Updated: June 15, 2016, 12:03 p.m.: For a while, it seemed like a new luxury high-rise, complete with an obligatory infinity pool and sky-high rents, was announced in Downtown Los Angeles every week. Then came the cranes.

Now, Downtown’s multifamily market risks becoming oversupplied, especially on the luxury end, Steve Basham, senior market analyst at CoStar Group, said in a recent report on the submarket.

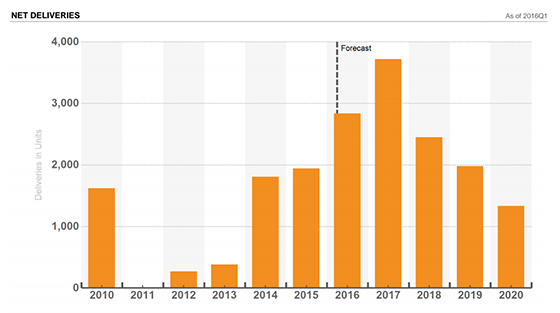

This round of DTLA’s revitalization has triggered “a building boom of historic proportions,” Basham said. More than 1,500 new units were delivered in the past year, and more than 6,000 are currently under construction, according to CoStar Market Analytics cited in the report.

The number of units delivered and expected to be delivered in DTLA (credit: CoStar Market Analytics)

The crane action includes mega-developments like Jamison and L&R’s 648-unit Circa project, which recently broke ground across from Staples Center, and is expected to deliver in 2017. It also includes CIM Group’s 888 South Hope, which is expected to open 526 units in South Park later this year. While massive, they are only two among more than a dozen luxury developments in the works.

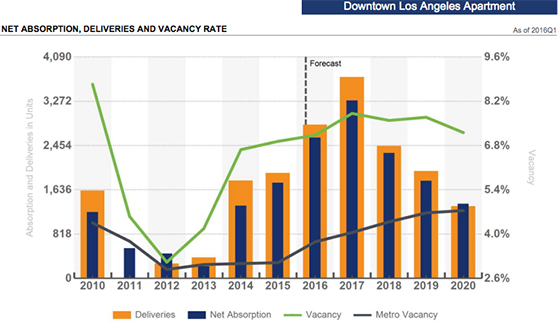

The projects are pro-forma-ed based on expected demand, but there are reasons for skepticism that such massive demand exists. The unprecedented rate of new construction has caused vacancies to rise and rental growth to slow, according to the report. Vacancy was a low 4.1 percent in 2013, but rose to 6.7 percent in 2014 and 6.9 percent in 2015. CoStar Market Analytics project that it will rise above 7 percent this year.

Downtown apartment vacancy and projected vacancy (credit: CoStar Market Analytics)

The rising vacancy is hardly deterring investors. More than 10 percent of inventory — more than 2,000 units — changed hands in the past four quarters.

“The revitalization of Downtown L.A. has been an encouraging post-recession story,” Basham said. “The question is whether the submarket can attract enough affluent renters to match the frenetic pace of development. An unprecedented number of units will deliver over the next two years, most of them high end. To keep fundamentals in check over this period, absorption will have to maintain its current lofty trajectory.”

DTLA absorbed most of the roughly 1,700 units that delivered over the past four quarters, a year-over-year demand increase of more than 10 percent. The new luxury buildings that opened in 2014 leased up quickly. The first phase of One Santa Fe in the Arts District, for example, delivered in August 2014 and leased about 35 units a month, according to the report. It is now almost fully occupied, and recently sold to Berkshire Group. The Financial District project 8th + Hope fully leased its 290 units, which delivered in August 2014, a year after completion.

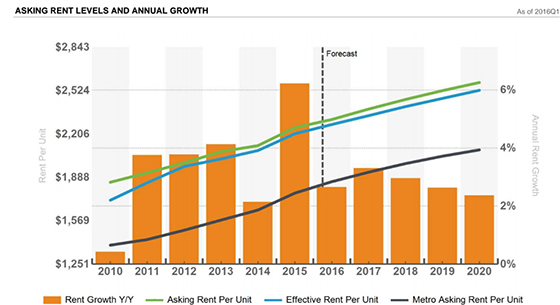

Rents and rent projections in DTLA (credit: CoStar Market Analytics)

However, 2015 was a rockier road, which “may provide evidence of increasing supply pressures at the top end of the market,” Basham said. The first phase of Geoffrey Palmer’s Da Vinci project, where asking rents average about $3.10 a square foot a month, delivered in May 2015 and was fully leased by the first quarter of 2016. Carmel Partner’s 700-unit Eighth & Grand project, however, was only about 25 percent occupied five months after opening, with 60 percent of the available units leased while the rest of the project was being completed.

“This [Eighth & Grand] development was highly anticipated as its ground floor is home to Downtown’s first Whole Foods, but the $3.65 [a square foot] average asking rents are near the top of the rent spectrum,” Basham said. “The dense concentration of luxury development Downtown is leading to increased competition for renters, and the resulting concessions will weigh on effective rent growth.”

At Eighth & Grand, tenants were offered the option of two months free rent or a year of free parking at the end of the first quarter. Similar concessions are a rarity in other pockets of the L.A. market. But then again, there isn’t another pocket of L.A. seeing as much construction of high-rent properties.

It’s generally accepted that 30 percent of income is a healthy amount to spend on rent. At that rate, a DTLA renter would need to earn about $95,000 annually to afford the average monthly rent of $2,250. To afford the new higher-end apartments, where rents average $2,500 a month, a renter would need to earn about $100,000 annually.

Reports of what current residents make, or even what constitutes “residents,” are quite varied. The Downtown Center Business District recently conducted a survey of 3,700 residents, concluding that the median annual income in the area was $98,000, with more than a quarter of residents earnings upwards of $150,000. Census data pins the median annual income in the DTLA area at $22,000 a year, because it includes Downtown’s large homeless population, largely concentrated around Skid Row.

“To sustain the current pace of development and retain renters who have flocked to the area in recent years, Downtown will need to continue to evolve,” Basham said. “Eclectic bars and trendy restaurants are everywhere, but basic community services like grocery stores, convenience stores, gas stations, and mid-level retailers are in short supply. As the affluent millennials who are helping drive the Downtown boom begin to age and start families, a vibrant nightlife will become less important than good schools, safe streets, and green spaces. Downtown L.A.’s transformation has been a success to this point, but significant work remains if the area is to become a true urban neighborhood.”

Correction: An earlier version of this story said that only 25 percent of the units at Eighth and Grand were leased in the first six months. The article has been updated to reflect that only 300 of the units were available, and about 60 percent of those were leased.