Tight inventory. Rising prices. Luxe new developments. And competition—fierce competition.

Against that backdrop, Manhattan’s largest brokerages carved out a bigger piece of the pie for themselves this year, The Real Deal’s annual ranking of the borough’s biggest residential real estate firms shows.

Although some firms saw their total number of listings drop, nearly all of the largest brokerages saw the dollar volume of their Manhattan exclusives inch higher, according to TRD’s ranking, which is based on a snapshot of data pulled from On-Line Residential on March 29. That reflects the leg up that larger firms have in landing pricey listings and new development deals. The dollar volume boost is also the result of the overall price appreciation in the market, which, while starting to level out, is certainly not over.

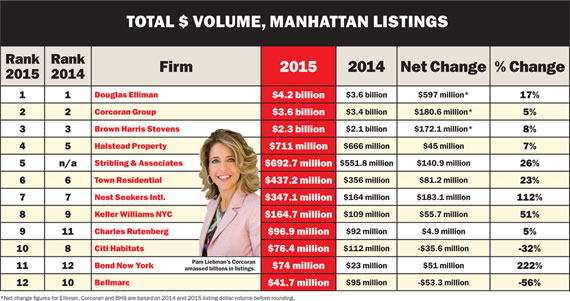

As it did last year, Elliman ranked at the top of TRD’s list for both number of agents and dollar volume of listings. The firm, headed by Dottie Herman and Howard Lorber, had a 17 percent increase in listings dollar volume from last year. (The firm’s total listings value was $4.2 billion, up from $3.6 billion.) Meanwhile, its top rival, the Corcoran Group, ranked second with $3.6 billion in listings.

The five biggest firms, by number of agents, were Elliman, Corcoran, Halstead Property, Citi Habitats and Town Residential.

As a group, Manhattan’s 12 biggest firms — only the borough’s largest brokerage by number of agents make the ranking — had a total of $12.8 billion in exclusive Manhattan sales listings, up marginally from $12.7 billion in 2014. But that was far higher than the $8.5 billion logged in 2013.

And listings figures may start increasing soon with tight inventory poised to ease in the coming months. Brokerages citywide are eager to pounce on that new supply.

“[Brokers] are itching, especially for their buyers, for [properties] to hit that they can chase and get,” said Stefani Markowitz, president of Rutenberg Realty. “People are really hopeful that there will be this new surge of inventory and that the late spring will be really busy.”

Recruitment envy

This year’s ranking saw a cluster of significant changes.

For starters, Stribling & Associates, which fell off the ranking last year, regained a spot at the table this year, after adding 25 more agents. On the flip side, Sotheby’s International Realty fell off the ranking because its headcount dropped. (The firm, however, had a massive $1.36 billion in listings and had the highest dollar volume — by far — on TRD’s mid-sized ranking and blew away a number of firms on this ranking to boot.)

Some smaller firms on the Big 12 saw significant growth: percentage-wise, Bond New York saw the biggest change in its listings volume, with $74 million in listings, up 222 percent. Nest Seekers International, meanwhile, had $347.1 million, up 112 percent.

But when it comes to Manhattan manpower, Elliman reigns supreme. The brokerage had 1,977 agents as of March 29, a nearly 15 percent jump from last year.

For many firms, wooing agents has become something of a blood sport, with longtime brokers and top producers defecting to rival companies like never before, several brokerage heads noted (see related story on page 40).

“Margins are low and expenses are high, and let’s be honest, there’s not a lot of inventory,” said Eric Barron, CEO of Keller Williams NYC, who noted that the recruitment environment has picked up “1,000 percent” over the last 12 months.

“It has become highly competitive,” he said.

Keller Williams was one of three firms to see huge gains in agent count, along with Town and Nest Seekers. Keller Williams added nearly 200 agents, bringing its total Manhattan headcount up to 535 agents. Town’s headcount grew to 577 agents, from 472.

Barron said his four-year-old firm has steadily matured, leading to last year’s growth spurt, which included a doubling of the company’s management team.

Meanwhile, Corcoran — which had 1,158 agents — saw a nearly 3 percent drop in agent headcount from 2014 to 2015, following a string of high-profile defections, including top brokers Robby Browne and Maria Pashby to Brown Harris Stevens, Lauren Muss to Elliman and others. Corcoran declined to comment for this article.

But during an interview with TRD in March, CEO Pam Liebman said: “We’re never happy to lose somebody, but we’re also not in a bidding war for agents.”

Brown Harris Stevens, meanwhile, saw its agent count jump by 15 percent to 496 amid an “explosive recruitment” period, said President Hall Willkie. Despite last year’s defection of top agent Kyle Blackmon to Compass — which was included in the mid-sized ranking — Willkie said the firm’s growth coincides with an expansion of the firm’s main office and forthcoming Downtown office.

