It’s always good to have deep pockets, but few institutional investors carry checkbooks backed by entire nations. Yet point to one of New York City’s recent big-ticket real estate deals and there’s a good chance a sovereign wealth fund was one of the buyers.

Through the first 11 months of 2015, sovereign wealth funds spent more than $22.6 billion on real estate in the United States, up from about $9.8 billion in 2014, according to research firm Real Capital Analytics.

“If you need billions of dollars for a project, where are you going to go?” said Savills Studley executive managing director Woody Heller, who heads the brokerage’s capital markets group.

The number of these funds has swelled over the past five years — there are now 73 sovereign wealth funds worldwide, up 18 percent from 2010, according to the investment-research firm Preqin. Altogether, the world’s sovereign wealth funds have $7.2 trillion in assets as of June 2015, according to the Sovereign Wealth Fund Institute, which tracks these funds.

Patrick Schena, a professor at the Fletcher School at Tufts University who studies sovereign wealth funds, said most of the new ones are in countries with emerging economies, where the goal is to create a stable flow of capital for governments. Many of the older and larger funds, meanwhile, have shifted focus to accommodate more mature economies. “When Norway was originally established, its sole purpose in life was to be a source of stability for the central budget and also to save excess funds. It dramatically outgrew that stabilization function,” Schena said. “Real estate is a logical choice in terms of diversification of its assets.”

About 60 percent of sovereign wealth funds are backed by oil and natural gas economies, and as prices for those commodities become increasingly volatile, some funds have looked to diversify their portfolios by investing in securities and real estate.

“It’s a capital-preservation issue,” said Jim Costello, Real Capital Analytics’s senior vice president. “They’re looking for good cash flow over a long period of time in a world where there aren’t too many cash-flow investment opportunities.”

He added: “These are 80-to-100-year type investment horizons.”

Putting together a comprehensive list of sovereign wealth holdings is anything but straightforward because the funds often make investments through third parties and many are notoriously secretive as to what they report publicly. But this month, The Real Deal ranked the sovereign funds making waves in the New York City real estate market. While exact figures are impossible to come by (undisclosed stakes are a norm), TRD used the best information available from the funds’ reports, Real Capital Analytics and news reports.

Below is a look at the funds with the biggest real estate presence in the Big Apple, ordered by their size globally.

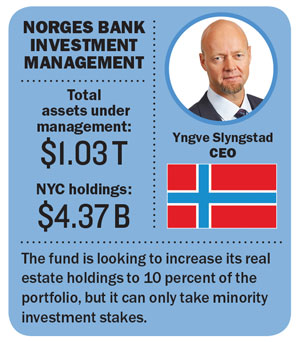

Norges Bank Investment Management

Norges Bank Investment Management

When it comes to huge resources of capital, it doesn’t get much bigger than Norway’s $1.03 trillion sovereign wealth fund, which is commonly referred to as the Petroleum Fund of Norway and said to be the largest in the world.

Up until 2010, the fund had not invested in real estate. But that year, the Norwegian government pledged to move up to 5 percent of its portfolio into real estate in countries outside of Europe. And last month, a group commissioned by the Norwegian government released a report calling for the fund to up its real estate holdings to 10 percent.

By the third quarter of 2015, the fund had 3 percent of its portfolio, or roughly $30.8 billion, in real estate.

“We have never made as many real estate investments as in 2014,” the CEO of the fund, Yngve Slyngstad, said during a presentation to the Norwegian Parliament in May. “The plan is to invest about 1 percent of the [fund] in real estate every year in the coming years.”

Norges, which was established in 1990 and derives its funding from the nation’s large oil reserves, is among the most transparent sovereign wealth funds. (Unlike many of its counterparts, it releases detailed annual reports on its properties and the stakes it holds in each one.)

Recently, the fund made headlines for losing $32 billion in the third quarter, or 4.9 percent, the biggest loss it has suffered in four years. Moreover, the country has said it plans to tap the fund this year to cover budget deficits. It would mark the first time that has ever happened.

Savills’ Heller said Norges is particularly attractive to partners looking to maintain control of their properties because the government mandates the fund take only minority stakes.

