INVESTMENT SALES IN MANHATTAN AND BROOKLYN

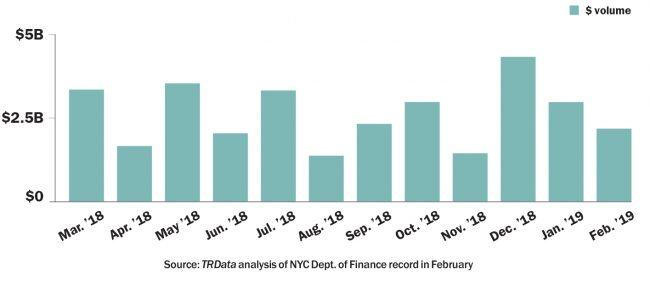

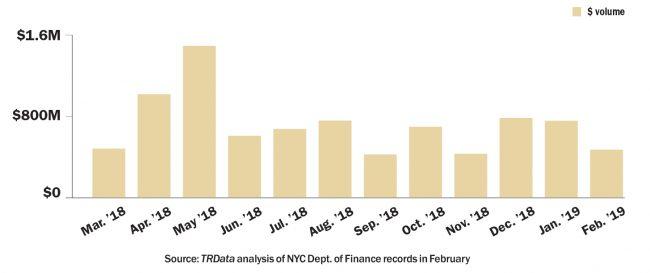

Manhattan investment sales continued a two-month slide in February with $2.23 billion in deals recorded — 17 percent below the 12-month average and down a quarter from the previous month. The top sale of the month went to WeWork, which closed on its $850 million acquisition of the Lord & Taylor building after months of delays. Brooklyn’s investment sales market had a slow February as well, with recorded deals totaling $485 million, 37 percent down from January. The borough’s top deal came from Simon Dushinsky’s Rabsky Group, which sold the Leonard Pointe luxury rental building in Williamsburg to UDR, a Colorado-based landlord, for $130 million.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 424 Fifth Avenuen(office & department store) | $850 million | WeWork & Rhu00f4ne Capital /nHudsonu2019s Bay Company | N/A |

| 34 Desbrosses Streetn(luxury rental) | $260 million | Related Companies /nJack Parker Corporation | NewmarknKnight Frank |

| 1760 Third Avenuen(student housing) | $213 million | 60 Guilders & RCG Longview /nChetrit Group | MeridiannInvestmentnSales |

| 670 Broadway (office) | $131 million | Cara Investment GmbH /nParamount Group | CBRE |

Source: TRData analysis of news reports and NYC Dept. of Finance records in February

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 395 Leonard Streetn(luxury rental) | $130 million | UDR / Rabsky Group | N/A |

| 406 Pine Streetn(office) | $24 million | Esther Blumenfeld /nYehoshua Fruchthandler | N/A |

| 1260 Atlantic Avenuen(warehouse) | $24 million | Cayre Equities /nAtlantic Properties LLC | Marcus &nMillichap |

| 96 North 10th Streetn(warehouse) | $23 million | Eliyahu Zev Kohn /nKo-Rec-Type | JLL |

Source: TRData analysis of news reports and NYC Dept. of Finance records in February

INVESTMENT SALES I N QUEENS AND THE BRONX

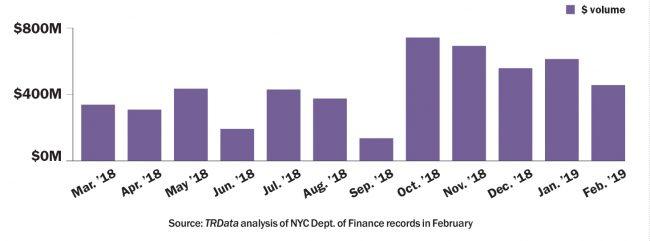

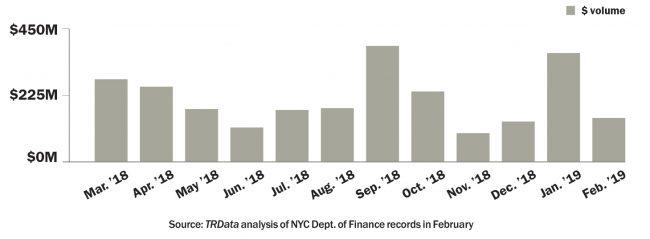

Queens’ investment sale market saw $449 million in deals recorded in February, the lowest dollar volume since September, but still just above the 12-month average. The top deal in the borough was Abingdon Square Partners’ transfer of a Long Island City self-storage facility to Life Storage for $58 million, followed closely by Blackstone Group’s $56 million buy of a warehouse near LaGuardia Airport. The Bronx logged just $150 million in deals in February, a 59 percent decline over January and 30 percent under the 12-month average. The largest deal in the borough went to Home Depot, which bought 1806 East Gun Hill Road — already home to one of its retail locations — from Madison International Realty for $33 million.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 29-01 Review Avenuen(self-storage) | $58 million | Life Storage /nAbingdon Square Partners | N/A |

| 83-15 24th Avenuen(warehouse) | $56 million | Blackstone Group /nSteel Equities | N/A |

| 24-16 QueensnPlaza Southn(residential development) | $39 million | Silverback Developmentn& AEW Capital Management /nGreystone Development | N/A |

| 164-11 Chapin Parkwayn(nursing home) | $39 million | Cassena Care /nCenterLight Health System | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in February

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 1806 East Gun Hill Roadn(big-box retail) | $33 million | Home Depot /nMadison International Realty | N/A |

| 181 East 161st Streetn(rental) | $12 million | Chaim Hirschfeld /nRelated Companies | N/A |

| 50-68 West FordhamnRoadn(one-story retail) | $12 million | Chestnut Holdings /nComjem Associates Ltd. | N/A |

| 1920 East Gun HillnRoad (diner) | $10 million | Home Depot /nMadison International Realty | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in February