There are more than a dozen bridge, tunnel, subway and ferry routes between Manhattan and Queens, and residential developers want you to know it.

Overall, there are more than 22 million square feet under development in Queens, according to The Real Deal’s analysis of building permits and offering plans filed between Jan. 1, 2011 and July 31, 2015. That pipeline is expected to bring more than 24,000 residential units to the borough, TRD found.

But some say that number may be even higher, since official plans haven’t been filed yet for some of the mega-projects set to rise along the Queens waterfront.

Long Island City and Astoria alone are preparing for an influx of nearly 30,000 — yes, 30,000, you read that right — new residential units in the next few years, industry experts said.

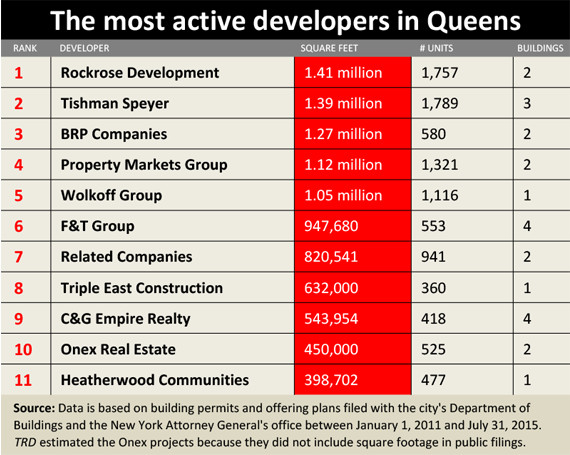

Leading the charge on TRD’s ranking of busiest developers (by square footage) is Rockrose Development, which is constructing more than 1.41 million square feet at two projects with a combined 1,757 residential units. Close behind is Tishman Speyer, with 1.39 million square feet under development. The firm’s three-building Long Island City project is the developer’s first in the outer boroughs, and will house 1,789 units.

Meanwhile, BRP Companies landed the No. 3 slot on TRD’s list with 1.27 million square feet under development, at two projects with 580 units. The rest of the top five includes Property Markets Group, with 1.12 million square feet under development, and the Wolkoff Group, with just over 1 million square feet at its 5Pointz project, which will include more than 1,100 units.

Yes, Queens is home to some massive, neighborhood-transforming mega developments.

Take the Hunter’s Point South project, a redevelopment of 30 acres on the Long Island City waterfront that the city authorized under the Bloomberg administration. The mixed-use development will include up to 5,000 apartments, 60 percent of which are intended for low- and moderate-income residents.

Related Companies, No. 7 on TRD’s list with roughly 820,500 square feet under development, is building the first phase in a joint venture with Phipps Houses and Monadnock Construction. The trio will build over 900 units. Tom and Frederick Elghanayan’s TF Cornerstone and Selfhelp Community Services are developing the second phase, with a total of 1,193 units, including 400 market-rate rentals. Plans for the second phase have not been filed, so they were not part of TRD’s analysis.

Many of the borough’s colossal projects have been in the works for years, like The Durst Organization’s 2,400-unit Hallets Point, which is slated to start construction this fall, and Alma Realty’s roughly 1,700-unit Astoria Cove development, which will have 460 affordable units. Durst is not on TRD’s list because plans for the majority of the project are not yet filled, while Alma has not yet filed any new building plans for Astoria Cove with the DOB.

Some of the largest projects in Queens are reimagining entire (mostly long-time industrial) neighborhoods. That’s the case at Sterling Equities and Related’s Willets Point, a $3 billion plan to redevelop the 23 acres around Citi Field, which includes a centerpiece convention center as well as 2,500 residential units. The developers, which also haven’t filed plans, are currently at a crossroads, after a state appellate court decision in July shot down part of the plan.

Meanwhile, the 1.8 million-square-foot Flushing Commons complex will replace a former municipal parking lot. F&T Group, which is No. 6 on TRD‘s list with nearly 948,000 square feet under development, is developing the complex with partners Rockefeller Group and AECOM Capital. When complete, it will be comprised of 350,000 square feet of commercial space along with 600 apartments, 1,000 parking spots and 1.5 acres of open space.

Meanwhile, the 1.8 million-square-foot Flushing Commons complex will replace a former municipal parking lot. F&T Group, which is No. 6 on TRD‘s list with nearly 948,000 square feet under development, is developing the complex with partners Rockefeller Group and AECOM Capital. When complete, it will be comprised of 350,000 square feet of commercial space along with 600 apartments, 1,000 parking spots and 1.5 acres of open space.

“People used to say the East River was the widest river in the world, but it’s just not true anymore,” said Rockrose President Justin Elghanayan. “It’s happening faster than people would have anticipated.”

Go big or go home

With few height restrictions in areas of Long Island City, developers are clamoring to build the tallest building on the Queens waterfront.

Kevin Maloney’s PMG is currently the frontrunner with its planned, 772-foot development at the edge of Queensboro Plaza, for which plans haven’t been filed. PMG purchased the site for $46.3 million last year from Queens developer Steven Cheung, who paid just $8 million three years earlier. In March, PMG and partner the Hakim Organization forked over another $56 million to buy additional air rights from the Metropolitan Transportation Authority to build a 77-story, mixed-use tower that will hold 930 apartments.

And developers aren’t just building tall in Queens; they’re assembling large sites to accommodate multiple towers.

