The day after mega brokerage Douglas Elliman launched its new 300-plus-page magazine this spring, its top executives and brokers took to social media.

Top producer Frances Katzen posted a photo of herself with boot-clad feet propped up on her desk holding the tome, which featured supermodel Naomi Campbell on its cover. Meanwhile, Hamptons broker Jessica Cohen shared a shot of herself reading her copy poolside with her dog in hand. And company Chairman Howard Lorber took his magazine to New York City’s streets, where he posed with Jason Binn, founder of DuJour Media, and socialite Cornelia Guest, who were sitting in a cherry-red convertible. Over the next week, the hashtag #Ellimanmag generated half a million posts, achieving the holy grail of social media: a viral campaign.

But those viral campaigns are few and far between for most firms. And while everyday social media may now be an integral (and mandatory) part of every New York City firm’s business strategy, there is still a very large question mark surrounding how effective it actually is.

Not only is it a fast-changing and crowded space, but brokerages are also clamoring to be heard in what can be a fleeting medium. Post a photo and seconds later it’s buried under another post. Tweet a teaser of a new listing and the same thing happens.

“A lot of your stuff will be that tree falling in the forest,” said Matt Leone, Halstead Property’s senior vice president of digital marketing.

But since The Real Deal last closely examined how residential firms are using social media in 2014, a lot has changed — from how firms are spending their social media dollars to how they are analyzing the effectiveness of their strategies.

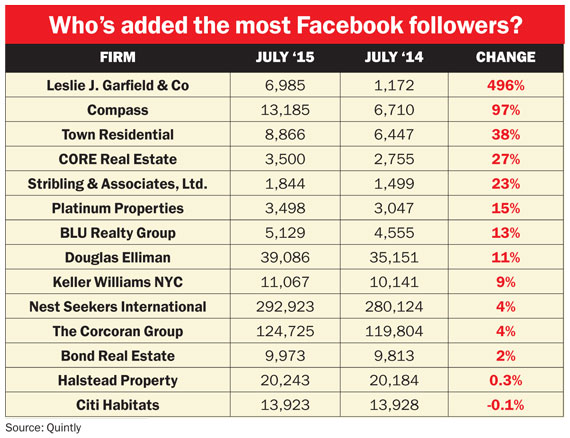

These days, the savviest players are looking at massive piles of data to shape and continuously tweak their message. To get a sense of how they are doing, TRD did a deep-dive into some of those metrics (see charts).

What we found is not shocking, but is critical — it’s not enough to simply amass followers. Engaging them is the key. “It’s a very noisy space and you’re competing with a lot of other people and brands,” said Jessica Scherlag, a social media strategist at the upstart brokerage Compass. “When people are re-tweeting or commenting, it prolongs the life of these visual assets.”

Measuring success

Nicole Oge, Elliman’s global chief marketing officer, said a key factor in launching Elliman Magazine via Instagram was the app’s ability to reach a wide swath of users.

In fact, the engagement rate on Instagram is 15 times higher than it is on Facebook and 20 times higher than on Twitter, according to Simply Measured, a social media analytics company.

Still, with firms shelling out hard dollars to boost social engagement, measuring success on social media is an elusive question that’s dogged the industry.

Halstead’s Leone said he monitors the firm’s social content via tools like Hootsuite, which enables users to schedule posts and organize content based on specific topics. He also looks at how often people like or share Halstead’s posts, using that data to shape decisions about the type of content to promote.

Leone said he no longer looks at how many people follow Halstead. Instead, he cares about how many people are interacting with the company via social media. “It only takes one person to connect with your content and message and want to do business with you, and then everything is worth it,” he said.

While some social media efforts focus on the long game, others, of course, are designed to have a clear-cut and swift impact. Late last year, for example, Elliman’s Fredrik Eklund, who appears on Bravo TV’s “Million Dollar Listing,” launched 11 North Moore Street in Tribeca on Instagram. One month later, sales hit the $100 million mark, out of a total projected sellout of $170 million. (Eklund’s immense social following — he had 410,000 Instagram followers as of last month — undoubtedly helped.)

