“Price is what you pay. Value is what you get.” Warren Buffet’s wise words handily sum up a dominant theme in New York’s residential market these days — which is to say, despite all the talk of glitzy new condos and penthouses with astronomical prices, developers, buyers and brokers are increasingly chasing value.

“Price is what you pay. Value is what you get.” Warren Buffet’s wise words handily sum up a dominant theme in New York’s residential market these days — which is to say, despite all the talk of glitzy new condos and penthouses with astronomical prices, developers, buyers and brokers are increasingly chasing value.

The phenomenon is playing out across all price points, and it applies to first-time homebuyers on the lowest end of the price spectrum to foreign investors seeking a “safe haven” for their money at the high end.

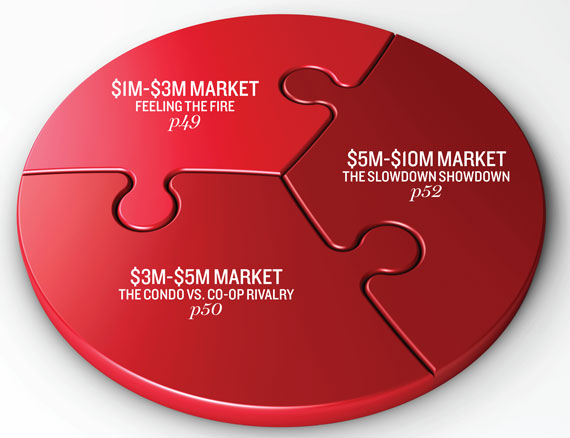

This month, The Real Deal dissected the market under $10 million, zeroing in on three key price brackets: $1 million to $3 million, $3 million to $5 million and $5 million to $10 million. What we found was that each of those markets is behaving very differently in this transitioning market.

Not surprisingly, properties between $1 million and $3 million are flying off the shelves. As prices rise across the board, this category is absorbing a growing number of buyers who are finding themselves priced out of more expensive apartments. And the majority of buyers in this range know that they need to act fast because there is a line of competing buyers who will grab the property if they don’t.

However, higher up on the ladder — in both the $3-million-to-$5-million range and the $5-million-to-$10-million market — sales have slowed as buyers wade through more choices than they’ve had in years and sellers overreach with asking prices.

“It’s just a tale of two markets,” said Noah Rosenblatt, founder of real estate analytics firm Urban Digs.

Compass agent James Cox put it this way: “We have more listings and more buyers than we did this time last year, but they’re looking for bargains and sellers are holding out for something better.”

No one is immune from price sensitivity, either.

“Even at $10 million, people are very aware of value and they will not overpay,” said Jeffrey Stockwell of Stribling & Associates. “Look, we live in uncertain times and people want to make smart decisions.”

Read on for a closer look at each market.