With new data-harnessing tools, retail real estate brokers have the power to go from global to granular in just a few clicks, offering tenants, developers and owners more insight than ever before.

Geofencing and machine-learning platforms are revealing details of consumer behavior, allowing for analysis of local information that can lead to sharper choices in the placement of retail tenants. And the ability to appeal to potential commercial investment buyers around the world is expanding with the use of visual imaging technology and online marketplaces, brokers said.

Venture capitalists certainly see the potential: In 2017, investment in real estate-related tech reached $12.6 billion, a gigantic jump from $4.2 billion in 2016, according to a 2018 report from real estate tech research and marketing agency RE:Tech.

But as profitable and “smart” as this technology may already be, it’s a mistake to indulge the rumors that software could soon replace the very brokers who use it, said experts in the field. The human side of broker-client relationships is just as important as ever, especially since brands need knowledgeable partners to filter and analyze the data accurately, they said.

This does mean that brokers need to hone their data skills. “The broker needs to be a consigliere [who is] extraordinarily facile with the data, tech and different experiential retail ideas,” said Zach Aarons, co-founder and partner at MetaProp NYC, an advisory firm and investor in new real estate technology. “Otherwise, the clients are just going to say, ‘Why am I paying these fees? I can go online and find space.’”

When it comes to the kind of tech retail real estate is looking to leverage, “predictive” is the buzzword of the day, used to describe the research technologies that can learn and eventually guess at future customer behavior. But there is symbiosis between brokers and even the most advanced tech, said Ben Liao, who in April became managing director of Colliers Proptech Accelerator, which partnered with startup Techstars to create an entrepreneurial lab for developing new commercial real estate-related software. “The tech will be value-enhancing, but it is the agents that have the industry-specific expertise to apply the tech,” said Liao. “How does tech enable them to be more impactful?”

That is the ultimate question for investors who are eager to find the right products and companies to support in this sector. Liao noted that 70 percent of VC investment in real-estate related technology has come within the last two to three years.

Geofencing and other mapping tools

In December 2017, JLL announced that it would begin using the geofencing tool PinPoint. Geofencing systems can measure and analyze consumer activity based on signals collected from mobile phone and GPS data within an electronic “fence” around the property that the firm manages.

Using that information, investor and retail clients can select a potential space within a property that gives a brand the best chance of success with the targeted demographic.

When applied to regional shopping centers, typically of more than 100,000 square feet, PinPoint can aggregate data about consumers’ behavior in or around a center. Where do they enter? Where do they go within the center?

PinPoint geofencing software tracks customer data within custom boundaries.

“We also have the ability to understand where they are going after that. Where do they live or work?” said Michael Startin, vice president and director of geographic information systems (GIS) for JLL.

Geofencing has raised privacy concerns, but Startin said that the data is collected in bulk and the information is not individualized. It’s the behavior patterns and commerce interactions that are valuable to prospective tenants, he said.

Another product at the forefront of real estate-related predictive analytics is LocateAI, which uses GPS data to understand consumer profiles and how stores or co-tenants affect each other. Co-founder and CEO Joe Lee said LocateAI can analyze 130,000 variables for every block in the country.

“Location is everything in retail,” he said. “The right street, block, co-tenant. There are so many things that can dictate how successful that location is for that store.”

While the interface works like a mapping tool, a host of data is available under the images. “Think of it like a mapping interface, like Zillow, but with way more data that you could layer on it,” Lee said. “You see brokers, developers, owners and investors who need tools to identify investment opportunity.”

LocateAI prefers to work directly with retailers, but the brands only get data from them. “You still need to use a broker to find the location, and the internal teams need to negotiate the lease,” said Lee.

He sees the person-to-person connection in real estate deals as essentially unchanged. “Deals happen though knowing people and connections. That aspect of wanting to go and see a site is not going to go away.”

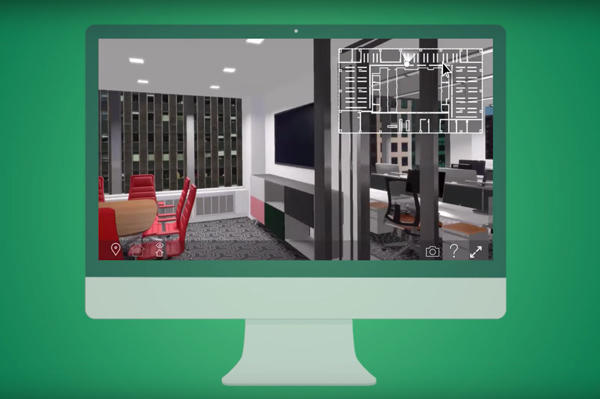

CBRE’s Floored allows clients to take a virtual tour and test out a variety of fl oor layouts.

Why walk when you can fly?

