INVESTMENT SALES IN MANHATTAN AND BROOKLYN

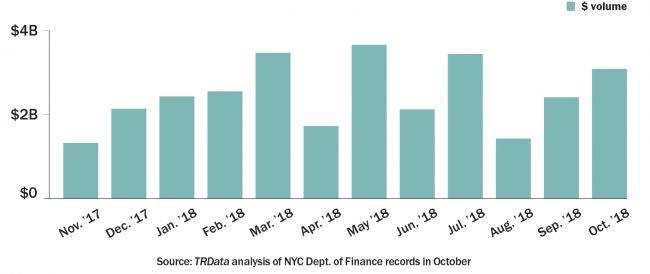

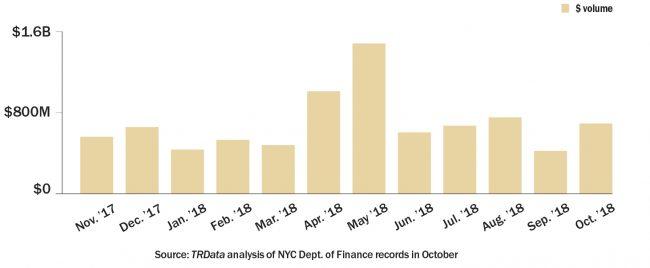

Manhattan’s recorded investment sales totaled over $3 billion in October, up 28 percent from September. L&L Holding and Normandy Real Estate Partners notched the top sale with their $880 million purchase of the full-block Terminal Stores building in Chelsea. Brooklyn rebounded from a slow September with $713 million in recorded sales in October, nearly equal to the rolling 12-month average. The largest deal in the borough was Vanbarton Group’s sale of a rental building at 33 Caton Place to the Dermot Company for $75 million.

MANHATTAN INVESTMENT SALES

TOP MANHATTAN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| Terminal Stores,n271 11th Avenue (office) | $880 million | L&L Holding Company,nNormandy Real Estate Partners / Waterfront New York, GreenOak Real Estate Advisors LP | CBRE |

| 101 Barclay Streetn(office) | $352 million | Bank of New York Mellon /nCity of New York | N/A |

| 400 Madison Avenuen(office) | $194.5 million | Daishin Securities /nASB Capital Management | N/A |

| Hotel Indigo,n180 Orchard Street (hotel) | $162.5 million | MRR Development /nBrack Capital Real Estate | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in October

BROOKLYN INVESTMENT SALES

TOP BROOKLYN INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 33 Caton Placen(residential)) | $75 million | Dermot Company /nVanbarton Group | HFF |

| 25 Paidge Avenuen(industrial) | $62 million | Two Trees Management /nZenith Energy | N/A |

| 109 25th Streetn(infrastructure,neasement) | $47 million | Morgan Stanley / MacquarienInfrastructure Corporation | N/A |

| 8713-8721 Fifth Avenue (commercial) | $16 million | Four Asteria Realty /nAR Global Investments | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in October

INVESTMENT SALES IN QUEENS AND THE BRONX

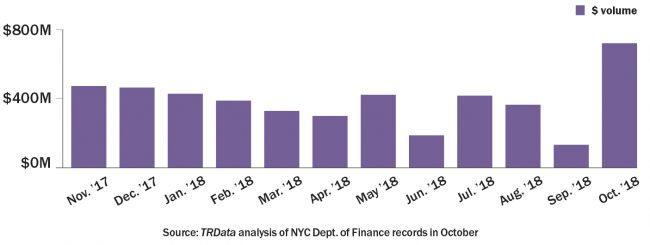

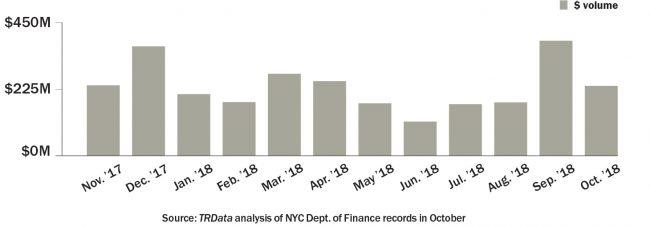

Queens investment sales swung from a 12-month low in September to a 12-month high in October with $727 million in recorded deals. The total was boosted from the month’s top sale, in which Simon Baron Development bought out partner Quadrum Global’s stake in the rental complex at 29-22 Northern Boulevard for $313 million, more than four times as much as the second-largest deal in the borough. Meanwhile, recorded investment sales in the Bronx regressed to the 12-month average in October, totaling $238 million. Portfolio deals were all the rage in the Bronx in October, with Heritage Realty acquiring six buildings from Exact Capital for $15.4 million and Quality Communities — a joint venture of Taconic Investment and Clarion Partners — picking up two apartment buildings from City Skyline Realty for $27.8 million.

QUEENS INVESTMENT SALES

TOP QUEENS INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 29-22 NorthernnBoulevardn(co-living, partner stake) | $313 million | Simon Baron Development / Quadrum Global | N/A |

| The Bindery, 30-02 38th Avenue (industrial | $75 million | Alexandria Real EstatenEquities / Brickman Real Estate | Cushman & Wakefield |

| 27-17 42nd Roadn(residential, 70% stake) | $67 million | Star Tower Condominium LLC / Eastern Star Development | N/A |

| 58-30 Grand Avenue (warehouse) | $39 million | Innovo Property Group /nNathan Indig | MeridiannCapital Group |

Source: TRData analysis of news reports and NYC Dept. of Finance records in October

BRONX INVESTMENT SALES

TOP BRONX INVESTMENT SALES RECORDED

| PROPERTY | SALES PRICE | BUYER/SELLER | LISTINGnBROKERAGE |

|---|---|---|---|

| 442 E. 176 Streetnand five othersn(residential) | $15.4 million | Heritage Realty /nExact Capital | N/A |

| 1534 Selwyn Avenue (residential) | $15.3 million | Quality Communities /nCity Skyline Realty | N/A |

| 1197 Grand Concourse (residential) | $12.6 million | Quality Communities /nCity Skyline Realty | N/A |

| 296 Grand Concoursen(development site) | $10.3 million | JCS Realty /nHenry Kessler et al. | N/A |

Source: TRData analysis of news reports and NYC Dept. of Finance records in October