INVESTMENT SALES IN MANHATTAN AND BROOKLYN

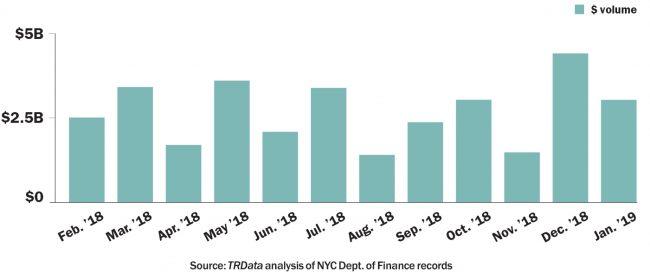

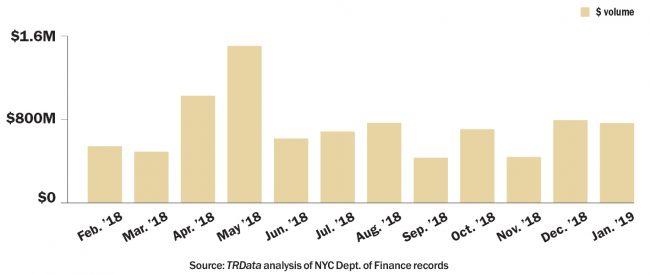

Manhattan investment sales in January reached just over $3 billion in deals recorded— 12 percent above the 12-month average, but down 30 percent from December’s peak. The top sale was of the office building One Dag Hammarskjöld, which Rockpoint Group bought from the Ruben Companies for $566 million. Brooklyn held steady in January, with recorded deals totaling $773 million, just 5 percent above the 12-month average and down 3.5 percent from the previous month. Warehouse deals dominated once again, and the largest sale saw Dov Hertz, Bridge Development Partners and Banner Oak Capital Partners team up for a $255 million last-mile play at Sunset Industrial Park.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| One Dag Hammarskju00f6ldn(office) | $566 million | Rockpoint Group /nRuben Companies | Cushman &nWakefield |

| 850 Third Avenuen(office) | $422 million | Chetrit Group /nHNA Group | MHP |

| 119 West 56th Streetn(hotel) | $390 million | GFI Capital Resources &nElliott Management / Jack ParkernCorporation | NewmarknKnight Frank |

| 212 East 42nd Streetn(hotel) | $278 million | Davidson Kempner /nHost Hotels and Resorts | JLL |

Source: TRData analysis of news reports and NYC Dept. of Finance records in January

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 75-81 20th Streetnand others (warehousendevelopment site) | $255 million | Dov Hertz, Bridge Developmentn& Banner Oak Capital /n601W Companies | Moshe Majeski |

| 333 Johnson Avenuen(warehouse) | $52.5 million | Steel Equities /nNormandy Real Estate Partners | PinnaclenRealty |

| 105 Evergreen Avenuen(warehouse) | $47 million | Uovo /nHalcyon Management Group | Kassin SabbaghnRealty |

| 424 Bedford Avenuen(residential) | $44 million | Global Holdings Group /nEast End Capital Partners | HodgesnWard Elliott |

Source: TRData analysis of news reports and NYC Dept. of Finance records in January

INVESTMENT SALES IN QUEENS AND THE BRONX

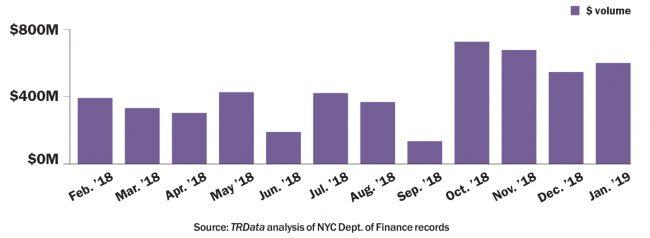

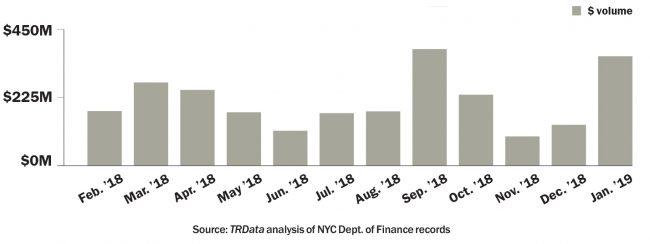

Queens investment sales ticked up slightly in January with $602 million in deals recorded, exceeding $500 million for the fourth straight month. The top deal in the borough was Criterion Group’s acquisition of a Long Island City development site for just under $80 million, after a lawsuit from the seller, PEC Realty, was dismissed. The Bronx started the year strong with over $367 million in deals recorded in January, nearly 70 percent more than the 12-month average, and the second-highest volume in the past year. Nearly a third of that sum came from the borough’s largest deal of the month, in which Maryland-based Realterm Logistics paid $115 million to buy a Morris Park warehouse from Modell’s Sporting Goods.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 22-09 Queens Plaza Northn& 22-09 41st Avenuen(development site) | $80 million | Criterion Group /nPEC Realty Corporation | AmorellinRealty |

| 23-30 Borden Avenuen(warehouse) | $75 million | Innovo Property Group /nAtlas Capital Group | Cushman &nWakefield |

| 48-49 35th Streetn(warehouse) | $72 million | North River Company /nMetropolitan Realty Associatesn& TH Real Estate | Cushman &nWakefield |

| 28-15 34th Streetn(residential) | $25 million | Pete Eliou /nPreviti & Associates | Golden KeynRealty Group |

Source: TRData analysis of news reports and NYC Dept. of Finance records in January

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALE PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 1500 Bassett Avenuen(warehouse) | $115 million | Realterm Logistics /nModell's Sporting Goods | CBRE |

| 980 East 149th Streetn(warehouse) | $57 million | Turnbridge Equities /nCon-Agg Recycling | N/A |

| 201 East 164th Streetn(residential) | $24 million | Lightstone Group /nSheridan Court Mews Associates | WestbridgenRealty Group |

| 820 Boynton Aven(parking) | $18.5 million | Bernard Jacobowitz /nJacob Schwimmer | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in January