Cushman & Wakefield’s purchase of Massey Knakal Realty Services for a reported $100 million came as an end-of-the-year shock for the industry.

But the real surprises will come as the companies begin merging their business models and cultures.

On its face, the merger seems like an unlikely marriage. For starters, Cushman is a New York-based global firm with a worldwide corporate identity, while Massey Knakal is a regional firm that has made a name for itself as a scrappy outer-borough brokerage specializing in building sales under $50 million.

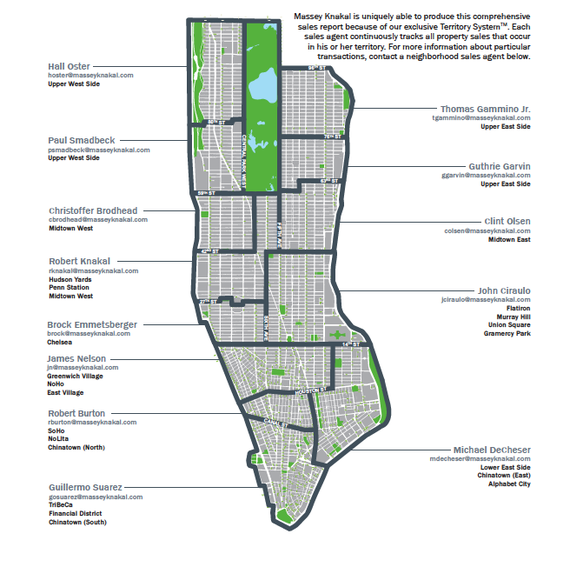

In addition, Cushman, which is headed by Edward Forst, follows a traditional brokerage system, while Massey Knakal uses a unique system that divides brokers and teams into roughly 50 geographic territories in the city.

The question that’s been on every industry mind since the deal was announced was: What would become of that signature territory system?

But as The Real Deal reported last month, Paul Massey, co-founder of his namesake firm and now the president of New York investment sales at Cushman, said that Cushman is actually going to adopt the territory system for all of its New York City sales brokers — a fact that other sources confirmed.

“We approached [the acquisition] saying to them we like what you are doing, and we want to continue that,” said Ron Lo Russo, president of brokerage at Cushman for the tri-state region.

The implementation of the system, however, “could take some time,” Massey said.

Sources say that Cushman’s plan to adopt the system raises a whole new round of questions, from “How will it change the company’s competitive standing against its rivals?” to “What will it mean for long-time Cushman brokers?”

But Massey said the system was “definitely part of what [Cushman] values about our platform.”

Little fish, big splash

On the global front, the deal barely registers as a blip for Cushman.

The firm, which has 16,000 employees and is owned by the publicly traded Italian firm Exor, is only adding a little more than 200 employees to its ranks.

But the deal, which closed on December 31, could have a transformative impact on the city’s investment brokerage landscape.

Not only does it boost Cushman’s headcount by more than 30 percent from about 700 to just over 900 in New York, it also makes the Manhattan-centric Cushman one of the most dominant players in the under $50 investment sales world in the outer boroughs. It also could mean a big boost for Cushman’s bottom line regionally. Last year, Massey Knakal did roughly $4 billion in deals.

That additional business could be a game changer for Cushman’s New York office, which got more beat up than its two main competitors, CBRE and JLL, in the wake of the recession, losing brokers to competing firms and struggling through two global leadership shakeups. Massey, Knakal, and some other members of their management team are already working of out Cushman’s headquarters at 1290 Avenue of the Americas. But for now, as the companies hammer out an integration plan, most of Massey Knakal’s brokers are still at that firm’s 275 Madison Avenue office and at outposts in Brooklyn and Queens.

Meanwhile, several industry insiders said the deal could spawn a sea change among the global commercial firms in New York, which have for years negotiated low-revenue office leases, but eschewed similar work in investment sales.

With Cushman now squarely taking on the lower-end investment sales world, some say CBRE, which already has a presence in the sub-$25 million market, might look to get more aggressive in that sector.

“I could see CBRE getting larger in the business,” said Brandon Dobell, who is a partner with the Chicago-based investment-banking firm William Blair & Company and an analyst covering real estate stocks.

