Barry Sternlicht, who has amassed an estimated net worth of $3 billion over the years, is co-founder, chairman and CEO of Starwood Capital Group. The investment firm manages more than $60 billion in assets, and Sternlicht is launching a public company focused on special acquisitions that will hold a $600 million IPO in May. Sternlicht is now on the hunt for discounted properties, including distressed hotels.

The Brown University and Harvard Business School graduate got his start in real estate investment at JMB Realty. Sternlicht was laid off from the company in 1990, following the market’s collapse, and went on to launch Starwood the next year with his partner at the time, Robert Faith. In one of their first deals, they bought apartments from the Resolution Trust Corporation — which the federal government formed to hold and liquidate properties owned by failed savings and loans in the wake of the S&L crisis.

Starwood, which is building its new headquarters in Miami Beach, now employs more than 4,000 people across 16 offices on three continents. Over the past three decades, the company has acquired and developed more than 150 million square feet of office, retail and industrial space, 300,000 hotel rooms and 180,000 multifamily units. Starwood has also invested about $7 billion in energy infrastructure and $230 million in oil and gas.

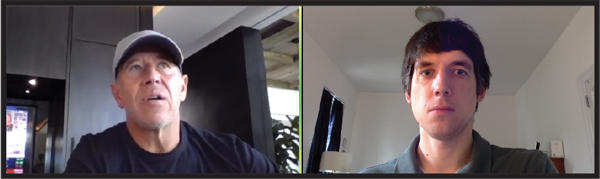

While the company has largely withstood the pandemic so far, Starwood has had to furlough some of its hotel workers. Sternlicht told The Real Deal he’s optimistic the hospitality industry will rebound from the pandemic, but said he’s more skeptical about the future of retail and voiced his many frustrations with Amazon. In a wide-ranging Zoom interview from his home in South Florida, the billionaire CEO also talked about everything from his stance on restarting the economy and his relationship with Donald Trump to his father’s harrowing experience during World War II.

DOB: November 27, 1960

Lives in: Miami Beach

Hometown: Stamford, Connecticut

Family: Divorced with three children

I always start with the hardest question: What is your full name? Barry Stuart Sternlicht.

Where were you born? Long Island. Stamford, Connecticut, is really where I grew up. I moved there at like 4 or 5 years old.

What were you like as a kid? Happy and a frustrated jock. I was pretty good at most sports but not great at anything. I actually taught tennis to earn a living during my summers before college.

Were you a good student? Yeah, I was a pretty good student. I always leaned toward the humanities. My major at Brown was called Law and Society. I used to call it Lost in Society because it was a major that combined economics, political science, history and philosophy.

Your father was a Holocaust survivor. Did he ever discuss that with you? Yes, but not until I was 38. I took him back to Poland. I think that was when he first told me that he killed someone during the war. He was not in a camp. He was lucky to survive in the mountains, and he was liberated by the Russians.

How do you think that experience shaped his worldview and how he raised you? I think he had a hard time trusting people. He always felt a little bit like an outsider, even though he married a gal from Brooklyn. He obviously taught me to be tough. My worst day was probably better than his best day during that eight- or nine-year period. He was angry, though — he really had a lot of anger against the Poles for their behavior during the war.

How did you get started in real estate investment? I really didn’t start in real estate until after business school. I had an offer from Goldman Sachs, which I didn’t take, and I went to JMB Realty instead. I always walked a little less conventional route, and that was the less conventional route.

Let’s fast-forward to the present, with Covid-19 continuing to wreak havoc on the world. What’s your next big move as an investor? I don’t know. Well, I’m not going to tell you. Too many of my competitors are going to hear about this. I think a crisis is a terrible thing to waste. I was exceptionally bullish on CNBC on March 13 and said we’d have a very quick recovery.

Are you referring to your comment about the pandemic being World War III for 90 days? Yup. I got that right. But with the fallout from Covid in the real estate markets, it will take time to figure out which tenants survive and which tenants don’t. The equity markets reprice overnight, and the real estate markets don’t.

You’ve said Starwood will look to be opportunistic during the pandemic. Does that mean you’ll look to buy properties at discounted prices? We will. We’ve probably laid out half a billion dollars in the last 45 days, but we haven’t bought any individual assets yet, although we have been actively acquiring public equities and CMBS securities. When it looks like the world is totally ending, that’s the hardest time to actually push the button and buy something.

Are there certain types of assets that you’ve got your eye on? We have a pretty deep background in hotels, and I’m willing to buy cheap real estate in the hotel space because I believe in the asset class. I think I know what we can do with them. Our thinking is: “Okay, where will we be in 24 months? Let’s not worry about the slope of the recovery right now.”

What’s your outlook on distress bets these days? We love distress markets from a buyer’s standpoint. I like markets like this where you have to hustle. Hopefully, we’re big enough now to help people survive, too. They can come to us, and we can give them capital.

Barry Sternlicht in the Zoom interview with The Real Deal’s Eddie Small

How do you feel about restarting the economy? Do you think it’s time to start lifting some of the social distancing restrictions? Yes. We have to reopen the economy, and we have to do it soon. People who are at risk should stay home, but the vast majority of people are probably not at risk. We have to open with protocols, and we have to watch the results really carefully, but that can be zip code by zip code. The medical experts, they’re the same people who told us that 2.5 million people would die. They’ve since revised their forecasts.

Have you had to lay off any workers or cut salaries? Not at the parent company or the asset manager. At our most impacted assets like hotels, we had no choice.

