INVESTMENT SALES IN MANHATTAN AND BROOKLYN

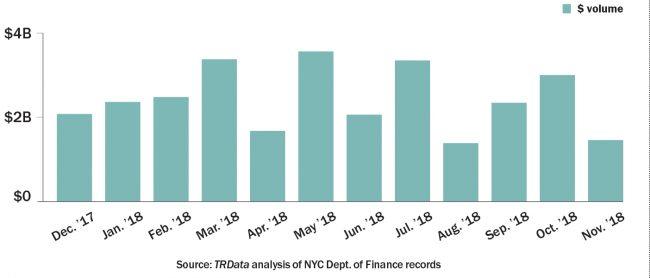

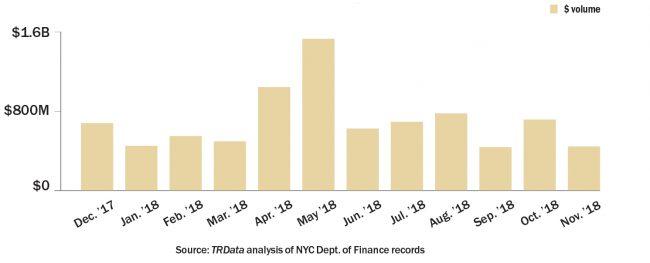

Manhattan investment sales dipped dramatically in November, totaling just under $1.5 billion, less than half of October’s total. The top sale was of the office tower at 425 Lexington Avenue, which Vanbarton Group bought from JPMorgan Chase for $701 million in the month’s only deal worth more than $100 million. Brooklyn had a similarly slow November, with just $444 million in sales recorded, a 37 percent decline from October. The largest deal in the borough was Jonathan Rose Companies’ acquisition of an affordable housing complex at 9000 Shore Road in Bay Ridge, which NYU Langone sold for $149 million. No other property in the borough changed hands for more than $20 million in November.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 425 Lexington Avenuen(office) | $701 million | Vanbarton Group /nJPMorgan Chase | HFF |

| 2330 Broadwayn(development site,nsenior housing) | $61 million | Welltower and Hines /nBeekman Estate | N/A |

| 160 East 89th Streetn(residential) | $55 million | Ditmas Management /nWilliam J. Diamond et al. | CBRE |

| 260 East 72nd Streetn(development site) | $47 million | Chetrit Group /nSL Green | Iron Hound Management |

Source: TRData analysis of news reports and NYC Dept. of Finance records in November

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 9000 Shore Roadn(residential) | $149 million | Jonathan Rose Companies /nNYU Langone | Newmark Knight Frank |

| 86-92 Atlantic Avenue (residential) | $16 million | Highpoint Property Group /nTulip Associates | N/A |

| 111 Woodruff Avenue (residential) | $14 million | Greenroad Capital /nNessim Tamman | GFI Realty |

| 11 Crooke Avenuen(residential) | $13 million | Greenroad Capital /nNessim Tamman | GFI Realty |

Source: TRData analysis of news reports and NYC Dept. of Finance records in November

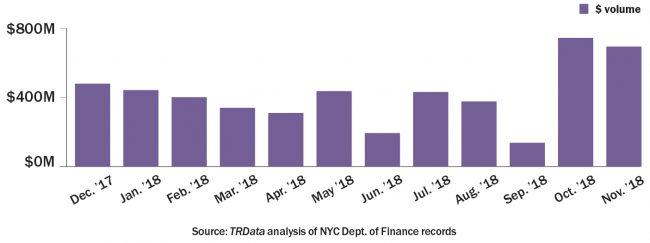

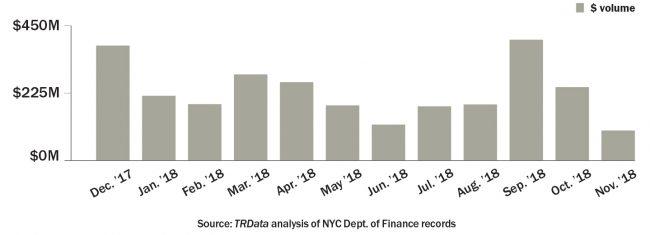

INVESTMENT SALES IN QUEENS AND THE BRONX

For the second consecutive month, Queens investment sales were pushed to historic highs by one blockbuster deal. Blackstone Group’s $475 million buy of the Parker Towers housing complex in Forest Hills accounted for nearly 70 percent of the borough’s investment sales volume, which totaled $679 million. The Bronx, on the other hand, fell to a new low in November, with a total of less than $100 million in recorded sales — with no single property selling for more than $10 million. The big story in the borough was a 14-property portfolio sale from MGS Associates to a trio of individual investors, which included nine Bronx and five Manhattan apartment buildings.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 104-20 QueensnBoulevardn(residential complex) | $475 million | Blackstone Group /nJack Parker Corporation | Newmark Knight Frank |

| 52-34 Van Dam Street (homeless shelter, ex-hotel) | $36.5 million | Shulem Herman /nLam Group | N/A |

| 39-04 NorthernnBoulevardn(development site) | $31 million | Bay Ridge Auto Group /nMarathon Petroleum | Ackman-Ziff |

| 37-59 81st Streetn(hotel, unfinished) | $15 million | Yu Ting Zheng /nJi Juan Lin | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in November

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 246 East 199th Street (residential) | $8.3 million | MB Capital Asset Management / Turuk family | Highcap Group |

| 2820 Decatur Avenue (residential) | $8.1 million | Eden Ashourzadeh et al. / MGS Associates | Marcus &nMillichap |

| 2728 Marion Avenuen(residential) | $5.6 million | Eden Ashourzadeh et al. /nMGS Associates | Marcus &nMillichap |

| 395 East 197th Street (residential) | $4.6 million | Eden Ashourzadeh et al. /nMGS Associates | Marcus &nMillichap |

Source: TRData analysis of news reports and NYC Dept. of Finance records in November