A few years ago, law firms were cutting their payrolls and scrambling to refocus their practices on bankruptcies and restructurings.

Indeed, the real estate law industry suffered through several years of volatility in the aftermath of the 2008 financial crisis, when deals came to a near-standstill.

And there were casualties. In 2012, the law firm Dewey & LeBoeuf filed for bankruptcy, then shuttered, sending its real estate lawyers to rival firms across the city.

Today, though, the landscape for real estate lawyers is decidedly better with the boom creating a boatload of legal work from financings to land use issues to development deals.

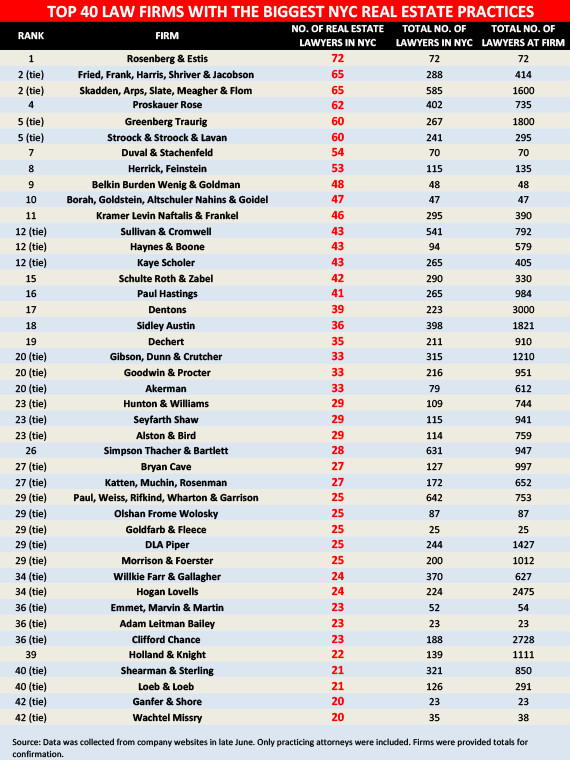

This month, amid that upswing, The Real Deal ranked city’s biggest real estate law practices by number of attorneys. The counts were based on a late-summer snapshot.

What we discovered is that the top echelon of the legal industry has significantly expanded in the last five years. In 2010, the last time TRD ranked these firms, there were 794 real estate attorneys working at the top 20 firms. Last month, that number stood at 986 attorneys — an impressive 24 percent jump.

However, a closer look reveals that not all firms were driving that growth.

In fact, some of the city’s highest-profile names shrank their ranks.

For example, Bryan Cave — which had 40 real estate attorneys back in 2010 — had only 27 as of last month and did not rank in the top 20, according to TRD’s tally.

Meanwhile, the top-five firms on TRD’s ranking all grew — but by varying amounts.

Perhaps the most surprising surge came from Rosenberg & Estis, which beat out a slew of global law firms to take the No. 1 spot. The real estate-only firm — which works exclusively in New York — increased its attorney headcount by a dramatic 64 percent, jumping to 72 lawyers from 44.

The rest of the top firms included well-known players: Fried, Frank, Harris, Shriver & Jacobson; Skadden, Arps, Slate, Meagher & Flom; Proskauer Rose; Greenberg Traurig ; and Stroock & Stroock & Lavan.

And all of those firms are, of course, benefitting from the increased activity in the market.

“There’s a lot of money seeking to be in the United States right now, particularly in gateway cities like New York,” said Jonathan Mechanic, head of the real estate practice at Fried Frank. “It’s a funding source for development in New York City. So consequently there’s a lot more legal work.”

As a result, hiring has picked up.

“In 2010, nobody was really calling anybody,” said Robert Ivanhoe, chairman of Greenberg Traurig’s global real estate practice, referring to law firm recruiting. “But now, the good people at all levels at good practices are very marketable.”

“I’m not irrationally exuberant,” added Ivanhoe, whose firm tied for the No. 5 spot, “but I feel generally pretty good about the market.”

Serious surges

Unlike other top firms, Rosenberg & Estis has not built its business on massive deals that are reinventing neighborhoods wholesale, like, say, Hudson Yards.

In fact, it specializes in the less-glamorous and lower-profile world of landlord-tenant disputes, though its work does run the gamut, from financing deals as small as $3 million, to sizeable development projects, mostly on behalf of the Durst Organization, like Via, the 709-unit tetrahedron-shaped rental rising on West 57th Street and the West Side Highway.

Rosenberg, which was founded in 1979, also usually charges less for its services than rival firms, said founding member Gary Rosenberg. (As TRD has reported, top-rung attorneys at some of New York’s most prestigious firms can command around $1,000 an hour.)

“We think our rates are very competitive,” he said, though he declined to be specific.

At the same time, associates have flocked to work at the firm because it doesn’t require 80-hour weeks, he explained: “We respect that you can have a family and a life outside.”

The last decade hasn’t been all wine and roses for the firm.

Between 2009 and 2011 it froze its billing rates because clients were struggling, according to Rosenberg. “The deals we were doing were not making the clients money but cutting their losses,” he said.

“But these last five years have been just about the best five years I can recall,” said Rosenberg.

Meanwhile, Skadden, an elite white-shoe law firm perhaps best known for its mergers and acquisitions and corporate advisory work, has also grown its real estate practice substantially. As of last month, the firm, whose real estate practice is led by Neil Rock, had 65 real estate lawyers in New York, up from 46 five years ago — a 41 percent increase.

The firm was one of several that represented China’s Anbang Insurance Group in its blockbuster $1.95 billion purchase of the Waldorf Astoria hotel from Hilton Worldwide Holdings in 2014. (Fried Frank, Greenberg Traurig and Hogan Lovells were the others.)

