(Illustration by Paul Kisselev)

On the evening of Dec. 3, the Corcoran Group’s Cathy Franklin rushed from showing a $22.5 million listing at One57 to 67 Wine & Spirits on the Upper West Side to talk about whiskey.

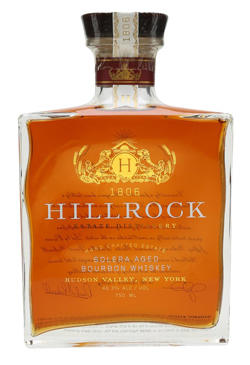

Franklin was at the store representing Hillrock Estate Distillery, a farm-to-glass operation in Ancram, New York, south of Albany, which she owns with her husband, Jeffrey Baker, an investment banker with a passion for farming. The Hudson Valley was a bastion of distilleries until the 1920s, when they dried up during Prohibition. Franklin said Hillrock is the first distillery in the region since that time.

When they’re not selling or developing real estate, New York brokers and developers are active investors in everything from the theater and restaurants to health drinks and wine. Some of these side investments are well known in the industry — like Peter Fine’s backing of “In the Heights.” The Atlantic Development Group co-founder invested after meeting political consultant Luis Miranda — father of the musical’s star, Lin-Manuel Miranda — through his work in the affordable housing arena. The same goes for Cohen Brothers Realty Corporation president, CEO and film aficionado Charles Cohen, who was the executive producer of “Frozen River,” a 2009 Academy Award nominee. And last month, Cohen acquired the society magazine Avenue.

Then there’s Harry Macklowe, the co-developer of 432 Park Avenue and a prominent art collector. Besides his real estate projects, Macklowe owns part of Kappo Masa, a high-end sushi restaurant below the Gagosian Gallery on Madison Avenue, where an eight-course tasting menu goes for $250 per person. Star chef Masayoshi “Masa” Takayama and prominent art dealer Larry Gagosian control Kappo Masa, but Macklowe invested $75,232 for a 1 percent stake, according to documents disclosed in his recent divorce.

And several of real estate’s biggest names own professional sports franchises. Related Companies’ Stephen Ross, for example, owns the National Football League’s Miami Dolphins; New Jersey developer Zygi Wilf and partners own the Minnesota Vikings; Sterling Equities co-founder Fred Wilpon owns the New York Mets; and fellow developer Frank McCourt owned the Los Angeles Dodgers for nearly a decade before selling the club out of bankruptcy for roughly $2 billion in 2012.

While many developers are active in the sports and entertainment arenas, the LeFrak Organization is a quiet but significant player in the energy market. The family-run company, which owns 40 million square feet of real estate, also has interests in more than 800 onshore oil and gas wells in Louisiana and East Texas, according to its website.

Although some “side hustles” pay big dividends, not all do. Ziel Feldman, a developer with HFZ Capital Group, has said one of his biggest career gaffes was investing in a rock-and-roll-themed amusement park that opened in Myrtle Beach, South Carolina, in 2008. “Most people drive to Myrtle Beach, and gas prices were at a record high,” he told The Real Deal in 2013. “It went bankrupt and was sold.”

Here is a closer look at some of real estate’s notable side businesses.

Balancing space and spirits

Franklin admits she was a wine drinker before discovering the satisfaction of whiskey. Not surprisingly, her whiskey of choice is now one her upstate distillery produces. “Right this minute I’m loving our Cabernet Finish Solera Aged Bourbon,” she said.

Franklin admits she was a wine drinker before discovering the satisfaction of whiskey. Not surprisingly, her whiskey of choice is now one her upstate distillery produces. “Right this minute I’m loving our Cabernet Finish Solera Aged Bourbon,” she said.

Franklin and Baker, a former executive managing director at Savills Studley, purchased the land for Hillrock Distillery in 1999. A few years later, the couple began production after enlisting the guidance of Dave Pickerell, a former master distiller at Maker’s Mark.

Despite being one of Corcoran’s top agents in 2018 with $200 million in sales, Franklin carves out time in the early morning, at night and on weekends to spearhead marketing and distribution for Hillrock. The couple’s three adult sons are also involved in the whiskey business. “We don’t play golf or tennis or get to be equestrians in the Hamptons,” Franklin said. “I spend every weekend at Hillrock.”

