From the April issue: It doesn’t matter if it’s a buyer’s market or a seller’s market: Top agents always fight tooth and nail for a piece of the action. And competition has been so intense recently that some have exhibited a decided lack of sportsmanship in the quest to best their rivals, sources say.

Top brokers are doing whatever it takes to maintain their market share, from adopting the team strategy to using cutting-edge technology to wow their clients.

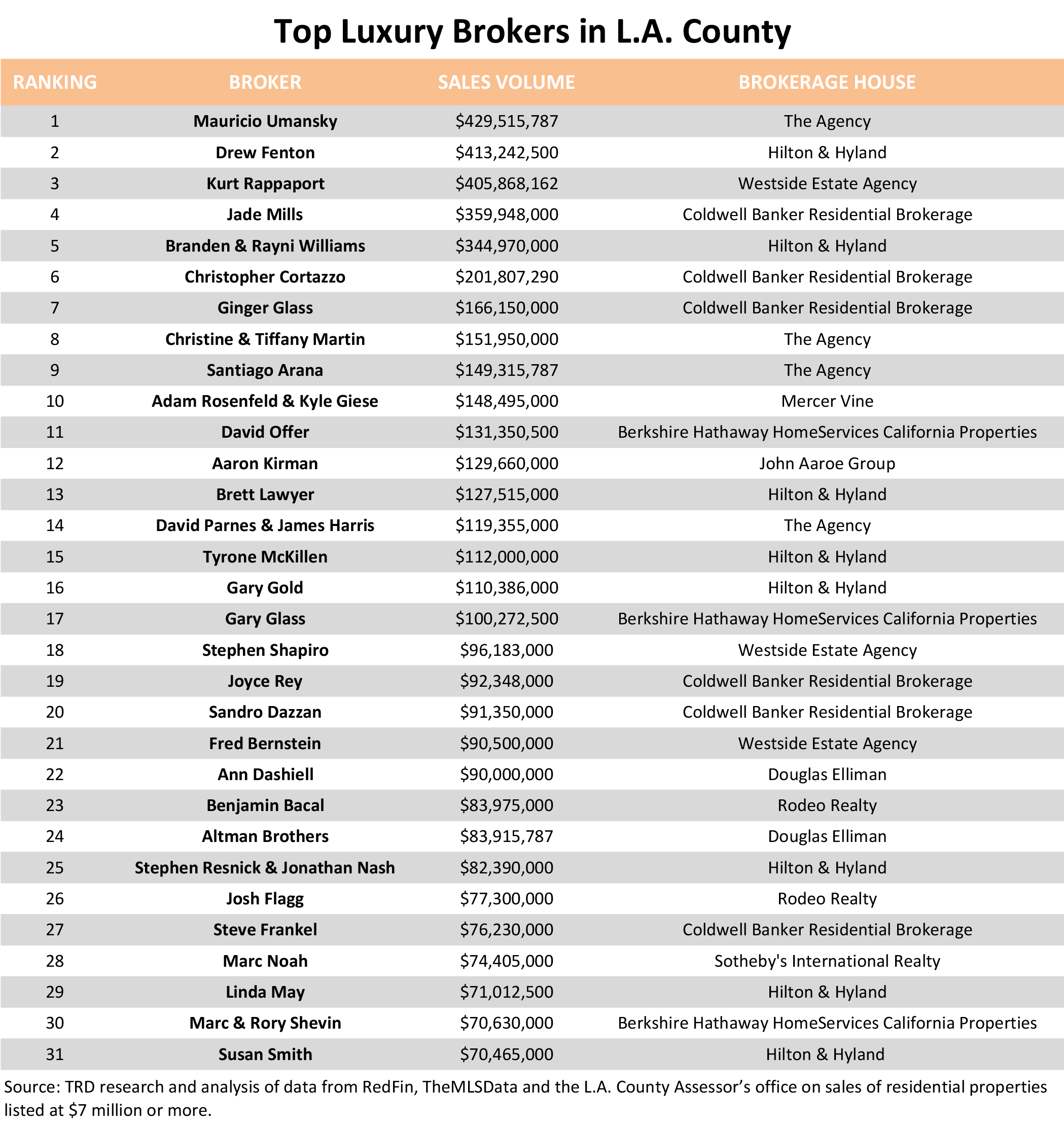

To drill down into how these high-flying brokers operate, The Real Deal takes a look at the industry’s highest-performing players in the luxury market, identifying the 30 top-producing agents for single-family home sales $7 million or higher.