“Competition is stiff amongst agents and clients, and amongst firms to attract and retain productive people,” he said.

While many other firms are basking in stronger showings, one firm that is badly struggling is the Bellmarc Group. The firm’s headcount dwindled to 295 agents, a 43 percent drop. That drop, which knocked the firm off of the top five by size, coincided with the company’s split from franchiser Coldwell Banker. It also came amid infighting between company founder Neil Binder and his partners. Those partners, Anthony DeGrotta and Larry Friedman, accused Binder of embezzling funds from the company. Within a span of several weeks in October, for instance, 15 Bellmarc agents jumped ship to Halstead, and 10 decamped to City Connections. Binder, who has adamantly denied the allegations, did not respond to requests for comment.

Inventory influx?

After record low inventory levels during the last few years, many brokerages are finally seeing signs of hope this spring.

There were just over 5,200 apartments available for sale in Manhattan during the first quarter, up 5 percent, according to real estate appraisal firm Miller Samuel.

That increase made a difference on the ground.

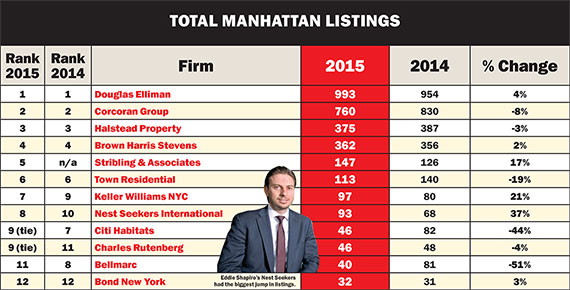

In terms of numbers of properties being marketed, Elliman also led the pack with 993 listings, up more than 4 percent year over year.

Three other firms experienced a surge in their number of listings, although the overall number of properties they’re marketing pales in comparison to the mega firms. Nest Seekers saw listings jump 37 percent to 93; Keller Williams saw listings increase 21 percent to 97, and Stribling logged a 17 percent jump to 147.

“Even though inventory is tight, you are starting to see a little bit more activity in the market,” said Elizabeth Ann Stribling-Kivlan, president of Stribling & Associates, which ranked No. 12 with 281 agents.

“People are listing [their apartments] because they’re finding places to go; there are new developments that have started to close.”

Nonetheless, the number of listings was down at six companies, including Corcoran, which saw an 8 percent drop to 760 exclusives. Citi Habitats, Rutenberg, Bellmarc and Town also saw drops, partially due to the inventory shortage.

“It’s a market-wide, systemic issue right now,” said Andrew Heiberger, Town’s CEO. “The flip side of having low inventory is you’re selling your listings.”

That seemed to check out in many cases, according to TRD’s ranking of closed sales (see related story on page 51). A number of firms, for example, saw a higher dollar volume of closed sales for the 12-month stretch ending in late March than their current listing dollar volume.

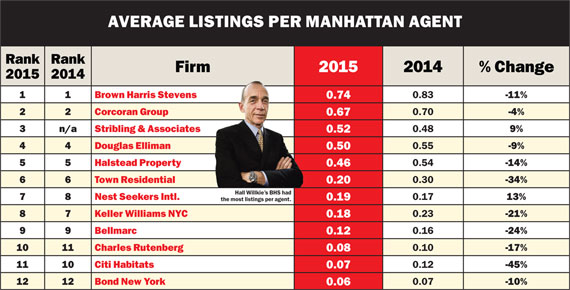

Still, the average number of listings per agent dropped nearly across the board, suggesting that a smaller number of agents have the lion’s share of listings.

At Bond, only 4 percent of agents have active listings, the lowest percentage of any firm on the ranking. Bond did not respond to multiple emails. On the other side of the spectrum, Brown Harris Stevens had a higher ratio or agents with listings, at 33 percent, than any of its rivals. “Everyone is fighting for that exclusive,” said Markowitz of Rutenberg, whose agents had 46 exclusives, down 4 percent.

Pushing up prices

But even as Manhattan brokerages duke it out for a finite number of for-sale properties, the emphasis on luxury — as well as overall rising prices — boosted the dollar value of listings among the top firms this year, just as it has in recent years.

“The luxury market has impacted all of us,” Halstead CEO Diane Ramirez said.

“We just listed a beautiful apartment, well over $10 million, on the Upper West Side, [and] we had an over-ask, accepted offer within one day,” she said, noting that the condo at 535 West End Avenue was asking $11.95 million.

