Seven years after the global financial crisis, New York’s real estate lending market is back with a vengeance. But much has changed.

Some of the biggest players of the pre-2008 years — Lehman Brothers and Wachovia — have disappeared. The former is gone for good and the latter is now a part of Wells Fargo, which late last month was publicly identified as the lead lender on a $2.5 billion loan for the purchase of the massive Stuyvesant Town-Peter Cooper Village housing complex.

Others, most notably Signature Bank, have risen from relative obscurity and gobbled up market share. Competition for deals is fierce, according to lenders and brokers. But who are the main players jostling to finance New York’s real estate boom?

This month, The Real Deal ranked New York City’s most active commercial real estate lenders by dollar volume of all reported loans originated in the five boroughs between the first quarter of 2014 and the second quarter of this year. The data, gathered by lending database CrediFi, includes everything from financings of individual apartments to trophy skyscrapers and from refinancings to construction projects. It also includes both balance sheet loans that stay on a bank’s books and securitized CMBS — or conduit loans — that get sold off as bonds.

And while several of the most active lenders are big national banks, local lenders play a surprisingly big role.

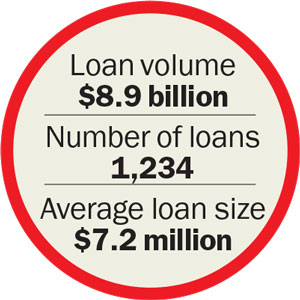

New York Community Bank

A state-chartered savings bank with a strong focus on the greater metro area, New York Community Bank comes out ahead of its much larger national and global rivals.

As a commercial real estate lender, the bank is known for its focus on small and mid-sized loans, and for avoiding risky products. In addition, NYCB keeps all its loans on its books and does not do CMBS lending. It also shies away from construction loans, sources say, focusing instead on income-producing assets, especially in the multifamily sector.

As a commercial real estate lender, the bank is known for its focus on small and mid-sized loans, and for avoiding risky products. In addition, NYCB keeps all its loans on its books and does not do CMBS lending. It also shies away from construction loans, sources say, focusing instead on income-producing assets, especially in the multifamily sector.

Perhaps unsurprisingly for a local lender, NYCB relies heavily on personal relationships. The lender has close ties to Meridian Capital Group, which arranges a large chunk of its business, sources say.

Its ability to close deals faster than its larger rivals also helps it drum up business.

Key figures at the bank are James Carpenter, chief lending officer, and John Adams, chief administrative officer of commercial lending. “John is a good guy to work with. You do not get re-traded when he gives you the deal,” said Jerry Swartz of brokerage HKS Capital Partners, referring to the practice of changing an offer once a deal is struck. “When his underwriters give you an offer, in almost all cases it gets delivered.”

Carpenter said NYC rent-regulated multifamily properties are the bank’s primary focus and represent roughly 75 percent of annual originations. The bank, he said, is attracted to the asset class because it provides “stable cash flows even during adverse credit cycles.”

But he said competition for deals is stiff amid a growing influx of foreign investors. “Deal structures have become increasingly more complex and the increased competition has created an environment with more aggressive loan terms with which to compete,” he said.

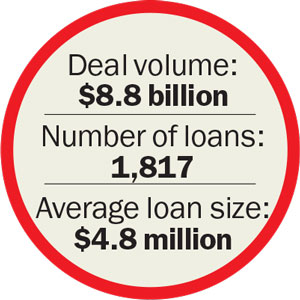

JPMorgan Chase

JPMorgan Chase has originated more commercial real estate loans than any of its peers in New York, but its average loan size is also the smallest among leading lenders. Unlike NYCB, JPMorgan does both balance sheet and conduit lending. Observers say those two businesses focus on different types of deals. For example, while 10-year loans on cash-producing assets are a prime target for a CMBS, construction loans are generally balance-sheet loans.

JPMorgan Chase is, in fact, active in the construction-lending arena, which is widely considered the riskiest area of lending. The bank is part of a group of lenders funding HFZ Capital’s acquisition of a giant High Line development site with a $1 billion loan, according to sources.