At the top of the list is Mauricio Umansky of The Agency, with $429.5 million in sales. He’s closely followed by Drew Fenton of Hilton & Hyland, with $413.2 million in sales, and Kurt Rappaport of Westside Estate Agency with $405.9 million. With a total of just above $3 billion in sales of properties over $7 million in L.A. County, the top brokerage is Hilton & Hyland, followed by The Agency, with Coldwell Banker in third place.

As principal and founder of The Agency, Umansky regularly dominates the Real Trends and Wall Street Journal ranking in the greater L.A. area, but he’s often accused of inflating his numbers by taking credit from other agents at the firm, sources say.

“The Agency is modeled like a law firm,” a luxury broker told TRD on the condition of anonymity. “You relinquish all of your database and contacts when you go there. They’ll take the listings for condos in an entire complex and put [Umansky or Billy Rose’s] names on all of them, and once they sell out, the two of them will get all the credit, but obviously they aren’t the only ones involved.”

Another source said The Agency inflates its sales volume more than any other brokerage, though the source said that’s not uncommon. The Agency did not respond to requests for comment on the issue.

But The Agency isn’t the only brokerage giving competitors a headache. Many fingers also point to Compass for disrupting market margins with its unmatchable poaching offers, thanks to a deep well of venture capital.

“They’re ruining everyone’s margins, making offers with no financial sense,” a source told TRD. “They’ll go and offer someone who makes $100,000 a year a $50,000 marketing bonus just to sign with them. That’s how they get poaches.”

The source, the principal of an L.A.-based luxury brokerage, went on to say that “Compass is an example of Wall Street not understanding the industry,” adding: “When you have a company like Compass that’s hemorrhaging money and still raising $9 million, $10 million, that’s scary.”

Compass declined a request for comment on the issue.

Team players

Like it or not, Compass will likely be sticking around — it’s among the top 15 luxury brokerages, according to TRD’s analysis. It’s also one of the firms most welcoming of the team concept, industry insiders say.

The startup built its entire business model around hiring top-producing agents and offering them streamlined supportive services.

And more brokerages are adopting the team model at the operational level, which translates to fewer listing agents and more staff working the back end. As opposed to one agent undertaking every element of a deal, top performers now have teams of specialists for each task, whether it’s marketing, contracting or planning open houses.

Halton Pardee + Partners may have some of the most sharply defined specializations within the industry.

“We only have specialists. We have transaction people, we have marketing people, we have listing agents that only represent sellers and buyer agents that only represent buyers,” said Halton Pardee’s director of sales, Justin Alexander.

In the last three years, the top 250 real estate teams nationwide have seen a sales volume increase of over 41 percent, according to data from Real Trends. During the same period, individual agent sales volumes have declined. However, it’s impossible to make a clear distinction between teams and individuals, since most top agents have assistants and other staff members who support their operations.

“There’s no doubt to me that teams are here to stay,” said Courtney Smith of Courtney + Kurt Real Estate, a duo under Compass that specializes in East L.A. homes. “[Big brokerages] will have to decide whether they appreciate teams, and therefore want to increase the level of support, or they decide that they don’t like teams and they need to hire accordingly.”

Along with her partner, Kurt Wisner, and their team of eight additional agents and staff, Smith jumped ship from Nourmand & Associates to join Compass in May.

For fellow Compass agent Greg Harris, it all comes down to a division of labor that maximizes efficiency. While the internet has provided a myriad of new streams for exposure, it has simultaneously necessitated more specialization, and hence more work for individual agents.

“With marketing, for instance, there used to be fewer vehicles. You had newspaper ads, billboards, et cetera,” said Harris, who is slowly expanding his own team. “Now you need people for marketing, people to organize the showings. The business now requires more manpower than ever.”

Sandro Dazzan of Coldwell Banker agrees. Dazzan partners with his mother, Irene Dazzan-Palmer, and they clock in at No. 19 and 37, respectively, on TRD’s ranking of top luxury agents. They have two assistants.

“A newer agent does not need the team model, but when you get to a point where you need someone for marketing, someone to do contracting, it becomes useful,” Dazzan said.

Online platforms that emerged in the mid-2000s also shook up the industry and necessitated more manpower, Wisner added.

“Back in the day, we were the controller of listing info,” he said. “Now, with Redfin and Zillow and Trulia, you’ll get an email from your client at 2 a.m. asking, ‘Have you seen this listing?’…No, we haven’t! It came out at 12:01 a.m., and we’re sleeping.”