Meanwhile, fellow Elliman broker and MDLNY star Luis Ortiz has also sold properties through Instagram, including an $8.5 million pad at the Four Seasons to someone who contacted him after seeing his post.

But for all the effort spent trying to reach a particular audience, social engagement can be a lot like throwing darts — sometimes only a few hit the bullseye.

There are also aspects of social media that are whimsical, arbitrary and downright unquantifiable. On Instagram, for example, 155 users “liked” the Corcoran Group’s close-up of a pastrami sandwich from Katz’s Delicatessen, compared with 140 who liked a photo of a $14.5 million penthouse at 10 West Street in Battery Park City.

[vision_pullquote style=”3″ align=”center”]

-Jared Seeger, Knightsbridge Park

[/vision_pullquote]

Town Residential’s marketing manager Jared Cohen — who measures the ratio of users to likes on the firm’s posts — said social media shouldn’t be dismissed just because it’s hard to measure.

“I have to argue it’s a valuable touch-point,” he said, noting that “word of mouth” leads generate 90 percent of Town’s deals.

Organic vs. paid

As real estate firms have gotten more scientific about their social media strategy, the thinking about paying for social media has drastically evolved.

But, of course, not all paid social media is created equal.

Paying to buy followers is still considered both an underhanded practice and an ineffective way to drive business (see related sidebar).

But there’s a big distinction between inflating those statistics and strategically paying experts to build a social media operation. Buying ads on social media can also be an effective way to boost content and promote the firm, sources say.

“In the end, all we want is for stuff to show up in newsfeeds so people actually see it,” said Leone, who said Halstead pays to promote individual posts for that reason.

Jared Seeger, founder and president of Knightsbridge Park, a real estate digital marketing firm, said brokerages are increasingly outsourcing part, or all, of their social media campaigns.

“The old model of having the 23-year-old intern slap stuff up on Facebook is a bit outmoded at this point,” Seeger noted.

To zero in on targeted audiences, social media has become “pay to play” in some regards. Seeger said he encourages clients — his have included Elliman, Corcoran Sunshine Marketing Group, Rudin Development, HFZ Capital and others — to set aside a certain amount of money for mar-quee ad placements. Facebook, in particular, can target narrow groups of users based on information in their profiles, he said. A jeweler, for instance, could target users who recently changed their relationship status to engaged or married. A real estate firm, meanwhile, could, say, select an audience of recent graduates who changed their hometown or started a new job.

“Whereas there was this impression a couple of years ago that social media was this completely organic effort, now there’s a resignation that to be really successful in that sphere it can be pay to play,” Seeger said.

But it doesn’t come cheap.

While pricing varies widely, social media advertising can cost tens of thousands of dollars. Outside consultants, depending on the services provided, can set a brokerage back $3,5000 to $5,000 a month.

“Having a paid social strategy has become more important,” said Compass’ Scherlag, who helped organize the firm’s Social Media Week at the end of last month that included workshops for its brokers and a panel discussion.

Scherlag said Facebook’s algorithm — which is largely kept secret — puts brand pages at a disadvantage to avoid inundating users with ads. Without paid advertising, therefore, less than 10 percent of a company’s audience will see a given post. That’s where paid ads come in, she said.

Businesses can pay Facebook to boost individual posts, or they can invest in “Page Like” ads that appear on the side of the screen and invite users to like or follow the brand’s page.

“We think it’s worth it to target the audience that’s interested in us,” Scherlag said.

To do that, brokerages have tapped a variety of companies for help.

Platinum Properties, for example, uses a New York City-based consulting company called Socialike.

Elliman’s social media agency, Rain, culls content from the web and works with an in-house team on strategy. The mega brokerage recently began working with L2 — a consulting firm founded in 2010 by NYU business professor Scott Galloway that analyzes digital trends. L2, which last year raised $16.5 million from venture capital firm General Catalyst Partners, is a subscription-based service that gives its members access to proprietary data, including their own digital performance.

Oge said if Elliman wants to keep its market share, “We have to be a little smarter and we need to be more open with respect to the shifts in the zeitgeist.”