Though Franklin declined to disclose Hillrock’s revenue, she said the distillery is on track to produce 20,000 cases in 2019, roughly the same amount made by Maker’s Mark in two days. Hillrock distributes in 12 states, including New York, where its whiskey is sold in more than 600 locations.

Franklin said that while Hillrock’s sales rose 25 percent year over year in 2018, she and Baker decided to cap how much they sell in order to let the whiskey age longer. “The business is profitable, but our focus is on building long-term value versus near-term profits,” she said.

Profiting from pink water

Did you know 800 million watermelons are discarded each year just because they’re too ugly to sell? Centaur Properties founder and CEO Harlan Berger did.

Did you know 800 million watermelons are discarded each year just because they’re too ugly to sell? Centaur Properties founder and CEO Harlan Berger did.

To reduce food waste, Berger came up with the idea for a cold-pressed juice derived from crushed watermelons. In 2013, he enlisted co-founder Jody Levy and launched Wtrmln Wtr. Three years later, their fast-growing startup scored the holy grail of celebrity endorsements when Beyoncé signed on as an investor.

“It was an awesome coincidence,” Levy told Fortune magazine of the partnership. (On a whim, Levy sent Beyoncé a few cases of Wtrmln Wtr after hearing the line “I’ve been drinking watermelon” in the pop star’s hit single “Drunk in Love.”)

Current NBA players Chris Paul and Kevin Durant, former NFL player-turned-talk show host Michael Strahan and Xander Bogaerts of the Boston Red Sox have since signed on as investors and brand ambassadors, said Berger, whose firm is behind the Jardim condominium in West Chelsea, a 36-unit building on the High Line. (Centaur is also developing the Battery Maritime Building with Cipriani USA.)

Berger declined to disclose how much money Wtrmln Wtr has raised to date, but he said the drink is sold in more than 15,000 stores. The developer estimated his company sells north of 20 million bottles a year at $2.50 a pop. Part of the reason Wtrmln Wtr is growing, Berger said, is demand from conventional retailers like Kroger and Walmart, two of the largest grocery chains in the country. “When I started, they’d look at me like I was out of my mind, crazy,” he said.

Prior to launching Wtrmln Wtr, Berger was involved in several restaurants. He sold Otto to Mario Batali in late 2001 and still owns a small piece of Wolfgang Puck’s restaurant empire, which he was under contract to buy at one point. Berger declined to discuss how those investments turned out, but having mastered cold-pressed juice, he said his next goal is to find a use for watermelon pulp — whether it be in watermelon paper or Fruit Roll-Ups-style snacks.

“The only time I really engage the public is if I’m doing a condo project,” Berger said. “This is kind of like that. The rest of the time, I roll up my sleeves and do my work.”

Sweat equity

What does Ironstate Development’s David Barry have in common with Justin Bieber and Sylvester Stallone? All three are backers of Rumble, the sexy, boxing-inspired gym whose legions of fans include model and reality television personality Kendall Jenner and retired soccer star David Beckham.

What does Ironstate Development’s David Barry have in common with Justin Bieber and Sylvester Stallone? All three are backers of Rumble, the sexy, boxing-inspired gym whose legions of fans include model and reality television personality Kendall Jenner and retired soccer star David Beckham.

For Barry, the connection to Rumble is through New York nightlife impresario Eugene Remm, who once managed the restaurant at Ironstate’s W Hoboken hotel. Two years ago, when Remm was formulating the concept for Rumble, Barry signed on as an investor.

“I invest first in the person,” he said. “I’ve known Eugene a long time. I knew he was going to work his ass off to make this succeed.”

But Rumble wasn’t Barry’s first foray into fitness. A former wrestler at Columbia University — and backer of the U.S. Olympic wrestling team — Barry was also an early investor in Peloton, the streaming fitness startup that has raised nearly $1 billion. Barry said he met Peloton co-founder and CEO John Foley at a birthday party for a mutual acquaintance, Amar Lalvani, CEO of Standard Hotels.

