From actors to pursemakers, it seems like everyone’s a developer in L.A. these days.

Developers both experienced and inexperienced rushed into the market last year, filing plans for mixed-use residential, retail and office projects. In 2016, 281 new projects plan were filed, comprising 35,902 residential or hotel units. That was up 69 percent over the number of projects in 2015, according to a TRD analysis.

The frenzy was driven at least in part by the impending threat of the Neighborhood Integrity Initiative, which will appear on the March ballot as Measure S. If enacted, every development that seeks a change to L.A.’s General Plan would be suspended.

While newcomers, such as New York’s Lightstone Group, filed plans for large projects, the most active developer was Koreatown’s Jamison Services.

Historically an office landlord, Jamison has been aggressively branching out out to multifamily projects. The firm was behind three of the 10 biggest projects filed with the planning department in 2016, according to TRD‘s analysis of city records.

Read on for the full list.

SunCal’s 6AM in the Arts District, 2,150 units

SunCal made news in March when it acquired a 14.5-acre site at the corner of 6th and Alameda Streets for $130 million. It took the Orange County developer six short months to finalize a grand plan: 1,305 apartments, 431 condo units, 412 hotel rooms, 253,500 square feet of office space, 127,600 square feet of retail, a 30,000-square-foot school, and 23,000 additional square feet for art and two parks.

To create this entirely new community, SunCal has tapped Dell computers founder Michael Dell to be a partner on the project. But it’s a long road ahead for the partnership, as the plan is reportedly likely draw opposition from neighborhood activists over the height of the hotels, which would reach 58 stories.

Westfield’s Promenade in Warner Center, 2,000+ units

Mega-landlord Westfield wrapped up 2016 with a bang, announcing its plan to redevelop its decaying Promenade shopping mall In Woodland Hills into a giant mixed-use project. The development calls for 1,432 apartment units, 572 rooms within two hotels, 244,000 square feet of retail, 629,000 square feet of offices, and a 320,000-square-foot entertainment center.

The redeveloped retail center would comprise multiple structures, the tallest of which would rise to28 stories, as well as two acres of open public space. Westfield’s footprint in the Valley is widening, with its newly renovated Topanga mall just up the street. The Promenade project, though, isn’t without controversy. Westfield was accused in a 2015 lawsuit of deliberately allowing the mall to deteriorate, and it was 80 percent vacant as of last July.

Lightstone Group’s Fig+Pico hotel, 1,160 rooms

Lightstone Group is among a handful of New York developers who set sights on the West Coast over the past year. If approved, its premiere Los Angeles prioject would have 1,162 keys spanning three hotels and 13,145 square feet of retail or restaurant space. The 1.2-acre site at 1240 South Figueroa Street is occupied by a two-story office building, which would be razed to make way for the hotels. The tallest structure would rise 42 stories.

Seeking a tax break — as is typical among large commercial developments Downtown — Lightstone’s February proposal piggybacks on the city’s call for more hotel rooms within walking distance of the Convention Center in South Park.

Lincoln Property’s Chinatown mixed-use, 920 units

Dallas-based Lincoln Property Company proved a major player in Los Angeles last year. Its biggest proposed project by far is a 920-unit mixed-use complex in Chinatown, directly adjacent to the L.A. State Historic Park. The firm tapped the owner of the eight-acre property, winemaker Steve Riboli, as a development partner, TRD reported. The project would span more than 1.1 million square feet, including 21,400 square feet of commercial space.

“Chinatown is the next district of DTLA to really see revitalization,” Rob Kane, Lincoln’s senior vice president, said in October.

Crescent Heights DTLA condo complex, 800 units

Undeterred by the dramas surrounding its Palladium Residences project in Hollywood — the reluctant inspiration behind the Neighborhood Integrity Initiative — Miami developer Crescent Heights filed plans in December for a 714-foot, 800-unit condo structure in Downtown L.A. The development would also include ground-floor retail space. Crescent Heights acquired the site for $11.5 million in 2015.

Jamison’s twin-tower apartments in DTLA, 760 units

Jamison filed plans for two 23-story apartment buildings at 3600 Wilshire Boulevard, comprising 760 units and more than 6,000 square feet of commercial space. The project would rise adjacent to the Wilshire Financial Tower, which is also owned by Jamison.

Marina del Rey housing complex, 658 units

An Irvine-based real estate firm called Sares Regis Group filed for one of the largest projects in the Marina del Rey pipeline — a 658-unit mixed-use complex with 27,300 square feet of commercial space. The 6.8-acre site is occupied by a 1977-built retail strip that will likely be demolished if the project is approved. The plans also call for alcohol sales permits for 12 establishments, city documents show.

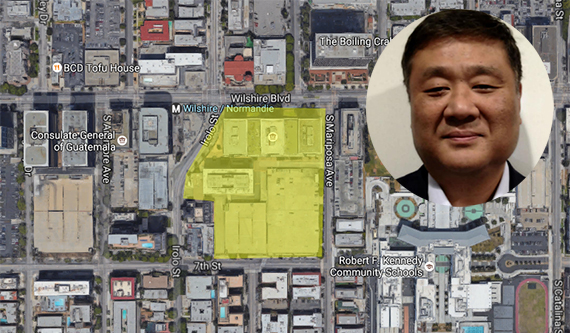

Koreatown high-rise, 644 units

W. Scott Dobbins of Hankey Investment and the development site at 2900-2949 Wilshire Boulevard in Koreatown

Jamison is behind the biggest proposed development in Koreatown in 2016. For its project at 2908 Wilshire, the company tapped investment firm Hankey Investment Co. as a development partner, The Real Deal reported in March. The project would have 644 apartment units and 13,200 square feet of ground-floor commercial space. Hankey bought the land for $7 million in 2009.

Another Jamison project in Ktown, 641-units

Jamison went big yet again with a 641-unit mixed-use project at the site of offices it owns at 3440 Wilshire Boulevard. The project also comprises about 18,500 square feet of commercial space. The seven-acre property currently houses three 12-story Class A office buildings and a 171,492-square-foot parking lot, all of which Jamison has owned since the late 1990s, TRD reported.

Carmel Partner’s Arts District condo complex, 600 units

Carmel Partners has its hands full with the 11-acre Cumulus project in South L.A., but the firm isn’t too busy to pursue a slightly smaller side project in the Arts District. Carmel wants to build 600 live-work condos on the two-acre lot bound by Mateo Street, 4th Place and Santa Fe Avenue, which it acquired for $24 million in 2015, records show.

Eda Kouch contributed to reporting