The fund made its first deals in the U.S. in 2013 when it bought a 49.9-percent stake in a portfolio of office properties owned by TIAA-CREF in New York, Washington, D.C., and Boston valued at $1.2 billion. The New York properties in the portfolio, 470 Park Avenue South and 475 Fifth Avenue, were just the beginning of its buying spree here.

The fund has gone on to acquire minority stakes in more than a dozen other buildings in the city.

In September, for example, it made a big splash when it agreed to acquire a 44 percent interest in a portfolio of office buildings in Hudson Square owned by Trinity Real Estate. According to Real Capital Analytics, Norges’ investment in the 11 properties totals $1.56 billion.

And back in February, it paid $401.9 million for a 45 percent interest in SJP Properties and Prudential’s 1.1-million-square-foot office tower 11 Times Square.

According to TRD’s tally, the fund’s NYC holdings total at least $4.37 billion.

Last month, the fund named Karsten Kallevig as the chief executive of its real estate group, where he had formerly been the chief investment officer.

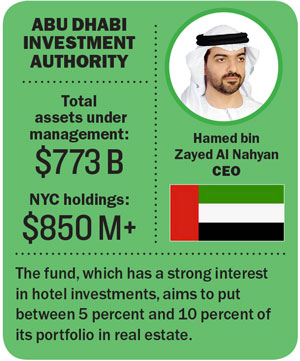

Abu Dhabi Investment Authority

Established in 1976, the Abu Dhabi Investment Authority is the largest sovereign wealth fund in the Middle East, with a portfolio worth $773 billion.

Established in 1976, the Abu Dhabi Investment Authority is the largest sovereign wealth fund in the Middle East, with a portfolio worth $773 billion.

The authority, headed by CEO and member of the Abu Dhabi royal family Hamed bin Zayed Al Nahyan, aims to invest 5 percent to 10 percent of its cash in real estate.

To date it’s favored hotel properties in England and Australia, as well as in scattered locations across the U.S. such as Georgia, Pennsylvania and Texas. But it has not shied away from big New York investments.

In 2014, the ADIA teamed up with the Related Companies and Singapore’s sovereign wealth fund to purchase the 1.1-million-square-foot office condo at the Time Warner Center owned by anchor tenant and media giant Time Warner, which is relocating to Hudson Yards.

The sale-leaseback deal came with a price tag of $1.3 billion, with the Singapore fund investing $400 million. It’s unclear what ADIA’s stake in the property is. As a result, TRD did not include that in its New York tally.

ADIA followed up that deal with the purchases of two Ian Schrager hotels last year — New York Edition hotel at 5 Madison Avenue for $343 million in April and the London NYC at 151 West 54th Street for $382 million in November.

Eric Anton, senior managing director at the commercial real estate brokerage HFF, said the fund has devoted significant resources to its hospitality specialty, noting that the traditional team “focuses on the other major food groups of real estate.”

In 2007, the ADIA spun off a smaller sovereign wealth fund, the Abu Dhabi Investment Council, which has about $110 billion in assets under management. The following year, the latter bought a majority stake in the Chrysler Building from Tishman Speyer for a price rumored to be $888 million.

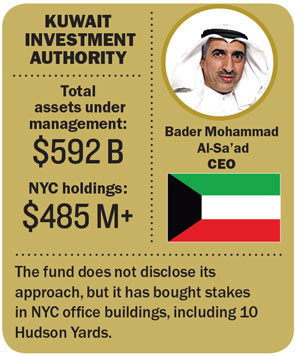

Kuwait Investment Authority

Kuwait Investment Authority

Established in 1953, Kuwait’s sovereign wealth fund, now with a hefty $592 billion in assets, is the world’s oldest. Yet it’s also one of the least transparent. Indeed, Kuwait has had a law since 1982 restricting what the fund can publicly disclose.

“No one knows what goes in, what comes out and what is going on inside,” according to a 2014 story in the asset management publication Chief Investment Officer. “But it was [around] before everyone else; it is still here — and it is growing.”

What is also known is that the oil-backed fund has been involved in some of New York City’s highest-profile real estate deals. In 2003, it was part of the investment group that bought the GM Building with developer Harry Macklowe. And more recently, in 2013, it bought an undisclosed stake in 10 Hudson Yards, which is being developed by Related, JP Morgan and Oxford Properties Group. The building topped out in October as the first office tower at the megaproject.

