As tenants turn their attention to the gleaming new skyscrapers rising on Manhattan’s West Side and Downtown, a handful of landlords are fighting back by reimagining some of the city’s classic office towers.

In Midtown, RXR Realty is spending more than $140 million to modernize the Art Deco 75 Rockefeller Plaza and L&L Holding is recladding Clarion Partners 390 Madison Avenue (formerly known as 380 Madison Avenue).

Meanwhile, Downtown, Fosun International is rebranding the International Style skyscraper 1 Chase Manhattan Plaza as 28 Liberty Street.

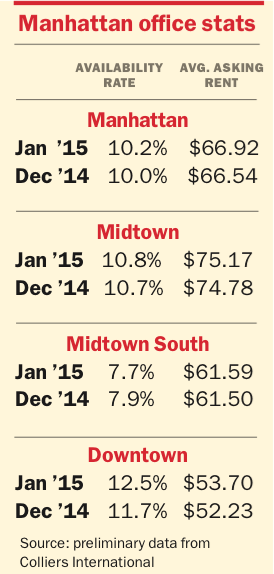

Last month, all three buildings hit the market, adding about 2.5 million square feet of space for option-starved tenants, and driving up the availability rate for Manhattan to 10.2 percent in January from 10 percent in December, figures from commercial firm Colliers International showed.

Adding to the rising availability rate was a lower amount of leasing activity, which fell from 4.1 million square feet in December to 3.1 million square feet in January, the Colliers data revealed.

Even so, office leasing agents and their clients remain optimistic that the market remains firm, because at the same time, Colliers showed that average asking rents rose in Manhattan last month by 40 cents per square foot to $66.62 per foot.

“I am seeing that the rents are up everywhere. A lot has to do with the tech boom, the low interest rates and employment trends,” Michael Beyda, a principal with the brokerage Benchmark Properties, said.

“I am seeing that the rents are up everywhere. A lot has to do with the tech boom, the low interest rates and employment trends,” Michael Beyda, a principal with the brokerage Benchmark Properties, said.

Midtown

Last month, two years after Scott Rechler’s RXR acquired the leasehold on the 33-story 75 Rockefeller Plaza, the firm put about 600,000 square feet on the leasing market.

The building is undergoing a major renovation, including moving mechanicals and simplifying the layout.

“We are not getting more rentable space,” said William Elder, executive vice president at RXR. “But we are making it more efficient.”

He said once the building reopens, which is set for January 2016, the nearly 70-year-old structure will be thoroughly modern.

He compared it to the office tower SL Green Realty is planning to build in the Grand Central submarket.

“It will be a brand new asset. No different from 1 Vanderbilt,” he said.

He said the asking rents were in the $80-per-square-foot range in the base of the building up to the “low-$100s” per square foot in the tower portion.

Those prices are above the average asking rents in Midtown last month. In January, the average asking rent was $75.17 per foot, the Colliers figures showed.

The availability rate rose slightly in Midtown to 10.8 percent, up just 0.1 point, despite the large blocks coming on line, in part because of strong leasing activity that topped 1.9 million square feet in January, the Colliers data revealed.

915 Broadway

Midtown South

Publishers Clearing House, the direct marketing and sweepstakes company, is subleasing a floor for about $60 per square foot at 915 Broadway just south of Madison Square Park, information from leasing database CompStak shows. The lease runs through January 2021.

Publishers Clearing House did not respond to a request for comment by press time..

The rental rate they are paying is near the average asking rent for Midtown South, which ticked up by 9 cents in January to $61.59 per foot, while the availability rate declined by 0.2 points to 7.7 percent, the Colliers statistics revealed.

Leasing activity in Midtown South slowed last month from December, falling to just under 900,000 square feet from 1.7 million square feet of deals inked at the end of 2014, according to Colliers figures.

Downtown

Landlords put several large blocks of space in older buildings on the market last month, including 28 Liberty and Vornado Realty Trust’s 20 Broad Street, a 542,504-square-foot tower next door to the New York Stock Exchange building.

Vornado listed the entire 27-story building last month, although it will not be available until the third quarter of 2016.

“The mood is good for this type of property that is well located, with the opportunity for branding and building within a building,” said Bruce Surry, executive vice president at CBRE. He is leading a team that includes David Young and Brad Needleman to marketing the structure.

Surry did not reveal an asking rent, but average asking rents Downtown rose sharply last month, in part because of the new space listed at 28 Liberty.

The average asking rent rose by $1.47 per foot in January to $53.70 per foot, the Colliers statistics showed.

But the new availabilities combined with a slow month of leasing led to a sharp increase in the Downtown availability rate in January, which rose by 0.8 points to 12.5 percent. Tenants leased just 308,000 square feet of space, even as 28 Liberty added nearly 1 million square feet to the market, on top of the block at 20 Broad.