While Compass and Halton Pardee embrace the burgeoning team model, it was Keller Williams that normalized the concept in the 1990s, multiple brokers said.

“[It’s] all about creating leverage,” said Keller Williams regional director Wendi Harrelson in an email statement.

It was Gary Keller, in researching his 2004 book, “The Millionaire Real Estate Agent,” who looked at top producers in the country and noticed that they had teams, Harrelson told TRD, saying, “We wanted to provide a place for teams to be comfortable and for teams to be able to grow.”

Blurred lines

But the team model isn’t for everyone, at least not yet.

Tension often develops between a brokerage and a top-producing team, Smith said. “Some [brokerages] are intimidated by the idea that a team can get so big that they’re a mini-brokerage of their own.”

Bargaining power, a luxury-brokerage principal said, is what brokerages should fear when it comes to teams.

From left: Mauricio Umansky, Drew Fenton, Kurt Rappaport and Jade Mills

Michael Nourmand of Nourmand & Associates adds that teams are manageable so long as they are small.

“The most common sized team is two people and an assistant,” said Nourmand. “Usually as the team augments, that they start to want more concessions from the firm.”

When a team decides to expand and hire new specialists, it typically pays out of pocket from its own commissions, insiders told TRD. But because an expansion will likely boost sales volume, brokerages may offer concessions and perks to growing teams.

Typically, bigger teams mean lower profit margins for the brokerage’s bottom line, a luxury-brokerage principal said. But that’s only a bad thing if the top producers at one firm all join the same team.

“There’s no set formula that every team in every brokerage follows. But you always have to be careful that one team isn’t cannibalizing the brokerage,” another source said. “If every major producer is pulled onto one team, you’re in trouble.”

Smith’s former employer conceded that teams aren’t sustainable for every business.

“Teams are certainly here to stay,” Nourmand told TRD, “but most top agents are still opting to be solo.”

The top four agents on the TRD ranking all, in fact, represent themselves as individuals. But the lines between an individual broker and a team are blurred when considering the back-end work that goes into one celebrity agent.

Coldwell Banker’s Chris Cortazzo, who took the No. 6 spot on the list, is insistent that he’s a one-man band. But he also has 13 staff members, all of whom he considers assistants.

“I don’t have a team, I represent myself,” he told TRD. “I have 13 assistants, so that creates my corporation. They’re all licensed, but they all work for me.”

His colleague Jade Mills (No. 4, with $360 million in sales) also considers herself a solo operation. But she’s flanked by four staff members, including two of her children, she told TRD.

Above and beyond

Whether on a team or flying solo, a broker will need a massive marketing effort to advertise properties, experts say.

“The industry is doing well, but brokerage margins are tighter. Brokerages are having to sell more,” Nourmand said. “The good news is that the market is good, prices are high. But so are the costs, because of marketing and a clientele that’s becoming more and more knowledgeable.”

Drone photography, for example, is now a must. “All of my clients want drone photography,” Mills said. But aerial visuals don’t come cheap. A drone-shot video can run up to $5,000 per listing.

Drone photography is a must-have for a luxury listing. A drone-shot video can run up to $5,000 per listing, experts say.

And open houses are no longer just open houses. They’re catered affairs and can sometimes turn into full-blown fetes. “For one open-house party, we did a poker ‘Casino Royale’ event and we had Land Rover sponsor it,” Alexander said. “We had a red carpet, live catering, and it really created an amazing buzz about the house. If it’s the right house, you do a great party.”

Marketing in general is costlier than ever. Halton Pardee + Partners, according to Alexander, spends $150,000 a month on marketing. Sally Forster Jones of John Aaroe Group has a marketing team that comprises four people.

“There’s a whole branding checklist: video, drone photography, daylight photography and then twilight photography, media outreach, social-media retargeting, and people still buy billboards,” Harris said. “In this day and age, you’ve got to do it all. Yes, even print advertising.”

Beyond marketing, sometimes it comes down to pulling out every last stop.

“It’s just a question of, do you have the listing long enough to sell it,” Nourmand said — or does it go to another broker?

“At the end of the day, every house sells.”

Correction: Because of a research error, a previous version of this story inadvertently excluded Adam Rosenfeld and Kyle Giese of Mercer Vine. They were ranked No. 10, with $148.5 million in closed sales. The update was made June 13, 2017.