If you had to boil it down to one point, what is your biggest concern about the pandemic in the long run? I’ll give you two. One is treating money as if it’s free and doesn’t matter. I do think we should spend trillions of dollars. I just think we should be super careful about how we spend it.

What’s the second one? I worry about fear-mongering. I heard a mayor say the other day that she’d keep her city closed until a vaccine was found. That may not be until next year — the country would be in a depression. You cannot keep [more than] 30 million people on unemployment. The whole financial system will collapse. We can keep our hotels closed for a few months. We can’t keep our hotels closed for a year and a half.

What has been the pandemic’s biggest impact on Starwood so far? I suppose hotels, but I think it’s just temporary there. We have some retail outfits, but they’re not really significant investments. For retail, this was a dagger to the chest.

Do you see a way forward for retail after all this? Walmart’s big enough to survive. Target and Costco seem to be doing fine. But I don’t want to walk down Main Street in Greenwich and see a Costco. I’m not interested in seeing an Amazon outlet. I like the mom-and-pop stores. I have to say, I’m not a fan of Amazon. They’re demolishing the Main Streets of America, and they could behave a lot more benevolently to communities.

Are there any Starwood assets that you think are well-positioned to hold up during the pandemic? We have apartments, and so far they’ve held up really well. We have 98 percent of the rent, so I’m pretty happy about that. Our best-performing asset, the one I’m happiest about, is a company we call InTown Suites. It’s classified as a hotel, but it’s a low-end extended stay, so people use it as an alternative to housing. We have 196 properties, 24,000 keys, and we’re 80 percent occupied.

How long do you think it will take for the hospitality industry to recover from this? It’s going to vary [depending on] the kind of asset you have and your location. I expect high-end resorts to do okay. The large fly-to markets and the large convention businesses will come back last. That’s Vegas and New Orleans and Chicago’s convention center base.

Do you see demand for office space going down after this, especially with so many people now working from home? The faster you reopen the economy, the faster people get back to their old habits. We might have less demand for space if companies are nervous about the economy and don’t need to expand, but they’re probably going to offset that by social distancing themselves a little bit. I think we’re down to like 220 square feet per employee, but they’ll go back to the 250 or 300 square feet you had 10 or 15 years ago. You’ll inch your way back that way.

You said before the pandemic that a bubble in tech stocks could impact office leasing by some of those companies. Does the same theory apply now? As long as those tech companies are growing, there’s going to be demand for office space, regardless of what’s going on. The government is busy trying to get money to the unemployed, as it should be, rather than breaking apart Google or Amazon. I do not know how it can get much better for those companies.

Are you bullish on any particular company stocks these days? I might have been one of the more vocally bullish people on the equity markets. But I did not expect the market to be down 10 percent from where it was pre-Covid.

You had been warning of a recession well before the pandemic. Are we in it now? Yeah. I thought that the country would slow its investment cycle this year. I didn’t realize you’d have Covid to deal with. There are two things I worry about coming out of this. One is our relationship with China. The outcome of that relationship is critical not only for U.S. economic growth but for the world. The second thing is the political climate. We’re going to have an election. It isn’t going to be kumbaya, I love you, you love me. This is going to be ugly.

Do you consider yourself a Republican, or are you more flexible ideologically? What are you, crazy? I’m an independent. I’m socially liberal and fiscally conservative. I think capitalism is the best form of government, but I think it needs to be regulated.

How would you rate the Donald Trump presidency so far? There’s one positive thing I’d say about the Trump presidency: If you’re a businessman, you’re no longer demonized. What I objected to under the Obama administration was the thought that we were morally corrupt for succeeding. I do think there are certain things that the federal government can uniquely do, like defense spending, and there are national priorities, like energy. We still don’t have an energy strategy.

What about a national pandemic strategy? Well, we had one [for an influenza pandemic] under Bush, and it was abandoned and dropped, so I guess we need one now.

When did you first meet Trump? I’ve known him for decades. He came to the opening of the first W Hotel on Lexington Avenue in 1998, so I probably met him around 20 years ago.

Do you consider him a friend? I consider him a friend, but I don’t talk to him as president. I haven’t been involved in the administration. I’m pro-choice, and the environment is another very important issue to me. It’s complicated.

What is the biggest mistake you’ve made in your career? Randsworth, that’s easy [JMB acquired the London property owner for $425 million in 1989, and by 1992, Citicorp forced it into bankruptcy, according to Forbes]. It really wasn’t my mistake, but I got blamed for it.

More recently, we bought some retail assets. I probably didn’t have the right management team for them, and I didn’t realize how quickly the retail space as we knew it would be reorganized and dismantled.

What do you like to do to unwind? I golf. My tennis career is still around. I work out and bike, and I travel and drink wine.

You have two sons and a daughter. Do you get to see and talk to them on a regular basis? I see them all. My daughter’s an hour away right now. I am divorced, though. I was married for 25 and a half years.

Are you still in touch with your ex-wife? All the time.

Are you dating anyone these days? I’m going to pass on that question.

Where do you live? I live in Florida, in South Beach.

Do you have any other homes? Yes. I have a home in New York City and on Nantucket.

Are you abiding by the stay-at-home rules in Florida? Well, I’m working from the house, but I’ll drive this weekend to play golf in a neighboring county. So it’s stay-ish at home for me.

What are you most looking forward to doing once the pandemic ends and social distancing restrictions ease up? Traveling. Going to Europe for the summer. I’m also excited to get back to the office. I’m not one of those people who’s in love with working from home. I like having people around me.

This interview has been edited and condensed for clarity.