JPMorgan Chase is, in fact, active in the construction-lending arena, which is widely considered the riskiest area of lending. The bank is part of a group of lenders funding HFZ Capital’s acquisition of a giant High Line development site with a $1 billion loan, according to sources.

One mortgage broker, however, said that while the bank is popular among borrowers looking for low rates, it can be bureaucratic.

“JPMorgan is an interesting animal,” said the broker, who spoke on the condition of anonymity. “They are probably the cheapest money out there, but there’s a little bit of a convoluted closing process.”

The broker explained that he recently worked on a New York loan from JPMorgan in which the underwriting package was mailed to the bank’s Texas office and then back to New York, delaying the process by days. “I’m like, ‘What just happened? You’re a global bank,’” he added. The bank did not respond to a request

for comment.

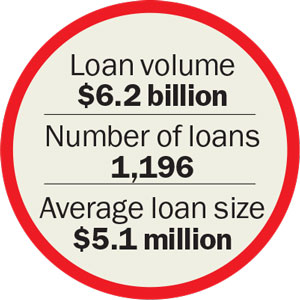

Signature Bank

Like NYCB, Signature Bank focuses on straightforward acquisition and refinancing loans — at slightly higher rates than some of its competitors in exchange for faster execution.

The bank is a relative newcomer among the big commercial real estate lenders. Its rise has a lot to do with the chairman of its commercial real estate committee, George Klett, who joined Signature from North Fork Bank in 2007 and is known for his deep pool of relationships with mortgage brokers and developers.

“They really built a department that I think was shaped by the way he has done business, which is to build very strong relationships with clients,” said Scott Singer, president of mortgage brokerage Singer & Bassuk Organization. “They work really hard to be a go-to source for their client base within the range of deals that they do. Signature is not likely the source for a couple hundred million and is not a construction lender, but beyond those two areas they are very active.”

“They really built a department that I think was shaped by the way he has done business, which is to build very strong relationships with clients,” said Scott Singer, president of mortgage brokerage Singer & Bassuk Organization. “They work really hard to be a go-to source for their client base within the range of deals that they do. Signature is not likely the source for a couple hundred million and is not a construction lender, but beyond those two areas they are very active.”

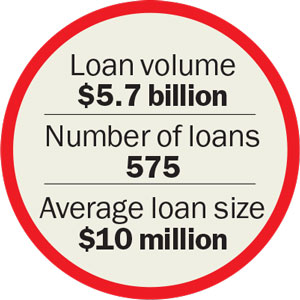

Singer added that Signature — which claims it did slightly more loans (1,246) valued at a slightly lower amount ($6 billion) during the period TRD looked at — stands out despite its small overall balance sheet size.

The bank’s growth may also be explained by the fact that it didn’t binge on securitized debt before 2008. That meant it had the funds to expand lending after the crash, when there were few competitors.

Klett said today the bank originates around 100 loans per month, with single deals going as high as $80 million.

Brokers say the bank’s business is centralized around Klett — a claim he doesn’t dispute.

“In a lot of banks much of the business is kind of segregated and no one is really in charge,” he said. “Here, when a loan comes in to one loan officer he or she is responsible until the day it goes off. Every loan has my name. If anything goes wrong, I am responsible.”

Ira Zlotowitz, founder of mortgage brokerage Eastern Union, said the bank knows how real estate players operate.

“They move fast — shake hands and get it done. People love that,” he said.

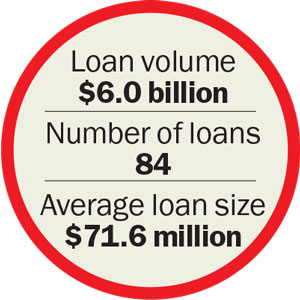

Deutsche Bank

The German banking giant is an outlier in this ranking in a number of ways. The only foreign lender, it is also the only Wall Street lender (with no local retail presence). In addition, its average loan size is the largest by far.

