In SL Green Realty’s latest annual report, company CEO Marc Holliday told shareholders that leasing at its under-construction One Vanderbilt has been moving so swiftly that the company almost got boxed out of its own building.

The real estate investment trust had to “move fast to reserve space for our own new headquarters … before all of the space we had targeted was leased,” Holliday wrote.

While that may have been an embellishment, leasing has picked up at the massive $3.3 billion tower. According to the REIT, 59 percent of the 1.6-million-square-foot building, which sits next to Grand Central, is spoken for and construction is expected to top out this summer, slightly ahead of schedule.

The recent momentum is a stark contrast from early last year, when slow pre-leasing at the building — which had just two tenants at the start of 2018 — was complicating the project’s financing.

SL Green’s Steven Durels, director of leasing and real property, said the construction of the building has fueled that velocity. “As they can stand on the floors and see it now in real life as opposed to in rendering form, everything that we’ve been saying for the last couple of years is getting over to people,” he said.

The Kohn Pedersen Fox-designed tower has, of course, been several years in the making.

In 2015, it landed a key rezoning that allowed it to move forward. That win came ahead of the wider (and more controversial) rezoning of the Midtown East area, which has been plagued by an aging office supply.

SL Green and other supporters say the office tower, one of the most expensive in the city, will be a huge step toward rectifying that problem.

Newmark Knight Frank’s Andrew Sachs — who represented real estate firm MFA Financial in its lease at One Vanderbilt — said new buildings like this one and those at Hudson Yards and the World Trade Center complex are seeing strong demand.

“Many forward-thinking, progressive companies are really gravitating towards new construction and all the amenities and efficiencies that go along with it,” Sachs said.

“They’re using it as a recruitment and retention tool for talent, which is where the battle is being fought in this space,” he added.

While early leasing activity at the building was dominated by larger tenants taking up multiple floors, the building has begun landing smaller financial firms — looking for smaller spaces on higher floors with higher rents.

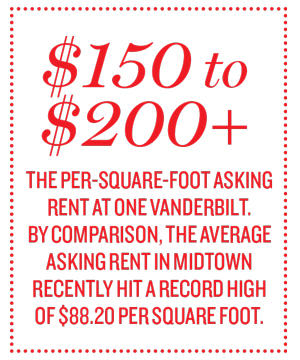

Asking rents at One Vanderbilt have ranged “from $150 to north of $200 per square foot,” Durels said. By comparison, the average asking rent in Midtown recently hit a record high of just $88.20 per square foot, according to data from CBRE, which has a team headed by New York Tri-State Chairman Robert Alexander representing SL Green at the site.

Last year, TRD wrote about the complex financing SL Green stitched together to make the building a reality. This month, we have a breakdown of the tenants filling up the space and the terms they’ve locked in, which we gleaned from public records, news reports and sources.

Tenant: TD Bank

Tenant: TD Bank

Floors: 14, 20-23

TD Bank, a subsidiary of Canada’s Toronto-Dominion Bank, was the first tenant SL Green clinched. The bank, which will relocate from its headquarters in Cherry Hill, New Jersey, committed to roughly 200,000 square feet back in November 2014 — several months before the tower won its rezoning. The 20-year deal comes with two 10-year renewal options and the right of first offer — an offer SL Green can accept or reject — for two additional floors. TD Bank, which incidentally was also part of the large syndicate of lenders that bankrolled the project for SL Green, will also have a retail bank on the ground floor at the corner of 42nd Street and Madison Avenue.

Tenant: TD Securities

Floors: 10, 11 (partial), 12

The financial services firm TD Securities, the investment-banking arm of TD Bank, snagged 118,872 square feet at the tower in a 20 year-deal with two 10-year renewal options. The deal, which was announced in December 2018, came about four years after TD Bank announced it would become the tower’s anchor tenant — a deal that helped pave the way for construction. TD Securities simultaneously inked a lease for 52,450 square feet at SL Green’s neighboring 125 Park Avenue. The company, which is moving from the Paramount Group’s 31 West 52nd, was represented by CBRE’s Robert Alexander, Ryan Alexander, Doug Lehman and Christopher Hogan. The deal gives the firm the option to expand on the 11th floor and the right of first offer on several other floors should another tenant vacate.

