It’s official. Manhattan landlords are discounting more of their for-lease office space.

It’s official. Manhattan landlords are discounting more of their for-lease office space.

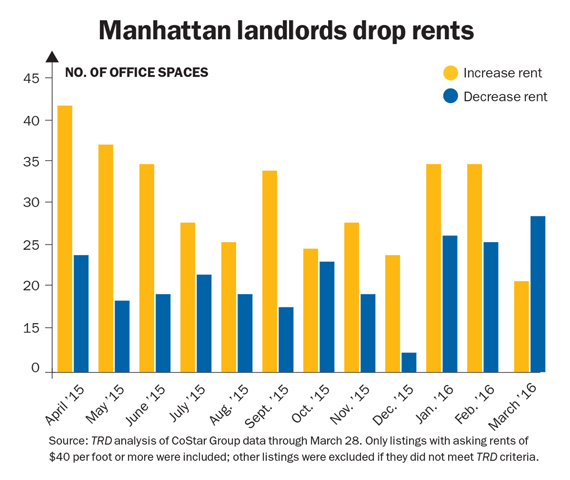

Last month, for the first time in at least a year, landlords chopped their publicly listed asking rents more frequently than they jacked up their pricing.

The Real Deal looked at more than 500 blocks of space with asking price adjustments over the past year at 170 Manhattan office buildings tracked by the data firm CoStar Group. TRD found that last month alone landlords cut the pricing on 24 office spaces in 19 buildings, while it only increased prices at 14 spaces in 13 buildings.

For the 11 previous months, more office spaces saw price hikes than chops.

Brokers said that owners of smaller buildings are more often than not the ones discounting (at least publicly) at the moment.

“Little landlords are lowering pricing but the bigger guys are holding back on base-rent reductions,” said Karen Kemp, a commercial broker at the Corcoran Group who is representing two commercial co-ops at 450 West 31st that both recently dropped their asking prices. (Full disclosure: TRD recently purchased a co-op in the building.)

Kemp said that bigger landlords are more boxed into their rents because of their loan terms and because they don’t want to reduce the value of their building (and possibly turn away potential investors) by locking in lower rental rates. However, they’re offering more incentives now to lure tenants than they were last year. “They’re really loosening up their wallets with incentives,” Kemp said.

Meanwhile, TRD’s analysis found that the number of price cuts last month represented a 71 percent increase over the average number of chops per month during the yearlong period we reviewed. TRD’s analysis was designed as a snapshot. It only looked at rents of $40 a square foot and up and at spaces where the landlords revealed their asking price. Yet there are far more spaces where landlords keep their rents under wraps.

Still, publicly revealed asking rents are a hugely important real-time barometer of the market — not only do they represent what’s happening behind the scenes, they’re also a leading indicator of where the market is going.

Landlords, of course, tweak pricing for a variety of reasons — from brisk activity in other parts of their portfolio to recent rehabs. But a landlord who reveals that they’re dropping their rent is telling the commercial leasing world in no uncertain terms that the interest in their building is less than anticipated.

Jack Senior, a broker at the boutique commercial firm Hudson Real Estate Partners, said in the Garment District, where he often does deals, owners are “ready to readjust their expectations.”

“They understand that what they want isn’t working,” he said.

However, not all landlords are cutting. TRD found that 14 spaces saw prices increases. That was down from an average of 26 price increases per month over the year that was reviewed.

Kemp said if landlords at big buildings start cutting, the whole market could start responding in more force.

“Once [large landlords start cutting rents], the other landlords have to do it,” she said. “[Then] the whole market starts to slide.”