The year in Los Angeles real estate was characterized by developer feuds, big-ticket investment sales, controversial ballot measures and record mansion prices. And in our first year on the West Coast, The Real Deal was there to capture all the hustling, and all the drama. Check out the stories readers most responded to below.

One Beverly Hills

A dramatic millionaire vs. billionaire development battle ensued in Beverly Hills. Instead of going through the usual city planning review process, Beny Alagem, the owner of the Beverly Hilton, spent millions trying to convince voters to pass a 26-story condo tower on the Hilton site via ballot measure.

Beny Alagem

The opposition effort was bankrolled by a competing developer next door: Wanda Properties, a subsidiary of Chinese billionaire Wang Jianlin’s Wanda Group. Its “No on HH” campaign aggressively sent mailers to all residents in the density-averse city. The pamphlets focused on the height of Alagem’s building when compared to other objects — such as three Statue of Liberty structures stacked on top of each other.

Voters loudly rejected Alagem’s measure. Meanwhile, the Beverly Hills City Council approved Wanda’s neighboring One Beverly Hills development. In an unprecedented development deal, Wanda will pay the city $60 million upfront.

Hugh Hefner, Daren Metropoulos and the Playboy Mansion at 10236 Charing Cross Road

2. Playboy Mansion will need a full-frontal renovation

Kenneth Bordewick

The Playboy Mansion sold this year for $100 million to Twinkie heir Daren Metropoulos, with the stipulation that Hugh Hefner can remain there until death. It was a story you just couldn’t make up.

The 33-year-old son of Hostess investor C. Dean Metropoulos plans to combine the mansion with the property he owns next door, creating a 7.3-acre residence. But experts familiar with the property told TRD the renovation of Hef’s lair is not a task for the faint of heart.

“It’s in horrible disrepair and the whole place smells like a urinal,” said interior designer Kenneth Bordewick, who once renovated the mansion’s bathrooms.

Michael Weinstein (Photo by Mark Boster/Los Angeles Times via Getty Images)

3. Can Michael Weinstein stop development without compromising his AIDS charity?

TRD‘s profile of AIDS Healthcare CEO Michael Weinstein, part of our Neighborhood Integrity Initiative series, was one of the most popular stories in the second half of 2016.

The controversial and litigious figure fueled the anti-density movement in Los Angeles by bankrolling what is now known as Measure S. If approved, the March 2017 ballot measure would halt most development in Los Angeles for two years. While some support Weinstein’s attempts to stop the corrupt flow of funds between developers and City Hall, others questions whether it is kosher to use AIDS nonprofit money for an anti-development battle. Many in the real estate industry question what is driving Weinstein, who once said, “If I wanted to live in Manhattan, I would live there.”

The controversial and litigious figure fueled the anti-density movement in Los Angeles by bankrolling what is now known as Measure S. If approved, the March 2017 ballot measure would halt most development in Los Angeles for two years. While some support Weinstein’s attempts to stop the corrupt flow of funds between developers and City Hall, others questions whether it is kosher to use AIDS nonprofit money for an anti-development battle. Many in the real estate industry question what is driving Weinstein, who once said, “If I wanted to live in Manhattan, I would live there.”

“He’s like that ex-boyfriend where you think you’ve seen the worst of them, but then they just continue to surprise you with how low they can go,” said entitlement consultant Steven Afriat.

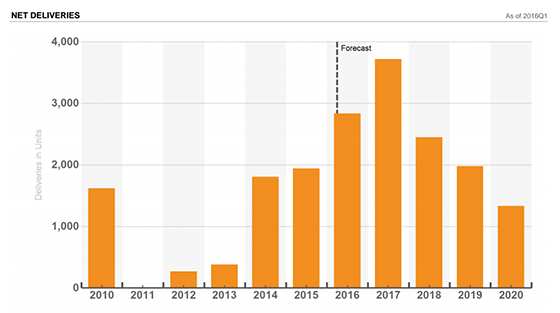

The number of units delivered and expected to be delivered in DTLA (credit: CoStar Market Analytics)

4. Downtown LA is in danger of becoming oversupplied: report

Several stories countered the ceaseless optimism of DTLA’s cheerleaders in the industry. The sheer volume of high-end residential construction is likely to lead to a luxury market oversupply, CoStar analyst Steve Basham told TRD. Vacancy rates actually increased Downtown from 2014 to 2015, he said, and pointed to landlords giving away concessions as a way to get ahead of the plethora of competing projects rising from the ground.

In another hype-diffusing report, TRD broke the news that the finances of the Bloc, Ratkovich’s 1.1 million-square-foot office and retail redevelopment in DTLA, had come under scrutiny from lenders, with a $122 million loan transferred to a special servicer. Ratkovich ultimately obtained a $225 million loan to refinance the Bloc, but most of its retail remains a ghost town.