For example, at its Long Island City project, Tishman and partner H&R Real Estate Investment Trust are building three residential towers at 30-02 Queens Boulevard, 28-10 Jackson Avenue and

38-39 Jackson.

Chad Sinsheimer, a director at Eastern Consolidated, cited the economies of scale associated with building big.

“If you’re going to commit resources to a project, the bigger you build, the cheaper you get,” he said. And, he said, “the higher you build, the higher price you can command on a sellout.”

Other developers are taking that strategy to heart.

Elghanayan and his father, Henry, who jointly head Rockrose, are currently in the middle of developing a four-tower project in Court Square, a fast-growing neighborhood within Long Island City.

Meanwhile, the Wolkoff Group, led by David Wolkoff and his father Jerry, are behind the massive development replacing the graffiti-covered 5Pointz building in Hunters Point with twin high rises that will hold a combined 1,116 units. The developers obtained a variance to build a 48-story tower, which will include 50,000 square feet of retail space.

For the mega-towers, developing a retail or commercial component is a must.

“You’ll have 20,000 new residential units in the next two, three years,” Sinsheimer said. “Those people will need places to buy clothing and go food shopping.”

Condos are coming

Until recently, the vast majority of residential units being planned in Queens were rentals.

This year, nearly 2,000 rentals have already hit Queens’ market, compared to just 450 new condos, according to Corcoran Sunshine Marketing Group.

But the number of new condos is up sharply from last year’s 130. “It’s not really surprising,” said the firm’s President Kelly Kennedy Mack. “It probably costs half [the price] for an extra subway stop.”

In the past two years, prices in Queens jumped considerably as renters seeking more affordable housing discovered the borough.

For example, when Rockrose leased up its 709-unit Link building in 2013, the developer priced one-bedrooms at $2,600 a month. “Now, a one-bedroom would be $3,100,” Elghanayan said. The developer is scaling up prices accordingly at its next buildings. At its building at 43-25 Hunter Street, one-bedrooms will be priced around $3,400. “These rents are pretty healthy considering how nascent the neighborhood is,” he said.

These days, the consensus is that more condos are coming thanks to rising land prices and the area’s robust rental stock.

Development sites are now trading for around $300 per buildable foot up from around $100 two years ago, and prices have jumped 50 percent in the last six months alone, said Sinsheimer. “Pretty much everything being built now is going to be condo,” he said.

PMG and Hakim are reportedly planning condos at the top of their Long Island City tower, although the developers haven’t said so definitively.

At Rockrose’s Court Square development, the fourth (and final) building will have 120 condos, said Elghanayan, who projected pricing around $1,300 per square foot, a premium over today’s average of just over $1,000 per square foot. He said it’s only a matter of time before developers start selling condos for $2,000 per square foot. “People are starting to pivot and say, wow, the market is hungry for condos,” he said.

Eric Benaim, CEO of Queens brokerage Modern Spaces, said the first wave of condos targeted first-time homebuyers, but developers are now looking to raise the bar on luxury condos with units priced between $2 million and $3 million.

LIC’s dominance

Not surprisingly, the vast majority of residential development in Queens can be found in Long Island City, where residential developers raced to plant a flag after the city rezoned 37 blocks east of the waterfront in 2001.

More than a decade later, longtime Queens players are being joined by newcomers such as Brooklyn developer Adam America. “Pretty much the who’s who of the development community is in the area and very active,” Eastern Consolidated’s Sinsheimer said.

Adam America recently paid $43.5 million, or roughly $260 per foot, for a site at 2212 Jackson Avenue, according to Sinsheimer, who represented the seller. “They’ve now seen we can do things cheaper here,” he said.

Although Long Island City is expected to see an influx of 22,000 apartments in the next few years, fears of an oversupply don’t seem to have taken root. Benaim, who has handled many of the biggest developments in Long Island City, predicted that as competition heats up, rental prices will level out at the current rate — roughly $55 per square foot.

New development marketing guru Nancy Packes said the neighborhood’s pipeline is secure, given the job growth in New York. “I don’t worry about Long Island City, that will always be prime,” she said.

Meanwhile, there are roughly 4,500 units under construction in Astoria, where it’s still cheaper to buy land. (Land prices in Long Island City are roughly $300 per foot, compared with $150 to $200 per foot in Astoria, Benaim said.)

Still, land prices in Astoria have jumped from $80 per square foot to $150 or $200 in the past 18 months as developers make a “land rush” in Astoria, Packes said.

Prices in both neighborhoods are on the ascent.

On the rental side, a typical one-bedroom in Astoria may go for $2,500 a month while the same size unit in Long Island City would be priced at $3,000 a month, said Benaim. For condos, prices have shot up from $700 a foot to more than $1,000 a foot in Long Island City, while Astoria’s prices are still roughly between $800 to $1,000 per foot.

In addition to areas like Flushing, Benaim said a healthy number of developments dot other neighborhoods, too, including Woodside, Rego Park and Sunnyside. Sunnyside is one of the borough’s last undiscovered gems, Benaim said. In February, Mayor Bill de Blasio floated the idea of rezoning Sunnyside Yards to create more than 11,200 affordable units, and former Deputy Mayor Dan Doctoroff has called for a new convention center and housing on the 200-acre rail yard.

“Sunnyside is going to explode,” Benaim predicted.

Correction: The story and chart have been updated to reflect properties that were inadvertently omitted.