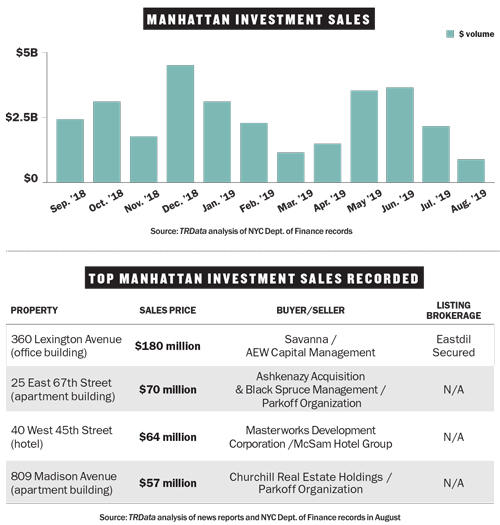

Investment sales in Manhattan and Brooklyn

Manhattan investment sales hit a two-year low in August with $995 million in deals recorded — 52 percent down from June and 59 percent below the 12-month average. The borough’s largest deal was Savanna’s $180 million buy of the office building at 360 Lexington Avenue from AEW Capital Management. Brooklyn’s investment sales market slowed down less dramatically, with $550 million in deals recorded in August, a 14 percent drop from the month prior and 3 percent below the 12-month average. The borough’s top deal was the Rabsky Group’s purchase of an 87.5 percent stake in a Gowanus development site at 313-331 Bond Street for $80 million. The seller, Yoel Goldman’s All Year Management, retained a minority stake.

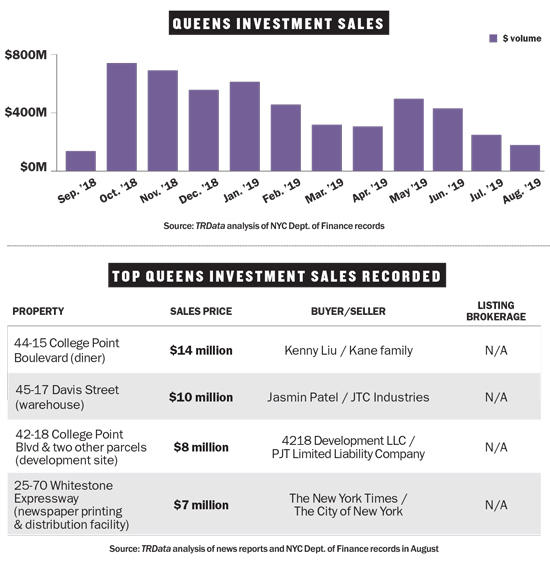

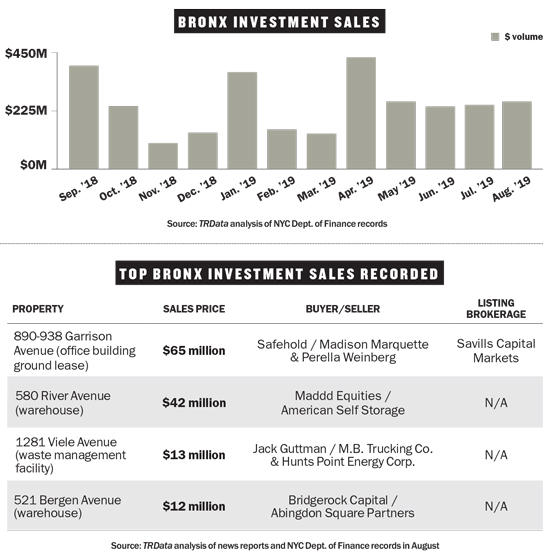

Investment sales in Queens and The Bronx

Queens’ investment sales market continued its downward slide in August with $163 million in deals recorded, a 28 percent decline from the previous month and 61 percent below the 12-month average. The 50-year-old Kane’s Flushing Diner at 44-15 College Point Boulevard was the borough’s priciest sale. Developer Kenny Liu acquired it for $13.6 million. The Bronx was the only borough to see an uptick in investment sales in August, with $248 million in deals recorded — up 7 percent from the month prior and 3 percent above the 12-month average. The borough’s top deal went to iStar-backed ground lease REIT Safehold Inc., which bought the land under the landmarked BankNote building.