Trending

With Playa District, EQ and Industrious redefine landlord, co-working relationship

The firms are repositioning the Howard Hughes Center in West LA

In a few months, the ground floors connecting a collection of bulky mid-rise buildings known as the Howard Hughes Center will look more like a private members club than a corporate campus.

Employees will be able to take yoga classes, have a drink on an outdoor deck and even play basketball just steps away from their office. Much of that is due to a new relationship that’s formed between corporate landlords, such as EQ Office, and hip, younger co-working firms like Industrious, which has been tasked with managing the campus.

Playa District, as it has been named, is the latest remodeling project to come from landlord EQ, a Blackstone-owned company with more than $450 million worth of assets across the country.

Nestled between Culver City and Playa Vista, Playa District is also the first collaboration between EQ and co-working firm Industrious, which will operate and manage the hotel-like amenities, in addition to co-working space at the 1.4 million-square-foot campus.

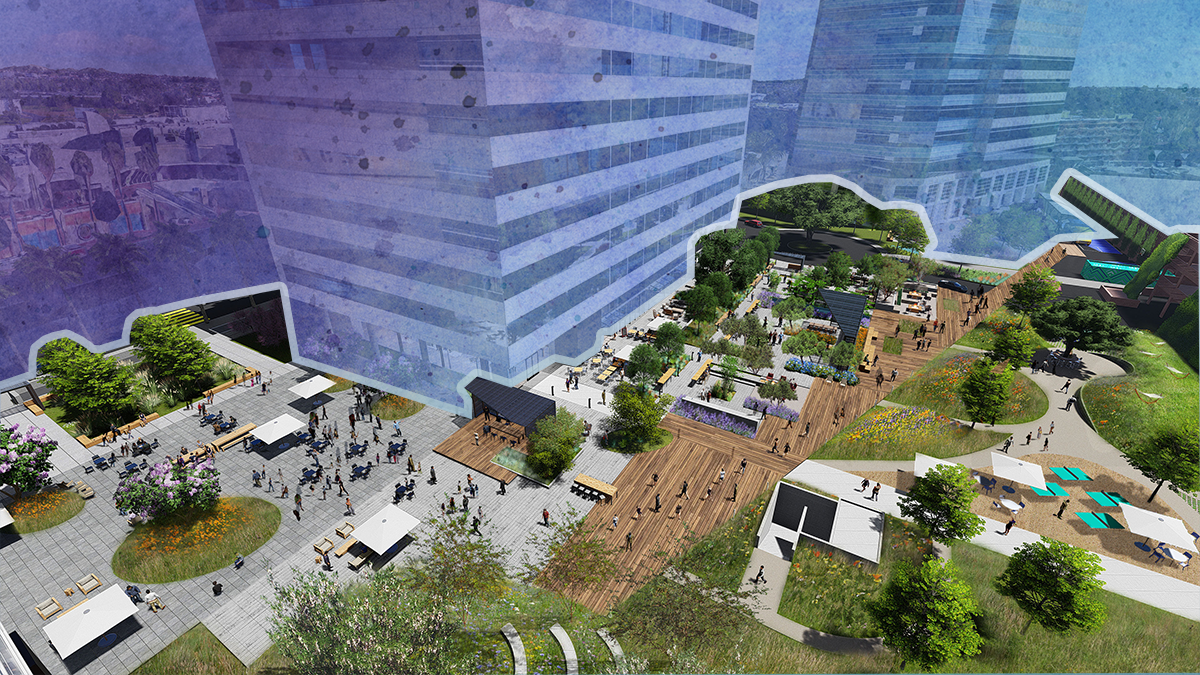

A rendering of Playa District

The partnership reflects a shift from the landlord and tenant relationship usually seen with co-working firms. What was once a long-term lease has evolved into a profit-sharing partnership in which the landlord and co-working operator are on more even playing fields.

It’s all part of a new type of co-working arrangement that could change the power dynamics in the industry.

For landlords, a management agreement with a co-working operator offers a big financial benefit. The co-working firm chips in on the cost of a project, shares some of its profits, and essentially eliminates a bit of the competition that comes with landing a tenant. In the past, landlords have feared that co-working companies would lure potential tenants away from directly leasing suites, especially as companies like WeWork target bigger startups.

But arrangements with co-working firms also force landlords to relinquish their traditional long-term lease, a key selling point for attracting potential buyers, financing or even other tenants.

Tim Marchal

“We, as a landlord, can only control so much real estate,” said Tim Marchal, vice president of the portfolio at EQ, who tasked his team and outside consultants to come up with “the right answer” to cope with the rise of co-working. “

“You can’t escape co-working and the effects of all the various companies in those work spaces. We have the scale to build off that product.”

Co-working has become an increasingly weighty player in office-space leasing. In Greater L.A., flexible office space operators are now occupying 3.2 million square feet, a six-fold increase from 2010, with an estimated 212,000 square feet expected to be added by the end of the year, according to JLL. That’s up from 2.4 million square feet last year.

For Industrious, the EQ deal came at a time when the company was pivoting from catering to freelancers and startups, and to bigger enterprise tenants and landlords. As part of the agreement, Industrious will directly manage about 140,000 square feet of flexible office suites. It will also operate the ground floor spaces, amenity experiences and conference rooms.

Eivind Karlsen

“We wanted to get closer to landlords as partners, rather than being at arm’s length,” said Eivind Karlsen, head of design at Industrious. “They are the asset owners — that’s their core business — and we really come in as an operational layer to support that.”

In the past year, Industrious’ business model has flipped from long-term leases to 75 percent of its contracts being management agreements, The Real Deal previously reported.

Playa District

EQ picked up Howard Hughes Center in June 2016 as part of a seven-property, $1.6 billion buy from Hines Real Estate Investment Trust.

About six months later, Marchal and Mark Motonaga, a partner at architecture firm Rios Clementi Hale Studio, were brainstorming ways to transform the corporate campus to a contemporary space that would attract tenants from all pockets of L.A.

“Part of the challenge was trying to figure out what the DNA of this place is and what neighborhood we belong to,” said Motonaga. “We came to the conclusion that if we really saw ourselves as part of a coastal community, sort of like Silicon Beach, then we wanted to make it more pedestrian friendly.”

Upon completion in February, two-story airplane hangar doors will open the lobbies of the two main office towers to a central courtyard, where workers will find shaded sitting areas, outdoor decks, a Winsome cafe, a pickle ball and basketball courts, barbeque pits, water feature, a farmers market and even a food truck alley. There will also be three gyms on-site.

A rendering of Playa District

Motanaga said the inspiration for the “play” elements in the campus stemmed from Silicon Valley, while the fitness component came from Southern California.

So far, it seems to be working.

Occupancy at the campus, which has Sony and Pepperdine University as anchor tenants, has risen from 66 percent to 87 percent since the companies started the project in late 2016, Marchal said. That’s despite rent growing by 30 percent, jumping from $3 to $4.65 per square foot per month.

JLL is handling leasing at the campus.

Many of the new tenants are also relocating from premiere Westside locations like Santa Monica or Venice. That wasn’t happening prior to the renovation, Marchal said. Tenants include production company All3Media, entertainment company Levity Entertainment, television show “Survivor,” and inflight entertainment company Global Eagle.

“This is really the first opportunity where companies that have two, four or 20 people have this sort of amenitized campus,” Karlsen said. “You’re taking that shared economy model of co-working and suddenly applying it to six buildings, 10 minutes from Los Angeles International Airport.”