“My main business is real estate investment,” Barry said. “I knew John and Eugene previously. It wasn’t like someone came to my office and showed me a deck.”

Barry declined to discuss financials but said he treats Rumble and Peloton as passive investments. “It’s certainly not like an outsized portion of my net capital basis,” he said.

There’s also risk involved, particularly in illiquid assets that he doesn’t control. While Rumble and Peloton seem poised for success, other investments have fallen flat.

“I’ve done movie projects,” Barry said. “Don’t do movie projects. Movies are real hard.”

The SouthBox gym is one of several local businesses Keith Rubenstein is invested in.

Busy in the Bronx

For the last few years, Somerset Partners founder Keith Rubenstein has been preaching the virtues of the South Bronx — and putting his money where his mouth is.

The developer and his partners are backers of several local startups, even after Somerset and partner Chetrit Group sold the planned site of a 1,300-unit South Bronx project to Brookfield Property Partners for $165 million in early 2018. Rubenstein’s portfolio includes Double Dutch Espresso, Nobodys Pizza, the SouthBox gym and Empanology, a gourmet empanada restaurant owned by a South Bronx chef.

Rubenstein said robust retail in the neighborhood is good for residential real estate values, but he’s drawn to founders, not just their business plans. “The idea is to incubate them and try to expand the business in the Bronx and beyond,” he said.

While his day-to-day is real estate, Rubenstein and a group of investors purchased the North American rights to KidZania, an experiential children’s play space headquartered in Mexico City, in 2015. Each KidZania entertainment center is roughly 100,000 square feet, and admission is $40. Rubenstein and his partners currently have three locations under development in Chicago, Dallas and the American Dream Meadowlands mall in East Rutherford, New Jersey, a project once known as Xanadu.

Their vision, however, is to install 15 to 20 KidZanias around the U.S. and Canada. Rubenstein said the time is right, given mall operators’ focus on experiential retail.

“They’re all looking for entertaining and creating foot traffic,” he said. “We bring 500,000 to 1 million visitors to a mall. Operators are interested in that anchor effect.”

Seeking green, from fitness to grooming

James Wacht

As a landlord and property manager, Lee & Associates NYC’s James Wacht had always been skeptical of franchises.

That was until two years ago, when his son, Evan, who is trained as a teacher, told him about My Gym, a popular gymnastics chain for children that had 450 locations worldwide — but none in Brooklyn.

In February 2017, father and son acquired territorial rights to franchise My Gym in Brooklyn and the Hamptons. Wacht declined to disclose the size of their investment — he and Evan are 50-50 partners — but public information shows that My Gym charges franchisees a $25,000 fee for one location. Royalties are 7 percent of revenue.

The Wachts opened their first location, a 3,600-square-foot space in Park Slope, in May 2018 and recently signed a lease for another space in Cobble Hill. Wacht said he was heavily involved in lease negotiations and construction, but his son handles day-to-day operations, like working with kids and their parents. “I wouldn’t have the patience to do what he does. I’d quit,” Wacht joked.

My Gym is just one of Wacht’s investments. Over the years, he’s backed a chain of bagel shops, and he is currently an investor in Barber Surgeons Guild, a high-end men’s hair salon expanding from Los Angeles to New York. He said he met the salon’s principal, Dr. Justin Rome, through Rome’s brother, who was Wacht’s physical therapist.

“I look for alternative investments besides real estate,” said Wacht, who has grown Lee NYC to 85 brokers from 20 in the last six years. “It’s not always about the money. It’s interesting. It’s also diversification. You can’t have all your assets in one asset type.”

Presidential vineyards, in name only

Eric Trump

The disclaimer on Trump Winery’s website is unequivocal: The business is a trade name associated with Eric Trump — and it is not owned, managed or affiliated with President Donald Trump or the Trump Organization. That wasn’t always the case.

The nation’s 45th president purchased the Virginia winery out of foreclosure in 2011 from Patricia Kluge, the ex-wife of late broadcasting billionaire John Kluge. At one time, Kluge wanted $100 million for the property, which sits on 1,300 acres near Thomas Jefferson’s Monticello estate. But as lenders closed in, Kluge cut a deal with Trump, a family friend, who envisioned turning the property into a kind of Virginia Mar-a-Lago.