Other firms are adding lawyers in spades, too.

Stroock, whose real estate practice is headed by industry veteran Leonard Boxer, grew its New York real estate practice to 60 attorneys from 43.

Stroock prides itself on having a wide range of expertise in-house, from commercial lending to land-use, partners said, noting that single-focus firms sometimes have to bring on outside experts which can rattle clients.

Among Stroock’s specialized groups is its co-op and condo division, which represents about 325 boards and is headed by partner Eva Talel. For Talel, business is largely being driven up by boards trying to pass smoking bans and dealing with senior citizens who can no longer care for themselves; she recently represented an Upper East Side co-op board forced to evict a woman in her 80s after she missed “many, many months” of maintenance payments.

Meanwhile, Duval & Stachenfeld, which ranked No. 7, has been quietly expanding. It logged 54 real estate lawyers, up from 31 five years ago.

The firm, which was founded in 1997 by real estate practice chair Terri Adler, helped structure the complicated ground lease for the Carlton House, a luxury co-op at 680 Madison Avenue that’s being developed by Extell and Angelo, Gordon & Co. It was also involved in the $277 million sale of the ground-floor retail condo there in 2013, to Thor Equities.

Lean and mean

Not everyone is in extreme expansion mode. For some, the last five years have been more about adding lawyers on a piecemeal basis — or shrinking.

In addition to Bryan Cave, well-known firms that have downsized their local real estate practices include Morrison Foerster and Willkie Farr & Gallagher. (Those firms did not make the top 20.)

Still, Bryan Cave, which had 27 lawyers this time versus 40 attorneys on the last go-round, has a roster of high-level clients including developers like Extell Development Company, Silverstein Properties, Madison Equities and the Gotham Organization, which it represented at Gotham West, a $520 million project that takes up nearly a full city block at 11th Avenue and West 45th Street.

In recent years, Bryan Cave’s has also added several non-bank lenders, like Ackman-Ziff Real Estate Group and Dune Real Estate Partners, to its client list, said Andy Auerbach, deputy leader of the real estate practice.

“It’s a very exciting area for us,” Auerbach said.

Others are growing, but at a slower clip.

For example, Fried Frank, which acts as legal counsel on some of the biggest and most sophisticated real estate deals in the city, increased its New York real estate practice to 65 attorneys from 60 in 2010.

Mechanic said the firm — which ranked No. 1 in 2010 and tied for the No. 2 spot this year — is “all over Hudson Yards,” the 28-acre mini city that the Related Companies is building on the Far West Side.

“When you think about all of the development going on there it’s mind boggling,” he said, noting that Fried Frank not only represented Related there, but also represented Coach and Time Warner in their mega office leases at the site, among other deals there.

Similarly, it handled the 1 million-square-foot office lease for media giant Condé Nast at One World Trade, and is handling the planned 1.3 million-square-foot lease for News Corp. and 21st Century Fox at Two World Trade.

While the firm let people go back in 2008 and 2009, it is “actively recruiting” today, Mechanic said. “We started mushrooming again,” he noted.

Meanwhile, Greenberg Traurig, which has 38 offices globally, had 60 New York real estate lawyers, just three more than five years ago, though Ivanhoe said he hired partners and associates since TRD completed its tally.

Jonathan Mechanic, the head of Fried Frank’s real estate practice

The firm, like others, has enjoyed a boon from Chinese investment in New York, representing developers in their quest for funding through EB-5, the U.S. visa-for-investment program that developers have been tapping for financing.

Likewise, when China’s Sunshine Insurance Group bought Midtown’s Baccarat hotel for $230 million earlier this year, Greenberg worked on behalf of the seller, Starwood Capital Group.

Greenberg, like other firms, has taken an incremental approach to rates.

Ivanhoe told TRD he billed $1,025 an hour last year. This year, it is $1,050, about a 2 percent increase, a far cry from the nearly double-digit annual increases during the last boom a decade ago, Ivanhoe said.

He said the flow of capital into New York bodes well for the legal profession.

“New York City is clearly the hottest market in the U.S., with the exception of maybe San Francisco,” Ivanhoe said. “But New York is a much, much larger market, and the demand to buy here is unbelievable.”

That, of course, is creating more work on the political-consulting front, too, which Herrick Feinstein is pleased to pick up. The firm — which had 53 attorneys up from 46 in 2010 — has a strong real-estate lobbying arm, which deploys urban planning experts who represent developers and other real estate interests to woo the city’s Planning Department, said Jonathan Adelsberg, a senior partner.

Adelsberg has also represented Michael Ring in a variety of transactions, including the well-publicized feud with his brother over the infamous NoMad-based real estate portfolio amassed by their father. Many of those buildings were recently sold to Extell.

Belkin Burden Wenig & Goldman, with 48 attorneys, also represents real estate dynasties like the Milsteins, the Rudins and the Macklowes. However, work on behalf of 300 co-op boards is generally its bread and butter.

Sherwin Belkin, the firm’s chairman and one of its founding partners, touted the firm’s cost-effectiveness when compared with some of the heavy hitters on the ranking. “We can offer a lot more close client attentiveness, and perhaps at a better price point,” he said.

In the end, though, size is only a single metric to evaluate the influence of a firm, lawyers say. And many firms feel they don’t have to swell their ranks to get ahead. “I would rather be lean and mean and service a very select group of clients, as opposed to being all things to all people,” said Herrick’s Adelsberg.

Correction: Due to a research oversight, these firms — Haynes & Boone, Goodwin & Procter and Kaye Scholer — were left off the original version of this ranking. They have been included and the ranking updated.