the same broad brushstrokes. The Real Deal examined the top transactions and projects in these counties for the 12 months ending on April 30, 2016, and found some definite trends.

For starters, long-stalled developments are finally moving forward. Take, for example, American Dream Meadowlands, the $1 billion mega mall planned to rise next to MetLife Stadium. After languishing for more than a decade, the project recently inked some major retail tenants.

The region is also benefiting from outside attention. For instance, AION Partners, a national real estate investment fund, has invested a hefty $183 million in an aging multi-family complex in Mount Olive. Likewise, a first-ever Chinese-developed condo is rising in Jersey City.

For a distinct change, new multi-family housing developments aren’t all hugging New Jersey’s waterfront. Developers have started prospecting in inland neighborhoods like Bergen-Lafayette in Jersey City, betting that renters won’t mind a longer commute.

“What happened along the waterfront was a huge success,” said Brian Hosey, the regional manager of the Elmwood Park office of Marcus & Millichap, the commercial brokerage. “Now, it’s all about the area between the waterfront and Newark, where developers are really doubling down.”

Thinking big

Many eyes are focused on Bayfront, which is on the west side of Jersey City, on the Hackensack River. A 100-acre parcel there, owned by Honeywell International, the Morristown-based thermostat manufacturer, is seeking developers who could build a dense mixed-use community of up to 8,100 housing units, 1 million square feet of offices, 600,000 square feet of stores and restaurants and 12,000 parking spaces. The master plan also includes three parks.

The site, polluted with chromium, has been in cleanup mode for years. But the project — whose 11.32 million square feet tops TRD’s list of the largest developments planned for Northern New Jersey — is slated to break ground this year, with a projected completion date in 2043. The project won $2 million in state tax breaks in April 2016.

Jersey City, the epicenter of the state’s current construction boom, is the location of another planned megaproject: Liberty Rising, a 2.4-million-square-foot, $4-billion development that is slated to include a hotel, apartments and a casino. Gambling is currently illegal in the northern part of the state, but New Jersey’s voters will decide whether to expand the practice in November. Fireman Capital Partners, the project’s developer, which owns the Liberty National Golf Course adjacent to the waterfront site, did not respond to a request for comment about their plans should voters reject the gambling referendum.

American Dream Meadowlands, placing third in TRD’s rankings of planned developments, finally seems to be making inroads after years of struggling. First unveiled in 2003, the mega-mall project located by the New York Giants and Jets stadium is on its third developer. There has been a flurry of completed retail leases in 2016, including the two largest leases on our list: Lord & Taylor signed for 132,579 square feet, and Saks Fifth Avenue took 120,784 square feet.

Critics wonder if American Dream will be able to lure enough shoppers away from nearby Manhattan and other big regional malls. Don Ghermezian, president of the mall’s owner, Triple Five, remains bullish. “We believe this match will be an extraordinary success,” he said in a statement last fall, “and our customers and visitors will be amazed at this new and unparalleled experience in fashion shopping.”

Multi-family focused

Five of the top 10 developments on TRD’s biggest projects list call for housing. One of the most ambitious is Journal Squared, in Jersey City’s burgeoning Journal Square neighborhood. Kushner Real Estate Group will cut the ribbon on the first of three planned towers there in November.

Journal Squared’s first 640,000-square foot tower consists of 538 studio to three- bedroom apartments to rent and 20,000 square feet of amenities, including an outdoor pool. A second 1 million-square-foot tower is scheduled to break ground in the spring of 2017 and open in the summer of 2019. The third tower, with 700,000 square feet, will begin construction in 2019 and finish in 2021, according to Jonathan Kushner, the firm’s president. Those last two phases represent the fourth-biggest project on TRD’s development list.

According to Kushner, Jersey City’s market is dominated by residents who can’t afford New York City rents. In the first quarter of 2016, one-bedrooms in Hudson County, which includes Jersey City, rented for an average of $1,890 a month, according to data prepared by the New Jersey Multiple Listing Service. In contrast, Manhattan one-bedrooms averaged $3,458, according to a report from Douglas Elliman Real Estate.