Ofer Cohen, president of the Brooklyn-based brokerage TerraCRG and a former Massey agent, said larger firms have not made a push to enter the Brooklyn market since the news hit last fall that Massey Knakal was for sale.

“I have not seen it yet. But I would not be surprised if there was a little bit of exploration,” Cohen said.

Getting territorial

It’s unclear what Cushman’s move to the territory system will look like; Massey said many of the details have not been hammered out yet.

“We are working through a thoughtful and careful strategy that will be completed by the end of the first quarter,” he said.

Some of the questions that will need to be answered: How will Cushman’s primary New York City investment sales team — which includes Nat Rockett, Helen Hwang and others — work within the system? And what about even more senior brokers like Bruce Mosler, chairman of global brokerage, who specializes in leasing, but occasionally does investment sales?

Also, what role will Massey Knakal co-founder Robert Knakal, now chairman of New York investment sales at Cushman, play? At Massey Knakal, he was a virtual company within a company, responsible for roughly $2.1 billion worth of deals last year, or about half of the company’s total investment sales.

The Massey Knakal system does allow brokers to go outside of their assigned zone, but when they do, they are required to pay the broker who specializes in that area a commission split.

Knakal and James Nelson, also a top producer, did many deals outside their own geographic area.

If Cushman brokers have to suddenly start giving up even a small fraction of their commissions simply because they did a deal in someone else’s territory, some sources said it would create a backlash.

“Giving Bob Knakal a cut is one thing, but giving Joe Schmuckly a cut out in wherever is another,” said one industry source. “In theory you give cuts because of value-add, but if there isn’t … that is essentially the rub in trying to reconcile the territory system with Cushman’s system.”

Some possible scenarios, Massey said, are that Cushman brokers could “join a team [or] they could be a lead territory agent. There is flexibility.”

In addition, Massey said that Cushman is eyeing the possibility of exporting the territory system to other U.S. markets to corner the lower-end investment sales markets elsewhere. That would create an entirely new revenue stream for the firm.

Cushman’s Lo Russo also said the firm would be flexible with the system.

“We are going to take it as it comes,” he said, leaving open the possibility of refining the system as it’s being implemented.

“We are not married to any particular way of doing anything. You have to be nimble in any environment,” Lo Russo said.

Put a tie on it

Massey Knakal’s two founding partners — who met at Coldwell Banker Commercial Real Estate as young brokers and founded their firm back in 1988 — are widely credited with creating a professional platform for the city’s unglamorous, lower-end investment sales market, making it more palatable to institutional players. That transformation, sources said, is akin to what the late Edward S. Gordon, along with the lesser-known Robert Ballard, who’s still at Cushman, did for modernizing office leasing back in the 1970s.

“They took a sector dominated by random, schlocky brokers and put a tie on it,” said one top investment sales broker, speaking about Massey Knakal.

Massey Knakal’s approach seems to have boosted the value of the firm.

The sale of the company to Cushman took place at a multiple of “10-plus” times the firm’s net earnings, according to sources.

[vision_pullquote style=”3″ align=”right”] “They took a sector dominated by random, schlocky brokers and put a tie on it.” [/vision_pullquote]Still, despite its valuation, Massey Knakal — which has very little name recognition outside of New York, but is arguably the most recognizable commercial brokerage in the outer boroughs — will drop its name entirely, said Massey.

“The Massey Knakal name will fade pretty quickly,” one longtime Cushman broker said.

Massey said only that a timeline to remove the name would be ironed out by the end of March.

“We will change the name to Cushman and we plan to communicate that to our clients. Our people are excited about being part of a global brand,” Massey said.

Some sources pointed to the irony that the Massey Knakal name is being dropped, noting that it took serious shoe leather — brokering deals and plastering signage on buildings all over the boroughs — to get property owners to get to know the hard-to-pronounce name. Now agents have to introduce the Cushman & Wakefield name, which is more associated with the corporate Manhattan brokerage world, to Queens, the Bronx and Brooklyn.

“I find it interesting that Cushman intends to do away with the brand,” said Robert Hebron IV, a broker with the family-owned, Brooklyn commercial brokerage, Ingram & Hebron Realty. “So much effort went into creating this incredibly recognizable market presence over all the years of their success.”

For now, however, all brokers are handing out two-sided business cards with both company names.