When it comes to eager buyers, the Northern New Jersey market is hardly lacking. And that means that for the brokers competing to woo them, every outreach tool must be exploited to the fullest — yes, including StreetEasy’s controversial new Premier Agent program.

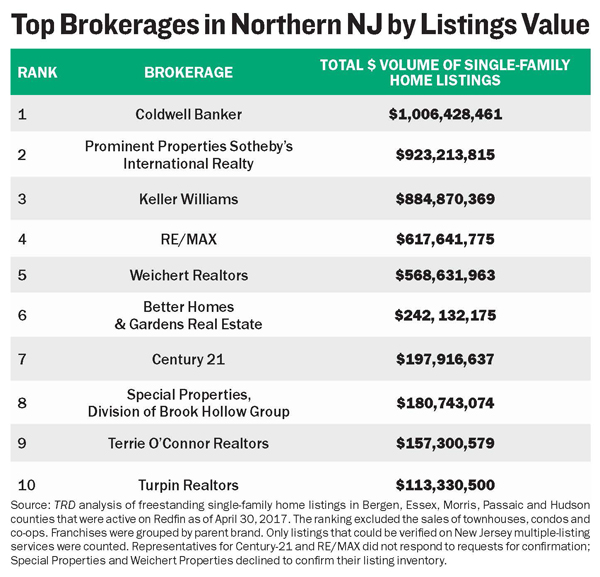

In what seems to be an arms race among firms, New Jersey’s top brokerages are looking to any and every tool for an edge in today’s competitive market. Every brokerage in The Real Deal’s ranking of the residential royalty of Northern New Jersey had its own strategies for staying on top. For this year’s ranking, TRD analyzed freestanding single-family home listings in Bergen, Essex, Morris, Passaic and Hudson counties that were active on Redfin as of April 30, 2017. The rankings excluded sales of co-ops, condos and townhouses. Franchises were grouped by parent brand.

At the top of heap was Coldwell Banker Residential Brokerage, which had more than $1 billion in active listings. Ron Aiosa, a broker at Boswell Aiosa & Associates, a franchisee of Coldwell with an office in Wyckoff, said his team uses the Premier Agent program — which essentially allows agents to pay for leads — and considers it a “necessary evil.” All lead generation tools have good and bad features, he said, adding, “the fact of the matter is that everyone is online, and agents want access to this.”

John Turpin, president and CEO of Turpin Realtors in Far Hills in Somerset County, which came in tenth in TRD’s rankings with $113.3 million in listings, said his firm reviewed the program a month ago and passed. “I determined that based on the conversion rate — both stated by them but also discovered by talking to brokers who’d tried it — that it was not appealing enough to warrant the investment,” he said in an email.

Different strokes for different folks

StreetEasy is far from the only platform brokers are employing to drive new business.

Beyond sending out 15,000 mailers per month to attract new business, Jill Biggs, a sales associate at Coldwell Banker in Hoboken, now finds many of her clients using social media advertising on Facebook, Instagram and LinkedIn, as well as platforms like Trulia. “I think for sure if you’re looking at the direction of real estate, you are going to see that is the way the industry is going,” said Biggs.

Meanwhile, big firms are developing their own proprietary tools. Keller Williams, which is third in TRD’s ranking with nearly $884.9 million in Northern New Jersey listings, is touting its Keller Cloud platform. The technology is designed to streamline data regarding leads, customers and transactions, and is complete with a Siri-like voice-operated assistant named Kelle. It plans to roll out a system for consumers this summer.

Coldwell Banker, which bills itself as “the original Silicon Valley real estate startup,” has been investing heavily in big data and smart home technology, such as a staging kit to help sellers use in-home gadgets to better appeal to buyers. In May, Coldwell began promoting its technology suite directly to consumers in a series of ads called “Storytelling.”

Some New Jersey agents have taken a creative approach to raising their online profile. Lori Turoff, Realtor associate at Keller Williams in Hoboken, has written the blog HobokenRealEstateNews.com since 2004. “Rather than providing anecdotal stories, I believe in doing statistical analysis,” said Turoff. “People want an expert — someone who really knows the market — to represent them.”