Trump ended up paying $6.2 million for the vineyard, $1.7 million for equipment and $500,000 for 200 acres around the property’s crown jewel — a sprawling 24,000-square-foot mansion with 45 rooms and a 3,500-bottle wine cellar, according to the Wall Street Journal. A year or so later, the president (who does not drink alcohol) sold or gave the vineyard to his middle son, Eric.

Trump Winery now manufactures 36,000 cases of wine each year, and its 200 planted acres make it the largest vineyard in Virginia. The president’s association with the property, however, remains a gray area.

During a 2017 speech in the wake of violent protests in Charlottesville, Virginia, Trump claimed ownership of the winery. That prompted some locals to boycott the supermarket chain Wegmans for selling Trump-branded wine. Trump’s 2015 federal financial disclosure form listed business entities related to the winery estimated to be worth between $6 million and $27 million, according to the New York Times. Revenues were listed between $784,000 and $2.6 million.

A spokesperson for the Trump Organization did not return a request for comment. In the past, Eric Trump has called Trump Winery a “tremendous success.”

A caffeinated side kick

It’s not your typical cup of coffee. That much can be said for the specialty drinks served up at Matthew Moinian’s Felix Roasting Company, which debuted this fall with a menu featuring a Hickory-Smoked S’mores Latte and Deconstructed Espresso Tonic.

It’s not your typical cup of coffee. That much can be said for the specialty drinks served up at Matthew Moinian’s Felix Roasting Company, which debuted this fall with a menu featuring a Hickory-Smoked S’mores Latte and Deconstructed Espresso Tonic.

Matt Moinian is the eldest son of developer Joseph Moinian, whose Moinian Group portfolio has more than 20 million square feet in property, including 2 Washington Street, a 345-unit rental in the Financial District, and 3 Hudson Boulevard, a 2 million-square-foot office tower in Hudson Yards being developed with Boston Properties.

Moinian, 33, joined the family business after law school and was the project manager for its W New York Downtown, which opened in 2010. In 2014, he developed the 122-room Hotel Hugo at 525 Greenwich Street in Soho in partnership with his uncle, Fortuna Realty Group’s Morris Moinian.

Felix Roasting opened in late 2018 at 450 Park Avenue South — an office tower Joe Moinian bought in 1982 and once called his “first serious office building.” It’s unclear whether the coffee shop pays rent at the property, where WeWork signed a 50,000-square-foot lease for six floors last summer. Matt Moinian declined to discuss the matter.

Broadway’s big lights

Marsi Gardiner reckons she’s seen “Dear Evan Hansen” around 15 times. But that’s par for the course for the Brown Harris Stevens agent, who moonlights as a Tony Award-winning producer. With her husband, Eric Gardiner, she has backed prominent productions like “Jersey Boys” and “Memphis.”

Marsi Gardiner reckons she’s seen “Dear Evan Hansen” around 15 times. But that’s par for the course for the Brown Harris Stevens agent, who moonlights as a Tony Award-winning producer. With her husband, Eric Gardiner, she has backed prominent productions like “Jersey Boys” and “Memphis.”

The Gardiners are longtime theater buffs who began investing in shows more than a decade ago. At the time, they were living in La Jolla, California, a section of San Diego where Eric was working as a financial adviser. One his clients convinced him to invest in a production passing through the La Jolla Playhouse, which has a track record for incubating Broadway hits. That turned into backing New York-based productions, and the couple relocated to the Big Apple in 2011.

With “Dear Evan Hansen,” a musical that grapples with teen suicide and depression, Marsi Gardiner said the couple is among eight lead investors. In that capacity, she and her husband were able to weigh in on the script while it was still in development. For example, Gardiner said she convinced the musical’s writers to make the end more uplifting.

“Being a parent, we said, ‘You’ve got to have hope at the end,’” recalled Gardiner, whose son, Ian, a former competitive surfer, is also an agent at BHS.

Gardiner, who has two other adult sons, said marketing is key when it comes to both real estate and theater. “In New York, if you have the right people invested [in a show], it’s all word of mouth,” she said. “All of a sudden, it’s all the hype.”