If the first half of 2016 painted an ominous picture for the Downtown multifamily market, the third quarter didn’t offer much of a respite, despite a dip in vacancy. Ever-growing supply still nudged rent growth downward and created a renters’ market.

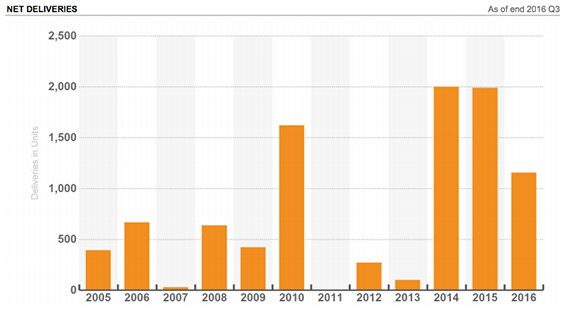

But the sunny days for owners aren’t all gone: Net absorption reached 1,500 units over the past four quarters, a year-over-year increase of about 10 percent, according to the latest CoStar report. That’s more than double the submarket’s five-year annual absorption average of about 600 units, indicating a sustained interest in the burgeoning neighborhood. So far this year, net absorption has grown by over 7 percent. To avoid the dreaded “O-word” — oversupply — absorption will have to keep at its current lofty pace, according to the CoStar report.

Even though unprecedented delivery in the past few years has created signposts pointing to a weakening apartment market, demand is still strong, according to Steve Basham, a senior market analyst at CoStar Group.

“Vacancy will be volatile, but this is purely supply-driven,” he said.

In the third quarter, vacancy decreased to 8.4 percent from about 11 percent in Q2, according to Basham. However, he said this was due to the lack of deliveries in the past three months. Vacancy is anticipated to creep up and remain volatile in the next few years as new construction finishes.

“You’ll see vacancy continue to fluctuate. In fact, it’ll probably go up soon, but there’s no downturn yet,” Basham said. “It’s absolutely encouraging that there’s strong enough demand in one quarter that vacancy dropped.”

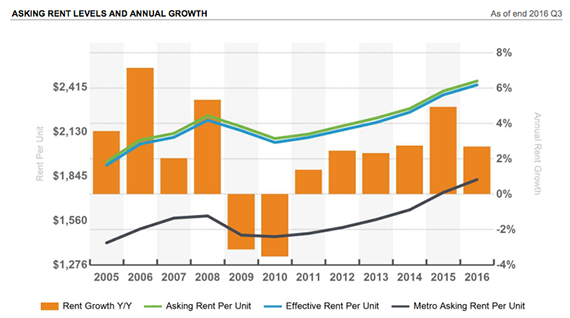

Meanwhile, rent growth is stalling at 3.3 percent year-over-year, ranking at the bottom of the L.A. submarkets. Average rents are edging toward $2,500 per unit, or about 35 percent higher than the metro average. Still, the decelerating rate is giving renters an advantage over landlords.

“Renters now have the ability to shop around for the best concessions and incentives, and that’s not going to slow down anytime soon,” Basham said.