Introducing clients to a site is getting a lot easier for retail brokers at CBRE, which in 2017 acquired the interactive 3D graphics firm Floored.

Floored creates presentations that not only show clients an available space but can orient the space within an entire neighborhood. The advantage, said New York-based CBRE retail broker Preston Cannon, is in inviting prospects from around the world to visualize their brand as part of the landscape.

“We are seeing the retail community become more of a global community,” said Cannon. “We can now bring the space to them instead of waiting a month or two for them to come to New York.”

Floored recently created a 3D interactive “fly-through” video — which resembles a drone flight, but with rendered images — showcasing retail space at 119-121 Broadway in the setting of Manhattan’s Soho. The short video takes the viewer on a tour roughly between the Apple and Nike stores. “Everyone wants to be in close proximity to those,” he said.

The video was then added into a digital marketing campaign sent to interested parties in Hong Kong, allowing viewers to hit play and be swept along on the pitch. Cannon described the look as “a refined Google Street View rendered without the people.”

Using virtual reality goggles, though, is a no, according to Cannon. He said adding another layer of technology can make people feel self-conscious, especially if a broker is standing there watching the person with goggles on.

“Virtual reality is isolating,” said Cannon. “Even iPad presentations are more interactive.”

Ten-X’s homepage.

Online brokering

Brokers seeking to reach beyond their network for potential buyers and sellers have a powerful ally in Ten-X, the online commercial real estate marketplace where buyers can bid on property from anywhere in the world. The company has racked up $20 billion in commercial sales since its founding in 2009, and many recent technological updates are further accelerating the pace of sales on the site, its representatives said.

In April, Ten-X launched dashboard features that allow brokers and sellers to get real-time information about investor interest, including the number of potential buyers who have signed confidentiality agreements (a requirement in order to access due diligence information and make offers), as well as their locations.

Lawrence Yuan, chief technology officer for Ten-X Commercial, compares the dashboard functionality to that of E-Trade, the online investing site. “You can log on to the dashboard and see how it is going. That’s where the dashboards are taking us,” he said.

With more data from transactions, Ten-X can also offer more predictive models using machine learning, Yuan said. “How do we help you make decisions? What are comparables? What is a good price range?”

The new data points should further facilitate the ease with which the site connects far-flung buyers and sellers, the senior vice president of Ten-X’s commercial division, Robert Drury said. “Within the brokerage community, you want to get the highest price, and you want the world to see your asset. Most brokers live in their markets, and they know the logical buyers in the market,” he said. “We get global reach.”

Sixty percent of the site’s buyers come from beyond the geographic area of the property, according to Drury, who added that 72 percent of buyers were not known to the listing broker.

Retail is the site’s biggest asset class, with the second being multifamily residential. Drury attributes the strength of the retail presence to the overall size of the market, but he also noted that Ten-X opens up access to a wider group of potential buyers, all of whom are equal and have equal access to information on the site.

“It’s been an old-boy network business, and there are still some obstacles. We find that unknown client,” said Drury.

Customers interact with an Outernets display at Dylan’s Candy Bar in New York City.

Maximizing and enhancing space

Understanding the consumer and adapting quickly may be the top priorities for real estate tech, but solving inefficiencies in the market is another key area for growth, Liao said.

“Within residential, there have been marketplaces to solve inefficiencies,” he added, using the example of Airbnb. On the retail side, new businesses that enable pop-up stores are the equivalent, according to Liao, citing the example of Las Vegas-based platform WithMe, which offers turnkey space in eight premium properties in five cities, allowing retail brands to have short-term space. There have also been rumblings that co-working giant WeWork will soon offer similar short-term retail spaces, both within its co-working properties and in standalone locations.

Products that create exceptional in-store experiences for consumers are also crucial to the field, Aarons of MetaProp said. “You are using the stores as an extension of the brand,” he said.

One leader he cites is Outernets, the New York-based company that brings together retail brands, real estate and advertising. Outernets aims to drive foot traffic and sales with interactive displays in storefront windows that can respond to movement, collect information with outward-facing cameras and offer passersby a quiz that nets them a discount. “Outernets turns the glass of a retail store into a digital experience. A lot of brokers are partnering with them,” Aarons said.

While the proptech field continues to grow at a rapid rate, there’s one area for caution: “GIGO,” or “garbage in, garbage out,” an acronym used by computer scientists. Algorithmic learning and prediction for retailers is only as good as the data going into the algorithm.

And pure data alone doesn’t reveal all the important information about retail properties, such as why tenants have not been signing long-term leases or why rents were low at a particular property. Sometimes quantitative data just fails to tell the whole story. Brokers need to add their own observations and knowledge to the information created by tech,

Aarons said.

Finding reliable, effective data will be the key, as important as the old method of standing on a street corner and counting the passersby.

“Retailers need to have a rationale,” Aarons said. “And it has to be backed up by data.”