In that regard, the firm is looking for cues from dozens of L2 members, which range from the crystal company Baccarat to Victoria’s Secret to the piano company Steinway & Sons.

“Benchmarking us within the industry is not my priority,” she said. “I don’t see the best practices in real estate, so [L2 is] going to be benchmarking us against other types of companies.”

Profitable posts

The experience of Manhattan-based residential brokerage Elika Real Estate, which became the subject of a case study by Facebook, offers a glimpse at exactly how firms can monetize social media.

This past fall, the firm invested in Facebook ads that are capable of targeting specific users, based on their location and interests, to promote a 115-page “Home Buyers Guide” geared toward New York buyers.

The campaign, which ran in November and December, reached more than 21,000 people, resulted in 962 guide downloads and generated 341 new website visits, according to the study, which Facebook promoted online.

Elika’s website logged 6,073 clicks from the ad, at an average cost to the firm of 17 cents per click.

“It’s paid for itself already,” said Gea Elika, who founded the brokerage, which exclusively represents buyers.

Elika declined to disclose the cost of the Facebook campaign, but ads on the social network range from a few dollars to boost an individual post to a few thousand dollars for a broader campaign. Elika said overall, social media accounts for 50 percent of the firm’s advertising budget, up from 10 percent a year ago. Facebook accounts for 35 percent of the social media budget. “The most enticing part is the fact that you’re able to monetize the marketing through Facebook,” said Elika. “If I’m looking for a consumer who likes Tom Ford and Mercedes, I can market through that channel.”

In fact, when Facebook users create ads, they check off boxes to select the characteristics of their intended audience — such as age, location or social groups they are part of. According to Facebook, that’s a way for businesses to “reach precisely the right people,” whether that’s a 55-year-old sports fan in California or a 35-year-old New Yorker interested in architecture.

While Elika calls his recent ad campaign a success, he wasn’t convinced that Facebook or Twitter ads could succeed until about a year ago. For years, the firm has used heat maps on its website to monitor what users are interested in and tweak its voice on social media.

But recently, the platforms themselves have improved their advertising features, letting businesses measure the effectiveness of ads. “They’ve matured into a marketplace,” he said.

The big ‘push’

A firm’s ability to track and engage their audience is key because, from a marketing standpoint, social media falls into the category of “push marketing.”

That’s the opposite of old-guard banner ads that wait for people to stop what they’re doing and visit a website. “The expectation that someone will do that, especially in a town like New York City, you’re probably thinking a little too highly of the content you’re putting up,” Oge said. “Push content coupled with awesome content is where magic happens in our business.”

Leone said Halstead’s social media decisions are all strategic. “For the most part, we have figured out by now what works and what doesn’t,” he said. “You gear your message toward that voice

or content.”

Beyond Facebook and Twitter, more firms are also embracing photo-and-video-driven platforms, such as Instagram and Periscope. And some firms are expanding the boundaries even further.

“Social media continues to change, so we have to constantly revisit [our strategy] and change accordingly,” said Elizabeth Kosich, director of marketing and digital strategy at CORE, which is starting to use Snapchat and Meerkat, an app that lets users stream video on Twitter.

Meanwhile, Town is testing the waters with Chinese social networking sites Weibo, QQ and Baidu. In May, the firm started running ads in Chinese offering brokerage services and featuring listings, said Cohen, who said the initiative is still in a beta phase, so it’s too soon to say how effective it is.

“We know that New York attracts international buyers,” he said. “Letting them know we have services that cater to their sensibilities is a great way to keep Town top of mind when they’re shopping for a firm to work with.”

Indeed, brand recognition is the end game for virtually everyone.

“Nowadays, brokerages all have access to the same information. One thing that differentiates is their social media,” said Dezireh Eyn, Platinum’s COO.

And, of course, “everyone wants to go viral,” Elika said.

“That will hopefully happen to us one day in some shape or form,” he said. “But if there’s steady conversation, that to me is success. We hope those people will remember us when they’re looking to rent or buy a home down the line.”