INVESTMENT SALES IN MANHATTAN AND BROOKLYN

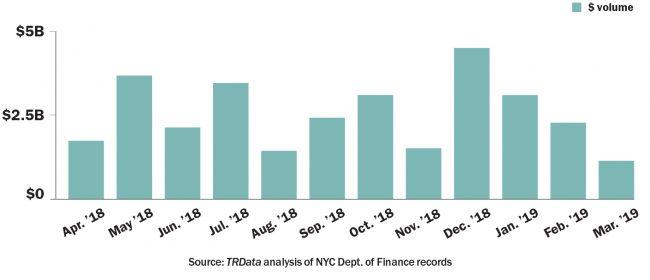

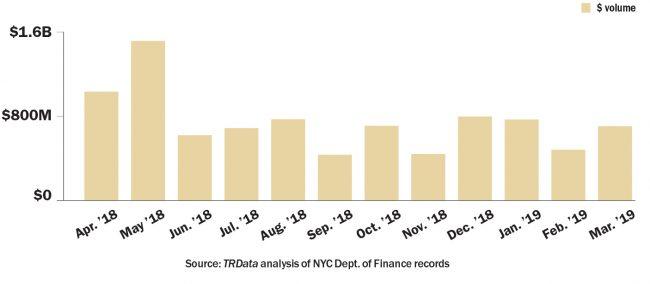

Manhattan investment sales fell for the third straight month with just $1.12 billion in deals recorded in March, the lowest monthly dollar volume since September 2017. The top sale of the month came from Sam Chang’s McSam Hotel Group, which sold a newly constructed hotel at 338 West 36th Street in the Garment District to Magna Hospitality Group for $274 million. Meanwhile, Brooklyn’s investment sales market bounced back with recorded deals totaling $710 million in March, 6 percent below the 12-month average. The borough’s top deal was made by Steiner NYC, which sold a majority stake in 333 Schermerhorn Street to a JPMorgan Chase real estate equity fund for $253 million.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 338 West 36th Street (hotel) | $274 million | Magna Hospitality Group / McSam Hotel Group | N/A |

| 3 Columbus Circlen(office condo, leaseback) | $216 million | Moinian Group /nYoung & Rubicam | CBRE |

| 9-11 West 54th Streetn(single- family homes) | $55 million | Skyline Developers /nDLJ Real Estate & J.D. Carlisle | Corcoran Group |

| 5 East 51st Streetn(residential, for officendevelopment) | $44 million | Macklowe Properties /nNoam Management | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in March

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 333 Schermerhorn Streetn(residential, 62% stake) | $253 million | JP Morgan /nSteiner NYC | N/A |

| 62 Imlay Streetn(warehouse) | $100 million | Prime Storage /nFruchthandler & Schron families | Capital Property Partners |

| 500 Kent Avenuen(development site | $50 million | Hampshire Properties et al. /nCon Edison | N/A |

| 1215 Fulton Streetn(development site) | $33 million | The Collective & Tower Holdings Group / Industrie Capital | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in March

INVESTMENT SALES IN QUEENS AND THE BRONX

Queens’ investment sales market continued to regress from its October spike, falling below the 12-month average in March for the first time in half a year with just $313 million in recorded deals. The borough’s top trade was also its largest multifamily deal of 2019, as HUBB NYC bought a 114-unit Astoria property from Mega Contracting Group and Treeline Companies for $75 million. The Bronx had another slow month, with just $133 million in recorded deals in March, 34 percent below the 12-month average. The two eight-digit deals in the borough went to Lightstone Group, which picked up a pair of South Bronx waterfront dev sites from Pantheon Properties and Borden Realty for a total of $59 million.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 31-57 31st Streetn(residential) | $75 million | HUBB NYC /nMega Contracting Groupn& Treeline Companies | JLL |

| 976 Cypress Avenue (self-storage) | $43 million | Extra Space Storage & PGIM / LSC Development | N/A |

| 135-01 35th Avenuen(development site) | $16 million | Century Development Group / Stemmax Realty | N/A |

| 22-04 Collier Avenuen(residential) | $14 million | Residential Management /nE&M Associates | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in March

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 399 Exterior Streetn(development site) | $31 million | Lightstone Group /nPantheon Properties | Ackman-Ziff |

| 355 Exterior Streetn(development site) | $28 million | Lightstone Group /nBorden Realty | Ackman-Ziff |

| 250 Willis Avenue (retail) | $7 million | Jose Medina /nManuel Medina | N/A |

| 2709 Heath Avenue (residential) | $7 million | Zeqe Mehmetaj /nEmerald Equity Group | Westwood RealtynAssociates |

Source: TRData analysis of news reports and NYC Dept. of Finance records in March