1883: Opening night at the Met Opera marks victory for nouveaux riches

1883: Opening night at the Met Opera marks victory for nouveaux riches

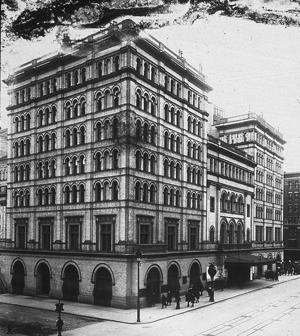

The Metropolitan Opera House opened in its first location, on Broadway and 39th Street, 135 years ago this month. Occupying a full block, the opera house was founded by 25 newly minted millionaires, including Cornelius and William K. Vanderbilt, James Roosevelt and John Pierpont Morgan. At the time, attending the opera was seen as a validation for New York’s elite. But many of the wealthiest industrialists were unable to purchase boxes at the city’s leading opera house, the Academy of Music, since most theatergoers kept their seats in the family. Frustrated, the nouveaux riches raised roughly $1.5 million to hire architect J. Cleaveland Cady to design their own theater in the Tenderloin area. When the opulent venue opened on Oct. 22, 1883, it received an overwhelmingly positive response. The New York Times declared the Met Opera would “dazzle the eyes” compared to the “primitive” Academy of Music (which would stop presenting operas a few years later). As the Met Opera’s reputation grew, however, so did the need for offstage storage. And the less glamorous blocks of the Garment District began to encroach on the Tenderloin’s thearter district, much to the chagrin of wealthy patrons. In September 1966, the opera house moved to its current home at Lincoln Center.

1933: Mercantile Building auctioned off to bondholders for $750K

The Mercantile Building changed hands in a foreclosure sale 85 years ago this month, according to the New York Times. The then 44-story tower fell into foreclosure after Chase National Bank brought the action against a group of private investors to satisfy a $5.7 million lien. The Art Deco skyscraper at 10 East 40th Street went to the sole bidder, a bondholders’ committee, for $750,000. The property was built in 1929 and originally named after its first tenant, metal manufacturer Chase Brass & Copper. The tower is famous for being the last standing structure to use direct current electricity, invented by Thomas Edison in the 1880s. Those power lines were finally removed from the building in 2007 and replaced with alternating current electricity. Today, the NYC Department of Finance pegs the building’s market value at about $130 million. The property is now owned and managed by the 100-year-old firm Joseph P. Day Realty Corp. The company’s namesake is the late real estate broker and auctioneer Joseph P. Day, who was also credited for reporting the Mercantile Building’s 1930s auction price in the Times.

1963: Tenants protest NYCHA plan to turn public housing into co-ops

A group of Bronx tenants gathered outside the New York City Housing Authority’s office 55 years ago this month to protest a plan to convert their homes into middle-income co-ops, the New York Times reported. NYCHA’s plan included converting eight public housing complexes in total, all in accordance with a recent change to the state’s housing laws that allowed public housing to be sold to private owners. The 44 protesters from Rosedale Gardens — some of whom were later given the option to buy their units — demonstrated against the conversion and demanded that NYCHA first repair and upgrade the 406-unit complex. The tenants hired their own engineer to assess the four 15-story buildings by looking at a sample of 100 apartments and reportedly found 1,152 “defects.” Decades later, maintenance and repair issues continue to plague NYCHA: Its current portfolio of 177,666 apartments requires an estimated $31.8 billion in repairs as of this summer. NYCHA is now under federal monitoring, and prosecutors have accused the authority of violating federal safety protocol by exposing residents to toxic lead poisoning.