From left: Claudia Sanchez and Sean Farley of Terrie O’Connor Realtors, and Jill Biggs of Coldwell Banker Residential Brokerage

A few of the better-known brokers in the hottest New Jersey markets said extensive digital outreach isn’t always necessary. Though she has an online presence, Short Hills-based Elaine Pruzon of Prominent Properties Sotheby’s International Realty — which came in second in TRD’s ranking with $923.2 in listings —said “95 percent of my business is referral.”

Meanwhile, others rely heavily on more traditional legwork to find new buyers and new inventory. “You have to get creative as an agent,” says Sean Farley, a broker/sales associate in the Ramsey office of Terrie O’Connor Realtors, which came in ninth in our rankings at $157.3 million in listings. He has been reaching out to potential sellers directly, sending mailings and asking contacts if anyone they know is willing to sell. “The buyers are getting more creative, too,” he adds. “They will go out and drive neighborhoods and say, ‘I saw this house. Can you check it out?’”

The market outlook

It’s a good time to be selling residential real estate in New Jersey. Despite the uncertainty that came with a new presidential administration — and challenges such as low housing stock, rising mortgage rates and increasing home prices — sales held steady this year, according to New Jersey Realtors, an advocacy organization for Realtors in the state. Improvements in the U.S. economy for several quarters in a row and low unemployment have sparked wage growth and consumer confidence, the report noted.

In March 2017, closed single-family home sales in New Jersey rose 18.6 percent year over year to 5,896, according to the group’s data. The median sales price for single-family homes inched up 0.6 percent to $274,700, while the average sale price rose 3.7 percent to $360,677, New Jersey Realtors found. The average days a home was on the market dipped to 84 from 96 during the same month last year. The median price of homes listed statewide was $289,000 in April, up slightly from the same time last year, according to Zillow.

The buyer bucket: Under $1M

Turpin finds that updated homes in move-in-ready condition attract the most interest. “Under $1 million, any listing that is priced reasonably is in demand,” he said. In the 16 towns the firm tracks in the North Central part of New Jersey — Bedminster, Far Hills, Peapack-Gladstone, Madison and Morristown among them — the firm has about a 4.5-month supply of homes, “which basically means that inventory is tight,” he said.

Hoboken and Jersey City are also particularly hot in this range. “Hoboken and Jersey City have gotten fairly expensive compared to where they used to be historically, but they are still way below New York and Brooklyn,” said Turoff. She added that for the past two years, there has been a lack of supply and increased demand. Turoff’s recent two-bedroom listings in Hoboken were both priced under $600,000, and they both had five offers the first weekend, she says. “One of those deals was an all-cash buyer,” she said.

However, some buyers are being priced out of the most popular neighborhoods and are moving into nearby communities such as Union City, Jersey City Heights and the Bergen-Lafayette neighborhood of Jersey City, as well as Newark. “They are more affordable and have good transportation,” Turoff said. “They are not as gentrified.”

However, some buyers are being priced out of the most popular neighborhoods and are moving into nearby communities such as Union City, Jersey City Heights and the Bergen-Lafayette neighborhood of Jersey City, as well as Newark. “They are more affordable and have good transportation,” Turoff said. “They are not as gentrified.”

As buyers have become more aware of these neighborhoods, Turoff has seen bidding wars break out. “I think the towns with the most accessible transportation into Manhattan are going to continue to flourish because of the lack of inventory in Manhattan,” she said.

Buyers are also looking for homes under $1 million in Bergen County, where the median home price was $517,900 in April, up from $485,000 at the same time last year, according to Zillow.

In Northwest Bergen County, Farley of Terrie O’Connor Realtors finds that houses in the $300,000-to-$600,000 price range are drawing multiple bids.

“The buyers are getting crazy because we’re not able to deliver new homes fast enough,” said Farley. “We’re getting emails from other agents: ‘If anyone is getting something in Ramsay in that $300,000-to-$600,000 price point — three bedrooms, 2.5 baths — please call me.’”

Claudia Sanchez, a broker in Terrie O’Connor’s Allendale office, finds that sales of properties under $1 million are percolating among families who are looking for a slower-paced, small-town life where children can walk to school.

“The under-$1 million price range is really desirable, even for those who can afford the luxury price point,” she said. “If in fact it is above $1 million, it has to be perfect. It can’t be a home where you can turn it into what suits you. Everybody has recognized how busy they actually are, and they don’t want a project on the weekend.”