Chris Cortazzo and the house at 33618 Pacific Coast Highway

5. Supreme Court ruling could have far-reaching implications for brokerages

In Horiike v. Coldwell Banker, the California Supreme Court ruled in November that a real estate brokerage representing both the buyer and seller in a deal owes the same fiduciary responsibilities to each party, and must investigate and disclose all important information related to the transaction.

Coldwell Banker’s attorney in the case, Edward Xanders, said the ruling against his client would create a “whole new ballgame” for agencies — including commercial brokerages such as CBRE — possibly forcing them to disclose damaging information. The California Association of Realtors also fought against the ruling.

“Buyers will be restricted in the properties they can explore, and sellers will have a limited pool of buyers,” the association said in a statement. “Allowing all parties to explore buying or selling more properties on the market, not fewer, benefits the consumer.”

The Spruce Goose hangar

6. Done deal: Google has leased the massive Spruce Goose hangar in Playa Vista

Google CEO Sundar Pichai

In June, TRD broke the news that Google had closed on its much-rumored lease for the Ratkovich-owned Spruce Goose hangar in Playa Vista. Then, in December, we were the first to report that Ratkovich and partner Penwood Real Estate were selling the hangar and three adjacent buildings to a Japanese investment firm for more than $300 million.

The buyer turned out to be ASO Group, which focuses on investments in infrastructure, private hospitals and healthcare — and real estate properties with long-term triple-net leases. The acquisition of its hangar was ASO’s first purchase in Los Angeles — but sources said it won’t be the last.

It was a big year for Playa Vista real estate. In fact, TRD’s scoop on car dealership mogul Hooman Nissani’s development plans for one of the last remaining developable plots of land in the neighborhood was our most-read story of the year.

Neil Shekter

7. Shekhter case now involves assault allegations

It’s the story that keeps getting weirder. It all started when Santa Monica developer Neil Shekhter of NMS Properties filed suit against hedge fund AEW Capital Management. He alleged the two companies negotiated a joint venture deal for several Westside apartment complexes on the condition that NMS could buy out AEW’s stake after a few years, but that AEW refused to abide by those terms.

AEW, in a motion, countered that NMS had forensically altered the joint venture documents to support its claims. A judge agreed that Shekhter had forged documents, destroyed evidence, and committed perjury. She dismissed Shekhter’s claims and ordered him to cede control of the properties to AEW. A month later, TRD broke the news that AEW had successfully sold the buildings for $430.5 million to SPI Holdings.

But it didn’t end there. An appellate court judge put a halt on the previous ruling, creating confusion about the fate of the already sold portfolio. Then, yet another ruling this month reinstated Shekhter’s ban from the properties. The reason: allegations that Shekhter physically assaulted members of SPI as they took control of the property.

Stay tuned for the next episode, as this one will bleed into the new year.

Mauricio Umansky and Billy Rose of the Agency

8. The Agency made under $1M over 36-month period

Despite its ubiquitousness in deals at the top of L.A.’s luxury market — including the sale of the Playboy Mansion — the Agency, a Beverly Hills-based brokerage led by Mauricio Umansky and Billy Rose, made less than $1 million in net income from 2012 through 2014, according to TRD‘s analysis of public financial statements submitted by Rose as part of his divorce filings. The Agency posted its best year of the three in 2014, when its net income was $1.05 million, up from a loss of $432,145 in 2013.

TRD broke the news this year that the Agency was in late-stage merger talks with New York City’s Town Residential, but the deal ultimately fell through.

2700 Colorado

9. Oracle in contract to buy 2700 Colorado in Santa Monica for $368M: sources

Larry Ellison

TRD broke the news of the priciest-ever per-square-foot deal in Santa Monica’s booming office market. Oracle paid Invesco $368 million, or $1,165 per square foot, for an office building at 2700 Colorado Avenue. JLL’s Carl Muhlstein and Hayley Blockley represented Invesco in the deal. Cresa’s Matthew Miller represented Oracle.

Sources said the company would occupy 100,000 square feet at the property, on top of the 175,000-square-foot lease it signed at Santa Monica’s Water Garden.

TRD was first to report several other major deals in Westside’s booming office market this year, including Artisan Partners $400 million purchase of the Lantana campus, Boston Properties’ $500 million acquisition of Blackstone’s stake in Colorado Center and Edward Minskoff’s $425 million purchase of the Bluffs at Playa Vista.

Steve Witkoff

10. Developer Steve Witkoff on why LA is a good, cheap bet for the next Edition

A rendering of the West Hollywood Edition hotel

A slew of major New York developers entered the L.A. market for the first time in 2016, from Edward Minskoff to Simon Baron. One of our most popular stories of the year was an interview with New York and Miami developer Steve Witkoff, who, along with Howard Lorber, Marriott and hotelier Ian Schrager, is bringing the West Coast its first Edition-branded hotel and condo development.

“L.A. is an incredibly cheap market compared to New York,” Witkoff said. “It’s maybe the cheapest of all the gateway markets for condominiums.”