Run by CEO Bader Mohammad Al-Sa’ad, the fund also owns a stake in the office building at 540 Madison. And in 2011, it bought 750 Seventh Avenue, which sits just north of Times Square, from Hines for $485 million, according to Real Capital Analytics.

Government of Singapore Investment Corporation

Singapore’s sovereign wealth fund, which has $344 billion in assets, had a history of staying under the radar, making relatively small investments in a large number of assets. But in 2006, it went big as one of the investors in Tishman Speyer and BlackRock’s $5.4 billion purchase of Stuyvesant Town.

Singapore’s sovereign wealth fund, which has $344 billion in assets, had a history of staying under the radar, making relatively small investments in a large number of assets. But in 2006, it went big as one of the investors in Tishman Speyer and BlackRock’s $5.4 billion purchase of Stuyvesant Town.

After the partners’ high-profile default, GIC wrote off its losses on its investment, which court documents revealed to be $100 million in equity and $575 million in mezzanine debt.

Nonetheless, in recent years it’s been one of the most active sovereign wealth funds on the New York real estate scene. And its appetite for real estate is growing.

In November, GIC president Goh Kok Huat told Bloomberg News he thought the fund was “underinvested” in global real estate and would be looking to increase its share of the portfolio to as much as 13 percent from the current 7 percent.

“We would like to put up more money across the globe, but it really depends on whether we see those transactions that are interesting,” he said. “We don’t have the compulsion to push money out through the door.”

Singapore established its sovereign wealth fund in 1981 with reserves from the nation’s central bank. Today, it’s ranked as the eight-largest sovereign wealth fund in the world, though it is among the less transparent.

Because the government of Singapore mandates that GIC make 20-year investments, the fund is considered a conservative long-term player.

As noted above, it invested $400 million in the Time Warner Center office condo deal with Related and the Abu Dhabi Investment Authority in 2014.

“We see significant upside in leasing the high-quality office space following Time Warner Inc.’s planned relocation to 30 Hudson Yards,” said Tia Miyamoto, GIC’s local head of real estate, in a statement at the time.

GIC’s other holdings in the city include stakes in the office portion of Midtown’s mixed-use CitySpire tower and 300 Park Avenue, also known as the Colgate-Palmolive building.

GIC bought into both of those properties as part of a deal in 2012 to acquire a majority interest in a 12-building, 7.3 million-square-foot office portfolio in eight U.S. cities with Tishman Speyer.

The fund is reported to be moving to a new office at 280 Park Avenue early this year.

Qatar Investment Authority

The Qatar Investment Authority, which was founded in 2005 on the back of the nation’s liquefied natural gas surplus, has $256 billion in total assets.

The Qatar Investment Authority, which was founded in 2005 on the back of the nation’s liquefied natural gas surplus, has $256 billion in total assets.

But it’s probably best known in New York City real estate for being one of the partners that purchased the GM Building with Boston Properties, along with Kuwait’s sovereign wealth fund, in 2008 for $2.8 billion. The size of the two Middle Eastern funds’ stake was not clear. But in 2013, both the Qatari and Kuwaiti funds sold their shares to a partnership lead by Soho China for $700 million.

The Qataris are now looking to spend $35 billion on U.S. real estate over the next five years, according to a statement the fund released in September when it announced it would open a New York office.

“With boots on the ground, our presence in New York

will anchor our interest in the region,” QIA’s chief executive Sheikh Abdullah bin Mohamed Al Thani said in the statement. “It is the perfect location to help strengthen our existing relationships and promote new partnerships as we continue to expand geographically, diversify our assets and seek long-term growth.”

The fund didn’t waste any time after announcing its new office.

In October, it closed on a deal to buy a 44 percent stake in Brookfield Property Partners’ Manhattan West megaproject on the Far West Side.

When the five-building, 7-million-square-foot project — which is anchored by the law firm tenant Skadden, Arps, Slate, Meagher & Flom — is complete and stabilized in 2019, the partners project it will be valued at $8.6 billion.

Earlier this year, Brookfield and the QIA also completed the takeover of the Canary Wharf Group, which owns some 7 million square feet of retail and office space in London’s East End business district.