To get a pulse on the movers and shakers in New York City real estate, industry buffs now look to China.

In the past 12 months, Chinese firms invested more than $6 billion in New York City commercial real estate, according to Real Capital Analytics. Over the next four years, Chinese investments in residential and commercial real estate in the U.S. are expected to top $218 billion. Hunger for information about the U.S. market and how to identify the right investment opportunities is overwhelming, and so The Real Deal returns to Shanghai this month for its second Real Estate Showcase & Forum in China.

The forum brings together some of the biggest names in the industry, including Douglas Elliman chief Howard Lorber, Kuafu Properties’ CEO Shang Dai, HFZ’s Ziel Feldman, the Witkoff Group’s Steve Witkoff, Soho Properties CEO Sharif El-Gamal and many more. Former New York Gov. George Pataki will be one of this year’s keynote speakers.

The event, running three days from Nov. 17 to 19, will feature eight panels and workshops at the five-star Jing An Shangri-La Hotel. The discussions will cover a wide array of topics, including development prospects, the EB-5 program, tips for foreign home buyers, and investment opportunities in New York, Miami and Los Angeles. The forum is expected to draw some 4,000 attendees and will feature more than 50 exhibits for residential and commercial developments.

The event, running three days from Nov. 17 to 19, will feature eight panels and workshops at the five-star Jing An Shangri-La Hotel. The discussions will cover a wide array of topics, including development prospects, the EB-5 program, tips for foreign home buyers, and investment opportunities in New York, Miami and Los Angeles. The forum is expected to draw some 4,000 attendees and will feature more than 50 exhibits for residential and commercial developments.

TRD’s publisher Amir Korangy said the event provides a crucial opportunity for American and Chinese investors to meet face-to-face and establish relationships.

“The companies that make the effort to go to China and meet with them directly will be the companies that will tap in to the billions the Chinese are spending every year in the U.S. real estate market,” he said. “If you’re not getting Chinese money, your competitors certainly are.”

George Pataki

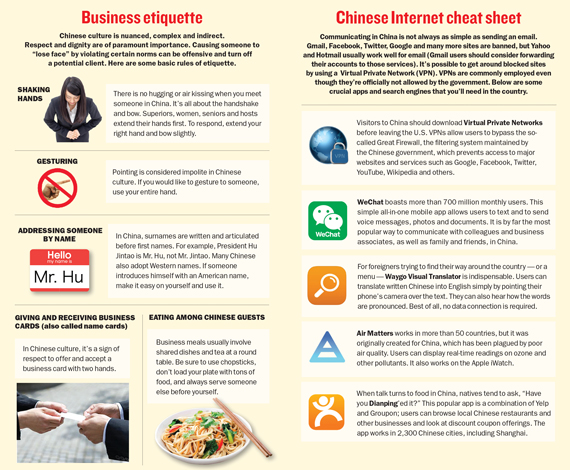

Last year’s panelists discussed, among other topics, how to bridge cultural differences, form strong joint ventures and navigate EB-5 financing. Some even offered basic — but crucial — advice.

“Americans think that Chinese people are complicated,” Kuafu’s Shang told last year’s crowd, noting that it’s important to learn even small cultural differences. For instance, he said, Chinese people hand out business cards with two hands.

Witkoff, meanwhile, urged Chinese investors to play an active role in New York: “We actually say to our partners: ‘We hope you put someone in New York or at least in the U.S.’”

This year’s event comes at an interesting — and somewhat uncertain — time for Chinese investors and their partners. Global concern continues to mount about whether the country’s debt-fueled housing bubble will burst and what that will mean for real estate investment abroad. At the same time, there’s ambiguity surrounding the future of EB-5. A new bill sponsored by Congressman Bob Goodlatte (R-Va.) is seeking to increase the minimum investment required in exchange for a green card. The increase would not only apply to new deals, but it would also require existing investors to retroactively pay more, though industry experts have told TRD that they don’t believe the bill will go through in its current form.

Still, institutional investors are increasingly financing ground-up luxury projects. For example, the U.S. arm of Shanghai Municipal Investment plans to build a $1 billion luxury condominium project at 520 Fifth Avenue with its partner Ceruzzi Partners. SMI also bought a $300 million stake in Gary Barnett’s Central Park Tower development. In August, Xinyuan Real Estate paid $66 million for a site in Flushing, Queens, where it plans to build a 269-unit condo building. And Bank of China is part of a consortium of banks providing a $1.5 billion construction loan for One Vanderbilt, SL Green Realty’s massive new office tower.

Howard Lorber

Chinese investors have also been snapping up commercial properties in the U.S. Anbang Insurance Group paid $1.95 billion for the Waldorf Astoria Hotel in October 2014, setting off a flurry of acquisitions in the city. This September, Anbang purchased 16 hotels from the Blackstone Group for $6.5 billion. A month earlier, China Orient Asset Management Corp. paid $143 million to buy a majority stake in four Flatiron District office buildings controlled by the Kaufman Organization. And in May, China Life purchased a minority stake in One New York Plaza for $700 million. Jonathan Miller, president of Miller Samuel, said that although there is some uncertainty in China’s economy, it’s still likely to funnel more investment into the U.S. real estate market.

“My reaction with the sort of reinflation of the housing bubble there is that it’s actually more incentive for capital flight,” he said. “I think the relationship is going to be long- term. It will cover all of our lifetimes.”