American Dream Mall proposal advances

The largest proposed mall and theme park project in North America, which is being developed by Triple Five Group, is moving forward.

After nearly seven hours of testimony, the Miami-Dade County Commission voted 11-1 to approve a comprehensive master plan amendment, changing the designation for the 194.5-acre development site from “industrial office” to “business office.”

The project will now head to state regulatory agencies for analysis.

Triple Five, whose principals developed and own the Mall of America in Minnesota, is looking to build 6.2 million square feet of shopping and entertainment space, including several amusement parks, along with 2,000 hotel rooms on a site sandwiched between Interstate 75 and Florida’s Turnpike. The project would cost an estimated $4 billion.

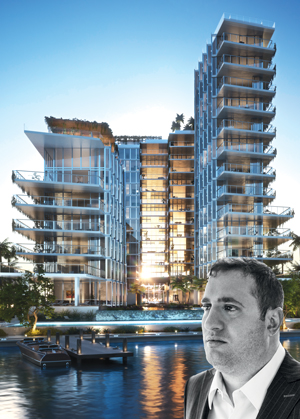

JDS kicks off sales for Monad Terrace

Monad Terrace and Michael Stern

Michael Stern’s JDS Development has launched sales for Monad Terrace, a 59-unit luxury condo building designed by Pritzker Prize-winning architect Jean Nouvel. The project, which will mark the New York developer’s entry into Miami Beach, is slated to be delivered in two years.

Stern, who is a co-developer of Echo Brickell and Echo Aventura, assembled the land from 13 sellers, spending more than $51 million on 14 parcels in 2015 and 2016.

JDS is developing the project with New Valley, Ackerman Development and Mink Development. Douglas Elliman is handling sales, with prices starting at $2 million.

The development is targeting buyers who “appreciate great design and architecture,” including New Yorkers and Canadians, Stern said. It marks the first building for Nouvel in Miami.

Amenities will include a bayfront swimming pool and dock access, as well as a cafe and juice lounge.

Owners face reality of dropping prices and skyrocketing inventory

Condos and single-family homes are spending more time on the market and selling at bigger discounts as luxury homeowners begin to face reality in South Florida.

The fourth-quarter Douglas Elliman reports show that the slowdown of the Miami and Miami Beach luxury market is continuing.

“For deals to happen, the sellers are traveling a lot further to meet the buyer in price than they were a year ago,” said Jonathan Miller, whose firm, Miller Samuel, authors the Douglas Elliman reports. “It’s a good sign that the market is adjusting.”

In Miami Beach and on the barrier islands, the median sales price of both luxury condos and single-family homes declined, and days spent on the market increased.

The median sales price of luxury single-family homes dropped by 56.4 percent to $5.45 million, according to the report, and time spent on the market ballooned to 80 days, up from 62 in the fourth quarter of 2015.

Condo prices declined by 2.1 percent to $2.35 million compared to the fourth quarter of 2015, and condos spent longer on the market — 171 days on average, compared to 62 days a year prior.

The difference between asking and closing prices also grew by 12.7 percent, up from 7.2 percent.

Sellers in Miami are “still anchored to 2014 prices,” Miller said, and “in mourning for not getting the price they wanted.”

Meanwhile, Miami Dade’s luxury condo inventory, defined as $1 million and up, skyrocketed 69 percent in the past year, according to a report by EWM Realty International. At the same time, $1 million-plus condos only accounted for 4.5 percent of total condo sales.