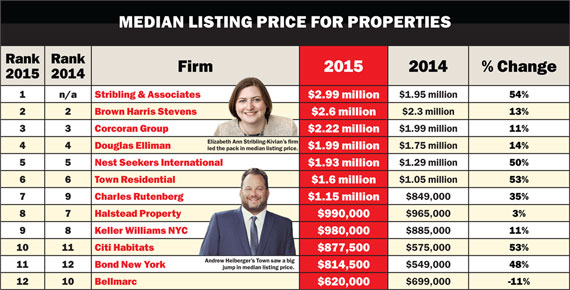

In fact, the median listing price was up at 11 of the 12 biggest firms, according to TRD’s analysis. (Bellmarc was the exception, with an 11 percent drop to $620,000.)

In a major coup, Stribling had the highest median price, $2.9 million, up 54 percent from last year, followed by $2.6 million at Brown Harris Stevens, historically the leader in this category, according to TRD’s analysis.

“You’re seeing a real increase in what people are willing to spend for something,” said Stribling-Kivlan. “The market is bearing higher prices, whether it’s the new development arena or even in the regular, everyday New York co-op and condo market.”

Stribling also claimed the biggest median price gain, followed by Town, Citi Habitats and then Nest Seekers. In general, Nest Seekers has benefitted from pricey listings being marketed by agent Ryan Serhant, a star of Bravo’s “Million Dollar Listing New York.”

Overall, the dollar value of exclusive listings rose at 10 of the 12 firms, fueled by higher prices and the onslaught of luxury condos. In fact, the luxury sector represented 30 percent of Manhattan listings during the first quarter, according to Miller Samuel. And overall, luxury inventory rose 14.5 percent to 1,575 units during the first quarter.

But while there are a number of stratospherically priced penthouses, the median luxury sales price registered in the first quarter actually decreased to $5.1 million from $5.7 million the year before.

Jonathan Miller, president of Miller Samuel, said the slide simply reflects a shift in product mix. There were “lots of closings of high-end sales a year ago, like those at One57,” he said.

Agents are, not surprisingly, migrating to where the money is.

Corcoran had 45 agents with listings priced at $10 million or more, up 50 percent from 2014, while most firms on the ranking were also up in the category.

New-construction condos are, of course, also a huge battleground and driver of listings. “We’re in a very competitive business,” said Heiberger, who noted that snagging new development deals requires approval from many parties, from the developer to the lender. “You have to win everybody over.”

The 5 percent inventory jump Miller Samuel found was driven by new development. The number of those properties on the market rose 22 percent in the first quarter compared to last year. And brokerages are seizing on that.

Elliman’s 17 percent listings jump, for example, came amid the firm’s aggressive push into new development sales. In 2014, Macklowe Properties tapped the firm to market and sell one of the highest-profile buildings in the city: 432 Park Avenue, which has an estimated sellout of $2.9 billion.

Meanwhile, Stribling picked up new projects like 252 West 57th from World Wide Group and Rose Associates, a building where a penthouse will reportedly ask $37.5 million. Those projects helped boost its listing dollar volume 26 percent to $693 million.

And the number of new units is poised to go up.

Some 6,000 new condo units are expected to hit the Manhattan market this year, up from 2,400 units in 2014, according to data from Corcoran Sunshine Marketing Group, the new development arm of Corcoran.

Giant jumps, big falls

While the order of the food chain changed, the rising market lifted most firms.

The majority of the firms on the ranking saw an increase in their dollar volume of listings from last year, according to TRD’s analysis.

Elliman added the most — with nearly $600 million worth of additional exclusives. Meanwhile, Corcoran added more than $180 million, and Brown Harris Stevens added $172 million, for a total of $2.3 billion in listings.

Among the 12 firms, Bond’s 222 percent increase was the biggest dollar volume jump. That brought the firm’s exclusive listings up to nearly $74 million.

Meanwhile, Nest Seekers saw listings volume jump to $347 million, up 112 percent. That jump was buoyed by a $48.5 million triplex at 240 Riverside Boulevard.

Two exceptions were the embattled Bellmarc Group, where the dollar volume plummeted 56 percent to $41.7 million, and Citi Habitats, where dollar volume dropped 32 percent to $76.4 million, according to a TRD analysis.

Citi Habitats President Gary Malin said TRD’s one-day snapshot didn’t reflect Citi Habitats’ entire business, which increasingly is focused on Brooklyn and Queens. (TRD only includes Manhattan data.)

“It’s a fluid business for all of us,” he said. Citi Habitats, thanks to its strong rental base, also does “heavy buy-side” business when those clients decide to buy, Malin noted.

“Manhattan inventory is very small,” he added. “There are a lot of people who aren’t putting their apartments on the market. What comes on gets sold very quickly.”