UPDATED, 3:05 p.m., May 6: U.S. commercial real estate values, which have steadily risen over the past six years to eclipse their pre-recession peaks, have “come to a halt,” according to real estate research and advisory firm Green Street Advisors’ latest report, which also found that pricing remains steady for “good product” assets in core markets.

Green Street’s Commercial Property Price Index, which tracks property values nationally, was unchanged in April, and the firm noted that property appreciation has come to a standstill after posting “near-double-digit gains in each of the past few years.”

“Pricing transparency still isn’t great, but it’s pretty clear that property prices have stopped going up,” said Peter Rothemund, senior analyst at Green Street, in the company’s April report.

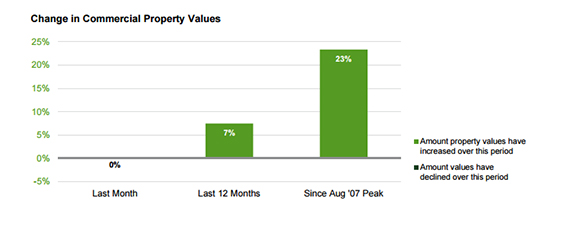

Yet property values still stand 7 percent above where they were in April 2015 and 23 percent greater than their pre-recession peak in August 2007, according to Green Street.

Rothemund noted that while prices for “B properties,” in terms of quality and location, “are probably lower than they were at the start of this year, there’s no evidence that pricing of good product in primary markets has changed.”

That’s good news for landlords of trophy assets in Manhattan. The Chetrit Group recently sold the Sony Building for north of $1.3 billion and Thor Equities is reportedly in contract to sell a retail and office building at 693 Fifth Avenue for $525 million.

Last month, Green Street reported that the national index had fallen slightly in March, to the tune of less than 0.5 percent, amidst a decline in transaction activity.

And late last year, the firm forecasted that commercial property values would drift lower over the course of 2016 as market indicators had “become notably more bearish.”

A previous version of this article stated that Green Street Advisors’ report “found that upside remains for ‘quality’ buildings in core markets.” The article has been updated to reflect that pricing for “good product in primary markets” merely remains unchanged, according the report.