Tenant: DZ Bank and DVB Bank

Floor: 26

Germany’s DZ Bank and its transportation finance-focused subsidiary, DVB Bank, signed separate leases that total 35,382 square feet — all of the 26th floor. The leases were announced in September 2017, but were the first to roll in after TD Bank. The German banking duo — currently perched at 100 Park Avenue — signed on for 15 years with a five-year renewal option. The companies were represented by a trio of brokers at the tenant-rep firm Savills: Evan Margolin, Lance Leighton and Brad Wolk.

Tenant: SL Green

Tenant: SL Green

Floors: 27, 28

While it may seem that SL Green could pick any floor in the tower, it did have to be strategic in choosing its own office.

Durels said the building has largely leased from the bottom up and that the higher floor plates get smaller because of the building’s tapering design. “If we had waited, we would have been forced higher into the building, and that would have forced us onto a third floor, which would have given us too much square footage,” he said of the firm, which is currently located at 420 Lexington Avenue.

With tenants above and below — and with additional nearby floors subject to expansion rights — the 27th and 28th floors appear to be the only pair of consecutive floors that would have given the landlord the required 70,000 square feet. The company gave itself a 10-year lease, with two renewal options: the first for 10 years, the second for five.

Tenant: Greenberg Traurig

Tenant: Greenberg Traurig

Floors: 29-31

Law firm Greenberg Traurig, which is currently stationed in the MetLife Building at 200 Park Avenue, plans to “center its New York-area operations” at One Vanderbilt, using it “in concert with a combination of alternative nearby locations to create an office campus,” Executive Chairman Richard Rosenbaum said in a statement when the lease was announced in early 2018. The firm — which counts SL Green among its clients and whose global real estate chairman is high-profile attorney Robert Ivanhoe — was represented by Newmark’s Barry Gosin and Moshe Sukenik in its 133,000-square-foot, 15-year lease (with the same renewal terms as the landlord).

Tenant: Carlyle Group

Tenant: Carlyle Group

Floors: 35-38

After originally picking up floors 36 through 38 last July, the Carlyle Group announced that it was expanding its lease in March and would be taking the 35th floor, too. The financial and private equity firm — which has $46 billion in assets under management — now has 127,744 square feet for 15 years, with a 10-year renewal option. The company, headed by co-CEOs Kewsong Lee and Glenn Youngkin, was represented by JLL’s Steven Rotter, Joseph Messina, Greg Lubar, Steven Spartin, Jessica Berkey and Andrew Lutzer.

Tenant: McDermott Will & Emery

Tenant: McDermott Will & Emery

Floors: 44-47, 67

Chicago-based law firm McDermott Will & Emery originally leased floors 44 through 46 and floor 67 before also snagging 47 — and bumping its upstairs neighbor, MFA Financial, up a floor in the process. The firm, which is now at RXR Realty’s 340 Madison Avenue, took nearly 130,000 square feet in a 20-year deal with three renewal options, for one 10-year or two five-year periods. Newmark’s Sukenik and Noel Flagg represented the law firm.

Tenant: MFA Financial

Tenant: MFA Financial

Floor: 48

MFA Financial, a publicly traded REIT that focuses on residential mortgages, inked a deal for the 47th floor in late 2018. But just four months later, the ground started shifting, literally. “Several tenants below them exercised pre-commencement expansion options, which is very typical for larger tenants that have those rights,” said Newmark’s Sachs, who represented MFA along with Neil Goldmacher and Bill Levitsky. “That ultimately had a sort of waterfall effect and pushed MFA up one floor.”

According to SL Green’s Durels, the difference in size between the two floors was only “a couple hundred square feet,” and the company now has roughly 30,000 square feet for 15 years with a five-year renewal option.

In addition to the fact that it’s a shiny new development, Sachs said the proximity to Grand Central was a big selling point that helped it select the tower over several along Park.

The firm is currently located at 350 Park, which Vornado Realty Trust is reportedly looking to demolish and replace with a supertall.

Tenant: Sentinel Capital Partners

Tenant: Sentinel Capital Partners

Floor: 51

Sentinel Capital Partners, a private equity firm that currently counts TGI Fridays among its wide array of holdings, took 28,448 square feet early last month. Newmark’s Lance Korman and Brian Waterman represented Sentinel in the 15-year deal.

Tenant: KPS Capital Partners

Tenant: KPS Capital Partners

Floor: 52

KPS Capital Partners, a private equity firm that invests heavily in the manufacturing and industrial space, took 28,024 square feet in a 15-year deal announced in April. The company, which is currently housed at SL Green’s 485 Lexington, was represented by Cushman & Wakefield’s Mark Weiss and Alan Wildes.