More families are seeking the homes close to the Allendale train station — a trend that began to emerge in the past three to five years, Sanchez said. The small town has a commute into New York City that, depending on the time of day, is just a little over an hour.

“For a while, people were moving as far out as they could to get away from the hustle and bustle,” the broker said. “What they came to realize was that they were spending a great deal of time commuting, and it wasn’t worth it. Being a little closer to the city and having public transportation available is a huge advantage.”

Many of the Allendale buyers who can afford properties above $1 million are instead opting to diversify their real estate purchases. “They feel like ‘We’ve seen what can happen in the housing market. We don’t want to buy at the top of our budget,’” said Sanchez. “They don’t want their life to be subject just to paying that one mortgage. They’d rather have a house down the Shore, on a lake or in the mountains.”

The buyer bucket: $1M-$2M

For homes in the $1 million-to-$2 million range, Short Hills is a sought-after destination. The median sales price in the Essex County community — known for its excellent school system and a direct train line into Manhattan — is $1.5 million, according to Trulia.

Pruzon at Prominent Properties Sotheby’s International in Short Hills said the market for homes in that range has been booming. “We’re experiencing multiple offers on most of the homes being listed just now in all price ranges,” said Pruzon, who sometimes sees more than three offers on a home. “To get into the market in Short Hills, a buyer has to be well-prepared to jump. We’re seeing a number of cash buyers remove the mortgage contingency so they can remain competitive.”

Aiosa of Boswell Aiosa & Associates has also found that buyers in the $1 million-to-$2 million range are continuing to flock. “Below $2 million, you’ll move pretty quickly,” the broker said. “Whether in Morris County or certain towns in Bergen, a million and change up to $2 million, you’ll churn them out. The minute you break the $2 million mark is when you see those sales slow down a little.”

Turpin of Turpin Realtors said that while activity is strongest in the eastern bedroom communities for homes priced between $1 million to $2 million, “we are definitely seeing that trend begin to trickle out to the suburbs and beyond.”

The buyer bucket: Above $2M

But the price points go much higher in the most upscale towns. In Alpine and Englewood, as well as Franklin Lakes and Saddle River, buyers are still looking at listings in the $3 million-to-$4 million range, Aiosa said. “What they really want is more land,” he added.

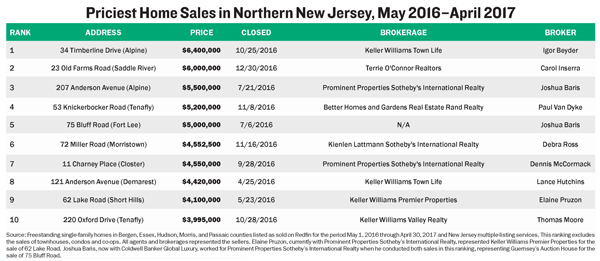

Igor Beyder, a broker at Keller Williams, sold 2016’s most expensive listing of a freestanding single-family home in all of Bergen, Essex, Passaic, Morris and Hudson counties. The six-bedroom, 10-bathroom estate at 34 Timberline Drive in Alpine went for $6.4 million in a deal that closed on October 25. But that was an astounding nearly 50 percent off what the sellers paid for it — $11.9 million. “They essentially bought it at half price. The owners didn’t want to sit on it any longer,” said Beyder.

For those who crave even more property than these communities afford, Aiosa’s team, which has a Morris County office in Butler, often finds homes in family-friendly communities such as Chatham, Harding, Madison, Mendham, Montville and Morris Township.

Other counties within reasonable commuting distances of New York City are also seeing high demand.

In Union County, where inventory is down 24.7 percent from March 2016, the median sales price rose to $337,450, up 16.4 percent, New Jersey Realtors reported. In Somerset, where inventory declined by 16.9 percent, the median sales price went from $402,500 to $407,000.

For homes above $2 million, land often plays a large part of the value, Turpin noted. “We are seeing improvement in this market in towns like Mendham and Tewksbury Townships,” he said. “Based on the energy I am seeing in the market right now, I expect continued improvement in the higher price ranges, which have been hit especially hard over the past several years and often provide a great opportunity.”

—Harunobu Coryne provided research for this article

Editor’s note: This story has been updated to clarify that The Real Deal’s rankings included only data pertaining to freestanding, single-family homes. The rankings excluded co-ops, condos and townhouses.