Expected to crest at 56 stories, One Journal Square is a fifth-place finisher on TRD’s top development list. The mixed-use project — which includes apartments, stores and offices — has been approved by zoning officials and received $93 million in tax breaks from the state. It is being co-developed by KABR Group and Kushner Companies, whose president is Jared Kushner, Jonathan’s cousin.

Another notable entry on the development list is 99 Hudson Street, a skyscraping 79-story, 781-unit tower that would become New Jersey’s tallest building. Rising on the waterfront in Jersey City, the tower is a rare New Jersey condo. Ranking sixth on our list, this project is also the first in the area led by a Chinese developer.

This isn’t the only foreign capital flowing into the state’s commercial real estate market. Titanium Realty Group, a Manhattan-based developer, was founded by Uruguayan Diego Hodara and is backed by other South American investors. Hodara said he is intrigued by Jersey City’s “frontier” neighborhoods. He currently owns two rental buildings in Bergen-Lafayette, a modest neighborhood that so far hasn’t been lavished with much attention from developers.

He isn’t the only developer betting that Jersey City enclaves are already too expensive. Oakwood Village, a rental complex in Morris County, will be marketed to renters who can’t afford Jersey City, said Victor Cole, the principal of AION Partners, which bought the site from AIG Global Real Estate for $183 million — a deal that clocked in as the second-most-expensive building purchase on TRD’s list.

At Oakwood, where the 1,224 units are more than 97 percent occupied, AION will spend $17 million to add 600 balconies, pave parking lots and build a new clubhouse. The complex will also get a new name: Oakwood at Flanders. Rents will average about $1,300 a month. “This is a supply-constrained area,” Cole said. “There is a lack of reasonably priced housing everywhere.”

Office market lags

By many measures, the office market in Northern New Jersey isn’t as strong as the residential market. To begin with, the volume of leasing in the first quarter of 2016 was the lowest in three years, according to the commercial brokerage Jones Lang LaSalle. In another sign of weakness, the office vacancy rate stood at around 26 percent, with asking rents of $26 a foot.

But not all office submarkets are created equally. The vacancy rate in suburban areas hovered around 30 percent, while the rate in those neighborhoods served by public transportation — such as Jersey City, Morristown and Summit — was closer to 15 percent.

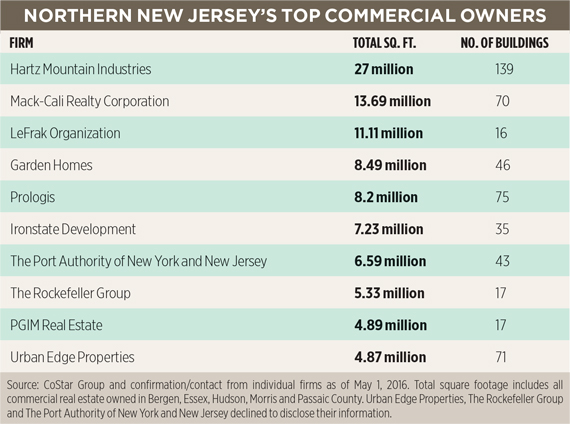

The top three office leases on TRD’s list were inked by financial industry companies taking space in Jersey City. J.P. Morgan Chase took nearly 344,000 square feet in LeFrak’s Newport Office Center. At second place, Bank of America leased approximately 335,000 square feet at 101 Hudson Street, which is owned by Mack-Cali Realty Corporation. In the third-largest deal, Fidelity Investments leased 226,000 square feet at the Newport Office Center complex.

And while TRD’s ranking of biggest commercial sales was dominated by multi-family properties, the top deal on the list was for an office complex. Spear Street Capital bought two office buildings — 70 Hudson Street and 90 Hudson Street — from Gramercy Property Trust for $299 million, in the year’s largest commercial trade.