The bank actually could have easily placed higher on TRD’s ranking. Late last month, news broke that Related Companies and Oxford Properties Group tapped Deutsche Bank and Bank of China to lead a $1.5 billion construction loan to finance their 1-million-square-foot Shops & Restaurants at Hudson Yards. That deal, along with nearly $3 billion in loans originated by its subsidiary German American Capital Corporation, was not included in this ranking.

The bank has a storied history in New York. Prior to 2008, it was one of the most active lenders here, but it got burned during the crash.

The bank has a storied history in New York. Prior to 2008, it was one of the most active lenders here, but it got burned during the crash.

In early 2007, it lent developer Harry Macklowe $5.8 billion with a one-year term for his $7 billion acquisition of Equity Office Properties’ Manhattan office portfolio (see related story on page 52). A $1.2 billion loan from Fortress Capital brought the loan-to-value ratio to a staggering 99 percent, a deal that would become a symbol of the era’s excesses. A year later, Macklowe defaulted and Deutsche Bank took over the properties and gradually began selling them off.

Then in 2010, the bank’s top two real estate executives — Jon Vaccaro and Eric Schwartz — left. In 2011, Jonathan Pollack took over the bank’s CMBS business, ushering in a new era of growth. Until decamping for the Blackstone Group this June, he was the commercial real estate group’s central figure.

Despite getting battered during the crisis, Deutsche hasn’t lost its appetite for big deals. Earlier this year, it originated a $1.1 billion CMBS loan to finance Ivanhoe Cambridge’s acquisition of 3 Bryant Park. And last month it issued a $321 million loan for Beacon Capital Partners’ office condo acquisition at 575 Lexington Avenue.

Some observers consider the departure of Pollack, widely considered one of the city’s most adept real estate bankers, a blow to the bank. But at least one broker told TRD that the defection might not be that damaging.

“If a senior person leaves and there’s quick indication from the bank that business will continue as usual, it doesn’t have to be disruptive,” the broker said.

Pollack’s departure isn’t the first staffing upheaval of the year at Deutsche Bank’s U.S. commercial real estate business.

In January, it sold a $2.5 billion loan portfolio to private equity firm TPG, which recently became Cushman & Wakefield’s parent company. According to Bloomberg, 11 Deutsche Bank employees jumped to TPG at the time.

Apart from giant acquisition loans, Deutsche Bank has also funded a couple of boutique condo developments in recent months, dishing out $104 million for the Naftali Group’s 219-223 West 77th Street and $40 million for the development firm Sumaida and Khurana at 152 Elizabeth Street. And in September, it provided a $115 million construction loan for private equity firm Savanna and the Silvermintz family at 540 West 26th Street, an office development.

Bank of America

Bank of America originates both balance sheet and conduit loans.

“It’s almost like two different banks,” said one of the abovementioned mortgage brokers. “You could go to Bank of America for a deal that fits both CMBS and balance sheet, and likely call two different originators.”

“Bank of America and Wells Fargo, they’re not the quick and nimble, entrepreneurial types,” added another broker. “Their pricing is cheap, but you don’t go to them for the last dollar.” (The last dollar is the top end of the capital stack, which real estate players often need to lock in quickly before closing a deal.)

“Bank of America and Wells Fargo, they’re not the quick and nimble, entrepreneurial types,” added another broker. “Their pricing is cheap, but you don’t go to them for the last dollar.” (The last dollar is the top end of the capital stack, which real estate players often need to lock in quickly before closing a deal.)

BofA doesn’t have nearly the average loan size of Deutsche Bank and it doesn’t do the same volume as JPMorgan, or even NYCB and Signature, but it did account for the largest single loan in the first half of 2015. In March, the bank and partner Wells Fargo refinanced the MetLife Building with a $1.4 billion loan.

BofA was an early financier of Manhattan’s luxury condo boom. In 2011, it led a syndicate that originated a $700 million construction loan for Extell Development Company’s One57. In early 2013, it led another consortium that funded Alexico Group’s Tribeca condo project 56 Leonard Street with $350 million. And the bank appears to still be bullish on the condo market. In September, it lent the Related Companies $200 million for its Tribeca development on Vestry Street.